12 Oct 4 Biotech Stocks Insiders are Selling!

Insider selling cannot be the sole indicator for investing in a stock, but it would be wise to make a note of the buying and selling activities to gauge a company’s prospects or the lack thereof. While insiders buying or selling the Company’s stock could provide investors with a general idea about the direction it is headed, a thorough understanding of its fundamentals, recent news and analyst estimates should be taken into consideration while making an investment decision.

We take a look at four companies that have witnessed insider selling in the past year.

Deciphera Pharmaceuticals, Inc. (NASDAQ: DCPH)

Market Cap: $1.86B; Current Share Price: 32.30 USD

Data by YCharts

Insider Selling Information for Past 12 Months: Matthew Sherman, the Executive VP & Chief Medical Officer of the Company sold USD 88 thousand worth of shares at an average price of USD 33.17. Insiders own 0.7% of the company, translating to USD 12 million.

Recent News: The Company announced preliminary results from an ongoing Phase 1b/2 study of rebastinib in combination with paclitaxel in patients with PROC and results from a Phase 1/2 study of vimseltinib in patients with Tenosynovial giant cell tumor (TGCT). In addition, Deciphera also provided a long-term update on the Phase 3 INVICTUS study of QINLOCK® (ripretinib) in patients with advanced gastrointestinal stromal tumors (GIST), besides results from a Phase 1 expansion study of ripretinib in patients with KIT-altered metastatic melanoma. The Company intends to announce the readout from the Phase 3 INTRIGUE trial in patients with second-line GIST later this year.

Company Profile: Deciphera is a commercial-stage biopharmaceutical company that is leveraging its proprietary switch-control kinase inhibitor drug delivery platform to create novel treatments aimed at the inhibition of protein kinases. The Company has an approved drug in the market, namely Ripretinib, which is a broad-spectrum inhibitor of KIT and PGDFRA. The Company’s pipeline consists of Vimseltinib, an orally administered inhibitor of CSF1R that is currently being evaluated in a phase 1 / 2 trial; Rebastinib an inhibitor of TIE2, currently being evaluated in a Phase 1B/2 in Solid Tumors in Combination with Paclitaxel and DCC – 3116, an inhibitor of ULK, undergoing a Phase 2 trial.

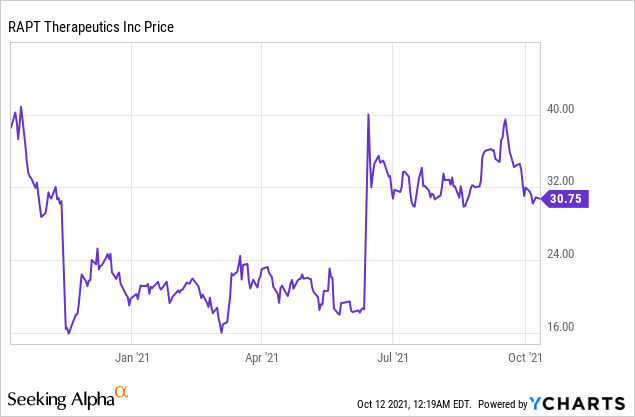

Rapt Therapeutics, Inc. (NASDAQ: RAPT)

Market Cap: $907.95M; Current Share Price: 30.79 USD

Data by YCharts

Insider Selling Information for Past 12 Months: In September 2021, Peter H. Svennilson, an insider sold shares worth USD 2.6 million at a price of USD 37.08 per share. Over the past year, insiders have sold USD 382.68 thousand worth of shares, translating to USD 13 million. Insiders held 2.4 percent of the Company as of September 19,2021.

Recent News: The Company announced positive topline results from a Phase 1b clinical trial of RPT193 as monotherapy in patients with moderate-to-severe atopic dermatitis (AD) during a late-breaking oral presentation at the European Academy of Dermatology and Venereology (EADV). The results demonstrate that at the end of the treatment at Day 29, the candidate showed clear benefits over placebo on the Eczema Area and Severity Index (EASI) score, EASI-50, vIGA 0/1 (clear or almost clear skin), body surface area (BSA), and pruritus NRS-3 and 4.

Company Profile: RAPT Therapeutics is focused on developing small molecule oral therapies for the treatment of oncology and inflammatory diseases. The Company uses a proprietary drug discovery and development engine to create highly selective small molecules that are capable of modulating the underlying critical immune responses to these diseases. FLX475, the lead oncology drug candidate, is a CCR4 antagonist that targets “charged” tumors. The candidate has completed a phase 1 clinical trial and is currently enrolling patients for the Phase 2 portion of the Phase 1 /2 study of FLX475 as a monotherapy, and in combination with pembrolizumab.

Image Source: Company

In addition, the Company is also developing RPT193, their lead inflammation candidate for the treatment of Atopic Dermatitis and Asthma. The Company is also developing GCN2 and HPK1 that are currently in the discovery stage. RAPT intends to initiate a Phase 2b AD trial in the first half of 2022 and provide an update on FLX475 and initiate a Phase 2a in Asthma as well.

FibroGen, Inc. (NASDAQ: FGEN)

Market Cap: $ 972.53M; Current Share Price: 10.50 USD

Data by YCharts

Insider Selling Information for Past 12 Months: In September 2021, Thomas Kearns, an independent director, sold USD 152 thousand worth of shares at a price of USD 11.58 each, a total value of $151,698.00. Insider holdings at Fibrogen hold roughly 3.02% of the stock as of September 28,2021.

Recent News: The Company faced a setback in August,2021, when the FDA declined to approve Roxadustat, intended for the treatment of anemia of chronic kidney disease, for want of more clinical data. A panel of experts, convened by the FDA, voted against the drug, with the FDA expressing concerns about the safety and efficacy of the drug previously.

Company Profile: FibroGen is a biopharmaceutical Company leveraging its expertise in hypoxia-inducible factor (HIF) and connective tissue growth factor (CTGF) biology to create a diverse pipeline of first-in-class therapeutics. The Company had a rough April, with shares of the company crashing on the heels of the disclosure that the safety analyses from a late-stage study of roxadustat in treating anemia of chronic kidney disease (CKD) included post-hoc changes to the stratification factors. The information essentially means that it can no longer claim that it is better at reducing major adverse cardiovascular events (MACE) when compared to erythropoiesis-stimulating agent epoetin alfa.

Roxadustat, the Company’s lead candidate, is a first-in-class, oral small molecule intended for the treatment of anemia associated with chronic kidney disease (CKD. The hypoxia-inducible factor prolyl hydroxylase (HIF-PH) inhibitor has demonstrated the ability to improve iron availability and reduce hepcidin. The product candidate has already been approved in China, Japan, and Chile for the treatment of anemia in CKD patients on dialysis and patients not on dialysis.

Image Source: Company

Astellas, its development partner, had filed the Marketing Authorization Application for roxadustat in Europe, which was accepted by the European Medicines Agency for review in May 2020. The drug was approved by the European Commission in August, 2021 and will be sold under the brand name Evrenzo. The sales from the drug are expected to bring in $690 million in Europe and Japan and the Company is eligible to receive a 22% royalty rate from Astellas, which could translate to $152 million as per analyst estimates.

In addition, it is also being evaluated in a Phase 2/3 development in China for anemia associated with myelodysplastic syndromes (MDS) and a Phase 2 U.S. trial for treatment of chemotherapy-induced anemia (CIA).

Furthermore, the Company is also developing Pamrevlumab, a fully-human monoclonal antibody, which is currently being evaluated in phase 3 clinical trials for the treatment of locally advanced unresectable pancreatic cancer (LAPC), Duchenne muscular dystrophy (DMD), and idiopathic pulmonary fibrosis (IPF). The candidate has been granted Orphan Drug Designation for LAPC, DMD, and IPF and Fast Track designation for LAPC and IPF. The candidate was recently awarded Rare Pediatric Disease Designation by the FDA for the treatment of Duchenne muscular dystrophy (DMD). The candidate is currently being evaluated in two Phase 3 trials in DMD.

The Company has had strategic collaboration with Astellas for development of hypoxia-inducible factor (HIF) anemia programs since 2004 for Japan, Europe, the Middle East, the Commonwealth of Independent States, and South Africa. FibroGen has entered into a partnership with AstraZeneca to develop the anemia programs in the U.S and other markets not licensed to Astellas, including China.

The Company also intends to announce the results from a Phase 3 anemia associated with MDS (MATTERHORN) trial in the second half of 2022 or the first half of 2023.

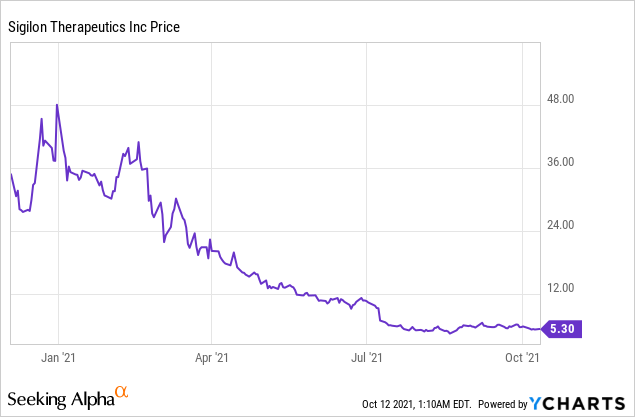

Sigilon Therapeutics, Inc. (NASDAQ: SGTX)

Market Cap: $169.58M; Current Share Price: 5.29 USD

Data by YCharts

Insider Selling Information for Past 12 Months: The biggest insider sale was from Daniel Anderson, the co-founder of the Company and a member of its Scientific Advisory Board, who sold shares worth USD 2.0 million at a price of USD 10.00 per share. Insiders owned 13 percent of Sigilon shares as of September 2021.

Recent News: In September 2021, the Company announced that the United Kingdom Medicines and Healthcare Products Regulatory Agency (MHRA) has accepted Sigilon’s Clinical Trial Application (CTA) for SIG-005, intended for the treatment of Mucopolysaccharidosis Type I (MPS-1). The Company has filed a CTA in Brazil and is planning to submit an Investigational New Drug Application with the U.S. Food and Drug Administration.

Company Profile: The Company’s Shielded Living Therapeutics™ platform aims to address the challenges posed by conventional treatment options for disease such as hemophilia, lysosomal diseases, or type 1 diabetes. The platform has the potential to provide durability, controllable exposure, no immune suppression and an affordable off-the shelf alternative to existing therapies.

Image Source: Company

Sigilon’s pipeline consists of SIG-001 for the treatment of Hemophilia A that is currently undergoing a phase 1 / 2 trial. The other candidates in the pipeline include SIG-005 intended for the treatment of MPS-1, that is currently undergoing IND-enabling studies and many other candidates in lead optimization and discovery stage.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://www.deciphera.com/pipeline

https://investors.rapt.com/static-files/5634e96b-dc5f-45c8-89db-210946257bd7

No Comments