08 Mar 4 Stocks Opening New Frontiers in Women’s Health!

8th March celebrates the cultural, political and socioeconomic achievements of women from different strata and geographies across the globe. Femtech, a category that leverages technology to address issues related to women’s health, is poised to become a $50 billion dollar industry by year 2025, according to estimates by Frost & Sullivan.

There are many companies in the clinical diagnostics, biotechnology, biopharmaceutical and medical device space that are dedicated to improving the lives of women, by addressing health issues such as cancers, endometritis and fertility management among others. We take a look at some of them that are at the forefront of innovation in women’s health:

Sera Prognostics, Inc (NASDAQ: SERA)

Market Cap: $126.17M; Current Share Price: 4.11 USD

Data by YCharts

The Company is dedicated to creating novel prenatal care products for women and babies. Sera’s products are aimed at reducing the risk of premature birth and pregnancy complications and deliver pertinent information to pregnant women, their healthcare providers and payers. The Company’s first product PreTRM, is a proprietary proteomic blood test that helps identify women who are at high-risk for spontaneous preterm birth, in asymptomatic singleton pregnancies. The test can be performed through a single blood draw during the weeks 19 or 20 gestational age. PreTRM is the only commercially available blood test that can predict premature birth.

The product offers improvement over conventional indicators of pre-term risk that take into account factors such as short cervical length and a previous history, which are not a reliable measure of predicting the risk of pre-term delivery as they fail 80% of the time. The Company has used biomarker prediction to develop a test that is minimally invasive, accurate, reliable and amenable to early administration.

Sera is leveraging its expertise in proteomics, using mass spectrometry to study peptides, to understand protein expression and the pathophysiology of preterm birth. The Company had announced the publication of a clinical validation of PreTRM threshold for clinical action, The Proteomic Assessment of Preterm Risk (PAPR) study revealed that patients at or above 15% risk, or twice the intended use population risk, had significantly higher risk of sPTB. The risk threshold was subject to an independent assessment in the Multicenter Assessment of Spontaneous Preterm Birth Predictor (TREETOP) study. The clinical decision point at spontaneous preterm birth (sPTB) risk was 15%, as determined by the company’s PreTRM® test in November 2021. The studies were in accordance with the guidelines laid down by the National Academy of Medicine’s (NAM) and had enrolled over 10,000 subjects from 20 sites across the U.S.

In February 2022, the Company entered into an agreement with MultiPlan, for participation in its PHCS and MultiPlan Networks, encompassing more than 700 healthcare payers and the 1.2 million healthcare providers that constitute its network. Sera also has a payer-centric partnership with Anthem that includes commercial contract, health economic analysis and an in-network clinical trial.

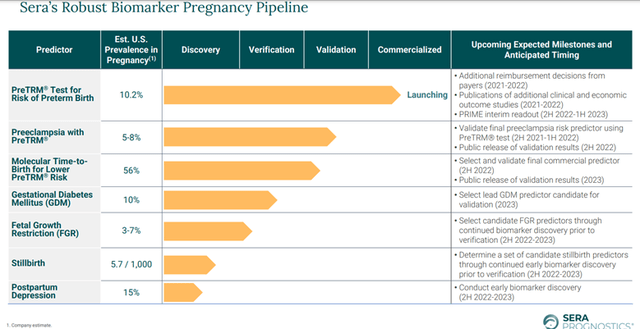

Image Source: Company

The Company has built a robust pipeline of candidates that are under the verification and validation stage such as Preeclampsia with PreTRM, Gestational Diabetes Mellitus (GDM), Fetal Growth Restriction (FGR) among others. Sera is also studying stillbirth and postpartum depression, which are currently in the discovery stage. Upcoming catalysts include PRIME interim readout in PreTRM® Test for Risk of Preterm Birth which is expected in the second half of 2022 or the first half of 2023.

Myriad Genetics, Inc (NASDAQ: MYGN)

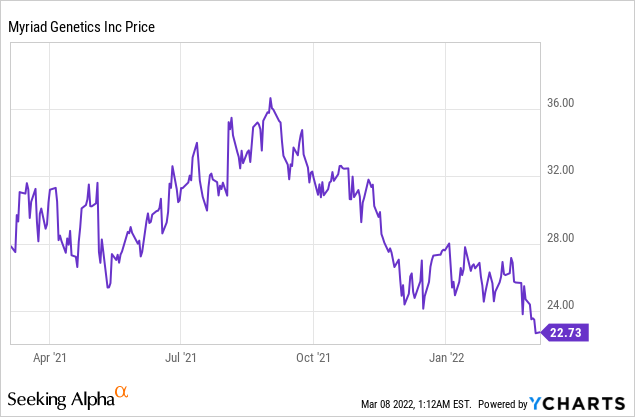

Market Cap: $1.82B; Current Share Price: 22.73 USD

Data by YCharts

Myriad Genetics develops and commercializes genetic tests that offer invaluable insights into the risk, disease progression and treatment decisions across a broad spectrum of diseases. The Company’s product offerings encompass three business areas namely Mental Health, Women’s Health and Oncology. Myriad’s products include MyRisk, a hereditary cancer test for the detection of breast cancer; Prequel and Foresight, a prenatal screening and carrier screen test for baby health; GeneSight a mental health medication test to check if antidepressants are working and MyChoice CDx (HRD Companion diagnostic test) and Prolaris, a prostate cancer diagnostic test.

In 2023, Myriad aims to launch FirstGene, a comprehensive prenatal screening test, which combines noninvasive prenatal screening + carrier screening. The Company already has a hereditary cancer test named MyRisk, with risk score for all ancestries. Myriad is working on launching a test for women with Postpartum depression as part of its Women’s health portfolio.

Most of the Company’s mental health business is driven by its online portal, with over 95% of the orders for GeneSight coming in through the online channel, and 10-15% of the business originating from digital market efforts. The Company is investing in paid ads, SEO and Website optimization and Brand Awareness to drive sales.

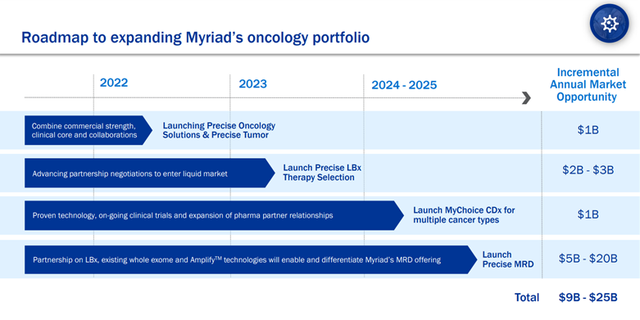

The Company’s oncology portfolio leverages its strength in hereditary cancer testing and companion diagnostics to offer an array of products that extend to ovarian, breast, prostate, and pancreatic cancer. Myriad is planning to expand its portfolio to include Liquid Bx treatment and Liquid Bx MRD.

Myriad is launching a new oncology solution named Precise and is partnering with Intermountain Healthcare and Illumina to bring it to market. Upcoming launches include Precise LBx Therapy Selection in 2023, MyChoice CDx for multiple cancer types and Precise MRD in 2024/2025.

The Company has embarked on a transformation plan to accelerate its growth. Myriad has taken steps such as redefining its brand, developing a new commercial model and eliminating debt. Furthermore, the Company seeks to take the current portfolio to its full potential by adopting a new brand and marketing strategy, restructuring the sales force and launching new products and offerings. Myriad is also seeking strategic partnerships and acquisitions to achieve growth, in addition to investing in technology and infrastructure. The Company is exploring new partnerships to offer early detection tests for Alzheimer’s.

Image Source: Company

As per the Company’s Q3,2021 results, the Mental Health vertical contributed to $24.1M of the revenue, while Women’s health brought in $59.1M. The Oncology products constituted $76.8M of the revenue. Myriad’s revenue guidance for 2022 include revenues in the range of $670-$700 million, gross margins of 70% – 72%, Adjusted Operating Expenses of $470 – $480 million and Adjusted EPS of $0.00 – $0.20.

Progyny, Inc (NASDAQ: PGNY)

Market Cap: $3.97B; Current Share Price: 43.46 USD

Data by YCharts

Progyny is a leading fertility benefits management company that offers comprehensive fertility solutions for employers, patients, and physicians. The Company’s service offerings begin from guidance from a dedicated patient care advocate and include access to a network of fertility specialists, driving optimal clinical outcomes and reduced healthcare costs.

The Company is focused on addressing the gaps in the rapidly growing fertility market such as inferior success rates, high medical costs and poor recruitment and retention, by delivering better outcomes and more efficient healthcare spend. The fertility market has been growing at a CAGR of 9.4% over the past 10 years and there are multiple tailwinds for the industry such as growing demand for fertility preservation and employer participation and sponsorship in offering fertility benefits. Progyny is at the earliest stages of penetrating the core assisted fertility market. As per its estimates there are over 8,000 companies in the U.S with over 1000 employees, of which only 3 percent are its clients, while companies in their target market constitute 75 percent of covered lives, of which only 5 percent are under contract with the company.

Progyny’s member utilization remained unaffected during the COVID-19 pandemic due to the time-sensitive nature of the treatment and the resilience shown by patients. The Company is the only fully managed fertility solution which delivers on multiple fronts such as coordinated member experience, active network management, predictable outcomes and data-driven decision making. In addition, the Company also offers better outcomes such as 16% better pregnancy rate per IVF transfer, 26% better miscarriage rate, 25% better live birth rate and 72% better IVF multiples rate.

Today, the Company has more than 265 clients across 30 industries, providing coverage to 4 million lives. Some of its clients include Unilever (NYSE: UL), Google (NASADQ: GOOG), Microsoft (NASDAQ: MSFT), 3M (NYSE: MMM), UBER (NYSE: UBER), Roche (OTC: RHHBY) among others. Progyny added 85 new clients in 2022 covering 1.2 million lives and has consistently achieved 100% client retention each year. The Company is aiming to expand its services in the U.S as well as beyond and is exploring expansion opportunities in university/school system employers, government and union employers.

Myovant Sciences Ltd (NASDAQ: MYOV)

Market Cap: $1.07B; Current Share Price: 11.43 USD

Data by YCharts

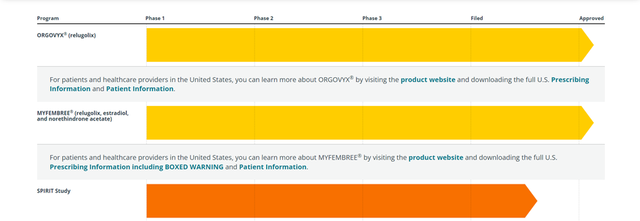

Myovant, formerly known as Roivant Endocrinology Ltd, is developing novel therapeutics for women’s health and endocrine diseases. ORGOVYX® (relugolix), the Company’s lead product is the only androgen deprivation therapy (ADT) medicine which is not an injection and is used for the treatment of advanced prostate cancer. Another product Myfembree (relugolix, estradiol and norethindrone acetate) is intended for controlling heavy menstrual bleeding due to uterine fibroids in premenopausal women.

In January 2021, the Company announced positive one-year data from the Phase 3 SPIRIT long-term extension study evaluating once-daily relugolix combination therapy (relugolix 40 mg plus estradiol 1.0 mg and norethindrone acetate 0.5 mg) in women with endometriosis. The study demonstrated meaningful reductions in dysmenorrhea (menstrual pain) and non-menstrual pelvic pain over one year (52 weeks) with minimal and stable bone mineral density loss. The Company had originally entered into a development and collaboration agreement with Pfizer for relugolix in various indications in oncology and women’s health in the U.S. and Canada in December 2020.

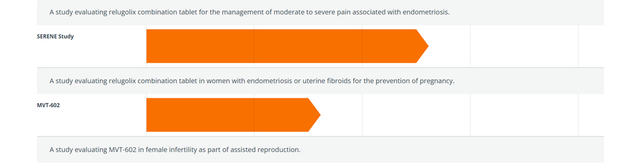

Image Source: Company

In September 2021, the Companies announced the acceptance of their supplemental new drug application for MYFEMBREE® (relugolix 40 mg, estradiol 1 mg, and norethindrone acetate 0.5 mg) for the management of moderate to severe pain associated with endometriosis. The application is supported by data from the Phase 3 SPIRIT program consisting of two pivotal clinical studies (SPIRIT 1 and SPIRIT 2), which evaluated 1,200 women with pain associated with endometriosis for 24 weeks. In addition, the Company has also submitted an open-label extension study for eligible women who completed either SPIRIT 1 or SPIRIT 2 through one year. The candidates Prescription Drug User Fee Act (PDUFA) is set for May 6, 2022.

The Company is also developing MVT-602, an oligopeptide kisspeptin-1 receptor agonist to trigger egg maturation in women undergoing assisted reproduction.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://www.pretrm.com/about-the-pretrm-test/

https://investor.myriad.com/static-files/fbced189-f3dd-431b-b22d-8ae57cada2ed

https://investors.progyny.com/static-files/51b1efcb-5b24-4a54-b0b2-fb553bc6c876

https://progyny.com/smart-benefits/smart-cycle/

https://www.myovant.com/our-science/pipeline/

https://www.frost.com/frost-perspectives/femtechtime-digital-revolution-womens-health-market/

No Comments