14 Feb 4 Stocks Under $10 with Massive Upside Potential!

Technology Industry has been focused on minimizing the impact of COVID-19 and marching ahead with its innovations and breakthroughs, be it critical components for semiconductors, cutting-edge data analytics or insurance services.

We take a look at some tech companies that are impervious to the scare and offer a very attractive upside in the long run. These companies not only have an excellent potential for growth and returns but have major upcoming catalysts such as contract awards, new products and services, growing client base or even global expansion plans lined up for the future.

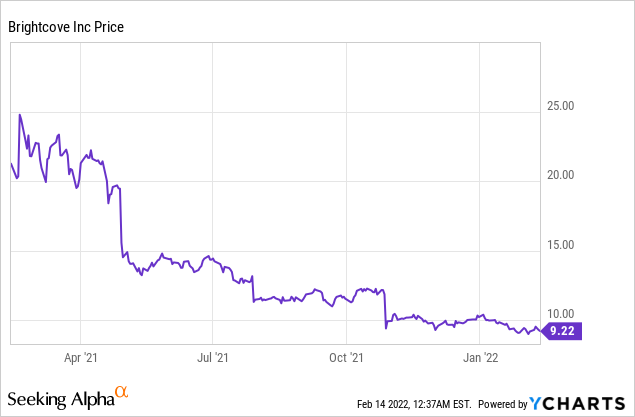

Brightcove Inc (NASDAQ: BCOV)

Market Cap: $378.86M; Current Share Price: 9.22 USD

Data by YCharts

Brightcove provides comprehensive video technology solutions that deliver safety, scalability and reliability. The Company’s intelligent video platform solutions help businesses connect with customers, enable monetization of content by media users and promote more efficient inter-organization communication. The platform facilitates over 3.75 billion streams per month and has over 3,263 customers spanning 70 countries.

The Company has appointed Marc DeBevoise as Chief Executive Officer and Board Director, who will be taking over the reins from Jeff Ray, who is retiring from his role as the CEO and Board Director. Marc DeBevoise has over 20 years of experience in technology, media, direct-to-consumer, and streaming and has worked as the Chief Digital Officer of ViacomCBS and CEO & President of CBS Interactive.

Most recently, Brightcove acquired Wicket Labs, an audience insight Company that will provide content and subscriber insights that will enable better understanding of video performance, viewer engagement, and ROI. This in turn will help customers achieve improved subscriber acquisition, conversions, engagement, and retention. The acquisition adds to the insights delivered by Brightcove and will include information pertaining to customer lifetime values, subscriber cohort analysis, engagement analysis and recommendations among others. Brightcove will benefit from Wicket Labs technology, brand, marketing assets, and customer relationships globally.

According to a report by Grand View Research Inc, the global Video Streaming market will reach an estimated USD 124.57 Billion by 2025, growing at a CAGR of 19.6 percent. The growth is due to the availability of high-speed internet such as 3G, 4G and LTE, which is causing an increase in the demand for online and on-demand content. As per an estimate over 100 million internet users watch videos online and 92 percent of these users share video content with others. Live Video is also one of the fastest growing segments in terms of ad revenue, with an impressive 113 percent growth in ad revenues, outperforming the growth of other forms of online video. Another interesting statistic is that 45 percent of live video users are willing to pay for live content. Live streaming solutions have wide applicability, transcending its current use for entertainment streaming. The technology can be applied to various segments of the economy such as news, business meetings, training, education, advertising campaigns ecommerce and online shopping as well.

The technology provides an opportunity to connect to target audiences and opens up new revenue streams. The industry is still at a nascent stage, being limited to passive broadcasts over TV’s, which will gradually evolve into more personalised live streaming experiences as the technology evolves and adaptation improves.

As per the Company’s Q3,2021 financial results, the revenue was $52.2 million, an increase of 6% compared to $49.1 million for the third quarter of 2020., of which Subscription and support revenue was $49.2 million, an increase of 6% compared to $46.3 million for the third quarter of 2020. Gross profits also witnessed an increased increase in gross margin at $33.5 million and 64% respectively when compared to a gross profit of $31.0 million and a gross margin of 63% for the third quarter of 2020. Furthermore, the Company’s Average annual subscription revenue per premium customer was $93,400 in the third quarter of 2021, as compared to $89,000 for the same period in 2020.

The net retention rate was 95%, while the recurring dollar retention rate was 93%, the Company ended the quarter with 3,205 customers, of which 2,265 were premium.

The Company reported cash and cash equivalents of $45.3 million as of September 30, 2021 compared to $37.5 million on December 31, 2020.

Porch Group Inc (NASDAQ: PRCH)

Market Cap: $850.22M; Current Share Price: 8.67 USD

Data by YCharts

Porch Group operates as a vertical software platform offering comprehensive services to home buyers, home inspectors, insurance carriers among others. The Company owned brands such as Inspection Support Network, HireAHelper, Elite Insurance Group and Kandela Brand offer services like insurance, moving services, security, concierge and TV/Internet services. Porch brings together software & services for companies, access to customers and service delivery all under one platform.

In exchange for the services, the Company is paid either through a SaaS fee or through enrollment in a Customer Access pricing model that gives it early access to homebuyers, which in turn enables revenue generation through sale of services to them. The software is offered free to companies and delivers improved customer experience, leading to increased demand and revenue for them.

The Company provides ISN Software to inspectors such as Housecheck, BPG Inspections, Elite Group; Porch’s moving services rendered through HireAHelper software are utilized by companies like POD, Budget and Packrat, while its utilities related white-labeled Porch Moving Concierge offerings are used by DTE, Florida Public Utilities among others. The services also extend to provision of inspection booking tools and a Repair Estimate Report and Moving Concierge as part of its real estate offerings.

According to Company estimates in 2019, $4 per inspection was generated in SaaS fees processed through its SaaS system, while the customer access model witnessed homebuyers generating $25 in revenue, making the payment with customer access is its most preferred option as it delivers 6x more value in exchange for free software. The Company also states that nearly 2/3rd of U.S homebuyers avail some service through the software platform (source: US Census Bureau and National Association of Realtors), while 26% of all U.S home inspections are managed through the Company’s inspection software. In fact, the Company gains early access to homebuyers, almost 6 weeks before the move data, giving it the opportunity to gain from major move related purchase decisions.

Porch has a robust pipeline of potential merger and acquisition interests, with over 150+ companies in the insurance, moving, home services space among others. Most recently, the Company made 4 acquisitions worth $122 million including Homeowners of America preparing ground for a deeper entry into the home insurance market. The Company also added V12, a mover marketing and data platform for $22 million, besides Palm-Tech and iRoofing, a home inspection service and roof application SaaS contractor respectively.

The Company, which made a SPAC IPO debut in December, raised over $323 million, allowing it to use the funds raised for strategic acquisition which will complement and augment its business. Porch has raised its revenue guidance for 2021 from $120 million to $170 million, marking a revenue growth of nearly 134% year-over-year over the previous year.

Indie Semiconductor Inc (NASDAQ: INDI)

Market Cap: $908.41M; Current Share Price: 8.09 USD

Data by YCharts

In June 2021, the Company announced the completion of its business combination with Thunder Bridge Acquisition II, Ltd, a special purpose acquisition company (SPAC). The transaction resulted in gross proceeds of close to $400 million for Indie and the new company retained the existing management team including Donald McClymont, the Company’s Co-founder and CEO, Ichiro Aoki, Co-founder and President; Scott Kee, Co-founder and Chief Technology Officer; Thomas Schiller, Chief Financial Officer and EVP of Strategy among others.

Indie aspires to be the “Autotech Partner” to everyone and is standard and partner agnostic. The Company’s solutions include ADAS/Autonomous Connectivity, User Experience and Electrification and has tie-ups with Tier 1 auto suppliers such as Aptiv, Valeo and Methode and counts among its client’s industry leaders like Tesla, Mercedes-Benz Daimler, GEELY, BMW, Audi, Porsche among others.

The Company provides best-in-class mixed signal Security Operations Center (SOC), which is capable of preventing cybersecurity threats and can proactively handle any issues and challenges arising in the computers, servers or networks related to connected cars. Indie has a robust supply chain in place, which provides reliability and scalability and can cater to diverse markets cutting across geographic regions.

Indie has shipped more than 100 million devices for use in manufacturing by automotive tier 1 companies and is steadily increasing its OEM penetration.

The Company also develops leading-edge ultrasound solutions and has a strong pipeline of system basic chips, FMCW LiDAR and Edge processors. Indie’s FMCW LiDAR Integration solutions that include optical engine, mixed signal processor SOC, scene scanner, power management and AI processors reduce power consumption by 10 times and cost by 20 times.

In addition, the Company also caters to wireless charging telematics, driver monitoring and cloud access. The global automotive telematics industry is expected to reach over $320.6 billion by 2026, growing at a CAGR of 26% from $40.4 billion in 2018 according to a report by Orion market reports.

The Company is also working on delivering a differentiated user experience through innovative CarPlay solutions, Infotainment and LED Lighting solutions.

Most importantly, the Company is seeking to gain a stronghold in the electrification space with its charging controllers and diagnostics solutions. Indie Semiconductor is on the approval list of over 12 Tier-1 approved vendor lists and has a backlog position of more than $2 billion and more than $2.5 billion in possible opportunities.

The Global LiDAR market is estimated to grow at a CAGR of 24.50% from 2019-2026 to reach USD 9.479 million by 2026, according to a report by Data Bridge Market Research. The growth in the market will be driven by technological advancements and increasing demand in a host of sectors. LiDAR technology is best suited to meet the demands of autonomous vehicles, military and Defense applications, aerospace and agriculture industry to name a few.

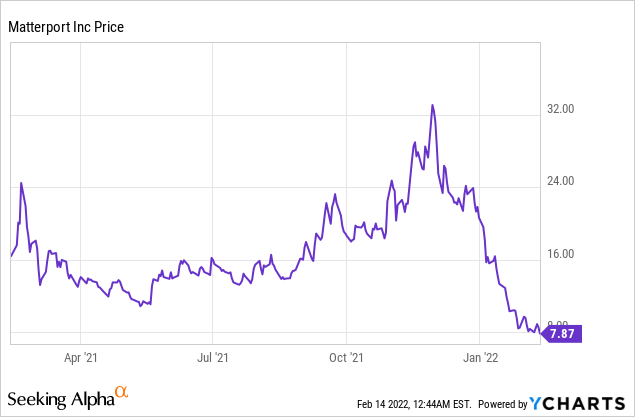

Matterport Inc (NASDAQ: MTTR)

Market Cap: $2.05B; Current Share Price: 7.87 USD

Data by YCharts

Matterport is emerging to be a popular pick for those interested in meta-verse related investments. A leading spatial data Company it enables individuals and companies to digitize and build digital twins of buildings and spaces. The Company delivers unparalleled spatial data insights that help in achieving better designs, promotion and management of key assets.

Image Source: Company

The Company has 439K subscribers across diverse verticals across 170 countries with 6.2 million spaces under management. Most recently, the Company introduced Matterport Axis™, a cutting-edge motorized mount that works in tandem with a smartphone to capture 3D digital twins of any physical space, resulting in improved speeds, precision and consistency. The product is aimed at homes, offices, hotels, rentals, retail locations and factory floors that need a supercharge 3D capture, which can be used with a smartphone.

The Company has made a series of additions to the Management team such as the recent appointment of industry veterans Florence Shaffer as Vice President, Strategy & Operations, Chief of Staff to CEO and Deepti Illa as Vice President, Global Integrated Marketing. In January 2022, Matterport appointed Tom Klein as Chief Marketing Officer (CMO) to spearhead Matterport’s global marketing initiatives as well drive growth across vertical markets.

Matterrport’s spaces under management grew by 92% YoY, and the Company has captured 10 billion square feet of space spread across 150 countries and is miles ahead of competition in terms of spaces under management. Subscribers can capture and digitize any space, from a living room to a board room, and share them with others for a fee. While most of the users currently are using the free-to-use plan, the Company is able to increasingly convert these customers into paid subscribers as evidenced by a 35% increase in conversion rates YoY. As per its Q3,2021 results, the subscriber count increased by 116% year-over-year to 439,000, while paid subscriptions rose to $27.6 million, an increase of 36%.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://matterport.com/news/matterport-appoints-tom-klein-chief-marketing-officer

No Comments