24 Nov 4 Tech Stocks Under $10 to Buy for Higher Returns

Technology Industry has been focused on minimizing the impact of COVID-19 and marching ahead with its innovations and breakthroughs, be it critical components for semiconductors, world-class data center solutions or cutting-edge data analytics and outsourcing facilities.

We take a look at some tech companies that are impervious to the scare and offer a very attractive upside in the long run. These companies not only have an excellent potential for growth and returns but have major upcoming catalysts such as contract awards, new products and services, growing client base or even global expansion plans lined up for the future.

Market Cap: $ 371.68M; Current Share Price: 8.69 USD

Data by YCharts

AXT manufactures high-performance alternative wafer substrates consisting of indium phosphide (InP), gallium arsenide (GaAs) and germanium (Ge) for the semiconductor industry. The Company’s products are intended for use in semiconductor or optoelectronic devices that require better performance than a silicon wafer substrate in industries like 5G infrastructure, silicon photonics, passive optical networks and power amplifiers for wireless devices and satellite solar cells among others.

The Company has a subsidiary in China (Tongmei), that not only produces similar wafer substrates but also has partial ownership in ten raw material producing companies in China. The Company is in the process of listing on STAR and is preparing for an initial public offering in Q2 or Q3 of 2022. In the meanwhile, preparations are underway in the form of an audit, conversion of the Beijing entity into a stock issuing company and merging of JinMei and BoYu into Tongmei. The listing in China will unlock a valuable asset and strengthens AXT’s overall position by giving it access to both the U.S as well as the Chinese capital markets.

AXT has developed a proprietary process technology namely Vertical Gradient Freeze (VGF) crystal growth and has built a strong intellectual property rights portfolio around it. There are significant barriers to entry in the markets that AXT operates in including the Indium Phosphide (InP) Market and hence a very limited competitive landscape, with AXT being a leading supplier along with competitors such as Sumitomo, Japan Energy and Freiberger.

In October 2021, the Company released its third quarter 2021 financial results, which showed revenue at $34.6 million, compared to $25.5 million for the third quarter of 2020, a 46% revenue increase when compared to Q3,2020. AXT’s diluted earnings per share (EPS) has increased by 1,201% since Q1,2020, while its revenue has grown for the last five quarters in a row. According to the Company, the revenue for Q4,2021 is projected to rise to $35.1 million, while the quarterly earnings per share are expected to rise to $0.11 by the end of 2021.

Cyxtera Technologies Inc (NASDAQ: CYXT)

Market Cap: $ 1.59B; Current Share Price: 9.56 USD

Data by YCharts

Cyxtera, which started trading publicly in July 2021, through a SPAC deal with Starboard Value Acquisition Corp (SVAC), offers data center products and services such as colocation, deployment and support services to enterprises and government agencies in the 29 markets across the globe. The Company received nearly $493 million in total cash from the transaction, which is to be used for reducing its debt and investing for future growth.

The Company operates through a sub-leasing model and has 61 data centers with over 2300 customers, operating a capital-light business model, unlike its competitors such as Digital Realty Trust and Equinix that own all and half of their properties respectively. Cyxtera is the third largest data center provider in the world and was formed from the assets of CenturyLink, a telecom provider that sold its data center and colocation business in 2017. The deal saw the combining of Medina Capital’s security and data analytics businesses such as Cryptzone, Catbird, Easy Solutions and Brainspace and formation of Cyxtera Technologies.

The advent of the internet and rapid globalization is driving the demand for high-quality, reliable data transmission. Increased adoption of IT –based solutions, the need for networking in almost all spheres of life and growing demand for mobile and internet services are other factors which are contributing to the growth in the industry. The growing demand for autonomous vehicles, adoption of artificial intelligence, and the rapid strides in augmented reality / virtual reality will prove to be drivers of growth for data centers such as Cyxtera.

As per the Company’s Q3,2021 financial results, revenue stood at $177.1 million, an increase of 2.9% to YoY, while core revenue increased by 8.4% to $161 million. Cyxtera’s core bookings increased by 2.5% over the same quarter last year and its average monthly core churn of 0.7% improved by 20 bps over the same quarter last year. The Company has raised its 2021 revenue guidance to $692M -$706M from $681-$702M earlier and $223M-$227M from $217M – $223M for transaction AEBITDA.

The Company intends to improve the current occupancy rate of 69%, expand its footprint in key markets as needed as well as foray into newer geographic locations through strategic mergers and acquisitions.

Market Cap: $ 1.82B; Current Share Price: 8.39 USD

Data by YCharts

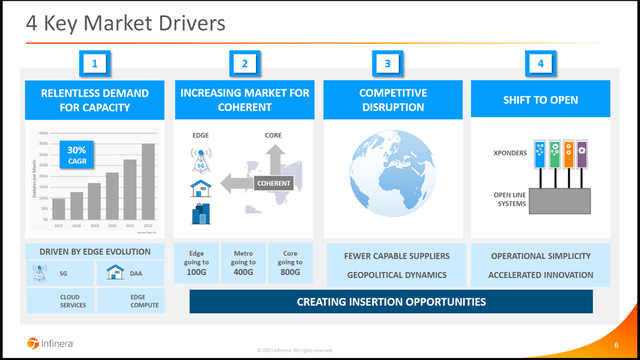

Infinera is on track to achieving revenue growth above the market, profitability on a non-GAAP operating basis and improving gross margins by 300 to 400 basis points, in spite of challenges in the form of supply constraints. As per its Q3,2021 financial results, the Company’s product backlog has grown by 50%. In addition, the factors providing impetus to the Infinera such as growth in traffic, rollout of 5G and mobile edge computing, growing demand for open optical networks and resistance to Huawei, are still driving the growth for the Company.

The Company’s strategy of eight by four by one, in which eight stands for core networks moving to 800-gig services, four stands for metro networks expanding to 400 gig and one reflective of coherent optics playing a crucial role in the rollout of 5G and mobile edge computing has led to the business being reorganized into two groups namely optical systems and coherent optical modules. There have also been changes in the management team, with the inclusion of industry veterans such as Tom Burns and Ron Johnson and Azmina Somani. The Company has also scored customer wins with TI Sparkle, GÉANT, Saudi Telecom, and Telstra, besides several other unannounced customers.

Image Source: Company

The Company is trying to gain a strong foothold in the optical technology market and is competing against the likes of Ciena and Huawei. Optical transmission is rapidly emerging as one of the fastest growing industries owing to reliability and ease of implementation. Wavelength Division multiplexing is emerging as one of the most focal segments of the global optical equipment market.

Infinera recently expanded its portfolio of optical networking solutions that leverage its XR optics technology to offer ICE-XR pluggables for point-to-point and point-to-multipoint transport applications. The Company is likely to benefit from the growing demand for bandwidth and the resistance to Chinese manufacturers amid political tensions. This offers an opportunity for Infinera to fill the gap created by Huawei and the Company is upbeat about its investments in operational improvements bearing fruit this year, providing it with the perfect avenue for growth and expansion.

The technology is extremely popular and much sought after as it allows telecommunication players to expand their network offering, without having to lay down actual fiber. These enable the telecommunication provider to assimilate technological development in their existing optical structure and increase or decrease the capacity of a link, without having to make any changes to the existing network.

According to a report by Acumen Research and Consulting, the global coherent optical equipment market will be worth over 70.14 billion by 2026, growing at a CAGR of 9.23 percent, from 34.61 billion in 2018. This offers a great opportunity for Companies such as Infinera to gain a strong foothold in the market.

Infinera is the creator of the industry’s first point-to-multipoint coherent optical subcarrier aggregation technology. The Company offers diverse solutions encompassing areas such as Intelligent Automation, 5G, Fiber Deep, DAA, cloud networking, business services, access and aggregation, in addition to core and subsea networks.

The Company’s offerings cater to the end-to-end need for networking solutions of Tier 1 carriers, internet content providers, cable operators, government, and enterprise networks worldwide, by using technology innovation. Infinera’s end-to-end, multi-layer packet optical and IP transport solutions facilitate scaling of bandwidth on demand, accelerate service provisioning, and automate operational tasks as per the Company.

Infinera’s proprietary vertically integrated Infinite Capacity Engine (ICE) allows the Company to offer economic and robust performance in the long-haul, subsea, data center interconnect, and metro transport applications. The services of the Company range from optical line systems, packet optical transport systems, compact modular platforms, carrier-grade routers, and management and automation solutions.

The Company offers differentiated photonic integrated circuit (PIC) and application-specific integrated circuit (ASIC) chips, which have been developed in-house. Infinera services nine of the top 10 global Tier 1 service providers, the top six ICPs, cable multiple systems operators (MSOs), cloud and data center operators, enterprises and government agencies according to the Company. It offers the lowest Total Cost of Ownership (TCO) and a “pay as you win” instant bandwidth operational model and has a customer base of over 500 clients worldwide, spanning six continents in more than 100 countries. The intellectual property portfolio of Infinera has more than 2000 patents.

Conduent Inc (NASDAQ: CNDT)

Market Cap: $ 1.18B; Current Share Price: 5.52 USD

Data by YCharts

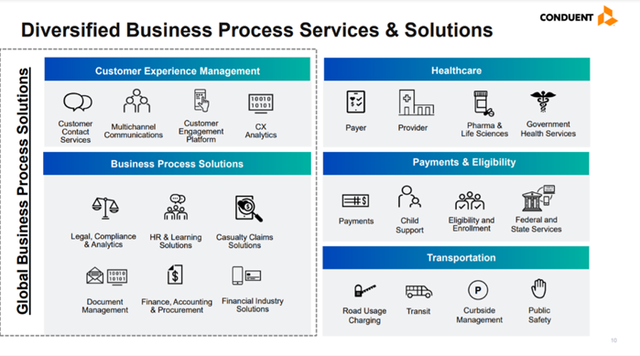

Conduent offers solutions for automation and analytics, to businesses and governments worldwide, in areas such as business processing, customer experience management, healthcare, payment processing and transportation solutions. According to a report by Grand View Research, the global business process outsourcing solutions market is poised to reach USD 435.89 billion in 2028 , growing at a CAGR of 8.5 percent , from USD 232.32 billion in 2020.

The Company’s services and solutions are utilized by a majority of Fortune 100 companies and more than 500 governments worldwide. Conduent helps organizations transform their businesses by automating operations by using leading-edge technology that enable them to achieve supply chain efficiencies and drive revenue growth. The services offered by the Company encompass document management and automation, casualty claim solutions, HR and learning solutions, Finance, accounting and procurement, legal and compliance solutions among others.

In June 2021, Conduit was named a GM Supplier of the Year winner in General Motors’ 29th annual Supplier of the Year awards. The Company was recognized for providing services such as Payroll, Legal Compliance, and Finance, Accounting and Procurement.

The Company’s revenue for Q3,2021 stood at $1,038, compared to $1,041 in Q3,2020, which isn’t a significant change. Conduent has witnessed increased volumes in its Government Payments business and new business ramp in Q3 as per its Q3,2021 financial results. New business TCV signings were at $344M, up by 4% YTD, while new business ARR was at $87M, up by 15 % compared to last year. The Net ARR Activity Metric stood at $132M, an increase of 25% from Q2 2021, clocking a positive rate for the fourth consecutive quarter.

The Company also enables the delivery of omnichannel customer experiences that are customized to suit specific industry, region and language requirements. Conduit provides customer experience (CXM) services such as contact services, multichannel communication and work-at-home solutions to companies in the banking, financial services, healthcare, retail, hospitality and telecom sector to name a few. Conduit registers more than 205 million customer interactions daily and over 10 billion annual customer communications.

As part of its Healthcare solutions the company offers payer, provider and interoperability solutions, besides life science and government and community health management services, which ensure that organizations are able to meet with compliance requirements, deliver high quality patient care and improve operational efficiency and reduce costs.

Image Source: Company

The Company’s IT modernization solutions assist government agencies and public sector organizations to transform the handling of payment processing, record management, child support and case management to name a few. Conduent has played an instrumental role in implementing Medicaid, CHIP and other government aid programs, with more than $80 billion disbursed to those eligible to receive federal, state and local government support.

Furthermore, Conduent uses a combination of hardware, software and advanced video analytics to help communities stay safe. The DriveSafe™ Enforcement System facilitates red light enforcement, speed control, restricted lane and one-way enforcement to name a few. Furthermore, its Vehicle Passenger Detection System (VPDS) is able to recognize violators with more than 95 percent accuracy and upon identification a license plate recognition camera collects plate number as evidence, with a 95 percent client retention rate across 114 global locations.

Image Source: Company

Conduent’s data analytics solutions include visual data analytics, statistical modeling and prediction analysis capabilities. Furthermore CiteWeb®is a violation processing system that offers support to its photo enforcement programs. The Company offers a full gamut of citation management and enforcement solutions ranging from automated enforcement, database management, delinquent collections to name a few.

In addition, it offers Automated License plate recognition system integration which is critical to toll collection, automated enforcement, parking assistance, Airport, Campus and event parking. The technology can also assist in retrieving stolen vehicles and creation of AMBER alerts in case of “HOT LIST” numbers.

Conduent’s ALPR system differs from other competitors, mainly through Signature Implementation that helps single out distinct characteristics or marks, which can be stored for confirming the number plates and act as references for the future. The system can also weed out number plates that aren’t a match, are too dark or unclear and prevent them from going to the manual review team. Additionally, the image segmentation feature helps establish character confidence by isolating individual characters.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://axtinc.gcs-web.com/static-files/3a62ebcf-6ef7-4397-9122-57091380f082

https://investor.conduent.com/

https://investor.conduent.com/static-files/93724ea4-7221-4da0-9fe4-1e9f199adc67

https://investors.infinera.com/overview/default.aspx

https://s28.q4cdn.com/745863527/files/doc_financials/2021/q3/3Q-Earnings-Deck-FINAL.pdf

No Comments