01 Sep 5 Biotech Stocks Insiders are Buying!

Insider selling or buying cannot be the sole indicator for investing in a stock, but it would be wise to make a note of the buying and selling activities to gauge a company’s prospects or the lack thereof. While insiders buying or selling the Company’s stock could provide investors with a general idea about the direction it is headed, a thorough understanding of its fundamentals, recent news and analyst estimates should be taken into consideration while making an investment decision.

We take a look at five companies that have witnessed insider buying in the past year.

Kronos Bio Inc (NASDAQ: KRON)

Market Cap: $1.18B; Current Share Price: 20.91 USD

Data by YCharts

Insider Buying Information for Past 12 Months: Insiders have been buying the stock of the Company, with the biggest single purchase being made by Norbert Bischofberger, the Company’s president, who bought USD 1.8 million shares at a price of USD 19.00 per share. Another transaction was made by Marianne De Backer, a member of the board of directors, who bought shares worth USD 35 thousand in the last three months.

Insiders at Kronos Bio own 15 percent of the company, which translates to about USD 172 million.

Christopher Dinsmore, the chief scientific officer at Kronos Bio, sold 9,189 shares at an average price of $20.59, for a total transaction of $189,201.51.

Recent News: Kronos has received an average rating of “Buy” from six analysts. The average 12-month price objective is $41.50. In July, Zack investments research upgraded its “sell” rating to “hold”. In addition, HC Wainwright initiated coverage with a “buy” rating and a $35.00 target price on the stock.

The Company has received an FDA clearance for the Investigational New Drug Application (IND) for lanraplenib (LANRA), marking its first IND in an oncology indication. This enables the company to proceed with a Phase 1/2 clinical trial in patients with relapsed or refractory FLT3-mutated acute myeloid leukemia (AML) in combination with gilteritinib, which is likely to be initiated in Q4,2021.

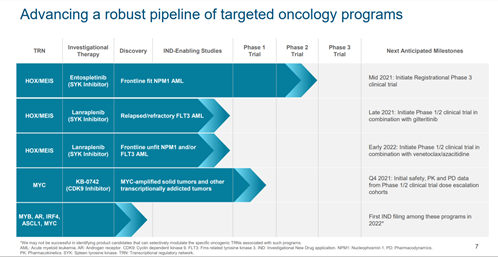

Company Profile: Kronos Bio is a clinical biotechnology company developing novel therapeutics for the treatment of cancer, by targeting dysregulated transcription. The Company’s proprietary product engine is being leveraged to create a portfolio of spleen tyrosine kinase (SYK) inhibitors, through focus on dysregulated transcription factors and the transcriptional regulatory networks (TRNs).

The Company’s product candidate entospletinib (ENTO) is currently under evaluation for the treatment of acute myeloid leukemia (AML). In addition, the Company is also developing a second SYK inhibitor, lanraplenib (LANRA), for the treatment of autoimmune diseases and relapsed/refractory FLT3-mutated AML.

Image Source: Company

Kronos is also working on KB-0742, intended for the treatment of MYC-amplified solid tumors, which is currently undergoing a phase 1/ 2 trial and is expected to announce initial safety, PK and PD data in Q4,2021.

Eyenovia Inc (NASDAQ: EYEN)

Market Cap: $142.71M; Current Share Price: 5.50 USD

Data by YCharts

Insider Buying Information for Past 12 Months: There have been multiple insider purchases of Eyenovia’s stock, with the most recent one being a purchase of USD 199 thousand worth of the stock by Stuart Grant, who paid USD 3.98 per share. In addition, the Company also bought USD 355 thousand worth of shares at USD 3.55 per during the past year. In total, insiders have bought nearly 459.44 thousand shares worth USD 1.8 million and currently own nearly USD 33 million worth of shares, that translates to 26 percent of the company.

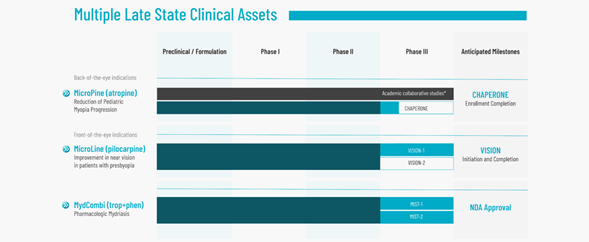

Recent News: The Company’s MydCombi has been granted a PDUFA date of October 28, 2021. MydCombi is a pupil dilation agent, which the Company believes has the potential to become a new standard of care for comprehensive eye exams.

Company Profile: Eyenovia has developed MydCombi (Mydriasis), a first-in-class fixed-combination micro-formulation product containing phenylephrine 2.5% -tropicamide 1%, for pharmacologic mydriasis, intended to improve the efficiency of eye dilations that are a prerequisite for diabetic eye check-ups as well as cataract surgeries. Eyenovia is targeting the development of clinical microdosing of advanced versions of well-established ophthalmic pharmaceutical agents, using its proprietary high-precision targeted ocular delivery system, which has the potential to replace the existing eye dropper delivery. This can result in improved safety, tolerability and patient compliance.

Image Source: Company

The Company’s proprietary Optejet technology overcomes the limitations in conventional eyedropper bottles that overdose the eye much beyond its capacity for only 6-8 μL of medication. The use of microdosing by the Optejet dispenser simplifies the process of self-administration and makes it more convenient and reliable; the device comes equipped with smart technology that enables patients to keep track of their therapy through reminders and adherence measures.

Image Source: Company

Eyenovia’s clinical pipeline has MicroPine (atropine) intended for arresting the progression of pediatric myopia and MicroLine (pilocarpine), a treatment for improvement of near vision in patients with presbyopia.

Prelude Therapeutics Inc (NASDAQ: PRLD)

Market Cap: $1.68B; Current Share Price: 35.69 USD

Data by YCharts

Insider Selling Information for Past 12 Months: During the past year, insiders bought shares worth USD 289 thousand. The biggest insider transaction was done by Mardi Dier, an independent director of the company, who bought USD 190 thousand shares at USD 19.00 per share. The share is currently trading at 36.92 USD. Insiders own nearly USD 106 million worth of shares in the Company, which translates to 6.7%.

The Company’s Chief Scientific Officer, Peggy Sherle, Phd, sold 1,700 shares at an average price of $35.19, for a total value of $59,823.00 on August 30, 2021.

Recent News: In July,2021, the Stock was upgraded from Neutral to Buy with a price target of $60 by BofA Securities. The analyst Tazeen Ahmad stated that the Company had “multiple catalysts near term that could further de-risk the platform. Additional ph 1 data on ‘543 are expected to be presented at medical meetings in 2H, where we look for additional responses and a consistent safety profile”. On the other hand, the stock received a downgrade from Zacks Investment Research, which changed its rating from “Hold” to “Sell”.

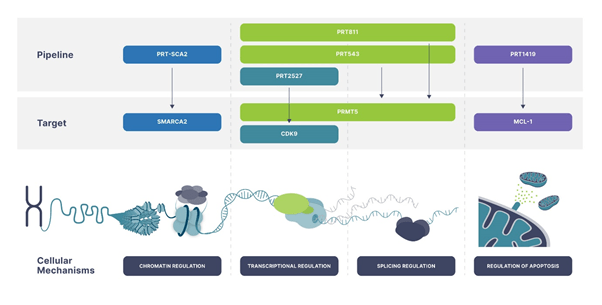

Company Profile: Prelude Therapeutics is aiming to develop novel small molecule therapies to redefine precision oncology. The Company is leveraging its expertise in medicinal chemistry, cancer biology and drug development to advance a pipeline of oncology drug candidates that address areas with large unmet needs. The Company is working on six distinct programs namely, methyltransferases, kinases, protein-protein interactions, and targeted protein degraders.

Image Source: Company

The Company’s pipeline consists of PRT543 and PRT811, candidates that selectively inhibit PRMT5. PRT543, is currently being evaluated in a Phase 1 clinical trial, in advanced solid tumors and select myeloid malignancies such as adenoid cystic carcinoma (ACC), myelofibrosis (MF), genomically-selected myelodysplastic syndrome (MDS) among others. PRT811, is being developed for the treatment of central nervous system (CNS) tumors such as glioblastoma multiforme (GBM) and primary CNS lymphoma and is currently undergoing a phase 1 clinical trial.

Prelude is also evaluating PRT1419, an orally available, potent, and selective inhibitor of MCL1, intended for the treatment of high-risk myelodysplastic syndrome, acute myeloid leukemia, non-Hodgkin’s lymphoma, and multiple myeloma, in a Phase 1 clinical trial.

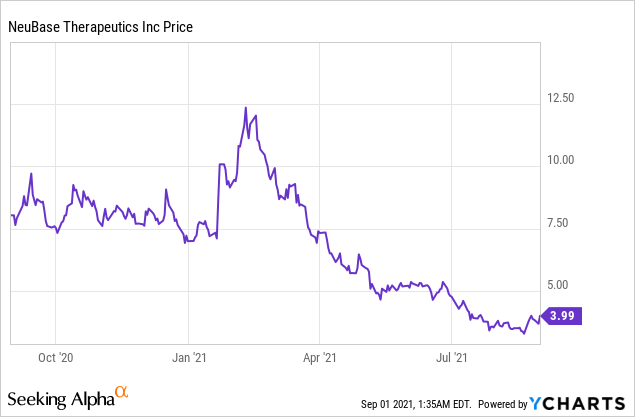

Neubase Therapeutics Inc (NASDAQ: NBSE)

Market Cap: $130.54M; Current Share Price: 3.99 USD

Data by YCharts

Insider Selling Information for Past 12 Months: The Company’s founder Dietrich Stephan purchased shares worth USD 60 thousand at a price of USD 5.00 per share. The stock is currently trading at 3.67 USD. Additionally, Dov Goldstein has bought USD 38 thousand worth of shares in the past three months. Insiders own close to USD 13 million worth of shares, which is nearly 10 percent of the Company.

Recent News: In June, 2021, the Company presented preclinical in vivo data that showed selective silencing of disease-causing mutations at the DNA or RNA level in three diseases, caused by distinct underlying genetic mechanisms. The compounds were well tolerated at pharmacologically active doses and were successfully delivered into the brain and muscle.

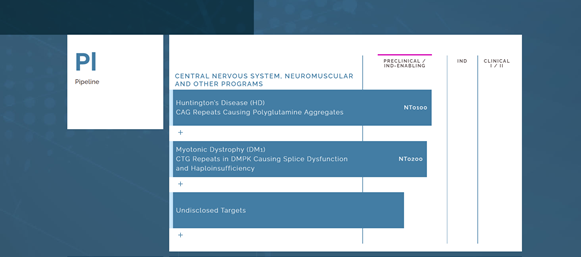

Company Profile: NeuBase’s proprietary Peptide-nucleic acid AnTisense OLigo (PATrOL™) platform enables the Company to develop leading-edge therapeutics which offer improvement over existing therapies by offering several advantages such as scalable and modular development, broad organ distribution and no immune response.

Image Source: Company

The Company is developing the NT0100 program for the treatment of Huntington’s disease (HD), which is currently undergoing preclinical development, with plans to file an IND for NT0100 by the end of 2021. Additionally, the Company is also developing NT0200 for the treatment of Myotonic dystrophy type 1 (DM1), which is a rare, autosomal disorder that results in progressive muscle wasting and weakness. The Company intends to file for an IND for the candidate in the fourth quarter of calendar year 2022.

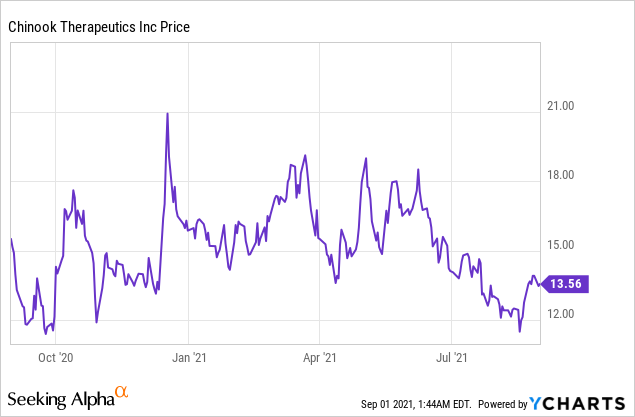

Chinook Therapeutics Inc (NASDAQ: KDNY)

Market Cap: $607.48M; Current Share Price: 13.56 USD

Data by YCharts

Insider Selling Information for Past 12 Months: Eric Dobmeier, the president of Chinook Therapeutic, bought shares worth USD 118 thousand at a price of USD 11.82 for each share, increasing the holding by 10 percent. In total, he bought 21.50 thousand shares over the past year at an average price of USD 12.77. Insiders own USD 5.5 million worth of shares, which translates to 1.0 percent of the Company.

Furthermore, Srinivas Akkaraju, Director of the Company purchased 208,500 shares at a price of $11.58, taking his total holding to nearly 3.38 million.

Recent News: In June, 2021, Evercore ISI analyst Joshua Schimmer, maintained a BUY rating of Chinook, with a price target of $32.00. The stock has an analyst consensus of Strong Buy with a price target of $31.25. In August 2013, analyst Ed Arce from H.C Wainwright maintained a BUY rating on Chinook Therapeutics with a price target of $28.00.

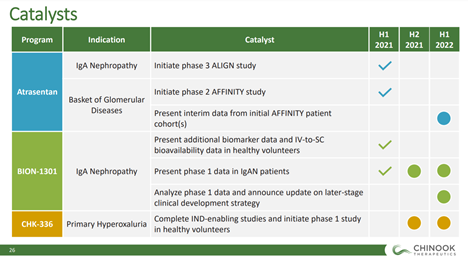

Company Profile: Chinook is a clinical-stage Company developing precision medicines that target rare and chronic kidney ailments with large unmet needs. The Company’s lead drug candidate is Atrasentan, which is currently undergoing a Phase 3 trial namely ALIGN and a Phase 2 trial named AFFINITY in IgA nephropathy and Glomerular diseases respectively.

Image Source: Company

Furthermore, the Company is also developing BION-1301, intended for the treatment of IgA nephropathy, that is currently being evaluated in a Phase 2 trial. CHK-336, a treatment targeting primary hyperoxaluria, is presently undergoing IND-enabling studies.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://ir.kronosbio.com/static-files/d480db44-ec64-4e64-ab50-be8688f3a32a

https://eyenovia.com/pipeline/

https://investors.preludetx.com/

https://finance.yahoo.com/news/neubase-therapeutics-reports-financial-results-200100942.html

https://www.neubasetherapeutics.com/pipeline/

https://investors.chinooktx.com/static-files/05872848-33e0-4e25-a2d6-174fa8d6f64

No Comments