01 Nov 4 Small-Cap Biotech Stocks for Your Investment Portfolio!

Clinical-Stage companies offer an exciting investment opportunity with massive upside potential. Most of these companies bring new and highly differentiated approaches, advanced scientific knowledge and a zeal for innovation to the table.

Our biotech picks this week are making strides in fields such as immune-oncology, ocular medicine and psychedelic medicine. Some of these companies have entered into strategic collaborations with some major pharmaceutical companies and have upcoming catalysts in the form of data readouts, initiation of clinical trials and IND submission to look forward to.

However, a word of caution is in order as clinical trials are fraught with risk and uncertainty. Even the slightest setback can prove detrimental to the existence of these companies. Failure to meet clinical endpoints, lack of funding or rejection from regulatory authorities are risks that these companies have to bear in pursuit of excellence.

Leap Therapeutics, Inc. (NASDAQ: LPTX)

Market Cap: $243.50M; Current Share Price: 2.79 USD

Data by YCharts

Leap Therapeutics, formerly known as HealthCare Pharmaceuticals, Inc. is a biopharmaceutical company developing novel therapeutics for the treatment of numerous cancers such as gastroesophageal, gynaecological, hepatocellular carcinoma, biliary tracts cancer and prostate cancer. The Company is developing a pipeline of first-in-class antibodies that work on key cellular pathways that play a crucial role in the growth and proliferation of cancer cells as well as identify and fight cancer.

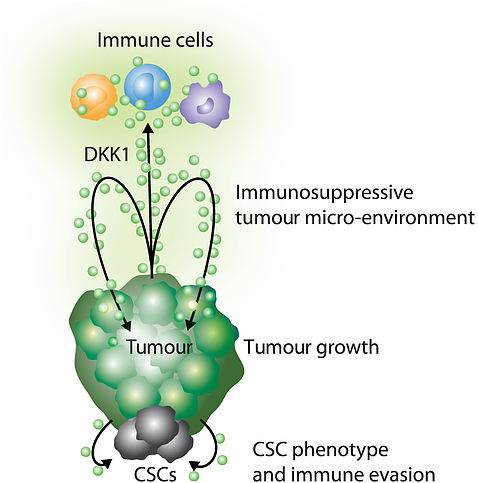

The Company’s lead candidate is DKN-01, a Dickkopf-related protein 1 (DKK1) that can regulate Wnt signalling pathways. Research shows that dysfunctional Wnt signaling can lead to cancer cell growth and suppression of the immune system. DKK1 has been found to be overexpressed in numerous cancers, most often leading to worse outcomes. The Company’s approach revolves around inhibition of DKK1 to generate a direct anti-tumor effect and an immune anti-tumor response.

Image Source: Company

DKN-01 is a DKK1 neutralizing antibody that has the potential to work in synergy with chemotherapeutics and checkpoint inhibitors.

The Company is also developing TRX518, an anti-GITR agonist, which can block the suppression of immune responses by regulatory T cells (Treg cells). A GITR (glucocorticoid-induced TNFR-related protein) can improve immune response to modulate the immune system to attack cancer. In preclinical studies, TRX518 has demonstrated the ability to effectively synergize with certain chemotherapeutics and checkpoint inhibitors in their anti-tumor cytotoxicities.

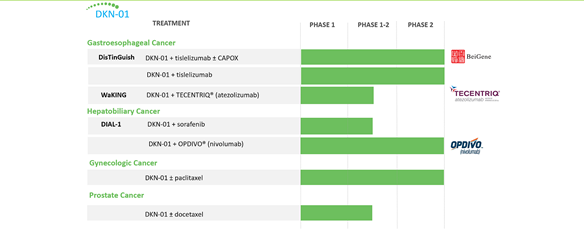

Image Source: Company

The Candidate is currently being evaluated in a Phase 2 trial named DisTinGuish in Gastro, in combination with BeiGene’s tislelizumab and CAPOX, in addition to DKN-01 + tislelizumab. WaKING, a Phase 1 /2 clinical trial is evaluating DKN-01, in combination with TECENTRIQ (atezolizumab).

Leap is also evaluating DKN-01 in Hepatobiliary Cancer in combination with sorafenib in the phase 1 / 2 DIAL-1 trial and in combination with OPDIVO (nivolumab) in a Phase 2 trial. The candidate is also under Phase 2 evaluation in Gynaecologic cancers in combination with paclitaxel and a phase 1 /2 study in prostate cancer in combination with docetaxel.

In September 2021, the Company announced that the first patient has been dosed in the Phase 2a DisTinGuish study, which is expected to enrol up to 72 patients. The study is part of an exclusive option and license agreement with BeiGene for the development of DKN-01 in Asia (excluding Japan), Australia and New Zealand, while Leap retains the rights for the rest of the world. The Company reported a successful mid-stage trial for DKN-01 in combination with BeiGene’s anti-PD-1 antibody tislelizumab in patients with gastric or gastroesophageal junction cancer. There could be a potential merger with BeiGene in the pipeline considering that the companies have been working closely and the candidate has already demonstrated an impressive response rate in first-line patients with gastric or gastroesophageal junction cancer.

Furthermore, the DKN—01 is being developed for the treatment of other solid tumor indications, which presents a million-dollar opportunity for the company.

Voyager Therapeutics, Inc. (NASDAQ: VYGR)

Market Cap: $137.33M; Current Share Price: 3.62 USD

Data by YCharts

In October 2021, the Company entered into a licensing agreement with Pfizer for its TRACER platform. The Company is eligible to receive up to $630 million, with $30 million for transgene-specific access to their novel AAV capsids and the rest of the amount being available in option exercise fees, milestone payments and royalties.

The Company’s TRACER system is an RNA-based functional screening technology, which stands for Tropism Redirection of AAV by Cell-type-specific Expression of RNA. This next-generation AAV Capsid platform can identify novel capsids with potential to target cells and tissues that fall beyond the reach of existing gene therapy delivery methods. Preclinical studies in non-human primates dosed with TRACER capsid 9P801 have demonstrated an over 1,000-fold transgene expression in the brain and a 100-fold higher transgene expression in the spinal cord, compared to AAV9. The capsid was also able to penetrate the blood brain barrier and were able to achieve extensive biodistribution and transduction in numerous areas of the brain including cortex, thalamus, striatum, cerebellum, brainstem and spinal cord.

Image Source: Company

The Company is using its novel platform to identify capsids with tropism for indications such as Huntington’s disease, monogenic ALS, Spinal Muscular Atrophy and other indications. In April 2021, the Company received an FDA clearance for its IND application for VY-HTT01, a gene therapy candidate for the treatment of Huntington’s disease after being placed on a clinical hold. Voyager is also developing vectorized monoclonal antibodies that are designed to deliver single-dose gene therapies that can overcome the limitations of passive immunization in indications such as Frontotemporal dementia, progressive supranuclear palsy and Alzheimer’s disease.

In 2019, the Company entered into a licensing deal with Neurocrine Biosciences in exchange for $165 and an additional $1.7 billion for four gene therapy programs. However, in February 2021, Neurocrine pulled out of the Parkinson’s program (NBib-1817 or VY-AADC) after FDA put a clinical hold on the phase 2 trial of NBib-1817 due to “observation of MRI abnormalities” in some of the patients.

Voyager still has three programs left namely Friedreich’s ataxia and another two undisclosed programs that could bring in $195 million and $130 million apiece respectively. The Company has had a hard time with partnerships with its agreements with Sanofi Genzyme and Abbvie meeting a similar fate.

Ocular Therapeutix, Inc. (NASDAQ: OCUL)

Market Cap: $508.51M; Current Share Price: 6.64 USD

Data by YCharts

In October 2021, the FDA approved a Supplemental New Drug Application (sNDA) for DEXTENZA (dexamethasone ophthalmic insert) 0.4mg, which is now indicated for the treatment of ocular itching associated with allergic conjunctivitis. DEXTENZA is the only FDA-approved physician-administered intracanalicular insert that can deliver preservative-free drugs with a single administration for up to 30 days. The candidate first scored an FDA approval in November 2018 for treatment of ocular pain following ophthalmic surgery, which was then extended to include the treatment of ocular inflammation following ophthalmic surgery in June 2019.

In September 2021, the Company reported in-market unit sales of DEXTENZA® billable inserts of 6,924 and 9,321 in July and August, during its presentation at the H.C. Wainwright 23rd Annual Global Investment Conference. Ocular is targeting a total addressable market of $13B in retinal diseases, a $4.8B market in Glaucoma, a $5.1B in Dry Eye Disease and a $1B market in Surgical.

Ocular is leveraging a novel Hydrogel Platform to develop sustained-release dosage of drops or injections that were previously approved by the FDA. The platform offers multiple advantages such as preservative-free drugs that reduce the potential for inflammation, adaptable to small molecules or large proteins, engineered release and convenience among others.

The Company’s first commercialized product, ReSure® Sealant, is already in the market for the treatment of intraoperative management of clear corneal incisions (up to 3.5mm) with a demonstrated wound leak, following cataract surgery with intraocular lens (IOL) placement in adults.

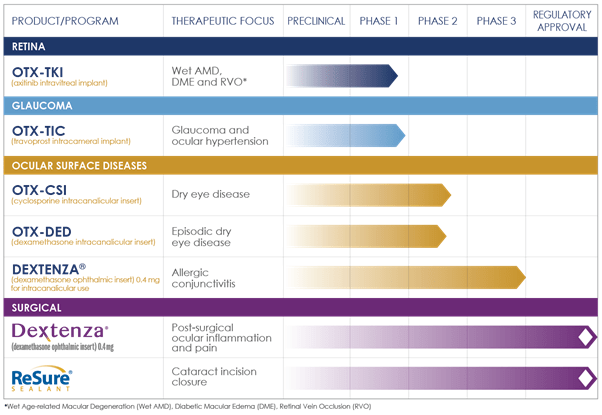

Image Source: Company

Ocular is building a robust pipeline of candidates that are currently under evaluation in various clinical trials. OTX-TKI (axitinib intravitreal implant) is undergoing a phase 1 trial in Wet AMD, DME and RVO, while OTX-TIC (travoprost intracameral implant) is undergoing a phase 1 trial in Glaucoma and ocular hypertension. The Company’s portfolio of ocular surface diseases consists of OTX-CSI (cyclosporine intracanalicular insert) which is being studied in a phase 2 trial in Dry Eye Disease, besides OTX-DED (dexamethasone intracanalicular insert), intended for the treatment of episodic dry eye disease.

The Company announced topline results from its Phase 2 clinical trial of OTX-CSI (cyclosporine intracanalicular insert) for the treatment of dry eye disease (DED), which failed to meet its primary objective and failed to show separation between the OTX-CSI treated subjects (both formulations) and the vehicle treated subjects (both formulations) for the primary endpoint of increased tear production at 12 weeks as measured by the Schirmer’s Test.

Upcoming catalysts for the Company include the initiation of a phase 2 trial in Glaucoma in Q4,2021. In addition, Ocular intends to release the topline data from a Phase 2 clinical trial of OTX-DED (episodic dry eye) in Q1,2022.

Mind Medicine, Inc. (NASDAQ: MNMD)

Market Cap: $928.043M; Current Share Price: 2.52 USD

Data by YCharts

MindMed is developing experimental psychedelic-inspired treatment solutions for anxiety, addiction and adult ADHD. Most recently, the Company announced the expansion of its pipeline to include a new program to develop R (-)-MDMA, intended for the treatment of social anxiety and impairment of social functioning in conditions such as autism spectrum disorder. The Company is targeting a US and EU registration and is likely to initiate its first clinical trials in R (-)-MDMA, S (+)-MDMA and R/S-MDMA in 2022, in association with Liechti Lab at University Hospital Basel.

The Company has entered into a partnership with Sphere Health to collect and analyse data for better insights into numerous biomarkers associated with mental illnesses. The companies are jointly conducting a study named MM061302 to create more effective machine learning tools that can identify biomarkers associated with anxiety and depression.

Image Source: Company

MindMed is targeting major psychiatric disorders in areas such as major depressive disorder, pain disorders and anxiety disorders among others. The Company estimates that over 51.5 million adults suffer from mental illnesses in the U.S alone, which translates to more than $225 billion in annual cost of mental health. To address this growing burden, the Company is working on creating a pipeline of novel drugs that have a unique mechanism of action, are well-tolerated and can bridge the gap between psychotherapy and pharmacology.

The pipeline of the Company consists of a potential Phase 2B trial initiation in generalized anxiety disorder in LSD in late 2021 and a Phase 2A in adult ADHD as well. The Company also intends to initiate a Phase 2a of 18-MC in opioid withdrawal, a Phase 2a of LSD in acute pain and chronic pain. MindMed’s ongoing trials include Phase 2a in anxiety disorder, major depressive disorder, and cluster headache.

The Company has built a strong portfolio of intellectual property rights with more than 45 patent applications filed that cover the same number of molecules and over 30 NCE’s. In addition, the patent portfolio also includes 10+ applications covering LSD and 3+ patent applications for 18-MC. These offer protection in matters of composition of matter, NCE’s/psychedelic analogues, methods of manufacturing among others.

MindMed has an exclusive licensing agreement with UHB and has acquired rights to multiple programs from them. The Company has received a $6.5 million NDA grant from the National Institute of Drug Abuse (NIH) for developing 18-MC.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://www.fiercebiotech.com/biotech/neurocrine-exits-165m-parkinson-s-pact-voyager-after-fda-hold

https://finance.yahoo.com/news/voyager-therapeutics-receives-fda-clearance-120000628.html

https://ocutx.gcs-web.com/static-files/cc39c886-ebaf-44ed-a6c5-b43099f6fb50

https://finance.yahoo.com/news/mindmed-expands-drug-development-pipeline-110000548.html

https://finance.yahoo.com/news/mindmed-announces-strategic-research-collaboration-113000062.html

https://mindmed.co/wp-content/uploads/2021/09/MindMed-Presentation_Sept3021.pdf

No Comments