21 Mar What’s Next for Nektar Therapeutics?

On March 14 2022, The Nektar Therapeutics (NASDAQ: NKTR) announced that a review by an independent Data Monitoring Committee (DMC) evaluating the safety and efficacy of bempegaldesleukin in combination with Opdivo (nivolumab), revealed that the study has failed to meet the primary endpoints of progression-free survival (PFS) and objective response rate (ORR), as measured by a Blinded Independent Central Review (BICR). In addition, another primary endpoint of Overall Survival (OS) also could not meet statistical significance.

The results have prompted the Company to unblind the doublet therapy arm, as no additional clinical benefit could accrue based on the data review by the committee. The Companies will not perform any additional analyses for the OS endpoint and will discontinue enrolment in the ongoing PIVOT-12 study in adjuvant melanoma.

Nektar Therapeutics (NASDAQ: NKTR)

Market Cap: $1.04B; Current Share Price: 5.60 USD

Data by YCharts

Jonathan Zalevsky, chief research and development officer of Nektar Therapeutics, commented

“While we are surprised and deeply disappointed in these results for the melanoma study, we will continue to await initial results from our first two ongoing studies in renal cell carcinoma and urothelial cancer, which are currently expected in the first half of 2022. We look forward to collaborating with BMS to evaluate the data from these other studies to guide the future development of bempegaldesleukin. Nektar remains dedicated to the development of therapeutics to treat cancer and auto-immune disease.”

Strength

Nektar’s areas of focus are cancer, auto-immune disease and chronic inflammatory diseases, where the company seeks to make an impact with its novel Polymer chemistry platform. The company’s lead drug candidate for treatment of melanoma is an immunostimulatory IL-2 cytokine prodrug + anti-PD-1 named Bempegaldesleukin (+ OPDIVO®), which underwent a pivotal Phase 3 registrational study (PIVOT-IO-001), in partnership with Bristol Myers Squibb (NYSE: BMY).

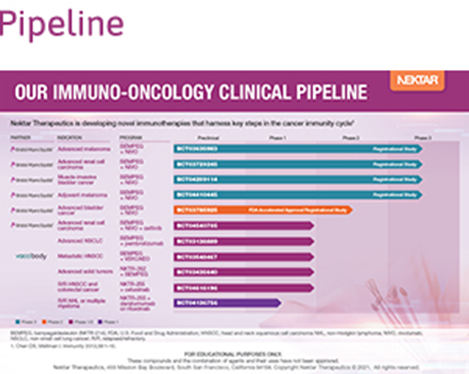

Bempegaldesleukin (BEMPEG/NKTR-214) has the potential to stimulate and expand specific cancer-killing T-cells and natural killer (NK) cells, without affecting intratumoral regulatory T cells. The candidate can deliver a controlled, sustained, and preferential IL-2 pathway signal and is part of five registrational programs and one mid-stage program for BEMPEG in combination with nivolumab (OPDIVO®) that the company is developing in collaboration with BMS.

The Company was engaged in a phase 3, randomized, open-label study of bempegaldesleukin (BEMPEG; NKTR-214) plus nivolumab (NIVO) versus NIVO monotherapy for the adjuvant treatment of patients with completely resected melanoma at high risk of recurrence. The trial had randomized a total of 783 patients over the age of 12 with Resected Stage IIIa–IV melanoma with no evidence of disease. The primary endpoint of the study is Recurrence-free survival, while secondary endpoints include overall survival, distant metastasis-free survival, safety and tolerability and quality of life.

The candidate has demonstrated durable responses and encouraging clinical activity in PIVOT-02, a multicentre phase 1/2 study in multiple solid tumor settings. The combination showed clinical activity with ORR 53% and CR 34%, in efficacy-evaluable patients, demonstrated durable and deep responses over time and was well-tolerated. The combination of BEMPEG + NIVO was granted a breakthrough therapy designation for treatment of patients with previously untreated, unresectable or metastatic melanoma by the FDA in July 2019.

Image Source: Company

BEMPEG is also undergoing evaluation in numerous indications including genitourinary cancer, (metastatic renal cell carcinoma), muscle-invasive bladder cancer, adjuvant melanoma metastatic head and neck cancer whose tumors express PD-L1, cancer vaccines, treatment for mild COVID-19 among others. In addition, Nektar is also developing NKTR-358 for autoimmune diseases (Systemic Lupus Erythematosus), NKTR-358 for ulcerative colitis, NKTR-358 for psoriasis and NKTR-358 for Atopic Dermatitis in association with Lilly.

The Company has multiple clinical collaborations, co-development and licensing agreements with top-notch Biotechnology and pharmaceutical companies such as Bristol-Myers Squibb, SFJ pharmaceuticals, Merck (NYSE: MRK), Exelixis (NASDAQ: EXEL), Vaccibody, Lilly and Janssen to name a few, which are leveraging the company’s proprietary platform to develop next-generation therapeutics.

Nektar has granted technology rights to third parties to enable drug development and manufacturing. Some of these medicines include Mircera, Cimzia, Neulasta, Pegasys among others.

Weakness

The Company has several commercial—stage drugs such as Movantik, a prescription medicine intended to treat constipation due to opioids in adults with chronic non-cancer pain, which was developed and commercialized by AstraZeneca as part of a global agreement. The Company has also developed ADYNOVATE, an extended half-life recombinant factor VIII (rFVIII) treatment for Hemophilia in collaboration with Baxter, which was later acquired by Takeda. However, revenues from these avenues that consist of milestone related payments and royalties, aren’t enough to fund its pipeline development and operations.

The candidate’s interim data analysis from a phase 1/2 trial that was shared in 2018, showed significant lowering of response rates, which differed significantly from an earlier interim analysis in November 2017. The candidate’s response rate slipped with more patients being evaluated, with overall response rate sliding from 63% after 11 patients in November 2017 to 52% after 23 patients in Melanoma. NKTR-214 did not fare any better in Kidney cancer and NSCLC, dashing hopes that the candidate could repeat its initial success in a larger population.

The Company reported $25.0 million in revenue in Q4,2021, as compared to $23.5 million for the same period in 2020. Revenues for FY21 were $101.9 million as compared to $152.9 million in 2020 owing to recognition of $50.0 million in milestones from BMS towards initiation of registrational trials in adjuvant melanoma and muscle invasive bladder cancer in 2020.

Operating costs and expenses for FY21 stood at $548.0 million as compared to $578.0 million in 2020. The Company reported a net loss of $523.8 million or $2.86 basic and diluted loss per share for the year ended December 31,2021, as against loss of $444.4 million or $2.49 basic and diluted loss per share in 2020

Opportunity

Melanoma, a form of skin cancer, accounts for about 1% of skin cancers but is responsible for over 7,650 deaths every year as per an estimate by the American Cancer Society, these numbers are steadily rising over the years with approximately 99,780 new melanomas diagnosis being made each year.

The 5-year survival rate for this illness has shown a significant improvement with faster and timely diagnosis, aggressive skin cancer screening programs for populations at greater risk of contracting the disease and rapid advancements in surgical and therapeutic options.

According to a report by Global data the global treatment market for melanoma is expected to reach $7.42bn in 2029 from $5.59bn in 2019 growing at a CAGR of 2.9%. The major drivers for growth in the market would be the expanding treatment options to include targeted combination therapies, deteriorating environmental condition leading to higher exposure to UV rays, favorable government and regulatory environment, patent expiration of certain biosimilars and launch of generics that are expected to pave the way for new players to enter the market.

However, the prohibitive cost of treatment may prove challenging and affect the growth prospects to an extent. A number of clinical trials are underway in the melanoma treatment industry with companies introducing unique first-in-class treatment options.

Threat

Clinical Trials are fraught with risk and uncertainty. However, a diverse pipeline will help mitigate the risk in case of adverse results or the failure to muster a regulatory approval. The success of its clinical trials will help the Company advance its pipeline but it should also be prepared to face any setbacks, in case its ongoing trials fail to meet their endpoints.

The Company has faced setbacks previously too. In January 2020, the Company had announced the withdrawal of its application for oxycodegol (formerly NKTR-181), as it received adverse advisory committee decisions from both Anesthetic and Analgesic Drug Products Advisory Committee, and Drug Safety and Risk Management Advisory Committee. The Company decided to cease further development and withdraw its NDA for the drug candidate, which was filed by the Company and accepted by the FDA in July 2018.

Key Takeaways

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://www.marketbeat.com/instant-alerts/nasdaq-nktr-percent-decline-2022-03-2/

No Comments