21 Jun 8 Things you should know about Sunnova Energy

The Company

Sunnova Energy International, Inc. (NYSE: NOVA) is a Houston, Texas-based provider of residential solar energy services in the United States and its territories. The Company provides a wide range of services encompassing installation, operations, maintenance, monitoring, repairs, on-site optimization, and diagnostics services.

The Company was founded in 2012 and is on a mission to deliver clean, affordable, and reliable energy that helps homeowners enjoy uninterrupted power. Sunnova is at the forefront of the energy transition by adapting to the changing energy landscape and technology advancements. The Company has over 208,000 customers as of March 31, 2021, along with more than 915 dealers and sub-dealers covering 38 states and territories.

Sunnova’s product offerings include Home Solar, Battery Storage, Roof Replacement, and Home solar protection, which can be customized and come with flexible financing options. The Company’s Sunnova Adaptive Home™ uses a combination of solar, battery storage, energy control, and management technologies to deliver affordable and reliable energy. The system can produce and store energy, optimize energy sources, and predict consumption in real-time.

Image Source: Company

The Company’s goal is to evolve from solar roof panels to integrating load control and EV charging and ultimately developing a nano-grid system for individual homes. The plan is to scale these nano-grids into microgrids which can add value by providing grid services to the local power network.

As of December 31, 2021, the Company operated a fleet of residential solar energy systems with a generation capacity of 1,140 megawatts serving over 195,000 customers.

Sunnova Energy International Inc (NYSE: NOVA)

Market Cap: $2.27B; Current Share Price: 19.76 USD

Data by YCharts

Differentiated Product and Service Offerings

The Company is working on offering highly differentiated technology-enabled energy services by combining top-notch service, leading-edge software, and aggregation. Sunnova is investing in the best hardware technologies to be integrated into its Sunnova Adaptive Home platform and is eager to capitalize on opportunities arising out of an increasing customer base.

Image Source: Company

Impressive Growth

As of 31 March 2022, the Company had 207800 customers, of which approximately 15,300 were added in the first quarter of 2021. The rate of customer additions grew by 74% in the latest quarter compared to the first quarter of 2021. In addition, the Company achieved a battery attachment rate of 19% and a penetration rate of 12.5%. The penetration rate was up from 10.5% as of 31 March 2021. Sunnova has performed 1,904 battery retrofits life to data as of the end of March 2022.

A Robust Distribution Network

Sunnova had over 915 dealers, sub-dealers, and new home installers as of 31 March 2022. The Company has successfully added 414 dealers, sub-dealers, and new home installers and expects the count to exceed 1,000 by the end of 2022.

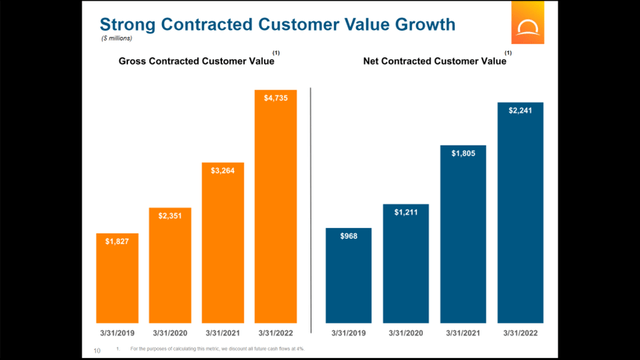

Contracted Customer Value

The Company is experiencing a steady growth in gross and net contracted customer value. The Gross contracted customer value stood at $4,735 million at the end of March 31, 2022, which is an improvement over the previous year’s figure of $3,264. In terms of net contracted value, the number stood at $2,241 at the end of March 2022, compared to $1,805 at the end of March 2021.

Image Source: Company

Most solar energy customers enter into long-term contracts with the providers, and Sunnova is no exception. The weighted average contract life remaining of the Company’s customers is 22.4 years.

Market Opportunity

Renewable Energy is derived from naturally replenishing sources such as Solar, Hydropower, Geothermal, and Wind Energy. According to the U.S Energy Information Administration, in 2019, renewable energy provided 11.5 quadrillion British thermal units (Btu) or 11.4% of total U.S. energy consumption, out of which the electric power sector contributed 56%, and 17 percent was from renewable energy sources.

The most significant advantage of renewable energy is its ability to reduce greenhouse gas emissions by lowering fossil fuel consumption, the most crucial cause of carbon dioxide emissions. The renewable energy sector has now come under a sharp focus owing to Joe Biden’s administration’s plan to fight climate change with greater emphasis on clean energy and a mission to reach net-zero emissions by 2050.

The government’s position on clean energy was made clear by its recommitting to the Paris Climate accord and its call for moving to clean energy by 2035. The new administration will invest close to $1.7 trillion over the next ten years in its bid for a “Clean Energy revolution” to establish the US as the clean energy superpower and transform the energy sector by providing the economic impetus. The US government plans to address 45% of the country’s energy requirements through solar power by 2050.

According to a report by Precedence Research, the global solar power market is estimated to reach US$ 368.63 billion by 2030, growing at a CAGR of 7.2%, from US$ 197.23 billion in 2021. The growth will primarily be driven by decreasing costs of renewable energy, a shift from fossil fuels to greener fuel sources, policy changes favoring renewable energy, government support and incentives, and changing geopolitical equations.

However, the market is also plagued by increasing borrowing costs and the unavailability of essential components for developing solar panels and batteries for energy storage. The lack of availability of critical components has put a spoke in the wheel of multiple solar projects, which have been delayed or canceled. Furthermore, the ongoing investigation by the U.S government into whether Chinese solar producers dodged tariffs is adding to the uncertainty.

2022 Full-Year Guidance

The Company expects to add 85,000 to 89,000 customers in 2022. Furthermore, Sunnova expects the adjusted EBITDA to be $117 to $137 million, while the principal payments received from solar loans are estimated to be between $134 to $154 million. The Company estimates the interest payments received from solar loans to be in the range of $45 -$55 million.

The adjusted operating cash flow is estimated to be $143 to $153 million, and the recurring operating cash flow is expected to be in the range of $39 to $59 million.

The Triple-Double-Triple Metric Growth Plan

Sunnova is focused on doubling its customer base to approximately 4,00,000 by the end of 2023. Moreover, the Company aims to double its net contracted customer value per share to roughly $37 by the end of the same period. It also intends to double the services sold per customer to approximately seven by 2023.

On the other hand, it is also seeking to triple the adjusted EBITDA along with the principal and interest on solar loans to approximately $530 million for the year ended December 31, 2023.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://www.sunnova.com/about-sunnova

https://investors.sunnova.com/home/default.aspx

https://www.wsj.com/articles/good-news-on-tariffs-wont-solve-challenges-for-solar-stocks-11654573566

No Comments