15 May Cantaloupe: Charging Through the Digital Payment Industry

Cantaloupe, Inc. (NASDAQ: CTLP) is a digital payments and software services company that provides end-to-end technology solutions for the unattended retail market. The Company offers a single platform for self-service commerce which includes integrated payments processing and software solutions that handle inventory management, pre-kitting, route logistics, warehouse, and back-office management.

Cantaloupe, Inc. (NASDAQ: CTLP)

Market Cap: $484.36M; Current Share Price: $6.36

Data by YCharts

The Company and its Revenue Drivers

Cantaloupe’s enterprise-wide platform is designed to increase consumer engagement and sales revenue through digital payments, digital advertising, and customer loyalty programs while providing retailers with control and visibility over their operations and inventory. As a result, customers ranging from vending machine companies to operators of micro-markets, car washes, electric vehicle charging stations, commercial laundry, kiosks, amusements, and more, can run their businesses more proactively, predictably, and competitively.

Image Source: Company

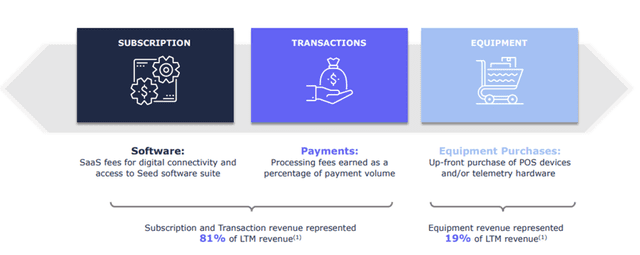

Cantaloupe derives the majority of its revenues from subscription and transaction fees resulting from transactions on, as well as connectivity and telemetry services provided by ePort® cashless devices, Seed™ software, and Quick Connect API services.

Devices operating on the Company’s platform and using its services include those resulting from the sale, finance, or a monthly bundled subscription (Cantaloupe ONE program) of point of sale (POS) electronic payment devices, telemetry devices, or certified payment software or the servicing of similar third-party installed POS terminals or telemetry devices. The majority of ePort customers pay a monthly service fee plus a blended percentage rate on transaction volumes. Transaction fees on volumes processed through the Company’s payment devices are the most significant driver of the Company’s revenues.

We’ll discuss why the Company seemed to be headed towards a rise in profits.

- Enormous Growth Opportunity

There is ongoing growth in demand for digital payment systems and advanced logistics management due to several reasons such as increased adoption of cashier-less models via vending machines or self-service kiosks, rising consumer demand for transaction convenience, safety, and security, and ongoing labor challenges.

Covid-19 also created a lasting impact by accelerating the secular shift to self-service commerce. A consumer survey of 2,000 people across the United States performed by the Company and CITE Research in 2021 found that 83% of consumers who increased unattended retail usage during the pandemic expect to continue using it at elevated levels when the pandemic is over. Clothing and health and beauty products had the greatest two-year increase with 70% – 71% of respondents interested in purchasing these items from vending machines in 2021 compared to 55% for clothing and 64% for health and beauty in 2019 respectively.

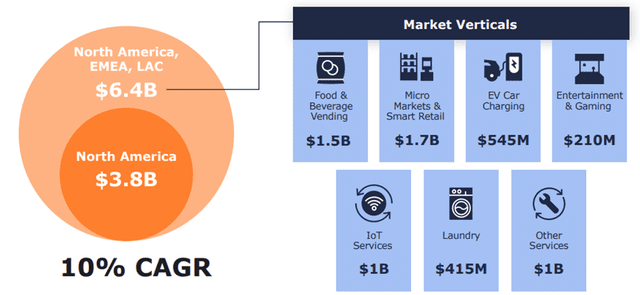

The key verticals served by Cantaloupe include vending, kiosks, micro-markets, laundry, vehicle services, and amusement and entertainment. Most of these verticals are poised to experience significant growth as shown below.

Image Source: Company

Cantaloupe has created a comprehensive growth strategy to benefit from the above opportunities. Organic methods are listed below:

- Maximize Growth in Existing Customers/Partners

- Capitalize on the Emerging Contactless, EMV, NFC, and Growing Mobile Payments Trends

- Expand into Micro Markets

- Penetrate Attractive Adjacent Markets

- Capitalize on Opportunities in International Markets

- Attractive Business Model

- Scalable, micro-payments platform – highly attractive because it can support businesses of all sizes and also accelerate key opportunities in new markets. The Company can expand its platform into core verticals like F&B vending, micro markets, AirVac, and laundry, and adjacent verticals like EV charging, entertainment and gaming, smart retail, and IoT services.

- Enterprise cloud software – the platform offered by the Company is well positioned for scale and international expansion due to key features such as cloud auto-scaling, no hardware installations, cloud infrastructure 99.99% uptime, localization (language, currency, tax, compliance), layered security, incident response & disaster recovery and more.

- Technology to convert locations in IoT – the Company has 1.15 million active devices on its IoT cloud and assists with asset monitoring, device management, and data analytics.

- Kiosk and POS innovations – Cantaloupe’s product innovations play a significant role in expanding Average Revenue Per User (ARPU). Some noteworthy innovations include remote price change (that is enabling product price changes from anywhere), AI-powered insights that help to grow revenue through optimized merchandising and space to sales, and closed-loop mobile payments that help to drive repeat customers, increase same-store sales and expand wallet options with rewards.

- Outstanding Financial Performance

Also worth mentioning is that the Company aims to complement organic growth with strategic Mergers and Acquisitions such as the recent Three Square Market acquisition.

Image Source: Company

If the management succeeds in executing the above key elements, Cantaloupe will likely see a strong rise in revenues.

The Company earns revenue through a combination of subscription, transaction, and equipment revenue – this represents a highly recurring revenue model for the Company.

Image Source: Company

Cantaloupe already has more than 25,000 active customers, $2.4 billion worth of transactions per year, and 124 million cardholders annually.

The Company is poised to grow even further, primarily due to its

Thus, along with an established recurring revenue model, the Company has unique and efficient offerings and technology that will allow it to expand into new markets. In other words, Cantaloupe seems to have in place all the working elements of a successful business model.

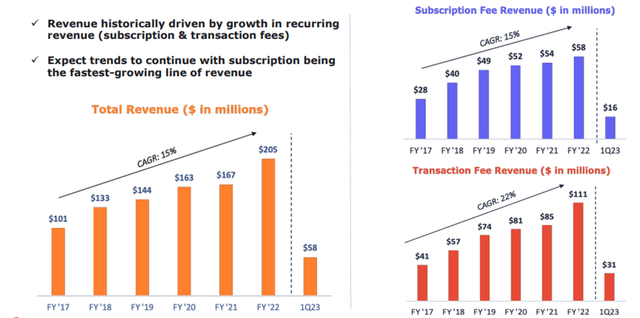

Over the years, growth drivers such as clearly defined direct and indirect sales channels, small and mid-market focus, range of add-on software services, micro-market offerings, and Cantaloupe ONE platform have helped the Company execute its expansion strategy, as shown below.

Image Source: Company

For FY22 (ended June 30, 2022), the Company reported a 23% increase in revenue to $205 million – a new record. Transaction fees were $110.7 million, an increase of 29% YoY, subscription fees were $58.1 million, an increase of 8% YoY, and equipment sales were $36.4 million, an increase of 31% YoY.

Total Dollar Volumes of Transactions in the fiscal year were $2.3 billion, an increase of 30.2% YoY. Adjusted EBITDA was $9.9 million compared to $7.6 million in the prior year.

Results for the latest quarter ended March 31, 2023, continued to be outstanding as well. Q3 FY23 revenue was $60.4 million, a 20% YoY increase, and record Adjusted EBITDA of $10.1 million, a 176% increase compared to Q3 FY22

For FY23, the Company expects revenue to be between $225 million and $235 million, Adjusted EBITDA to be between $12 million and $17 million, and U.S. GAAP Net income to be between $1 million and $5 million.

Total Operating Cash Flow is expected to be between $10 million and $15 million.

The Company’s three-year outlook includes 15%+ sustainable revenue growth, 20%+ subscription revenue growth, and about 20% Adjusted EBITDA margin in FY26.

Overall, Cantaloupe seems to hold great promise due to a large, unpenetrated, and growing Total Addressable Market, exponential subscription revenue growth, and an unrivaled platform that is ready to scale internationally. Hence it is a Company worth watching out for.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://www.sec.gov/ix?doc=/Archives/edgar/data/896429/000162828023002819/ctlp-20221231.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/896429/000162828022029291/ctlp-20220930.htm

https://www.sec.gov/Archives/edgar/data/896429/000162828022026591/ctlp-20220630x10k.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/896429/000162828023016905/ctlp-20230331.htm

https://cantaloupeinc.gcs-web.com/static-files/307fc2ee-0eca-4af8-87e9-3ebb2876be92

No Comments