29 Aug Aviat: Expanding the Global Web of Wireless Networking

Aviat Networks, Inc. (NASDAQ: AVNW) is a global supplier of microwave networking solutions backed by an extensive professional services and support suite.

The Company designs, manufactures, and sells wireless networking products, solutions, and services to two principal customer types – Communication Service Providers (CSP) and Private Network Operators.

Communications Service Providers customers include mobile and fixed telecommunications network operators, broadband and internet service providers, and network operators, which generate revenues from their communications services.

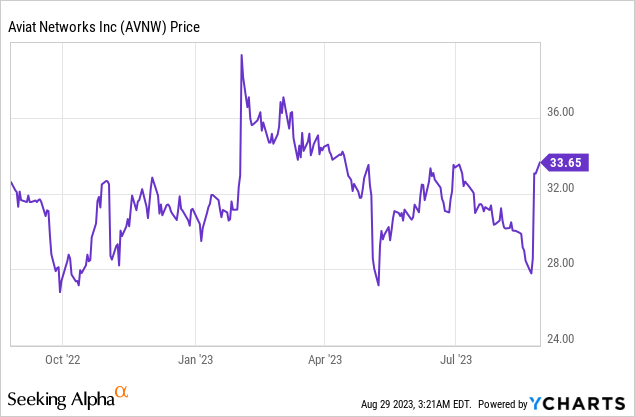

Aviat Networks, Inc. (NASDAQ: AVNW)

Market Cap: $384.98M; Current Share Price: 33.65 USD

Data by YCharts

Private Network Operators include customers who do not resell communications services but build networks for reasons of economics, autonomy, and security to support a wide variety of mission-critical performance applications, such as federal, state, and local government agencies, transportation agencies, energy, and utility companies, public safety agencies and broadcast network operators around the world.

The Company and its Products

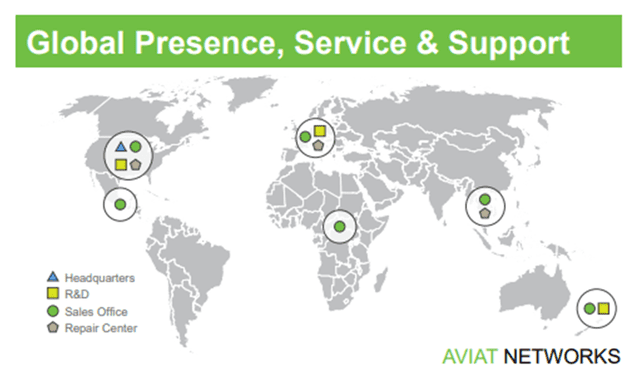

Headquartered in Austin, TX, Aviat has a global customer base of over 3,000 and enjoys a strong position with global service providers and private network operators. The Company is known for unique and compelling innovations, leading technology (200+ patents), and unrivaled microwave expertise.

Image Source: Company

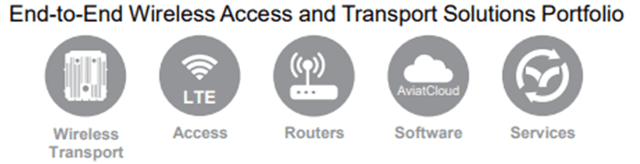

Aviat’s products utilize microwave and millimeter wave technologies to create point-to-point wireless links for short, medium, and long-distance interconnections. In addition to wireless products, the Company also provides routers and a range of software tools and applications to enable deployment, monitoring, network management, and optimization of its systems and automate network design and procurement.

Image Source: Company

Aviat also source, qualify, supply, and support third-party equipment such as antennas, optical transmission equipment, and other equipment necessary to build and deploy a complete telecommunications transmission network. The Company provides a full suite of professional services for planning, deploying, operations, optimizing, and maintaining customers’ networks.

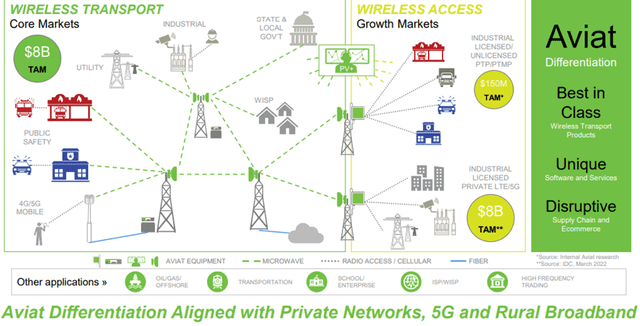

The Company’s products find application across several market segments, including Mobile/ 5G Networks, Rural Broadband, and Private Networks.

Image Source: Company

Aviat’s wireless systems deliver urban, suburban, regional, and country-wide communications links as the primary alternative to fiber optic, low earth orbit satellite, and copper connections. Fiber optic connections are the main alternative. Short-range wireless solutions are faster to deploy in dense urban and suburban areas and lower cost per mile than new fiber deployments. In developing nations, fiber infrastructure is scarce, and wireless systems are used for long- and short-distance connections.

Wireless systems also have advantages over optical fiber in areas with rugged terrain and provide connections over bodies of water, such as between islands or offshore oil and gas production platforms. Through the air, wireless transmission is also inherently lower in latency than transmission through optical cables and can be leveraged in time-sensitive networking applications.

In other words, Aviat’s products have a broad scope of application, which may eventually lead to Company growth. Below, we will discuss, in more detail, our rationale for covering this Company.

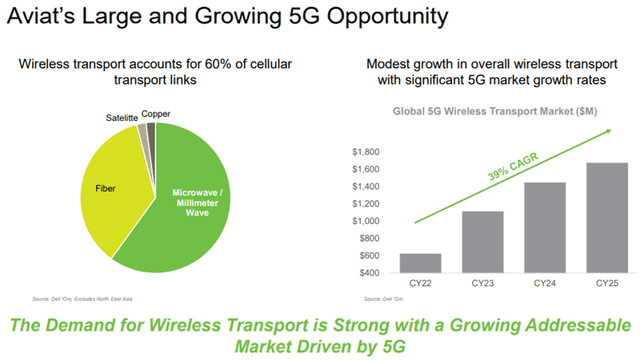

- Tremendous Market Opportunity

As already mentioned, there is scope for future demand for microwave and millimeter wave transmission systems in market segments such as

- Mobile/ 5G Networks:

As mobile networks expand, add subscribers, and increase the number of wirelessly connected devices, sensors, and machines, they require ongoing investment in backhaul infrastructure. Whether mobile network operators choose to self-build this backhaul infrastructure or lease backhaul services from other network providers, the evolution of the network drives demand for transmission technologies such as microwave and millimeter wave wireless backhaul.

Image Source: Company

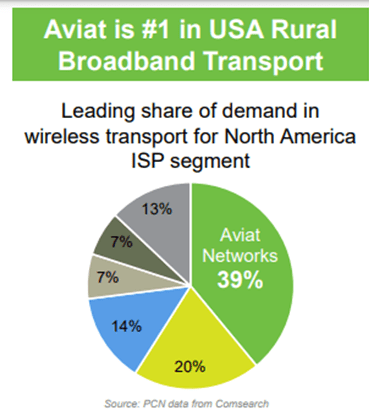

- Rural Broadband:

Transport equipment delivers broadband connectivity to rural and suburban communities as an alternative to costly fiber. Significant investments are being made to improve rural household and enterprise connectivity, many of which create wireless transport opportunities.

Image Source: Company

- Private Network:

There is also demand for microwave technology in other vertical markets, including utility, public safety, financial institutions, and broadcast. Many utility companies worldwide are actively investing in “Smart Grid” solutions and energy demand management, which drive the need for network modernization and increased capacity of networks.

Investments in network modernization in the public safety market can significantly enhance the capabilities of security agencies. Improving border patrol effectiveness, enabling interoperable emergency communications services for local or state police, providing access to timely information from centralized databases, or utilizing video and imaging devices at the scene of an incident requires a high bandwidth and reliable network.

Microwave technology can also engineer long-distance and more direct connections than optical cables. Microwave signals travel through the air much faster than light through glass, and the combined effect of shorter distance and higher speed reduces latency, which is valued for trading applications in the financial industry.

Thus, keeping the above discussion in mind, the main growth drivers for the Company in this segment would be

- ARPA Funding ($350B for US States’ water, sewer, and broadband infrastructure). States upgrading their public safety communications to broadband.

- Growth in Private LTE and Industrial IoT ($16B for Private LTE by 2025)

- Growing Complexity, Vendor Outsourcing Share of Wallet Opportunity

Overall, there are opportunities for continued investment in backhaul and transport networks favoring microwave and millimeter wave technologies. Aviat seems well poised to take advantage of the same.

- Well Positioned for Growth

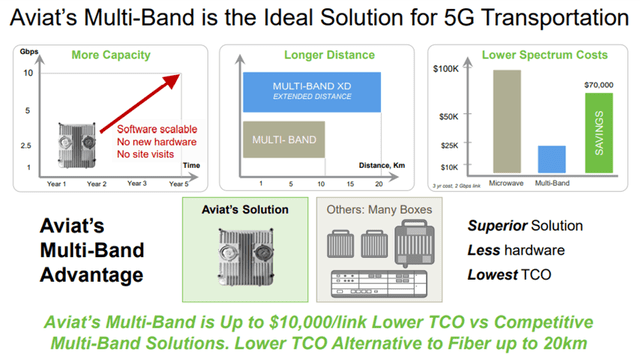

Aviat is well positioned for growth in 5G and Rural Broadband markets as it offers highly differentiated, lowest Total Cost of Ownership (TCO) for 5G and rural broadband applications. More specifically, the Company offers

- Best in-Class Wireless Transport Products

- The industry’s highest capacity, highest power radios on the market for the lowest TCO

- First, to integrate microwave and IP/MPLS routing

- Unique multi-band solution for 5G

Image Source: Company

- Unique Software (SaaS) and Services

- The industry’s only interference monitoring software for microwave

- Complete turnkey services, including network operations center (NOC)

- Network operations automation with ProVision Plus, Aviat Design

- Disruptive Delivery and Supply Chain Offerings

- E-commerce go-to-market model with Aviat Store

- US and international manufacturing, industry best lead times

Aviat already has the leading share of demand in USA rural broadband transport. Thus, the Company can quickly capitalize on this position to gain even more customers.

Image Source: Company

Just like rural broadband transport, Aviat is also the leader in Private Networks Wireless Transport due to its

- Mission Critical Product Differentiation

- Highest Power Radios

- IP/MPLS Integration

- Software Innovations

- Strong Global Partners in Security and Defense, such as Motorola and Airbus

- Differentiated Services Offerings, which include design, installation, support, and managed services.

To summarize, there is a significant growth opportunity for the Company. Aviat is prepared to benefit due to its innovative products and services for lower TCO, strong incumbency to grow with the installed base, and expanding e-commerce and supply chain capabilities.

This indicates that the Company may embark on an unbroken upward trajectory.

- Financial Performance

For the twelve months ended June 30, 2023 (FY23), the Company reported total revenues of $346.6 million, compared to $303.0 million in FY22, an increase of $43.6 million or 14.4%. North America revenue of $202.1 million increased by $2.3 million or 1.1%, compared to $199.8 million in FY22. International revenue of $144.5 million increased by $41.3 million, or 40.1%, compared to $103.2 million in FY22.

Image Source: Company

The Company reported GAAP gross margin of 35.8% and non-GAAP gross margin of 36.1%. This compares to GAAP gross margin of 36.1% and non-GAAP gross margin of 36.2% in FY22.

For FY23, the Company reported GAAP total operating expenses of $97.8 million, compared to $80.5 million in FY22, an increase of $17.3 million or 21.5%. On a non-GAAP basis, excluding restructuring charges, share-based compensation, and merger and acquisition expenses, total operating expenses for FY23 were $84.1 million, compared to $75.8 million in FY22, an increase of $8.3 million or 11.0%.

For FY23, the Company reported Adjusted EBITDA of $47.0 million, compared to $38.3 million in FY22, a year-over-year increase of approximately $8.7 million.

Specifically, for FY23, Aviat successfully integrated the Redline Communications acquisition and won significant new business internationally, including Bharti Airtel in India. Additionally, the Company ended the year with a backlog of $289 million, up 18% versus last year.

For FY24, Aviat provided guidance of revenue between $367 and $374 million and Adjusted EBITDA between $51.0 and $56.0 million.

As can be seen from the graph below, Aviat has demonstrated a steady improvement in revenues and EBITDA over the last few years.

Image Source: Company

The management seems focused on increasing revenue, capturing Aviat’s differentiation, and improving overall shareholder value, which may help the Company continue its upward march.

Aviat is nevertheless exposed to certain risks, such as

- Aviat’s products and services market is characterized by rapid technological change, evolving industry standards, and frequent new product introductions. Hence, if the Company fails to develop or introduce, on a timely basis, new products or product enhancements or features that achieve market acceptance and beat competition, the business may suffer.

- In the past, Aviat has experienced and could continue to experience declining sales prices. Thus, to ensure profitability, the Company must continue improving manufacturing efficiencies, reducing the costs of materials used in products, and introducing new lower-cost products and product enhancements.

Conclusion: Overall, Aviat seems to have a promising future as it offers innovative and highly differentiated solutions in a rapidly expanding marketplace. However, it is essential to note that the Company’s success eventually depends on its ability to keep up with technological changes in the industry and reduce costs to increase profitability in the long run.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://investors.aviatnetworks.com/static-files/1c5d60a1-e3f6-4cb1-b504-b56a3c14fb38

https://www.sec.gov/ix?doc=/Archives/edgar/data/1377789/000137778922000137/avnw-20220701.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1377789/000137778923000013/avnw-20230331.htm

No Comments