11 Sep Xometry: When Connections Lead to Growth

Xometry, Inc. (NASDAQ: XMTR) is a global online marketplace connecting enterprise buyers with suppliers of manufacturing services. The Company powers the industries of today and tomorrow by connecting people with big ideas to the manufacturers who can bring them to life.

Xometry, Inc. (NASDAQ: XMTR)

Market Cap: $929.63M; Current Share Price: 19.38 USD

Data by YCharts

The Company and its Products

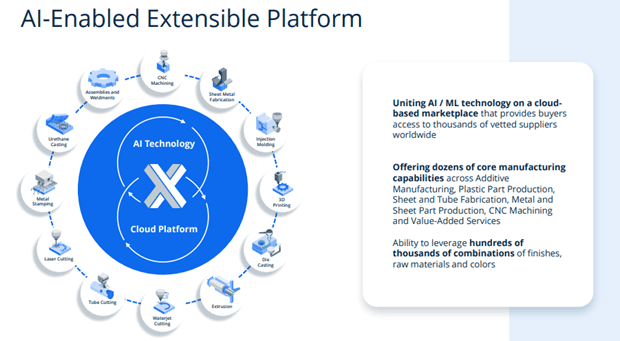

Xometry uses proprietary technology to create a marketplace that enables buyers to efficiently source manufactured parts and assemblies and empower suppliers of manufacturing services to grow their businesses.

Image Source: Company

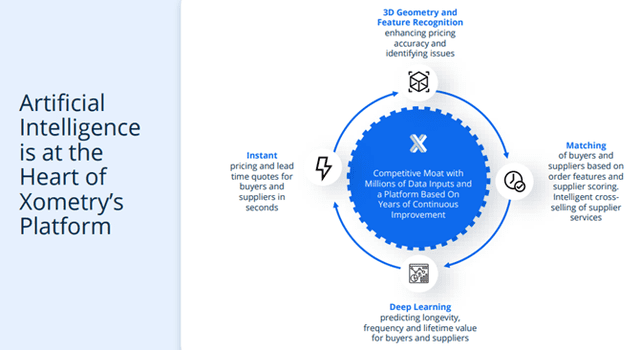

Its AI-enabled technology platform is powered by proprietary machine learning algorithms and a dataset, resulting in a sophisticated marketplace for manufacturing. As a result, buyers can procure the products they want on demand, and suppliers can source new manufacturing opportunities that match their specific processes and capacity. Interactions on Xometry’s platform provide rich data insights that allow the Company to continuously improve its AI models and innovate new products and services, fueling powerful network effects as it scales.

Image Source: Company

In 2022, Xometry generated most of its revenue from the prices it charged buyers on its platform. Buyers begin by uploading an engineering schematic that contains 3D design specifications, typically a computer-aided design or a CAD file. Then, the Company prices transactions through a proprietary, AI-enabled instant quoting engine based on volume, manufacturing process, material, and location. The convenience and transparency of the model lead to increasing buyer stickiness and spending over time. In addition, Xometry incorporates elements of environmental, social, and governance (ESG) practices into its marketplace by offering buyers the ability to purchase carbon credits to offset the carbon used to make their parts.

Image Source: Company

Below, we will discuss our rationale for covering this Company.

- Rapidly growing global marketplace

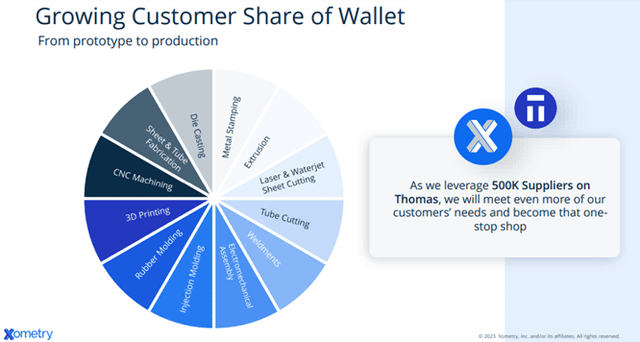

At the time of Xometry’s IPO in 2021, the Company’s addressable market stood at $260 billion based on the estimated need for six key manufacturing processes offered on its platform. This included CNC machining, injection molding, 3D printing (including fused deposition modeling, direct metal laser sintering, PolyJet, stereolithography, selective laser sintering, binder jetting, carbon digital light synthesis, and multi-jet fusion), sheet forming and cutting, die casting and urethane casting. Subsequently, Xometry acquired Thomas, which has data about suppliers that offer over 70,000 industrial processes, which expands its addressable market to over $2 trillion globally.

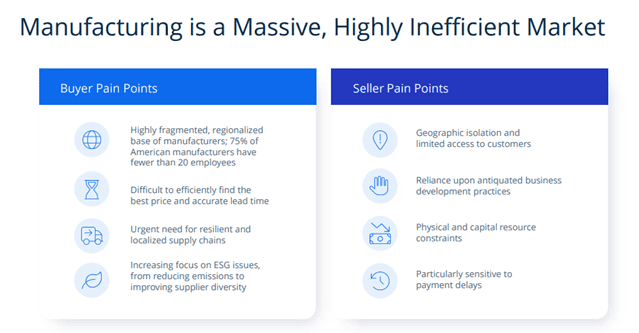

The main reason why Xometry has a significant market opportunity is because the Company’s platform quickly and effectively resolves buyer and seller pain points, making it highly popular among consumers.

Image Source: Company

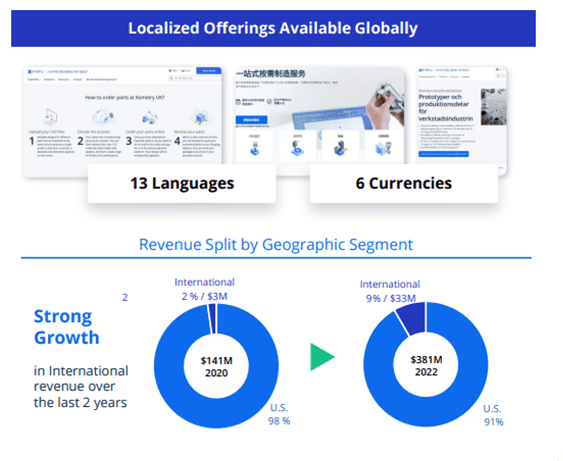

Xometry’s extensible platform offers a one-stop shop. It supports significant industries and manufacturing processes across North America, Europe, and Asia, which has helped it grow at a rapid pace internationally.

Image Source: Company

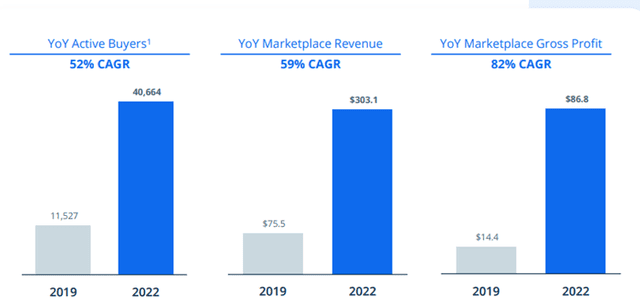

Xometry has a track record of benefitting from the opportunity provided by the massive, highly inefficient manufacturing market – this is evident from an analysis of the Key Performance Indicators over the last few years.

Image Source: Company

Overall, Xometry’s extensible marketplace platform solves several pain points of buyers and sellers in a highly disorganized manufacturing market. Hence, there is a significant growth opportunity for Xometry, and the Company has already demonstrated that it is well-equipped to benefit from it.

- Meaningful growth strategy

Xometry follows a six-pronged comprehensive growth strategy that may help it achieve its objectives.

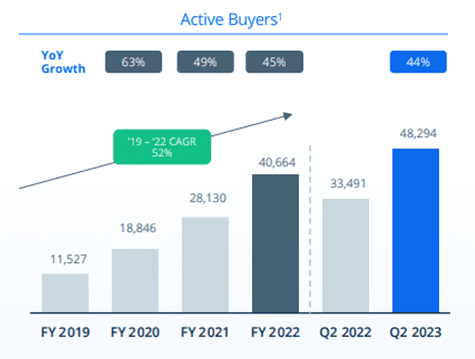

- Attract new buyers and grow wallet share with existing buyers. Xometry continues to invest in acquiring new buyers through traditional paid sales and marketing techniques and leveraging its organic solid referral network to drive awareness and build trust. As a result of the Company’s efforts, the number of active buyers increased to 40,664 in FY22 from 11,527 in FY19, demonstrating a CAGR of 52%.

Image Source: Company

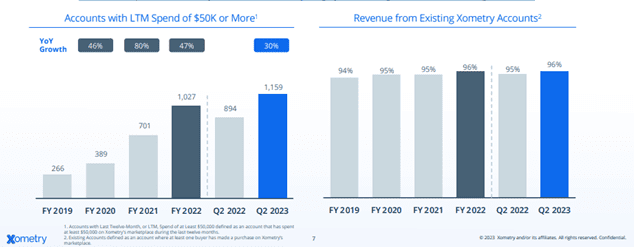

The Company is also focused on increasing buyer stickiness and buyer spending within existing accounts by investing in sales and marketing capabilities. As shown below, growth in Accounts with the last twelve months (LTM) spend of $50K reflects Xometry successfully embedding itself in customer supply chains. Additionally, the Company’s reliable “land and expand” customer dynamics drive Xometry’s highly recurring revenue from existing customers.

Image Source: Company

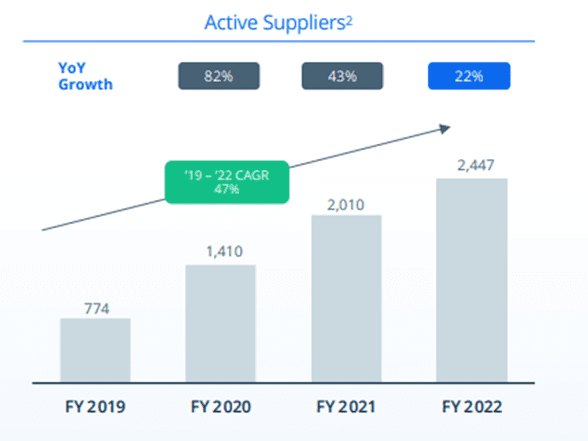

- Deepen and expand supplier partnerships. The Company is focused on attracting new suppliers, recognizing the massive opportunity still in front and the intrinsic benefit an active, diverse supplier population brings to the overall platform. Xometry has succeeded in growing its active supplier base from 774 in FY19 to 2,447 in FY22, representing a CAGR of 47%.

Image Source: Company

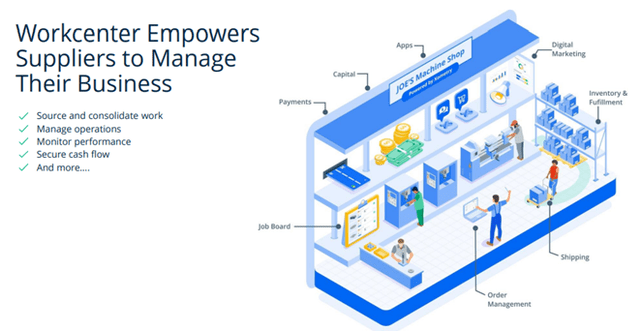

- Become an enterprise solution for suppliers. As Xometry grows the amount of data processed by algorithms, it can provide suppliers with progressively sophisticated data insights and analytics. Combined with workflow management software and other supplier services, the Company aims to increasingly become the enterprise solution for suppliers to manage their businesses on and off the platform.

Image Source: Company

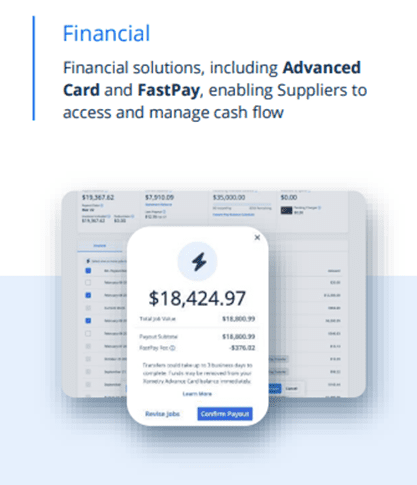

- Enhance and offer additional supplier products and services. Supplier products and services allow Xometry to deepen supplier relationships and increase engagement. Revenue from supplier services was approximately 20% of total revenue for the year ended December 31, 2022. The Company plans to continue to market our financial service products to U.S. suppliers, enhance features that allow quicker conversion of purchase orders to cash, and build toward a full-service digital wallet for suppliers to use for payouts and purchases.

Image Source: Company

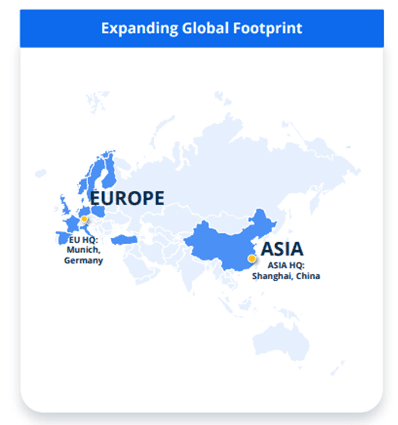

- Continue international expansion. There is a significant opportunity in the global manufacturing ecosystem for a marketplace like Xometry. With operations throughout most of the contiguous United States and customers in Europe and Asia, the Company has established footholds in significant markets worldwide. It will continue to dedicate sales and marketing resources to develop supplier networks and attract buyers.

Image Source: Company

- Pursue strategic acquisitions. With the size and complexity of the manufacturing industry, there is a significant opportunity for targeted investments and acquisitions to strengthen competitive positions and processes. For example, in December 2021, Xometry acquired Thomas – it expects that as it leverages 500K Suppliers on Thomas, it will meet even more customers’ needs and become that one-stop shop.

Image Source: Company

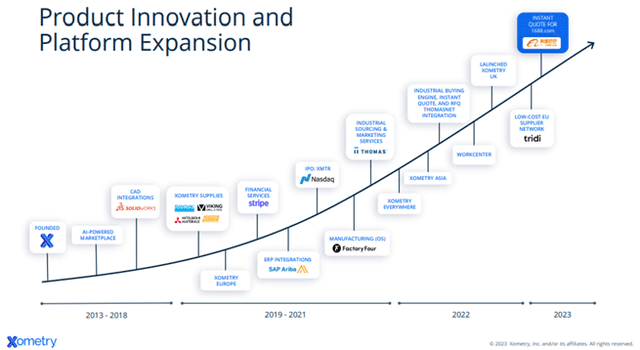

The effect of Xometry’s growth strategy since inception till date has been captured in the image below.

Image Source: Company

As is evident, Xometry has put constant effort toward product innovation and platform expansion and expects to continue on the same path.

- Financial Performance

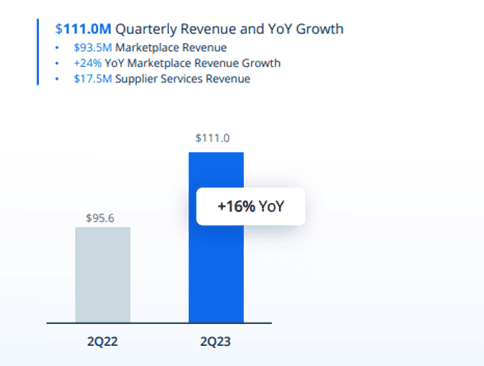

For Q2 FY23, Xometry reported that revenue increased 16% YoY, driven by solid marketplace growth of 24% YoY and 8% QoQ. Q2 FY23 gross profit was up 16% YoY due to 34% growth in marketplace gross profit. Marketplace gross profit was up a robust 19% QoQ.

Image Source: Company

Q2 Adjusted EBITDA loss was $8.7 million, a $3.1 million QoQs improvement driven by higher revenue, gross profit, and improved operating leverage.

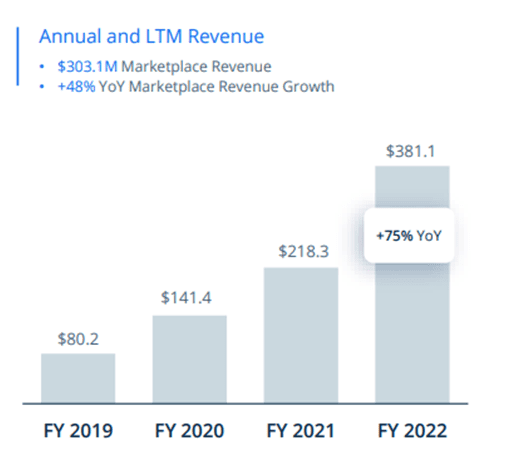

For FY22, Xometry reported revenue of $381.1 million, an increase of 75% YoY. Total gross profit for FY22 was $147.6 million, an increase of 158% YoY. Gross profit margin improved to 38.7% for FY22 from 26.2% for FY21.

Image Source: Company

Adjusted EBITDA was negative $41.8 million for FY22, reflecting an increase of $2.0 million YoY.

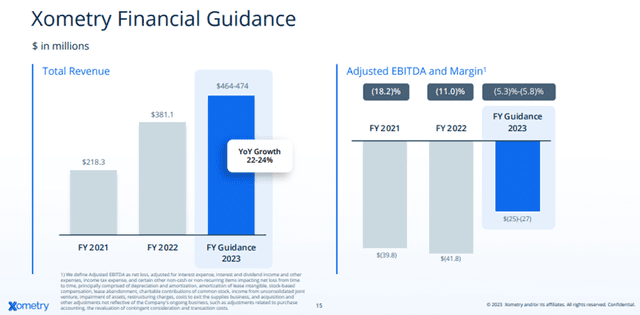

For Q3 FY23, Xometry expects revenue growth of 15%-17% YoY to $119-$121 million, driven by solid marketplace growth. It hopes to continue gaining market share, fueling robust marketplace revenue growth in 2023, and continuing on the path to Adjusted EBITDA profitability in Q4 2023.

For FY23, the Company expects revenue growth of 22 – 24% YoY to $464 – 474 million through measures such as realigning sales efforts to improve focus on top 200 accounts, continued expansion of processes and materials with deeper integration with Thomas, rapid international expansion and growth; and further enhancements and adoption of new products, including Workcenter.

Image Source: Company

In other words, even in the future, the Company expects to continue on its robust growth trajectory, making it a fascinating watch.

Risks

Despite Xometry’s promising efforts and performance, the Company faces certain risks.

Firstly, Xometry has a track record of incurring losses – as of December 31, 2022, it had an accumulated deficit of $249.4 million. If the Company’s revenues decline or fail to grow at a sufficient rate, it may not achieve profitability.

Secondly, Xometry may not be able to maintain its historical growth rate record due to factors like slowing demand for its platform, insufficient growth in the number of buyers and suppliers who transact on the marketplace, increasing competition, a decrease in the development of the overall market, failure to continue to capitalize on growth opportunities, failure to realize anticipated revenue growth from supplier services, among others.

In such cases, Xometry’s future performance may not be as exciting as anticipated.

Conclusion

Lately, Xometry has demonstrated an exciting track record of growth – most specifically, for FY22, its revenues grew 75% YoY. The Company has a robust and proven growth strategy. It operates in a highly fragmented market with significant growth opportunities, indicating that perhaps its best days are still ahead.

However, the Company has a history of losses. If it cannot grow future revenue due to causes such as intense competition or a decrease in the overall market, it may underperform, which is why investors need to proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://investors.xometry.com/static-files/efae27ef-8db2-4573-9d21-bbcaeff53825

https://investors.xometry.com/static-files/99676512-1d3f-462b-8101-7a53c4fa11a0

https://www.sec.gov/ix?doc=/Archives/edgar/data/1657573/000095017023040612/xmtr-20230630.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1657573/000095017023008494/xmtr-20221231.htm

No Comments