21 Dec Luminar Technologies: Upgrading Vehicle Safety and Autonomy

Luminar Technologies, Inc. (NASDAQ: LAZR) is a global automotive technology company ushering in a new era of vehicle safety and autonomy. The Company has been building from the chip level up. Its light detection and ranging sensor, or lidar, is expected to meet the demanding performance, safety, reliability, and cost requirements to enable next-generation safety and autonomous capabilities for passenger and commercial vehicles and other adjacent markets.

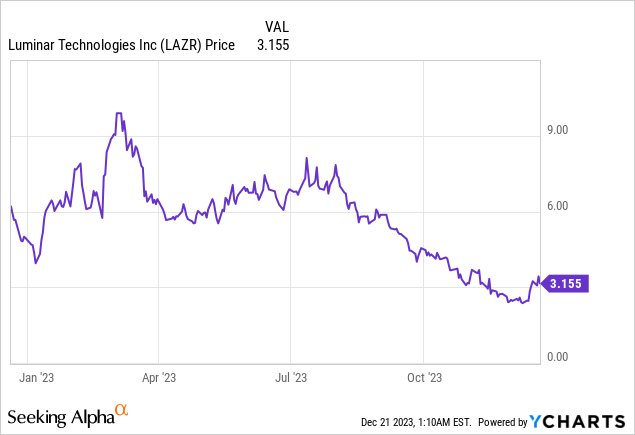

Luminar Technologies, Inc. (NASDAQ: LAZR)

Market Cap: $1.27B; Current Share Price: 3.16 USD

Data by YCharts

The Company and its Products

Luminar has built an advanced hardware and software platform for the past decade to enable its more than 50 industry partners, including most global automotive OEMs.

From Volvo Cars and Mercedes-Benz for consumer vehicles and Daimler Trucks for commercial trucks to tech partners NVIDIA and Mobileye, Luminar is poised to be the first automotive technology company to enable next-generation safety and autonomous capabilities for production vehicles.

Image Source: Company

The global mobility and e-mobility sector increasingly focuses on safety and autonomy, specifically next-generation advanced driver assistance systems (ADAS) and highway autonomy for passenger and commercial vehicles. Luminar’s products provide increased situational awareness in a broad range of driving environments through improved and higher confidence detection and planning at all vehicle speeds.

The Company’s portfolio encompasses sensor hardware (Iris), in-development perception and decision-making software, and a high-definition “3D” mapping engine that improves existing vehicle safety features and enables new levels of vehicle automation for passenger, commercial, and other applications.

Image Source: Company

We’ll discuss the critical rationale for covering this Company.

- Significant Market Opportunity

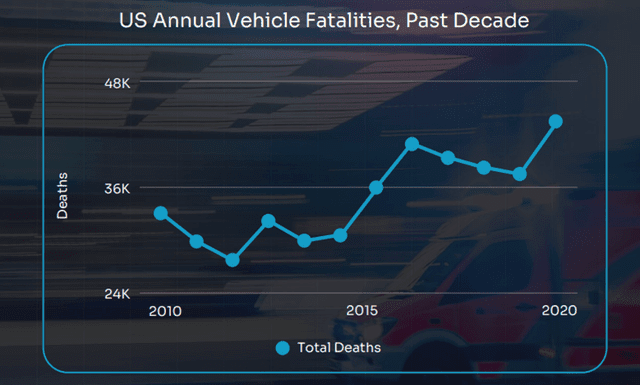

Annually, there are approximately 1.3 million annual fatalities from vehicle collisions globally. Additionally, there are 50 million injuries from vehicle collisions globally, and on average, four collisions over the life of US drivers.

Image Source: Company

Vehicles with current camera and radar-based ADAS systems experienced collisions in pedestrian AEB scenarios. Therefore, the market needs a step-change in ADAS technology to make a true impact and save lives.

The market is currently segmented in two distinct categories: (1) ADAS (Level 0—No Driving Automation, Level 1—Driver Assistance, and Level 2—Partial Driving Automation) and (2) autonomous driving (Level 3—Conditional Driving Automation, Level 4—High Driving Automation, and Level 5—Full Driving Automation). Within these two segments, the most significant near-term business opportunities exist for technologies that enhance, not replace, the driver in ADAS and highway autonomy applications (L3). Luminar’s products meaningfully improve ADAS functionality and are key highway autonomy enablers.

Luminar has a master plan to save 100 million lives within 100 years, critical elements of which include:

- Create the world’s best lidar for production cars and trucks

- Launch and enable the safest and most advanced vehicles/trucks on the road, starting with high-end models

- Launch and allow Proactive SafetyTM & highway autonomy on mainstream models

- Democratize advanced safety for all while monetizing upgrades for autonomy, software, and services.

- Comprehensive Business model

- unique and innovative products

- monetization of end-to-end vertical ecosystem

- commitment to quality

- successful supplier-partnership ties

- rapidly expanding manufacturing footprint

- Financial Performance and Outlook

Luminar is already planned into more than 20 production vehicle models and is uniquely positioned to deliver confirmed revenue, scalable profits, and exponential growth from its multi-billion order book over the near term and long term. In other words, there is a significant market opportunity for the Company, and Luminar is prepared to benefit from it.

The Company expects triple-digit revenue growth annually for the next five years (32x) by monetizing the end-to-end vertical ecosystem.

Image Source: Company

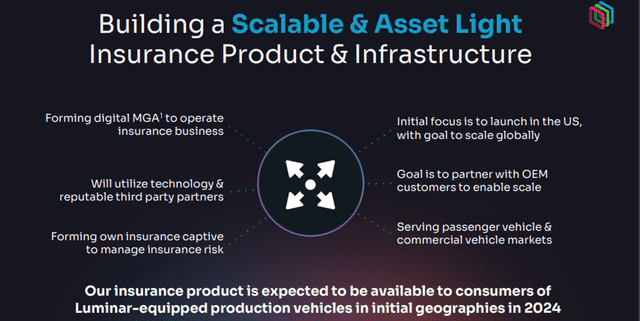

Of the above, Luminar’s insurance opportunity deserves special mention.

Image Source: Company

Since Luminar’s technology reduces & mitigates these collision scenarios, the Company is willing to underwrite expected insurance savings to subsidize the cost of its technology to the consumer and OEM. For this purpose, the Company is partnering with Swiss Re, a leading global reinsurance company.

Image Source: Company

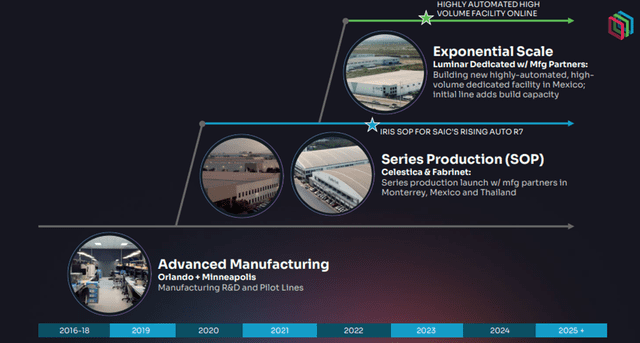

A key differentiator for Luminar is its commitment to quality and industrialization. The Company is transforming its supply chain for automotive-grade certification.

Image Source: Company

Also, Luminar follows a successful supplier partnership model and has ties with 89 suppliers in 16 countries to provide 100% scalable and automotive-grade products.

Moreover, it has a significant manufacturing footprint with facilities in Minnesota, Mexico, and Florida, and the following site is planned for Thailand, Asia.

Image Source: Company

To summarize, Luminar has an effective business model, key elements of which include

Based on these, the Company can rapidly reach new heights in the global industry.

For Q3 FY23, Luminar’s revenue was $17 million, up 33% compared to Q3 FY22. Q3 GAAP net loss was $134.3 million, or $(0.34) per share; Q3 Non-GAAP net loss was $84.1 million, or $(0.21) per share. At the end of the quarter, Luminar’s cash and liquidity position stood at $321 million.

For FY22, revenues stood at $40.7 million. GAAP net loss was $445.9 million for the entire year, or $(1.25) per share; Non-GAAP net loss was $279.3 million, or $(0.78) per share.

For FY22, Luminar had met or exceeded all 4 2022 milestones.

Image Source: Company

Luminar expects 2023 revenue of around $75 million, or roughly 85% YoY growth. The Company expects to reach a gross margin positive on a non-GAAP basis in Q4’23. For FY23, Luminar expects to achieve the following milestones:

Image Source: Company

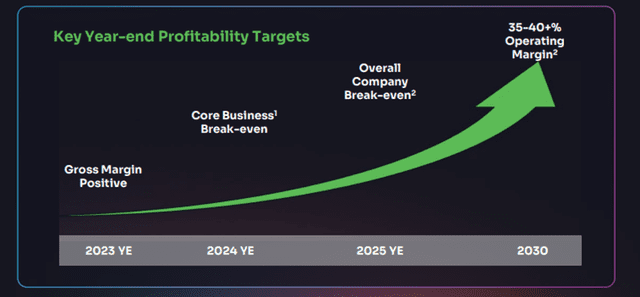

By 2030, the Company aims to reach a 30 – 40% profitability margin.

Image Source: Company

Other than the above, Luminar expects to at least double revenue each year for the next several years and targets reaching revenues of over $5bn by 2030. The Company has enough customer wins to scale sensor and revenue growth exponentially. Luminar’s next-generation sensor plus software, solutions, and ecosystem products also enable mass market penetration and higher margins, so it seems the Company will achieve its lofty aims.

Risks

Luminar has a promising outlook but is exposed to certain risks. The Company is early-stage with a history of losses and expects to incur significant expenses and continuing losses for the foreseeable future. Secondly, the Company’s success depends heavily on adopting its products. If its lidar products are not selected for inclusion in autonomous driving systems or ADAS by automotive OEMs or their suppliers, the business will be materially and adversely affected. Finally, the Company expects to incur substantial R&D costs and devote significant resources to identifying and commercializing new products, which could significantly reduce profitability and never result in revenue.

Conclusion

Luminar has an innovative portfolio of products that promises to change the landscape of vehicle safety and economy. Its comprehensive business model has proven its efficacy by demonstrating a 33% jump in revenues YoY for Q3 FY23. For FY23, Luminar expects an 85% increase in revenues YoY and plans to reach an operating margin of over 30-40% by 2030 – all these elements make the Company a fascinating watch.

However, Luminar has a history of losses, and the success of the Company depends on the adoption of its technology by automotive OEMs or their suppliers. Hence, potential investors should proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1758057/000162828023037965/lazr-20230930.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1758057/000162828023005649/lazr-20221231.htm

Sorry, the comment form is closed at this time.