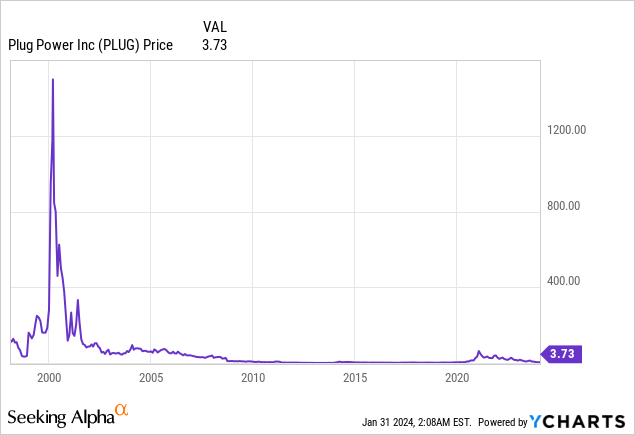

31 Jan Plug Power: Creating a Path for Global Green Hydrogen Economy

Plug Power Inc. (NASDAQ: PLUG) provides turnkey hydrogen fuel cell (HFC) solutions for the global green hydrogen economy.

Plug Power Inc. (NASDAQ: PLUG)

Market Cap: $2.26B; Current Share Price: 3.73 USD

Data by YCharts

The Company and its Products

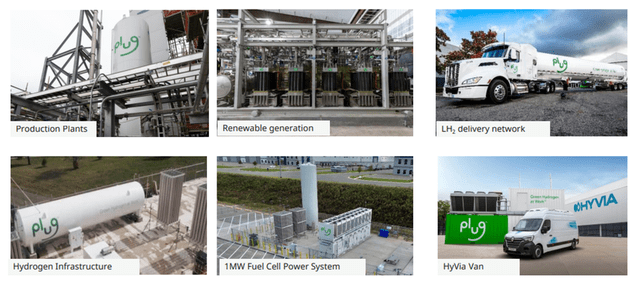

The Company’s innovative technology powers electric motors with hydrogen fuel cells amid an ongoing paradigm shift in the power, energy, and transportation industries to address climate change and energy security while providing efficiency gains and meeting sustainability goals. Plug created the first commercially viable hydrogen fuel cell (HFC) technology market. As a result, the Company has deployed over 60,000 fuel cell systems for e-mobility, more than anyone else worldwide. It has become the largest buyer of liquid hydrogen, having built and operated a hydrogen highway across North America.

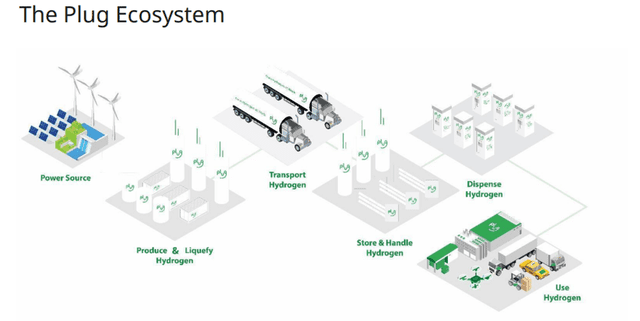

Image Source: Company

Plug delivers a significant value proposition to end customers, including meaningful environmental benefits, efficiency gains, fast fueling, and lower operational costs.

Image Source: Company

Plug’s vertically integrated GenKey solution ties together all critical elements to power, fuel, and provide service to customers such as Amazon, BMW, The Southern Company, Carrefour, and Walmart.

Image Source: Company

The Company is now leveraging its know-how, modular product architecture, and foundational customers to rapidly expand into other key markets, including zero-emission on-road vehicles, robotics, and data centers.

We will discuss the rationale for covering this Company.

- Growing Market Opportunity

Plug is the Company behind the end-to-end green hydrogen ecosystem that offers products and solutions ranging from fuel cells to electrolyzers to the production, storage, handling, transportation, and dispensing of liquid green hydrogen. Plug aims to make hydrogen adoption easy for its customers and is helping customers meet their business goals and decarbonize the economy.

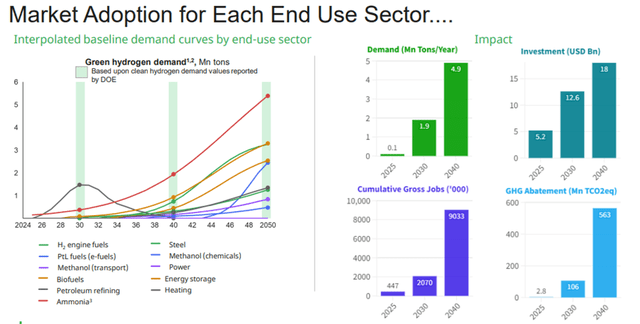

Image Source: Company

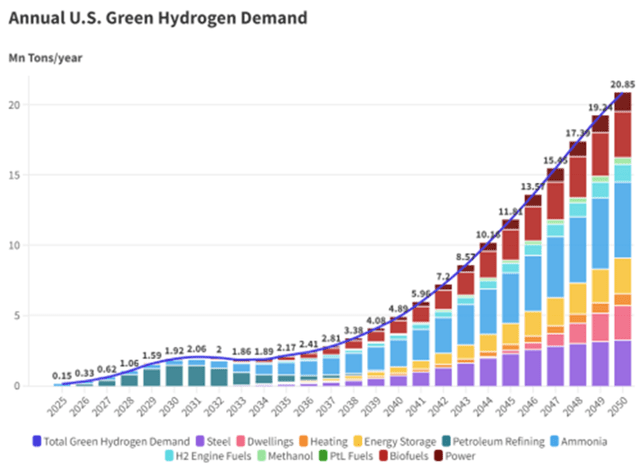

Until the green hydrogen economy reaches maturity, a limited supply will be available. During this maturation process, most extensive, hard-to-abate industries are expected to consume significant percentages of the green hydrogen produced, if not all of it.

Image Source: Company

In most applications, there is a sizeable societal value in deploying green hydrogen. However, in some areas, it can make an outsized impact. Plug is doing the work to carefully understand where, how, and when it should deploy green hydrogen to grow the business and benefit society most significantly.

Image Source: Company

In creating the first commercially viable market for hydrogen fuel cells, the Company has deployed more than 60,000 fuel cell systems for forklifts and more than 180 fueling stations.

Plug has made many investments to capture the green hydrogen opportunity presented through decarbonization.

Image Source: Company

The Company is utilizing various methods to expand its business.

For example, Plug is partnering with Fortescue to build the Green Hydrogen economy. Plug is the preferred supplier for a 550 MW PEM electrolyzer supply contract for Fortescue’s Gibson Island Project in Brisbane, Queensland, Australia, and has entered into an MOU for supplying a range of capital equipment, including electrolyzer, liquefier/other cryogenic equipment, and potential co-investments in US green hydrogen plants.

The Company has also taken steps to accelerate the Korean hydrogen economy.

Image Source: Company

From 2020 till now, Plug’s manufacturing capacity has grown from 50,000 square feet to nearly 1 M square feet, translating into 1900% more capacity. Over the same time, the Company’s product system has evolved from a Class 1 10KW system to a 1MW Fuel Cell System, which means 150 times more power. Moreover, compared to 2020, the Company has several hydrogen plants to its credit today. These include the following:

Operational

Tennessee – 10TPD

Final Commissioning

Georgia – 15TPD

Under Construction

Louisiana – 15TPD Texas – 45TPD

New York – 74TPD

Under Development

Antwerp – 35TPD

Finland – 3 sites

– 85TPD H2 + 70 kt ammonia

– 2 mt DRI/HBI/100TPD H2

Denmark – 1 site

France – 40TPD

Thus, Plug has a vast market opportunity since green hydrogen is critical to decarbonizing hard-to-abate industries, such as long-haul transportation and heavy manufacturing of steel, chemicals, concrete, and more. Moreover, the Company is well-poised to benefit from this opportunity – this is evident from the progress it has made since 2020.

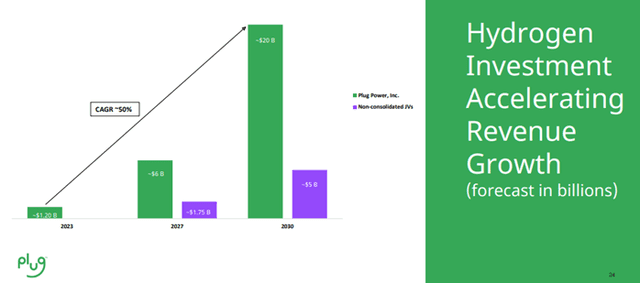

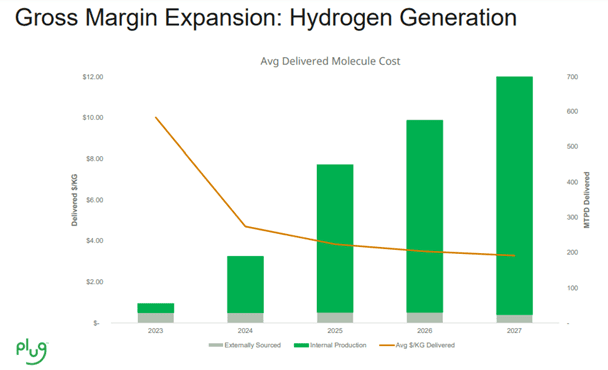

- Sound Business Strategy

Plug aims to grow revenues from approximately $1.2 billion in 2023 to $6 billion in 2027 to $20 billion in 2030.

Image Source: Company

The Company’s goals are based on its business strategy, which is focused on the following:

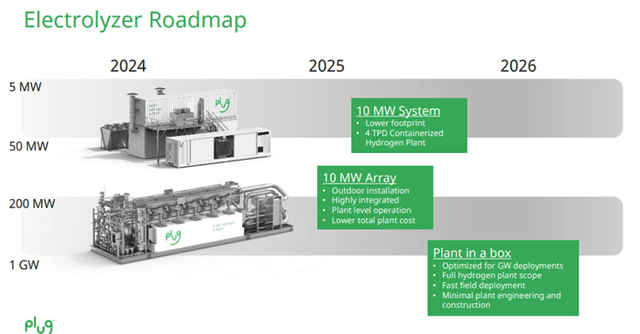

Image Source: Company

Image Source: Company

Thus, Plug has definitive revenue goals and is making solid strides to achieve them through efforts in multiple spheres. Given its progress, the Company will likely achieve its aim.

- Financial Performance

For Q3 FY23, revenue was $199M, compared to $189M for Q3 FY22, up 5% YoY. Overall, the Company’s gross margin was negative 69%, compared to negative 24% for the third quarter of 2022.

Unprecedented supply challenges in the hydrogen network in North America negatively impacted 2023 overall financial performance. This hydrogen supply challenge is a transitory issue, especially as the Company expects Georgia and Tennessee facilities to produce at total capacity by year-end.

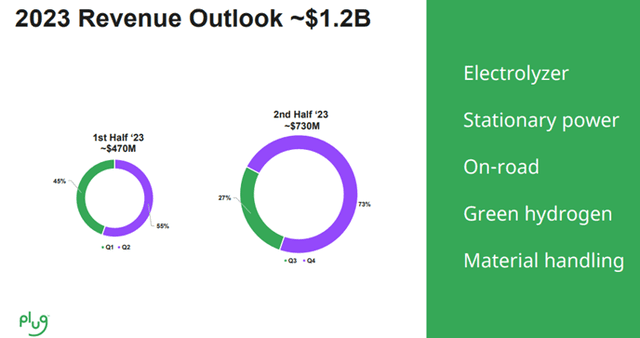

For FY23, the Company has provided a revenue outlook of approximately $1.2B.

Image Source: Company

During the previous year, the Company had reported $701.4M revenue for FY22 with $220.7M in Q4 FY22 — up 40% and 36%, respectively, YoY.

The Company achieved a gross margin of (28)% in FY22 versus (34)% in FY21 and a gross margin of (36)% in Q4 FY22 versus (54)% in Q4 FY21.

Though FY23 was a lackluster year, the Company is poised to ramp up revenues and profits in the upcoming years.

Risks

The Company’s success depends on the successful execution of its business strategy. If Plug fails to do so, its financial condition and results of operations will be severely affected.

Secondly, if Plug experiences delays in meeting development goals (including delivery of electrolyzers to customers, as well as the completion of hydrogen generation projects), its products exhibit technical defects, or if Plug is unable to meet cost or performance goals (including power output), useful life and reliability, the profitable commercialization of products will be delayed. In this event, potential purchasers of Plug’s products may choose alternative technologies, and any delays could allow potential competitors to gain market advantages.

Conclusion

The entire world is walking the path to decarbonization, and green hydrogen is expected to play a vital role in the process of achieving net zero by 2030. Plug is fully equipped to take advantage of this opportunity – the Company created the first commercially viable hydrogen fuel cell (HFC) technology market and has become the largest buyer of liquid hydrogen. The Company is now leveraging its know-how, modular product architecture, and foundational customers to rapidly expand into other key markets, including zero-emission on-road vehicles, robotics, and data centers. Plug expects to achieve revenues of $20 billion by 2030.

Nevertheless, Plug’s success depends on the successful execution of its business strategy and its ability to meet development goals on time; otherwise, its financial and operational performance may be negatively impacted. Hence, potential investors must proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://s29.q4cdn.com/600973483/files/doc_presentations/2023/Oct/11/plugsymposium2023_slides_f.pdf

https://www.sec.gov/ix?doc=/Archives/edgar/data/1093691/000155837023002599/plug-20221231x10k.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1093691/000155837023018601/plug-20230930x10q.htm

https://s29.q4cdn.com/600973483/files/doc_financials/2022/q4/PLUG-4Q22-Investor-Letter-FINAL.pdf

Sorry, the comment form is closed at this time.