28 May Accolade: Achieving Growth through Personalized Healthcare

Accolade, Inc. (NASDAQ: ACCD) is a personalized healthcare Company that provides personal, data-driven and value-based healthcare solutions.

Accolade, Inc. (NASDAQ: ACCD)

Market Cap: $577.49M; Current Share Price: 7.37 USD

Data by YCharts

The Company and its Products

Accolade’s solutions provide a healthcare experience that helps people better understand, navigate, and utilize the healthcare system and workplace benefits. The Company’s customers (members) are primarily employers that deploy Accolade solutions to provide employees and their families a single place to turn for their health, healthcare, and benefits needs.

Accolade also offers expert medical opinion services to commercial customers (which includes employers, health plans, and governmental entities) and virtual primary care and mental health support, both directly to consumers and to commercial customers.

Image Source: Company

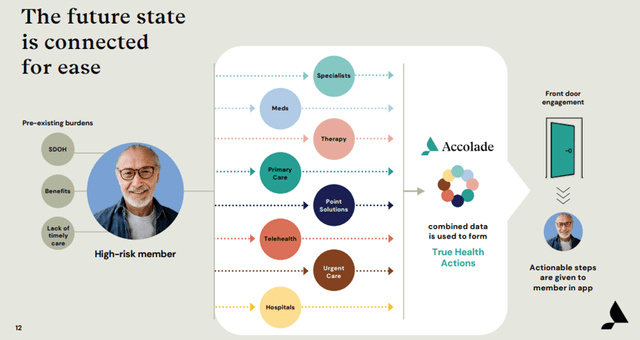

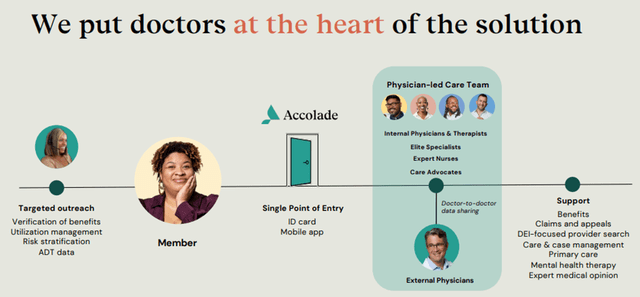

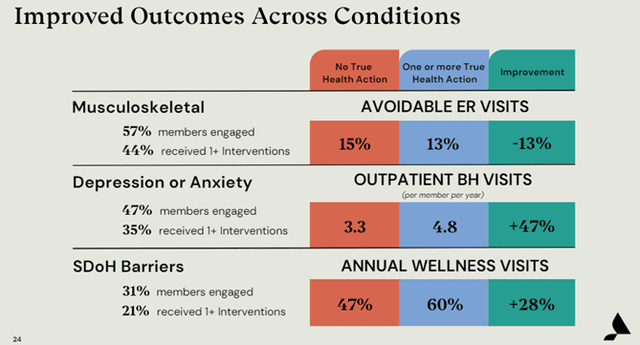

The Company’s innovative platform, called True Health Engine, combines open, cloud-based intelligent technology with multimodal support from a team of empathetic and knowledgeable Accolade Care Advocates and clinicians, including registered nurses, physician medical directors, pharmacists, behavioral health specialists, women’s health specialists, case management specialists, expert medical opinion providers, and primary care physicians.

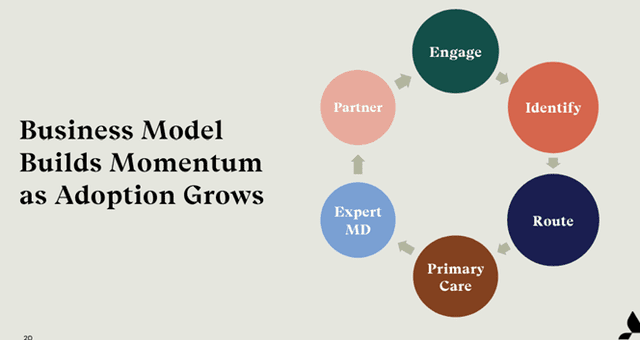

Accolade leverages its integrated capabilities, connectivity with providers and the broader healthcare ecosystem, and longitudinal data to engage across the entire member population, rather than focusing solely on high-cost claimants or those with chronic conditions. The Company’s goal is to build trusted relationships with its members that ultimately positions it to deliver personalized recommendations and interventions.

Image Source: Company

We will discuss the critical rationale for covering this Company.

- Highly Underpenetrated Personalized Healthcare Market

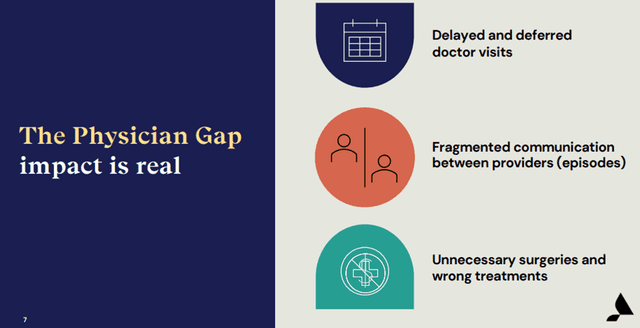

The U.S. healthcare system is complex and places significant strain on consumers, who struggle to effectively use their healthcare and benefits, make informed decisions about their health, and navigate the fragmented network of providers and third-party benefit programs. Healthcare consumers face challenges finding providers and scheduling appointments, physicians oftentimes do not have complete data to understand the longitudinal needs of each patient, and access to appropriate care and the quality of available care varies widely based on several reasons commonly referred to as Health Equity, including economic, social, and geographic. Collectively, these challenges are known as the Physician Gap.

Image Source: Company

Accolade has designed its solutions to close this Physician Gap by following a clinical model that emphasizes both contextual and concordant care – health care that takes into account a person’s lifelong healthcare experience delivered by a team of people who understand their individual need. This approach also takes into account the numerous social determinants of health, such as social, economic, race, and geographic barriers that impact the quality and accessibility of healthcare.

Image Source: Company

Healthcare payors, including managed care companies, the government, employers, and consumers, face significant and rising costs. For large employers in particular, the direct costs are substantial: the total annual employer cost for healthcare is estimated at more than $10,000 per employee. Employers also bear indirect costs in the form of absenteeism, decreased productivity, and diminished morale, all potentially intensified during times when their employees are forced to work remotely due to threats to public health.

Accolade fixes the physician’s gap which in turn leads to savings in direct and indirect costs.

Image Source: Company

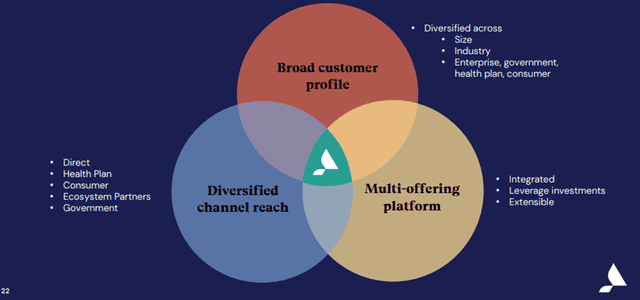

Moreover, Accolade is well-equipped to serve diversified customer profiles which would allow it to create further opportunities and expand the Total Addressable Market (TAM).

Image Source: Company

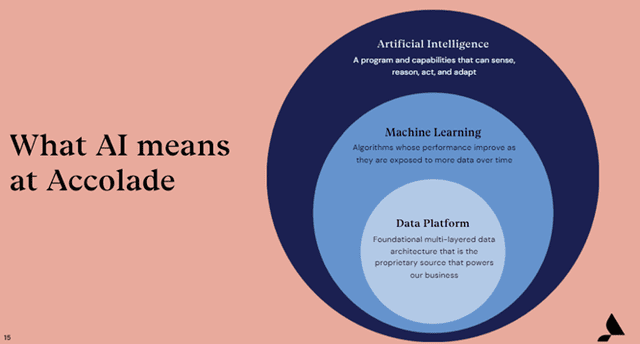

The Company has a massive opportunity to leverage AI and healthcare tech to transform healthcare experience for all employers and millions of consumers. Since FY19, Accolade’s customer base has expanded significantly and the Company continues to work towards garnering a greater share of the $216 billion Total Addressable Market.

Image Source: Company

- Dependable Growth Strategy

Accolade has a formidable growth strategy based on the following pillars

- Grow customer base: The Company has a highly skilled sales and marketing team that draws on advanced demand-generation strategies to reach and educate the market about Accolade’s offerings and increase the opportunities to grow its customer base.

Image Source: Company

- Retain and expand relationships with customers: By delivering measurable outcomes to customers, Accolade achieves strong customer retention, which enables it to expand and deepen these relationships.

Image Source: Company

The Company’s expert medical opinion and virtual primary care offerings complement its advocacy solutions and can be sold as standalone solutions or provide cross-sell opportunities to drive incremental revenue.

- Invest in technology: By leveraging technology in areas such as machine learning and artificial intelligence, predictive analytics, and multimodal communication, the Company can generate more efficiencies in its operating model while simultaneously improving its ability to deliver better health outcomes and lower costs for both members and customers.

Image Source: Company

- Continue to develop new offerings: The Company is constantly innovating to enhance its model and develop new offerings, including the recently introduced Accolade Care and Accolade Connect.

- Expand into adjacent markets: Accolade has significant additional opportunity in adjacent markets, including expanding with government-sponsored health plans, such as TRICARE, Medicare Advantage and Managed Medicaid (as well as traditional Medicare and Medicaid), along with those administered by Veterans Affairs. Its technology platform and broad range of healthcare services is also enabling it to expand opportunities with health plans, including their individual and family plans and fully-insured commercial customers.

Image Source: Company

- Opportunistically pursue partnerships: The Company has historically integrated new and complementary capabilities into its offerings by forming strategic partnerships and other relationships with third parties. These partnerships include Health plans, such as United Healthcare, Aetna, Blue Shield of California, and Priority Health, as well as condition-specific point solutions that leverage its distribution infrastructure to connect with more employer customers and a member engagement model to connect with more qualified participants (as shown below).

Image Source: Company

In other words, Accolade’s growth strategy should help the Company reap exceptional results in the future.

- Financial Performance

For FY24, Accolade achieved revenues of $414.3 million, up 14% YoY. Gross Profit was $158.8 million for FY24, compared to $132.5 in FY23. Net loss for the period stood at $99.8 million compared to net loss of $459.7 million for FY23.

Image Source: Company

For the fiscal year ending February 28, 2025, Accolade is targeting

Revenue between $480 million and $500 million

Adjusted EBITDA between 3% and 4% of revenue

Image Source: Company

The Company is targeting $1B in revenue and 15-20% Adjusted EBITDA in 5 years. Its aim is to achieve consistent 20% revenue growth with increasing profitability. Given Accolade’s track record, it seems that the Company will succeed in achieving its goal.

Image Source: Company

Risks

Accolade seems to have a promising future, however it is exposed to certain risks. Firstly, Accolade has a history of net losses, and it anticipates increasing expenses in the future, due to which it may not be able to achieve or maintain profitability. Secondly, Accolade derives a significant portion of revenue from its largest customers. The loss of any of these customers, or renegotiation of any of its contracts with these customers, could negatively impact results. Lastly, Accolade may face intense competition, which could limit its ability to maintain or expand market share within the industry, and if the Company does not maintain or expand its market share, the business and operating results will be harmed.

Conclusion

Accolade is on an upward growth trajectory – the Company targets $1B in revenue and 15-20% Adjusted EBITDA in 5 years. However, it is exposed to certain risks – for example it has a history of losses which may extend to the future and it may face intense competition which could hamper its future prospects. Hence investors must proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1481646/000148164624000020/accd-20240229.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1481646/000148164624000008/accd-20231130.htm

https://ir.accolade.com/static-files/523b8b51-c0d9-4229-92da-7f8cf78fc2fc

https://ir.accolade.com/static-files/7599f77e-19b4-4c7e-9e25-0349a5c89659

Sorry, the comment form is closed at this time.