06 Sep Altus Power: No. 1 in the Commercial Solar Race

Altus Power, Inc. (NYSE: AMPS) is a leading commercial-scale provider of clean electric power, serving commercial, industrial, public sector, and community solar customers with end-to-end solutions.

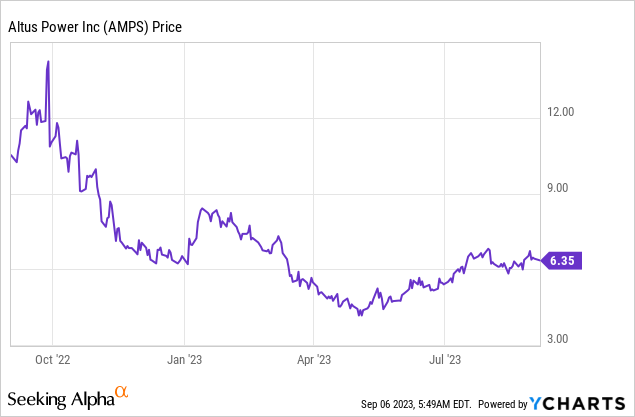

Altus Power, Inc. (NYSE: AMPS)

Market Cap: $1.02B; Current Share Price: 6.35 USD

Data by YCharts

The Company and its Products

Altus is a developer, owner, and operator of large-scale roof, ground, and carport-based photovoltaic (PV) and energy storage systems, serving commercial, industrial, public, and community solar customers.

The strength of the Company’s platform is enabled by premier sponsorship from The Blackstone Group, which provides an efficient capital source and access to a network of portfolio companies, and CBRE Group, Inc. (CBRE), which offers direct access to its portfolio of owned and managed commercial and industrial (C&I) properties.

Altus owns systems across the United States from Hawaii to Vermont.

Image Source: Company

As of December 31, 2022, its portfolio comprises 470 megawatts (MW) of solar PV. The Company has long-term power purchase agreements (PPAs) with over 300 C&I entities and contracts with over 5,000 residential customers serviced by approximately 40 megawatts of community solar projects.

Altus has agreements to install over 70 additional megawatts of community solar projects, all in advanced stages of development. Its community solar projects are currently servicing customers in 5 states, with projects in two additional states currently under construction. The Company also participates in numerous renewable energy credit (REC) programs nationwide.

Below, we will discuss in detail our rationale for covering this Company.

- Expanding Total Addressable Market

Electricity demand has been evolving for many years, but the progress has accelerated with the renewable targets and decarbonization goals established by many corporations transitioning to clean electricity generation. The demand comes from multiple industry segments, including public, private, and residential customers. Historically, the C&I market has been under-penetrated by traditional utility-scale solar PV providers due to the smaller scale of projects and difficulties associated with scaling nationally.

The confluence of multiple clean energy trends creates a significant market opportunity for Altus. According to the U.S. Energy Information Administration (EIA), the U.S. spends $400 billion on electricity each year, of which $200 billion is spent on C&I. An additional $98 billion of investment will be required to meet the U.S.’s 2030 sustainability goals. Further, C&I customers are projected to spend over $6 trillion on electricity between now and 2050.

It will be necessary to rapidly increase the scale and scope of renewable generation assets in the U.S. to meet the various targets and commitments set by corporations and governments. Through its strategic partnerships and market-leading financing, Altus is well-equipped to help meet this demand and lead the clean energy transition.

So far, the Company has benefitted significantly from available market opportunities. It experienced substantial growth in the last several months as a product of organic growth and targeted acquisitions. The Company operates in 22 states, providing clean electricity to customers equal to the electricity consumption of approximately 60,000 homes, displacing 320,000 tons of CO2 emissions per annum. In fact, as of June 30, 2023, Altus Power was the largest owner of commercial solar in the U.S.

Image Source: Company

Thus, based on recent achievements, it can be said that Altus is poised to reap full advantages of the expanding solar energy market through its existing national partner footprint, efficient acquisition and deployment strategies, and standardized approach to customer contracts and asset financing.

- Effective Growth Strategy

Altus utilizes a three-pronged strategy for accomplishing its growth objectives.

- Resourceful customer acquisition process

Firstly, Altus aims to increase customer and partner engagement velocity to ensure efficient access to clients and real estate.

Image Source: Company

Some of the measures taken by the Company to increase engagement include

- The Company’s digital platform streamlines all prospective customer engagement and onboarding

- Trammell Crow Company projects offer shared installation costs, unified permitting, and interconnection processes

- Master lease agreed for CBRE Investment Management and Trammell Crow properties

In other words, Altus strives to create value for customers and partners. Hence, it is likely to generate more clients and achieve growth objectives.

- Increase in construction capacity

The Company has expanded its construction muscle through measures such as

- Ramping up development capacity with CBRE project management

- Making personnel additions to its development, construction management, and energy optimization teams.

- Creating capacity to co-ordinate all pre-construction permitting, interconnection, and utility relationships

Image Source: Company

As of 12/31/2022, Altus had over 50 projects in construction or pre-construction. This is a record for the Company and a testament to its strengthening construction capacity.

- Efficient access to capital

Altus has been restructured to ensure access to capital in a volatile environment. It now has access to the following multiple funding sources.

Image Source: Company

Quick and adequate funding enables the Company to take advantage of growth opportunities when they arise. It also ensures the timely execution of ongoing projects.

- Robust financial performance

For Q2 FY23, the Company reported operating revenues of $46.5 million, compared to $24.8 million during the same period of 2022, an increase of 88%. The increase was primarily due to a more significant number of solar energy facilities in operation as a result of construction completions as well as acquisitions during the past twelve months.

Adjusted EBITDA for Q2 FY23 was $30.6 million, compared to $13.9 million, a 120% increase YoY. This increase in adjusted EBITDA was primarily the result of increased revenue from additional solar energy facilities, partially offset by an increase in general and administrative expenses associated with an increase in personnel.

Image Source: Company

Q2 FY23 was the best in company history regarding revenue and adjusted EBITDA. At a time when other companies in the industry were having difficulty accessing capital, Altus’s thoughtful balance sheet construction, including its strategic partnership with Blackstone Structured Finance, allowed it to execute on its robust pipeline of opportunity.

For FY22, Altus reported revenues of $101.2 million, a 41% increase compared to FY21, and adjusted EBITDA of $58.6 million for FY22, or a 43% increase compared to FY21.

Image Source: Company

Especially over the last couple of years, Altus has demonstrated the ability to execute its plans despite volatile environments and grow spectacularly.

For FY23, Altus reaffirmed 2023 adjusted EBITDA in the $97-103 million range, representing 70% growth over 2022 at the midpoint. The Company also expects the 2023 adjusted EBITDA margin to be in the mid-to-high fifty percent range.

Image Source: Company

Altus is on a mission to maximize asset sizes, enhance customer reach, and continue its growth in the profitable clean energy market. However, it is exposed to certain risks.

Risks

Firstly, the Company’s growth strategy depends on the widespread adoption of solar power technology. If solar power technology proves unsuitable for widespread commercial deployment or if demand for solar power products fails to develop sufficiently, Altus would be unable to generate enough revenues to achieve and sustain profitability and positive cash flow.

Secondly, solar systems face competition from traditional regulated electric utilities, less-regulated third-party energy service providers, and new renewable energy companies concerning providing electricity on a price-competitive basis. Standard utilities generally have substantially greater financial, technical, operational, and other resources. They thus may be able to devote more resources to the research, development, promotion, and sale of their products or respond more quickly to evolving industry standards and changes in market conditions than Altus.

Finally, although Altus benefited from the declining cost of solar panels in the past, its financial results may be harmed now that the cost of solar panels has increased, and expenses overall may continue to increase in the future due to increases in the price of solar panels and tariffs on imported solar panels imposed by the U.S. government.

Conclusion

The Company has demonstrated exceptional growth over the last few quarters due to its highly effective growth strategy, including a robust client acquisition strategy and increased construction and financing abilities.

Nevertheless, Altus is subject to risks such as competition from traditional and less-regulated third-party energy service providers and increasing cost of inputs such as solar panels. Moreover, if the adoption of solar power fails to grow as expected, Altus may be harmed by a shrinking market. Hence, investors should proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1828723/000182872323000051/amps-20221231.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1828723/000182872323000105/amps-20230630.htm

No Comments