24 Jun AMSC: Restructuring the Power and Energy Market

American Superconductor Corporation (NASDAQ: AMSC) is a system provider of megawatt-scale power resiliency solutions that orchestrate the rhythm and harmony of power on the grid™ and that protect and expand the capability and resiliency of the U.S. Navy’s fleet. The Company’s system-level products leverage the Company’s proprietary “smart materials” and “smart software and controls” to provide enhanced resiliency and improved performance of megawatt-scale power flow.

American Superconductor Corporation (NASDAQ: AMSC)

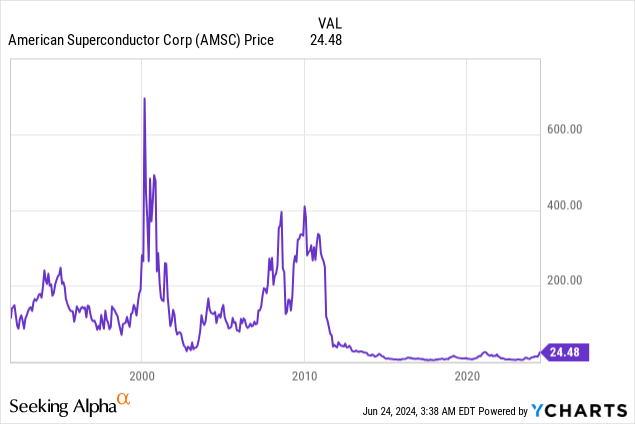

Market Cap: $903.87M; Current Share Price: 24.48 USD

Data by YCharts

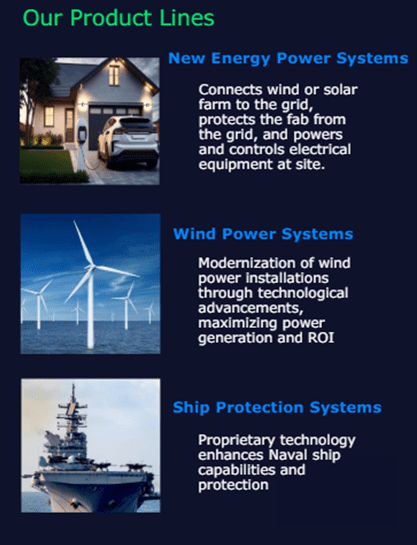

The Company and its Products

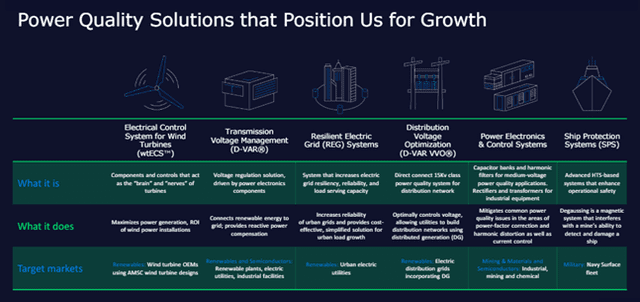

AMSC designs, develops, and deploys power control systems that harmonize an increasingly complex energy system.

Through its Gridtec™ Solutions, AMSC provides engineering planning services and advanced grid systems that optimize network reliability, efficiency, and performance. Through its Marinetec™ Solutions, AMSC provides ship protection and is developing propulsion and power management solutions designed to help fleets increase system efficiencies, enhance power quality, and boost operational safety. Through its Windtec™ Solutions, AMSC provides wind turbine electronic controls and systems, designs, and engineering services that reduce the cost of wind energy.

Image Source: Company

The Company’s solutions enhance the performance and reliability of power networks, increase the operational safety of navy fleets, and power gigawatts of renewable energy globally. Founded in 1987, AMSC is headquartered near Boston, Massachusetts, with operations in Asia, Australia, Europe, and North America.

We will discuss the critical rationale for covering this Company.

- Significant Addressable Market

AMSC aims to power a more reliable and resilient grid that can incorporate renewable energy sources. Its pioneering products, software, and control solutions create more cost-effective ways for renewables to deliver a cleaner, less carbon-intensive tomorrow.

The Company provides solutions that address four critical drivers of the business:

Image Source: Company

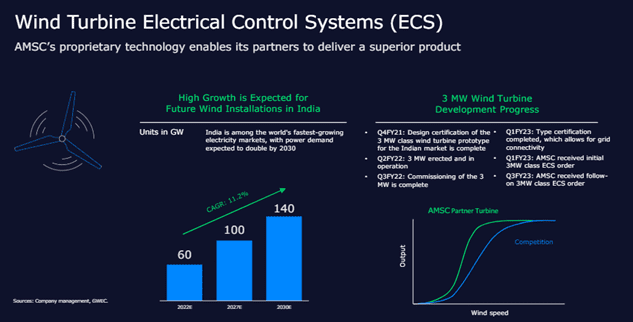

- The Global Demand for Renewables: The Company designs wind turbines and provides electrical control systems that control the wind turbine’s voltage, current, frequency, pitch, and yaw.

Image Source: Company

At the substation level, AMSC provides interconnection solutions that allow wind farms to meet the utility’s grid code requirements for voltage, power factor, and dynamic performance of the plant during unforeseen system disturbances by utilizing its dynamic voltage management solutions, static voltage management solutions, and harmonic filters.

- The Global Demand for Materials and Electric Vehicles: AMSC provides transformation, rectification, voltage management, and harmonic filtering systems at the substation level that manage input power from the grid and control power for the operation of large-scale industrial equipment such as furnaces, chemical plants, or semiconductor fabrication plants.

- The Global Demand for Semiconductors: AMSC provides sag mitigation systems, which are substation-level power conditioning systems. These systems can include both dynamic and static voltage management as well as harmonic filter solutions specifically designed to improve the facility’s overall power factor and harmonic compliance needs.

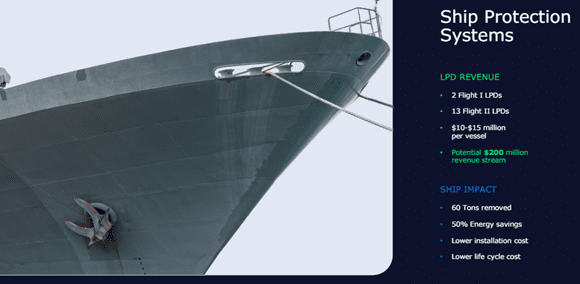

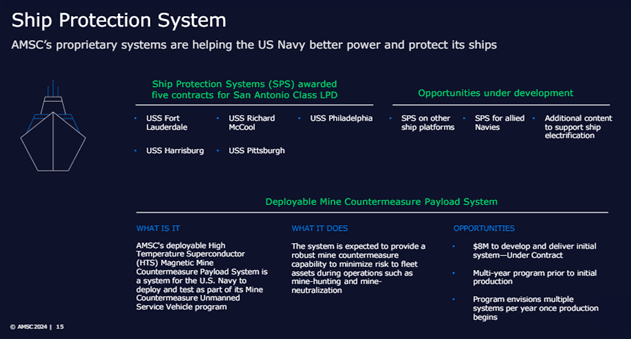

- The Electrification of the Navy Fleet: The Company provides advanced ship protection systems designed to help fleets increase system efficiencies, enhance warfare capabilities, and boost reliability, performance, and security.

- Comprehensive Business Strategy

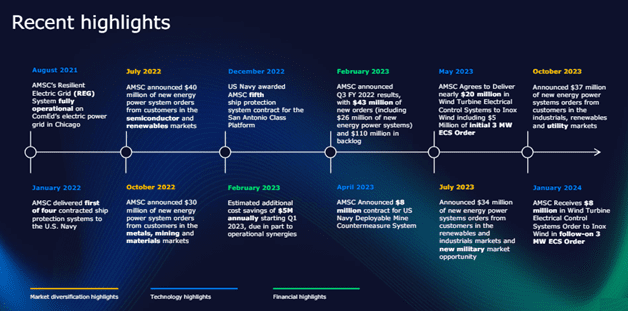

- Provide solutions from power generation to delivery. From the generation source to the distribution system, AMSC focuses on providing best-in-class engineering, support services, technologies, and solutions that make the world’s power supplies smarter, cleaner, and more resilient. The Company’s recent achievements in this regard are shown below.

Image Source: Company

Moreover, AMSC is developing additional solutions for this critical market, which may include power management and power generation similar to what it does for electric grids.

Image Source: Company

Overall, AMSC estimates the total annual addressable global market for its products and solutions is nearly $9 billion.

Image Source: Company

The Company’s addressable market is driven by (i) the nearly $500 billion investment in renewables to update the aging grid for better support in the adoption of intermittent renewable power sources, (ii) the nearly $100 billion investment in the mining and processing of materials as well as the $160 billion investment in semiconductor capacity—both of which are driven by the electrification of transportation, the need to prioritize energy security and bolster domestic supply chains—and (iii) the over $30 billion investment by the U.S. federal government in U.S. military ship systems and capabilities to help ensure performance and security amid geopolitical uncertainty.

AMSC has developed various unique solutions for the markets mentioned above. AMSC provides wind turbine manufacturers with a unique and integrated approach to wind turbine designing and engineering, customer support services, and power electronics and control systems. It is the only Company in the world that can provide transmission planning services, grid interconnection, voltage control systems, and superconductor-based distribution systems for power grid operators. This unique supply scope offers AMSC greater insight into customers’ evolving needs and more significant cross-selling opportunities, thus enabling the Company to benefit exponentially from expanding market demand.

The Company plans to drive revenue growth and enhance operating results through the below objectives.

Image Source: Company

Image Source: Company

Additionally, AMSC has made successful acquisitions, leading to more extensive sales in multiple markets.

Image Source: Company

The Company serves target markets such as Australia, Canada, Chile, India, Japan, Jordan, Mexico, Singapore, South Africa, South Korea, the United Kingdom, and the United States.

Overall, AMSC’s sound business strategy should help it achieve new heights.

- Financial Performance:

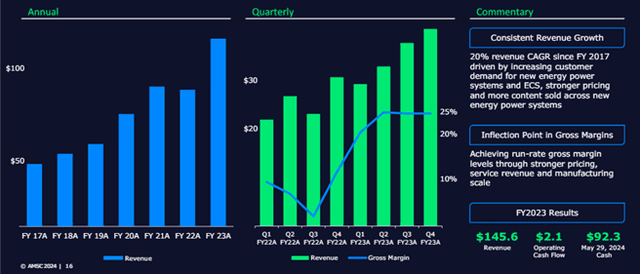

For AMSC, revenues for Q4 FY23 were $42.0 million compared with $31.7 million for FY22. The YoY increase was due to higher Grid segment revenues, primarily driven by strong new energy power system sales, and higher Wind segment revenues due to 3MW ECS shipments.

AMSC’s net loss for Q4 FY23 was $1.6 million, or $0.05 per share, compared to a net loss of $6.9 million, or $0.25 per share, for FY22.

Image Source: Company

The Company has displayed a 20% revenue CAGR since FY17. Specifically, for FY23, the Company reported revenues of $145.6 million, compared to $106.0 million in FY22. The 37% revenue increase YoY was driven by higher Grid and Wind segment revenues than in the prior year.

AMSC reported a net loss for FY23 of $11.1 million, or $0.37 per share, compared to a net loss of $35.0 million, or $1.26 per share, in FY22.

For Q1 FY24, AMSC has provided guidance of revenues between $38 – $42 million.

Image Source: Company

Risks

AMSC provides unique solutions for a large addressable market and is poised for rapid growth. However, the Company is exposed to certain risks.

Firstly, AMSC has a history of operating losses, which may continue in the future.

Secondly, the Company’s contracts with the U.S. government are subject to audit, modification, or termination by the U.S. government and include specific other provisions in favor of the government. The continued funding of such contracts remains subject to annual congressional appropriation, which, if not approved, could reduce AMSC’s revenue and lower or eliminate profit.

Finally, the Company operates in competitive markets, and many of AMSC’s peers have substantially greater financial resources, research & development, manufacturing, and marketing capabilities. This could limit AMSC’s ability to acquire or retain customers.

Conclusion

For FY23, AMSC recorded a 37% increase in revenues year over year. The Company has displayed a 20% revenue CAGR since FY17.

AMSC provides unique solutions for an increasingly complex energy market expected to grow significantly over time. However, the Company is exposed to certain risks – for example, it has a history of losses and faces substantial competition – hence, investors must proceed cautiously.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://www.sec.gov/ix?doc=/Archives/edgar/data/880807/000143774924018602/amsc20240331_10k.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/880807/000143774924002041/amsc20231231_10q.htm

https://ir.amsc.com/static-files/443da504-b669-4c75-8351-bd37450cbf76

Sorry, the comment form is closed at this time.