27 May Can Lordstown Motors Withstand the latest test of its “Endurance”?

Lordstown Motors Corp. (NASDAQ: RIDE) is taking a drubbing again, after reporting disappointing Q1 earnings, which included higher than expected forecasted expenses and lowering of the production forecast of its electric pickup. The forecast for Endurance, touted to be the first commercial vehicle to feature four in-wheel hub motors, has been slashed from nearly 2,200 vehicles to 1000.

The Company reported its Q1, 2021 financial results with a net loss of $125 million. Lordstown also revised the operating expenses of 2021 by $115 million to reflect the higher spending related to beta testing, vehicle validation tests, production costs and enlisting third-party engineering. The Company is now planning to raise additional capital to ensure its planned start-of-production date of late-September 2021 remains on track.

Steve Burns, Lordstown Motors’ Chairman and CEO, stated

“We have encountered some challenges, including COVID-related and industry-wide related issues, as we progress towards our start of production deadline. These include significantly higher than expected expenditures for parts/equipment, expedited shipping costs, and expenses associated with third-party engineering resources. We secured a number of critical parts and equipment in advance, so we are still in a position to ramp up the Endurance, but we do need additional capital to execute on our plans. We believe we have several opportunities to raise capital in various forms and have begun those discussions.”

However, Lordstown has finished 48 out of 57 prototypes and will begin pre-production vehicle builds in July. The vehicles have passed frontal and pole crash tests and are performing as per expectation on parameters such as durability and validation. The Company has also made progress on numerous other fronts related to production at the Lordstown plant.

Lordstown Motors Corp. (NASDAQ: RIDE)

Market Cap: $ 1.67B; Current Share Price: 9.44 USD

Data by YCharts

Mounting Woes!

The news comes in wake of Lordstown already mounting troubles. In March 2021, the Company was alleged to be misleading investors on demand and production capabilities by Hidenburg Research. The allegations made by the research firm included misinformation about the progress of its production capabilities, delay in receiving equipment for in-house battery production, non-completion of significant testing requirements including Federal Motor Vehicle Safety Standards testing required by the National Highway Traffic Safety Administration (NHTSA).

Other serious allegations include reporting fictitious orders to enable it to raise more capital from investors. The Company had announced the receipt of a non-binding 100,000 EV Truck orders from a commercial fleet operator in January 2021. Hidenburg also raised questions about a $735 million order from E Squared Energy, a Texas company, which hasn’t started its fleet operation yet, but was listed as an order by the Company.

Lordstown admitted to using the services of a consulting firm Climb 2 Glory to find out the potential demand and sales for its truck, while denying claims about creating a false impression or hyped-up sales figures.

In March 2021, the Company received a notice from the U.S. Securities and Exchange Commission for details related to its merger with DiamondPeak Holdings, a special purpose acquisition company and the preorders of its vehicles.

High Stakes!

The International Energy Agency predicts that Electric Vehicles, which stand at 3 million today, will grow to 125 million by 2030. The Global Electric Vehicle market is all set to compete with the internal combustion engine (ICE) vehicles in the next five-year, accounting for one out of every five cars sold by 2030, according to Seth Goldstein, an analyst and chair of Morningstar’s electric vehicle committee. The growth of this industry is a result of the initiatives by governments around the world, in the form of tax rebates, grants, and subsidies for adoption of renewable and more environment friendly options for transportation. Unlike conventional vehicles which can only replenish their fuel at specific public locations, Electric vehicles can be charged at home or commercial charging stations.

However, the limitation of sufficient charging capacity to cover long distances discourages the use of these vehicles. There is an increased focus on research and development activities, especially in the passenger car sector, to improve infrastructure and supply equipment and establish EV chargers at easily accessible public places, to allow long distance travel as well. Range anxiety, which acts as the biggest impediment for the market at present, will soon be a thing of the past, with Companies racing to develop connectivity modules.

The demand for electric vehicles will also bolster the demand for ancillary industries such as engine components, electronics for propulsion systems, battery optimization and torque transfer devices. In fact, the demand for lithium, which is a crucial component of energy storage in transportation batteries, is likely to quadruple over the next decade according to Seth Goldstein.

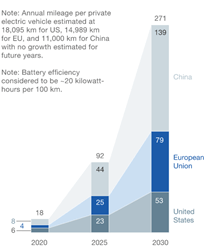

A report by McKinsey estimates that by 2025, there will be more than 350 EV models introduced into the market, with ranges of 200 miles. However, a lack of charging infrastructure could hamper the growth in the market. The report also highlights the fact that besides price and driving range, lack of access to charging stations is the third most serious barrier to EV. However there has been a gradual decline in prices and improvement in driving range and companies are making a concerted effort to provide the requisite charging infrastructure. Furthermore, the total energy demand for electric vehicles in China, the United States and European Union alone will reach 280 billion kilowatt-hours by 2030.

Image Source: Mckinsey

There has been an increasing interest in EV’s owing to environmental concerns, which has prompted leading automobile makers such as BMW, Daimler, Ford, and Volkswagen to announce an investment plan for deployment of 400 charging sites across Europe, in addition to investing approximately $90 billion in electric vehicles, according to a report by Reuters.

A Winning Product – On Paper!

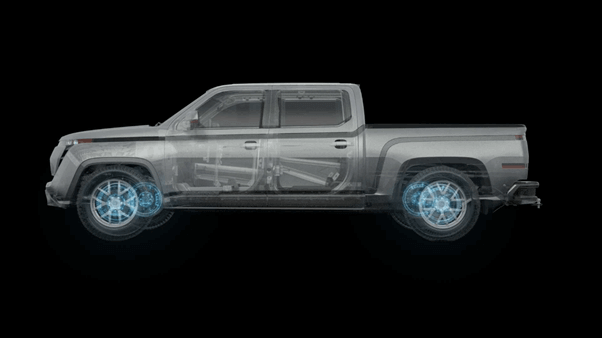

LordTown Motors Endurance is likely to be the world’s first all-electric commercial pickup which boats of a revolutionary design and is built from ground up. The vehicle has four-in-wheel hub motors which improve control and very few moving parts that lead to lower maintenance costs and even lower costs of ownership when compared to conventional commercial vehicles.

Image Source: Company

The Company offers Hub Motors that are electric motors incorporated into the hub of a wheel, which results in less wasted motion and faster and more efficient performance. The vehicle also comes with integrated software and an advanced telematics system that offer constant monitoring and optimized performance. In addition, being fitted with four motors allows the vehicle to enjoy the lowest center of gravity and more stability.

Endurance can produce 2,000/4,400 lb-ft of torque (Continuous/Peak), with a 7,500 lb towing capacity, delivering a powerful performance and superior control for all terrains. The vehicle also offers superior battery charge with over 250+ miles for 30 to 90 minutes of battery charging.

The Company has a fully operational plant for in-house production in Lordstown, Ohio, replete with an 800,000 sq.ft propulsion facility for battery packs.

Key Takeaways

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://finance.yahoo.com/news/lordstown-motors-reports-first-quarter-200100538.html

https://www.autonews.com/automakers-suppliers/firm-exposed-nikola-calls-lordstown-motors-mirage

https://www.autonews.com/mobility-report/sec-review-lordstown-motors-spac-deal-vehicle-preorders

https://investor.lordstownmotors.com/static-files/9b6bd13c-acd0-4476-9192-89e4a739e4cf

No Comments