21 Sep Centrus Energy: Powering the Future, Globally

Centrus Energy Corp. (NYSE American: LEU) supplies nuclear fuel and services for the nuclear power industry. Centrus provides value to its utility customers through the reliability and diversity of its supply sources – helping them meet the growing need for clean, affordable, carbon-free electricity.

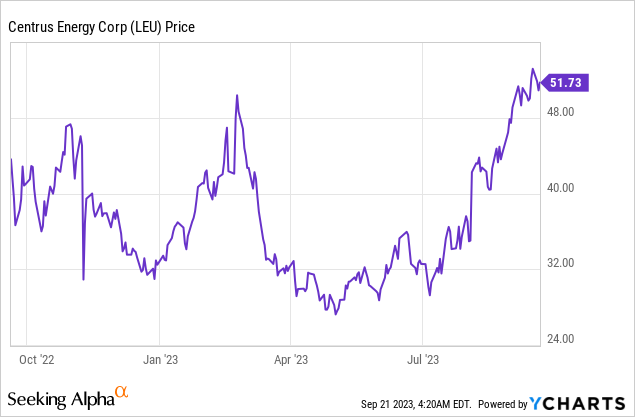

Centrus Energy Corp. (NYSE American: LEU)

Market Cap: $803.14M; Current Share Price: 51.73 USD

Data by YCharts

The Company

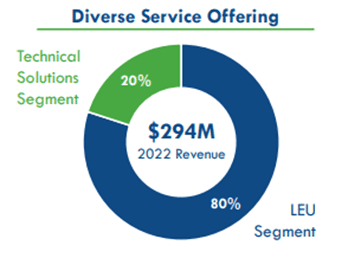

Centrus operates two business segments: (a) LEU, which supplies various components of nuclear fuel to commercial customers from a global network of suppliers, and (b) Technical Solutions, which provides advanced engineering, design, and manufacturing services to government and private sector customers and is deploying uranium enrichment and other capabilities necessary for the production of advanced nuclear fuel to power existing and next-generation reactors around the world.

The LEU segment provides most of the Company’s revenue. It involves the sale of enriched uranium for nuclear fuel to customers, primarily utilities that operate commercial nuclear power plants. Most of these sales are for the enrichment component of LEU, measured in SWU. Centrus also sells natural uranium (the raw material needed to produce LEU) and occasionally LEU with the natural uranium, uranium conversion, and SWU components combined into one sale.

Image Source: Company

Below, we will discuss the critical rationale for covering the Company.

- Growing Industry Dynamics with Strong Tailwinds

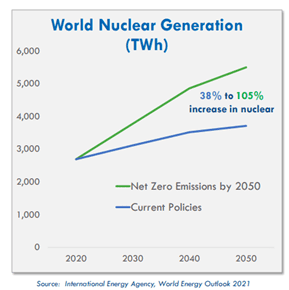

According to the International Energy Agency (IEA), nuclear energy is poised for global growth. Without new climate policies, carbon-free nuclear power is expected to grow almost 40% in the next three decades.

Image Source: Company

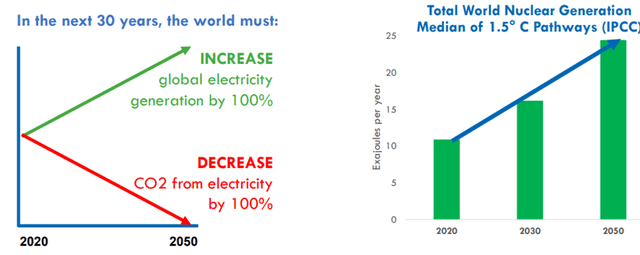

In the next 30 years, to meet expected electricity demand and achieve existing climate goals, the world must increase global electricity generation by 100% and decrease carbon dioxide from electricity by 100%.

The International Panel on Climate Change evaluated 85 possible pathways to meeting global climate targets. In the median scenario, nuclear energy would have to more than double to achieve net zero emissions by 2050.

Image Source: Company

The world has already embraced nuclear energy, and Centrus is well prepared to exploit this market opportunity.

Image Source: Company

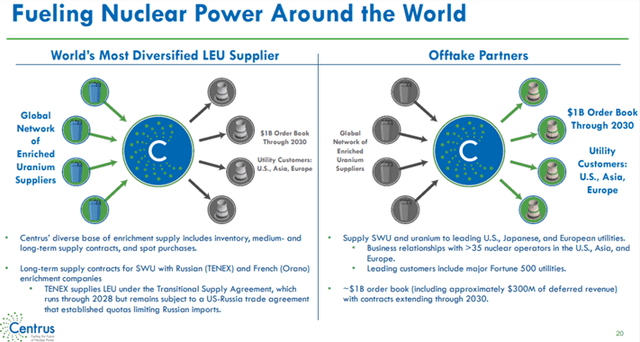

Centrus is the most diversified enriched uranium supplier to utilities in North America, Asia, and Europe, with a $1 billion long-term order book through 2030.

The Company’s leading customers include e Fortune 500 utilities, and overall, Centrus has business relationships with 35+ nuclear utilities.

Image Source: Company

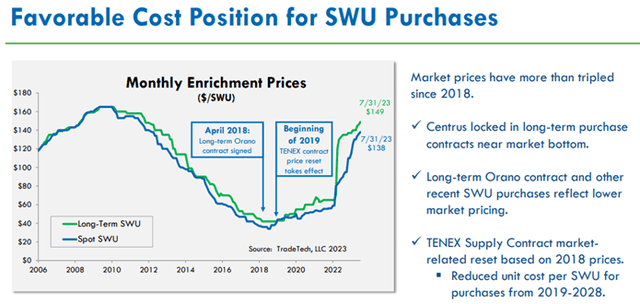

The Company already has secured cost-competitive supplies of SWU under long-term contracts through the end of this decade to allow it to fill existing customer orders and make new sales. A market-related price reset provision in its largest supply contract occurred in 2018. It took effect at the beginning of 2019 – when market prices for SWU were near historic lows – which has significantly lowered Centrus’s cost of sales and contributed to improved margins.

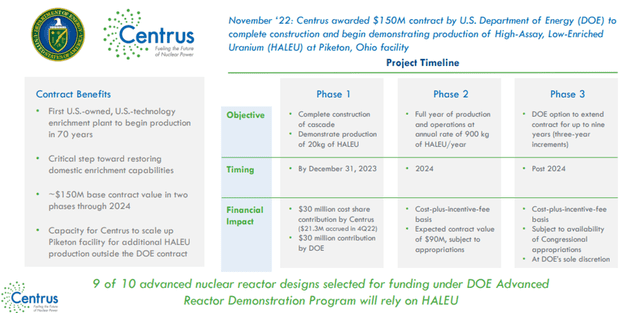

Under a contract with the Department Of Energy (DOE), the Company’s Technical Solutions segment is deploying uranium enrichment and other capabilities necessary to produce advanced nuclear fuel to meet the evolving needs of the global nuclear industry and the U.S. Government. Centrus is also leveraging its unique technical expertise, operational experience, and specialized facilities to expand and diversify the business beyond uranium enrichment, offering new services to existing and new customers in complementary markets.

In other words, Centrus is perfectly poised to profit from the upcoming market opportunity.

- Advanced Fuel Pioneer

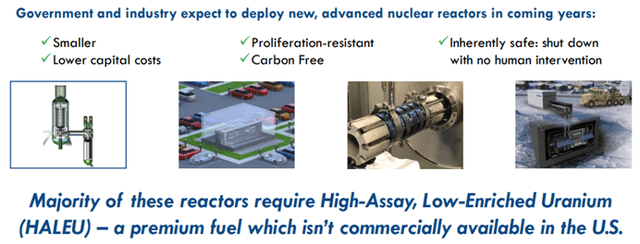

Centrus is working on pioneering U.S. production of HALEU, enabling the deployment of a new generation of HALEU-fueled reactors to meet the world’s growing need for carbon-free power. HALEU is a high-performance nuclear fuel component expected to be required by several advanced reactor and fuel designs currently being developed for commercial and government uses.

Image Source: Company

While existing reactors typically operate on LEU with the U235 isotope concentration below 5%, HALEU is further enriched so that the U235 concentration is between 5% and 20%. The higher U235 concentration offers several potential advantages, including better fuel utilization, improved performance, fewer refueling outages, simpler reactor designs, reduced waste volumes, and better non-proliferation resistance.

The lack of a domestic HALEU supply is widely viewed as a significant obstacle to the successful commercialization of these new reactors. For example, in surveys conducted by the U.S. Nuclear Industry Council in 2020 and 2021, advanced reactor developers indicated that the number one issue that “keeps you up at night” was access to HALEU. As the only Company with a license from the NRC to enrich up to 20% U235 assay HALEU, Centrus is uniquely positioned to fill a critical gap in the supply chain and facilitate the deployment of these promising next-generation reactors.

The Company has a first-of-a-kind NRC-licensed HALEU production capacity under construction in Piketon, Ohio, with support from the U.S. DOE. This facility’s production can be scaled up incrementally in a modular fashion as commercial and government demand for HALEU grows.

Image Source: Company

The Company’s existing license also covers LEU production, which can be scaled up alongside HALEU – generating additional cost synergy.

This is important because the Russian invasion of Ukraine has dramatically increased market prices for uranium enrichment. Subject to the availability of funding and offtake commitments, Centrus could deploy LEU production alongside HALEU production.

Image Source: Company

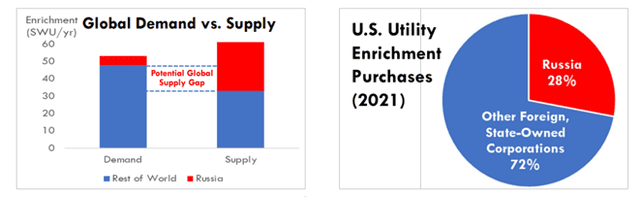

In fact, due to the absent Russian supply, the global enrichment deficit would be ~15 million SWU/yr – equal to the entire annual requirements of the U.S. or Europe.

Image Source: Company

In 2021, U.S. utilities purchased ~4 million Russian-origin SWU (28% of U.S. demand), and transitioning away from Russia requires significant public-private investment and will take years to accomplish.

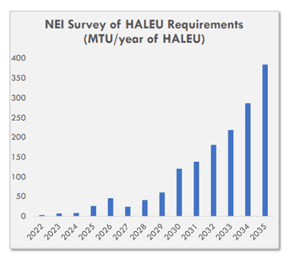

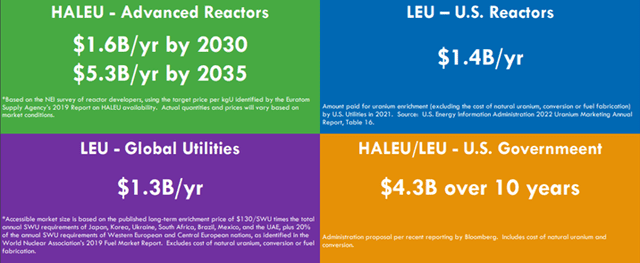

Hence, in the future, HALEU demand could become very large. The Nuclear Energy Institute (NEI) surveyed U.S. advanced reactor developers in 2020 to estimate potential HALEU demand through 2035. This estimate suggests a total market value of $1.6B/year by 2030 and $5.3B/year by 2035, and even if actual demand is lower than survey responses suggest, the market would still be huge.

Image Source: Company

The proposed U.S. Department of Energy initiative would offer long-term offtake commitments for LEU and HALEU, and at least a portion of the offtake may require U.S. enrichment technology. Centrus AC100M is the only deployment-ready U.S. technology, indicating a bright future for the Company.

- National Security Partner

Centrus is already a longstanding partner to the U.S. Government – the Company traces its roots to the Manhattan Project and Atoms for Peace. It became a publicly traded company in the 1990s when the U.S. privatized its uranium enrichment enterprise.

Centrus has safely operated the U.S. government’s enrichment plants for decades and served as the U.S. government’s executive agent on Megatons to Megawatts – the most successful disarmament program in history. The Company has a history of working with the U.S. Department of Energy to re-establish America’s domestic uranium enrichment capacity for national security and commercial needs.

However, the United States still needs suitable domestic uranium enrichment capability to meet U.S. national security requirements since the Paducah GDP shut down in 2013. Longstanding U.S. policy and binding non-proliferation agreements prohibit using foreign-origin enrichment technology for U.S. national security missions.

As mentioned earlier, Centrus’s AC100M centrifuge is the only deployment-ready U.S. uranium enrichment technology that can meet these national security requirements, albeit requiring one minor change in the sourcing of materials. An acceptable source for replacing this single material has been identified, and the replacement material is currently being tested.

Image Source: Company

Thus, Centrus has a competitive advantage as it offers an integrated solution for commercial and national security needs.

- Financial Performance

Centrus generated total revenue of $98.4 million and $99.1 million for Q2 FY23 and Q2 FY22, respectively, a decrease of $0.7 million.

Revenue from the LEU segment was $87.6 million and $85.5 million for Q2 FY23 and Q2 FY22, an increase of $2.1 million. The increase was primarily due to the $39.5 million increase in uranium revenue for Q2 FY23, partially offset by a $37.4 million decrease in SWU revenue. The reduction in SWU revenue was due to the decline in the average price of SWU sold, partially offset by an increase in the volume of SWU sold.

Revenue from the Technical Solutions segment was $10.8 million and $13.6 million for Q2 FY23 and Q2 FY22, respectively, a decrease of $2.8 million. The decrease was primarily related to the transition from the HALEU Demonstration Contract to the HALEU Operation Contract in late 2022. For Q2 FY23, the HALEU Operation Contract generated $10.4 million in revenue, whereas the HALEU Demonstration Contract generated $12.1 million for the same period in 2022.

Centrus generated total revenue of $293.8 million and $298.3 million for FY22 and FY21, respectively. Revenue from the LEU segment was $235.6 million and $186.1 million for FY22 and FY21, respectively, an increase of $49.5 million YoY.

Revenue from the Technical Solutions segment was $58.2 million and $112.2 million for FY22 and FY21, respectively, a decrease of $54.0 million. Revenue in FY21 included $43.5 million related to the settlement of the Company’s claims for reimbursements for particular pension and postretirement benefits costs incurred in connection with a past cost-reimbursable contract performed at the Portsmouth GDP. Excluding this one-time payment, revenue from the Technical Solutions segment decreased $10.5 million in 2022, driven by reduced work performed under the HALEU Demonstration and X-energy contracts, partially offset by increased work under the HALEU Operation Contract and other contracts.

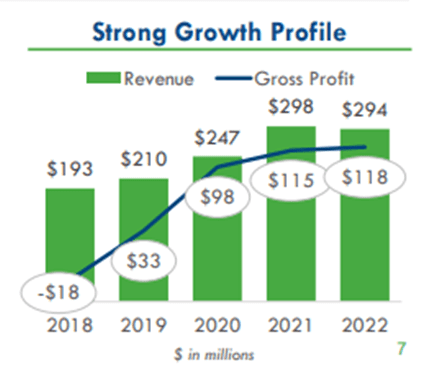

Nevertheless, Centrus has displayed a strong growth profile over the years, with 6.1% Revenue CAGR and 34% Net Income CAGR from 2017 – 2022.

Image Source: Company

For FY22, the Company achieved a Gross Profit of $118 million and Gross Margin and Operating Margin of 40% and 20%, respectively. The Net Operating Loss Balance stood at $781 million on 12.31.2022, and the Company had a cash balance of $213 million on 6.30.2022.

Centrus has significant market opportunities it can take advantage of in the future.

Image Source: Company

Considering Centrus’s existing infrastructure, upcoming projects, and unique position as a national security partner and advanced fuel pioneer, the Company’s financial performance may improve by leaps and bounds in the coming days.

Risks

Nevertheless, Centrus is exposed to several risks that may affect its future performance.

These include uncertainty about whether or when government funding or demand for HALEU for government or commercial uses will materialize, uncertainty regarding the Company’s ability to commercially deploy competitive enrichment technology, risks related to the war in Ukraine and geopolitical conflicts and the imposition of sanctions or other measures by either the U.S. or foreign governments, risks associated with the refusal of TENEX to deliver LEU to Centrus, and so on.

Conclusion

Centrus has a promising future due to the expected explosion in global demand for nuclear fuel and services and its position as a national security partner and advanced fuel pioneer.

However, there is always the risk that the Company may not be able to implement its technology to benefit from the opportunities adequately – or it may meet roadblocks such as insufficient demand and funding – hence, one should proceed cautiously.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://investors.centrusenergy.com/static-files/058b474a-c135-4600-a84b-e9908864a7af

https://www.centrusenergy.com/news/centrus-reports-fourth-quarter-and-full-year-2022-results/

https://www.sec.gov/ix?doc=/Archives/edgar/data/1065059/000106505923000009/leu-20221231.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1065059/000106505923000043/leu-20230630.htm

No Comments