20 Feb Exagen: Enabling Timely Diagnosis for Lupus Patients

Exagen Inc. (NASDAQ: XGN) provides autoimmune testing solutions. Exagen transforms the care continuum for patients suffering from debilitating and chronic autoimmune diseases by enabling timely differential diagnosis and optimizing therapeutic intervention.

Exagen Inc. (NASDAQ: XGN)

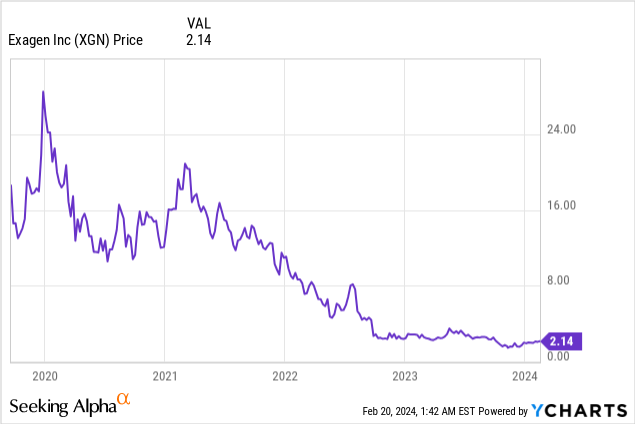

Market Cap: $36.48M; Current Share Price: 2.14 USD

Data by YCharts

The Company and its Products

Exagen has developed and is commercializing a portfolio of innovative testing products under its AVISE® brand, several of which incorporate Cell-Bound Complement Activation Products (CB-CAPs) technology. CB-CAPs assess the activation of the complement system, a biological pathway widely implicated across many autoimmune and autoimmune-related diseases, including systemic lupus erythematosus (SLE). The Company aims to enable healthcare providers to improve patient care through the differential diagnosis, prognosis, and monitoring of complex autoimmune and autoimmune-related diseases, including SLE and rheumatoid arthritis (RA).

The Company’s lead testing product, AVISE® CTD, enables differential diagnosis for patients presenting with symptoms indicative of various connective tissue diseases (CTDs) and other related diseases with overlapping symptoms. The comprehensive nature of AVISE® CTD allows for the testing of several relevant biomarkers in one convenient blood draw, as opposed to testing serially for individual biomarkers, which adds time and cost to the diagnostic process.

Image Source: Company

AVISE® CTD leverages CB-CAPs technology to enable the differential diagnosis of SLE. AVISE® CTD provides rheumatologists and their patients with sensitive and specific results that allow for potentially faster and more accurate differential diagnosis of SLE compared to other currently marketed testing methods.

Image Source: Company

Beyond SLE, AVISE® CTD allows rheumatologists to accurately diagnose other overlapping autoimmune and autoimmune-related diseases, including RA, with the same blood sample.

Exagen’s RA-focused testing products include AVISE® MTX and AVISE® Anti-CarP. AVISE® MTX is a drug monitoring test designed to aid in the optimization of methotrexate therapy, the standard of care, and first-line treatment for patients with RA. AVISE® MTX is based on Exagen’s proprietary methotrexate polyglutamate (MTXPG) technology that measures blood levels of MTXPGs, the active metabolite of methotrexate linked to disease control in RA patients. AVISE® Anti-CarP, which measures anti-carbamylated protein antibody (anti-CarP), was developed by the Leiden University Medical Center and introduced as a biomarker-driven RA prognostic test through a distribution agreement with Werfen USA, LLC to identify patients prone to more severe disease.

In addition, Exagen continues to populate a growing proprietary database of de-identified patient test results from its clinical studies and laboratory. The Company plans to collaborate with existing and future pharmaceutical and biotechnology partners to help maximize the total value of its in-house database.

Below, we will discuss the rationale for covering this Company.

- Large and underserved autoimmune disease market

Exagen’s AVISE® CTD may provide clinical utility for millions of patients in the United States suffering from diseases like SLE, RA, Sjögren’s syndrome, antiphospholipid syndrome (APS), other autoimmune-related diseases such as autoimmune thyroid, and other disorders that mimic these diseases, such as fibromyalgia. There is an unmet need for rheumatologists to add clarity in their CTD clinical evaluation, and there is a significant opportunity for Exagen’s tests that enable the differential diagnosis of these diseases, particularly for potentially life-threatening diseases such as SLE.

Image Source: Company

The National Institute of Environmental Health Sciences estimates that there are approximately 24 million patients in the United States with existing cases of autoimmune diseases. Of these patients, approximately seven million are potentially referable to rheumatologists. Based on the current Medicare allowable reimbursement rate, they would be candidates for an AVISE® CTD test, representing a total addressable market of approximately $7.5 billion. The total addressable market for AVISE® testing products is roughly $9.0 billion, based on estimated patient populations, the current Medicare allowable reimbursement rate, and testing frequencies.

Image Source: Company

Standard laboratory tests for diagnosing SLE include measuring immunological biomarkers, such as antinuclear antibodies (ANA), anti-double stranded DNA (anti-dsDNA), and other autoantibody tests. However, most individuals who test positive for ANA do not have SLE. Approximately 11-13% of individuals with a positive ANA test have SLE. This lack of specificity leads to inappropriate non-autoimmune referrals from primary care physicians to the rheumatologist. For example, 30% of fibromyalgia patients may test positive for ANA, potentially generating as many as four million inappropriate rheumatology referrals. In addition, a study published in 2012 reported the estimated prevalence of a positive ANA test in the average, healthy US population to be 13.8% (32 million people), indicating a significant need for a specific test for this disease. This unmet need can be fulfilled by the AVISE® CTD test, as indicated below.

Image Source: Company

On the other hand, RA is a chronic, systemic autoimmune disease in which the immune system attacks the joints and can also affect other organ systems. The annual incidence and prevalence of RA in the United States is estimated to be 135,000 and 1.5 million, respectively. Patients suffering from RA develop joint damage that is associated with painful inflammation and often progresses to irreversible damage of cartilage and bone, leading to significant disability and a reduction in quality of life and the ability to work.

As discussed, Exagen markets testing products under the AVISE® brand that allow for the differential diagnosis, prognosis, and monitoring of complex autoimmune and autoimmune-related diseases, including SLE and RA, indicating a promising future for the Company.

- Effective Business Strategy

The critical elements of Exagen’s business strategy include:

- Focus on flagship product, AVISE® CTD:

Exagen has demonstrated a solid record of commercial growth of the AVISE® CTD test.

Image Source: Company

The Company is uniquely positioned to continue expanding its commercial presence within the autoimmune disease market by leveraging its specialized sales force and expansive relationships with rheumatologists across the United States. Using its specialty laboratory focused on rheumatology, Exagen plans to build upon industry-leading quality, service, and technology to support robust AVISE® CTD adoption and continue to grow the ordering physician base.

- Continue developing innovative testing products, using clear criteria for R&D projects and commercialization milestones:

The Company intends to leverage its protein and molecular assay development capabilities, bioinformatic team, and proprietary technologies to pursue the development of additional testing products designed to have superior clinical utility for CTDs. Exagen undertakes research projects that can impact results and address the top consumer needs in the rheumatology space. The research projects have a competitive advantage (such as using proprietary technology), a pathway for reimbursement, and an established evidence development plan with sufficient market size. Criteria for developing products that Exagen ultimately commercializes include Medicare coverage (specific to patient population), proprietary value-based pricing, published clinical utility, and a strategy for medical guideline inclusion.

- Maintain meaningful margin:

Exagen seeks to maintain a meaningful margin by increasing operating leverage by implementing internal initiatives, such as leveraging validation and reimbursement-oriented clinical studies to facilitate payor coverage of its testing products. The Company plans to increase focus on long-term reimbursement and average sales price (ASP) growth by optimizing revenue cycle practices, focusing managed care efforts on medical policy expansion, and continuing to educate insurance payors on the published, real-world evidence of the clinical utility of its testing products, showing healthcare cost savings and reductions in time to diagnosis.

Image Source: Company

Exagen seeks to improve per-test costs by focusing on profitable, core test offerings, reducing fixed costs and overhead, and focusing laboratory resources on AVISE® CTD optimization. Additionally, the Company employs a streamlined salesforce covering territories designed to achieve the most efficient and effective reach and frequency for promoting AVISE® CTD.

Thus, Exagen has a well-thought-out, three-pronged strategy for growth, which involves focusing on its existing product, developing new products, and increasing product margins – this strategy, if followed diligently, may show excellent results in the long run.

- Financial Performance:

For Q3 FY23, Exagen announced a total revenue of $13.4 million and a gross margin of 57.4%. Non-GAAP adjusted EBITDA was $(3.6) million, and net loss was $(5.4) million.

The AVISE® CTD trailing twelve-month average selling price (ASP) was $320.

Image Source: Company

For FY22, Exagen reported a total revenue of $45.6 million and recorded 135,210 flagship AVISE® CTD tests.

Total gross margin was 46.9%, and net loss was $47.4 million.

The Company has recently reaffirmed its full-year 2023 total revenue guidance of at least $50 million and full-year 2023 non-GAAP adjusted EBITDA guidance of approximately negative $20 million. There was a record AVISE® CTD testing volume of roughly 137,000 units delivered during the year ended December 31, 2023, and a cash balance of $36.5 million at the end of the year.

In the future, Exagen estimates it can achieve profitability with an annual revenue of $75M and a gross margin of 60%.

Image Source: Company

Risks

Exagen has a promising future – its unique testing methodology caters to the unmet needs of a vast market, and the Company seems well on its path to profitability. Nevertheless, it is subject to certain risks.

Firstly, many of Exagen’s potential competitors have widespread brand recognition, substantially greater financial, technical, and research and development resources, and more excellent selling and marketing capabilities. Others may develop products with prices lower than Exagen’s, have preferred network status, or offer solutions at prices designed to promote market penetration – this could force Exagen to lower the list price of products and affect its ability to achieve profitability.

Secondly, Exagen’s success heavily depends on intellectual property, particularly obtaining and enforcing patents. Obtaining and enforcing patents in the diagnostics industry involves both technological and legal complexity and is costly, time-consuming, and inherently uncertain. Depending on decisions by the US Congress, the federal courts, and the USPTO, the laws and regulations governing patents could change in unpredictable ways that would weaken Exagen’s ability to obtain new patents or to enforce existing patents – this may negatively impact the Company’s performance.

Conclusion

The Company’s products are estimated to have an addressable market of about $9 billion, and the AVISE® CTD test has shown a steady growth track record over the last several years, indicating that the Company may dominate its segment soon.

However, Exagen’s future results may be impacted by its competitors’ performance or disrupted due to patent rules and regulations changes. Hence, potential investors must proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://investors.exagen.com/node/8751/pdf

https://investors.exagen.com/static-files/4daa6162-63a4-464c-8117-9518a297b156

Sorry, the comment form is closed at this time.