17 Aug Harmonic: Disrupting Video Streaming and Broadcasting

Harmonic Inc. (NASDAQ: HLIT) is a virtualized broadband and video delivery solutions leader. The Company enables media companies and service providers to deliver ultra-high-quality video streaming and broadcast services to consumers globally.

Harmonic revolutionized broadband networking via the industry’s first virtualized broadband solution, enabling cable operators to deploy gigabit internet service more flexibly to consumers’ homes and mobile devices.

Harmonic Inc. (NASDAQ: HLIT)

Market Cap: $1.13B; Current Share Price: $10.10

Data by YCharts

The Company

Harmonic is a global provider of (i) versatile and high-performance video delivery software, products, system solutions, and services that enable customers to efficiently create, prepare, store, playout, and deliver a full range of high-quality broadcast and streaming video services to consumer devices, including televisions, personal computers, laptops, tablets and smartphones and (ii) broadband access solutions that enable broadband operators to more efficiently and effectively deploy high-speed internet, for data, voice and video services to consumers’ homes.

The Company operates in two segments, Video and Broadband.

The Video business provides video processing, production, and playout solutions and services worldwide to broadband operators, satellite and telco Pay-TV service providers, and broadcast and media companies, including streaming media companies. The Video business infrastructure solutions are delivered by shipment of products, software licenses, or software-as-a-service (SaaS) subscriptions.

The Broadband business provides broadband access solutions and related services, including CableOS software-based broadband access solutions to broadband operators globally.

Harmonic is committed to creating a more equitable and sustainable world.

Image Source: Company

We’ll discuss key elements that make the Company an exciting watch.

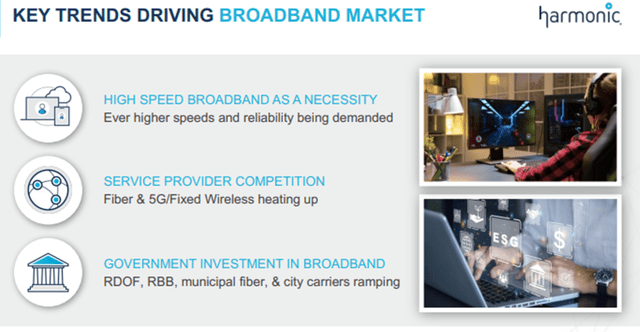

- Growing Addressable Market

Broadband operators continue to face challenges from the rapid growth of demand for broadband bandwidth in their networks, driven primarily by more users with more connected devices and applications, bundled digital video, voice, and high-speed data services, bandwidth-intensive VOD and streaming video services, and interactive cloud applications. In addition, the operation of network infrastructure is space, power, and personnel intensive. Hardware-centric networks can also be expensive to update or replace. Broadband operators need to significantly upgrade existing equipment and network technologies to remain competitive, especially in the face of heightened competition from non-cable service providers such as telcos to deliver gigabit data rates.

Image Source: Company

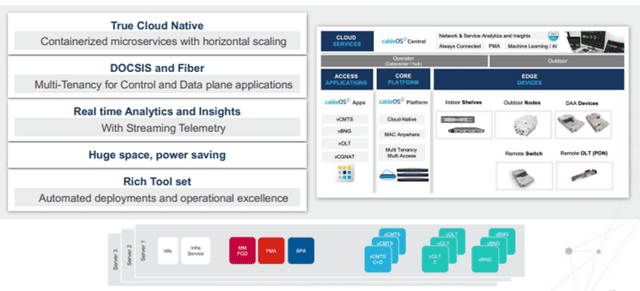

This has led to a growing addressable broadband market for Harmonic, with cloud services, fiber, and analytics presenting increased opportunity.

Image Source: Company

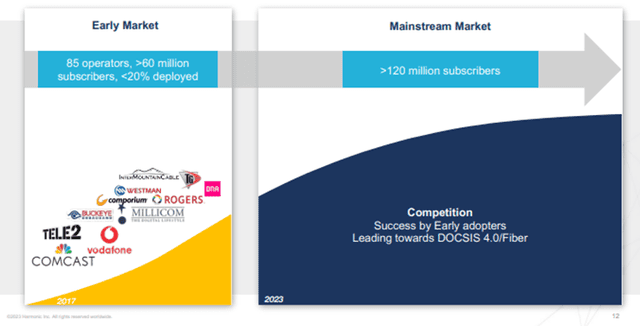

The Company is already a leader in multi-gigabit broadband. Its transformative cloud-native technology is far ahead of the competition, and many leading broadband operators are embracing Harmonic’s solutions.

Image Source: Company

Due to these reasons, the Company is poised to benefit significantly from the rapid demand for broadband. The broadband market is expected to grow to about $2 billion by 2025, indicating a CAGR of more than 30%. Harmonic’s broadband business division is also expected to grow at more than 30% CAGR to achieve more than 800 M in revenues by 2025.

Image Source: Company

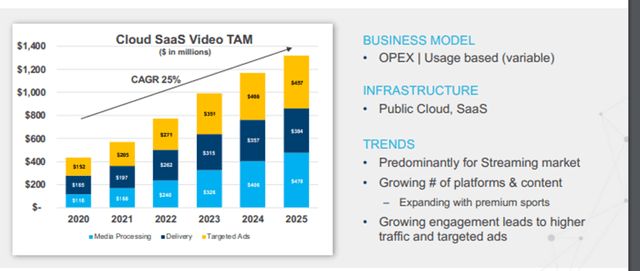

Concerning the video business, Harmonic is targeting the new Cloud Saas market, which is expected to grow to more than $1.3B by 2025. In this division, the Company expects to garner more than $110M by 2025, which indicates a CAGR of more than 45%.

In this regard, it seems that Harmonic will achieve its target, primarily because of its industry-leading video streaming technology. This assumption is further bolstered by several Tier 1 streaming media wins achieved by the Company over the past year.

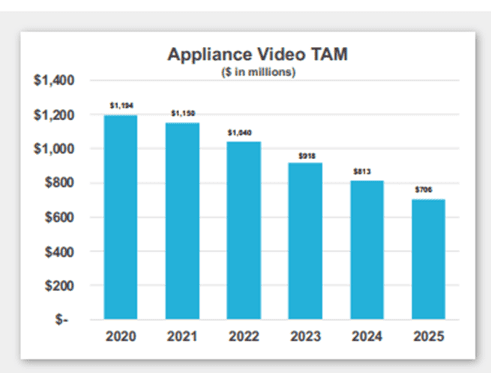

Also worth mentioning is the video appliance market, which is predominantly meant for broadcast workflows.

Image Source: Company

It is expected to decrease in size from about $1.19B in 2020 to nearly $.7B in 2025; however, it is a highly profitable market for media companies and requires a multi-billion dollar install base. Here, the Company will primarily focus on efficiency and cost reduction.

Image Source: Company

Broadband and Cloud Saas markets are expected to grow exponentially until at least 2025, and Harmonic seems well prepared to benefit from the same.

- Innovation, Expertise, and Customer Success

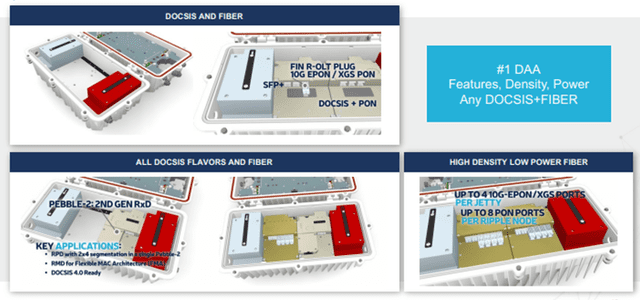

In the broadband category of products and solutions, the Company offers CableOS Software-Based Broadband Access Solution, which delivers unprecedented scalability, agility, and cost savings. It enables customers to migrate to multi-gigabit broadband capacity and the fast deployment of DOCSIS data, video, and voice services.

Image Source: Company

There is also the CableOS Central Cloud Services, a value-add subscription service for CableOS customers that enhances and simplifies the deployment, monitoring, operation, and maintenance of the CableOS solution.

Image Source: Company

The efficacy and popularity of the Company’s broadband solutions are evident in its deployment expertise and customer success, as shown in the image below.

Image Source: Company

At the same time, the Company offers two categories of video processing and delivery solutions – software-based video appliances and SaaS platforms – to deliver broadcast and streaming services and capabilities in the media market.

Image Source: Company

Video processing appliances, which include network management and application software and hardware products, provide customers with the ability to acquire various signals from different sources and in other protocols to deliver a variety of real-time and stored content to their subscribers for viewing on a broad range of devices.

Image Source: Company

The Company has explicitly seen an increasing number of customers seeking to leverage the inherent commercial, operational, and infrastructure flexibility offered by VOS360 SaaS platforms.

Image Source: Company

As can be seen, Harmonic’s products and solutions are used by the best in the industry. Due to efficacy and popularity, the Company is a market leader in both business segments and thus poised to soar above competition and deliver excellent results in the future.

- Financial Performance

For Q2 FY23, Harmonic achieved revenue of $156 million, down 1% YoY. Meanwhile, broadband segment revenue was $97.1 million, up 20% YoY. Gross Margin was GAAP 54.5% and non-GAAP 54.7%, compared to GAAP 52.3% and non-GAAP 52.8% in the year-ago period.

The Company achieved double-digit year over year Broadband (20%) and Video SaaS (58.3%) revenue growth and strong gross margins for the second quarter; however, it experienced hardware sales delays across our business segments resulting in total revenue below expectations.

Despite these short-term headwinds, Harmonic had the most enormous backlog in the Company’s history, and its operating model continued to deliver solid profitability. Several new customer wins reinforced its market position’s strength, further supporting its multi-year growth plan.

For FY22, Harmonic reported record revenue of $625.0 million, up 23% YoY. Broadband revenue was up 60%, while Video SaaS revenue was up 63% YoY. Adj. EBITDA was $86.5 million, up 51% YoY; EPS was $0.55, up 62% YoY; and near record backlog and deferred revenue of $457.1 million.

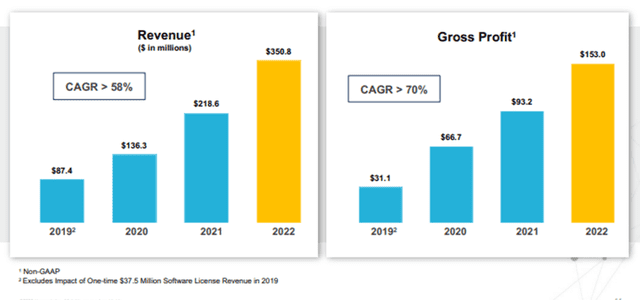

Specifically, from 2019 to 2022, the broadband business demonstrated exceptional growth, with revenue and gross profit increasing at a CAGR of more than 58% and 70%, respectively.

Image Source: Company

By 2025, Harmonic expects revenue to reach more than $825 million, indicating a 3-year CAGR of more than 34%.

Image Source: Company

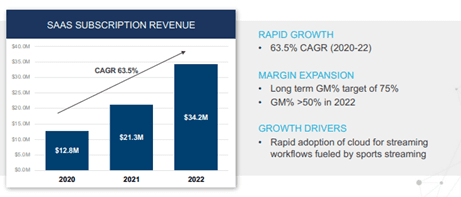

Similarly, SaaS Cloud within the Video Business segment grew exponentially at a CAGR of 63.5% from 2020 – 2022.

Image Source: Company

By 2025, the same segment is expected to grow to $110 B, which indicates a CAGR of more than 45%.

Image Source: Company

For FY23, Harmonic expects total revenue in the range of $705 – $740 million, gross margin in the field of 50.9% – 51.9%, and EPS between $0.63 – $0.74.

All the above tables and figures demonstrate that over the last few years, Harmonic has derived substantial benefits from expanding broadband and video markets. Its products and solutions are highly effective – its unmatched popularity among customers indicates this. It seems that even in the future, the Company will grow from strength to strength and thus should be closely tracked.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://investor.harmonicinc.com/static-files/cbdd6cc7-9ad7-402f-b7e4-681770a953f6

https://www.sec.gov/ix?doc=/Archives/edgar/data/851310/000085131023000070/hlit-20230630.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/851310/000085131023000044/hlit-20230331.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/851310/000085131023000021/hlit-20221231.htm

https://investor.harmonicinc.com/static-files/64af6a36-64b5-4ef1-b22b-c65ffa98a19e

No Comments