20 Jun Harrow Inc: Envisioning a Bright Future

Harrow Inc. (NASDAQ: HROW) is an eyecare pharmaceutical company engaged in discovering, developing, and commercializing innovative ophthalmic pharmaceutical products for the North American market.

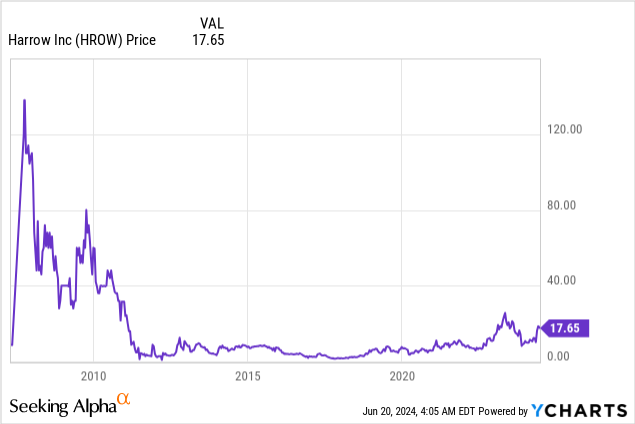

Harrow Inc. (NASDAQ: HROW)

Market Cap: $624.49M; Current Share Price: 17.65 USD

Data by YCharts

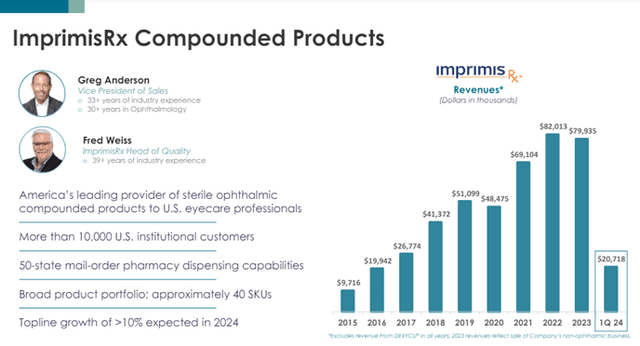

The Company and its Products

Harrow owns commercial rights to one of North America’s largest portfolios of branded ophthalmic pharmaceutical products, all marketed under the Harrow name. The Company also owns and operates ImprimisRx, one of the nation’s leading ophthalmology-focused pharmaceutical-compounding businesses. In addition, Harrow has a non-controlling equity interest in Melt Pharmaceuticals, Inc., and two other companies (Surface Ophthalmics, Inc. and Eton Pharmaceuticals, Inc.) that began as subsidiaries of Harrow and were subsequently carved out of the corporate structure and de-consolidated from its financial statements.

Over the past few years, Harrow has invested in broadening its product portfolio of FDA-approved products. The Company’s investments in this regard have led to the pursuit and completion of several announced transactions, all focused on eyecare pharmaceuticals primarily for the U.S. and Canadian markets.

Harrow owns commercial rights to:

- IHEEZO®

- VEVYE®

- TRIESENCE®

- ILEVRO®

- FLAREX®

- NATACYN®

- TOBRADEX® ST

- ZERVIATE®

- VERKAZIA®

- NEVANAC®

- FRESHKOTE®

- MAXITROL®

- MAXIDEX®

- IOPIDINE®

Image Source: Company

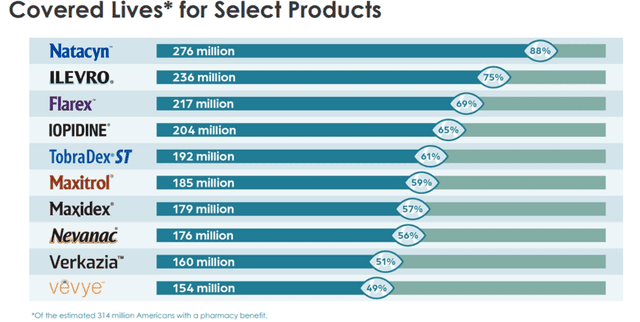

Harrow also owns U.S. rights to some discontinued products. In February 2024, the Company announced that it out-licensed Canadian rights for VERKAZIA, Cationorm® PLUS (a preservative-free formulation for dry eye or allergy relief), VEVYE, ZERVIATE and IHEEZO to Apotex Inc. The Company also owns worldwide rights to NATACYN and FRESHKOTE.

We will discuss the critical rationale for covering this Company.

- Fast Growing Ophthalmology Market:

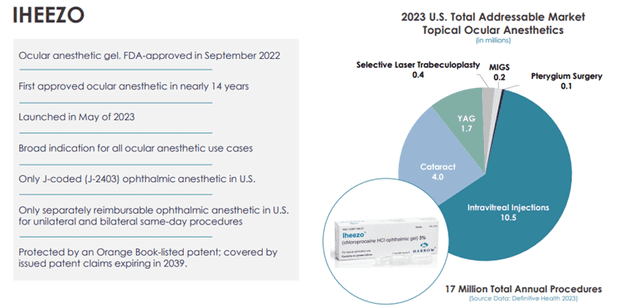

For any ocular procedure, a surgeon may require drugs for sedation, dilation, anesthesia, inflammation and infection prevention, and ocular surface preservation. The cataract surgery market continues to experience significant growth. According to Market Scope, approximately 4.8 million lens procedures were performed in the U.S. in 2021, 97% of which were cataracts, with the number expected to grow to 5.5 million lens procedures in 2026. Nearly 96% of the refractive surgery procedures performed are LASIK (laser in situ keratomileusis) surgeries, an outpatient surgical procedure used to treat nearsightedness, farsightedness, and astigmatism. According to an article published in 2021 in Clinical Ophthalmology, an estimated 800,000 eyes were treated with laser correction surgery (such as LASIK) each year for the previous ten years. Harrow’s Iheezo product has broad indications for all ocular anesthetic use cases.

Image Source: Company

Image Source: Company

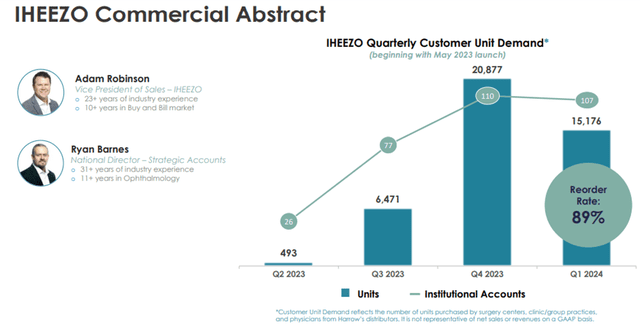

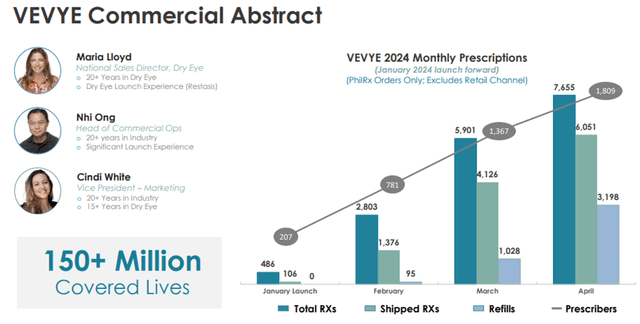

Dry eye occurs when the eye does not produce enough tears or when the tears are not of the correct consistency and evaporate too quickly. Inflammation of the surface of the eye may also occur. According to a 2023 Market Scope report, 39 million people in the U.S. suffer from both signs and symptoms of dry eye, with 49% of diagnosed dry eye patients having moderate to severe dry eye. The same report stated the global dry eye product market is expected to grow from $5.8 billion in 2023 to $7.5 billion in 2028. Dry eye is among the most common conditions seen by eye care professionals. Harrow’s Vevye is the first and only water-free cyclosporine (0.1%) to treat the signs and symptoms of dry eye disease. It, therefore, has the potential for widespread application in this market.

Image Source: Company

Image Source: Company

Intravitreal injections are one of the most common procedures ophthalmologists perform in the United States. According to a 2023 article published in Healio, approximately 8 million intravitreal injections were expected to be performed that year. These injections are utilized to administer critical medications into the eye that treat diseases including but not limited to proliferative diabetic retinopathy, diabetic macular edema, wet age-related macular degeneration, neovascular glaucoma, retinal vein occlusions, intraocular tumors, and endophthalmitis. In addition, products and product candidates are being developed and used to treat symptoms associated with an eye disease known as geographic atrophy. Most medicines in these products and product candidates are administered via intravitreal injection. Therefore, as these products and product candidates gain commercial adoption, the number of annual intravitreal injections should increase further and at an increased rate compared to recent years.

Vitrectomy is a surgical procedure undertaken by a specialist where the vitreous humor gel that fills the eye cavity is removed to provide better access to the retina. This allows for various repairs, including the removal of scar tissue, laser repair of retinal detachments, and treatment of macular holes. According to an October 2022 article on the Cleveland Clinic website, U.S. surgeons perform about 225,000 vitrectomies yearly. The number is likely to grow as eye care providers find more uses for vitrectomy. Harrow’s Triesence, in particular, is intended for visualization during vitrectomy.

Image Source: Company

Chronic non-infectious uveitis affecting the posterior segment of the eye is an inflammatory disease that afflicts people of all ages, producing swelling and destroying eye tissues, leading to severe vision loss and blindness. Based on internal estimates and information published on the MedScape website (which was updated as of March 2023) that cites various ranges of prevalence of uveitis, we estimate this disease affects approximately 100,000 people each year in the U.S. The standard of care treatment for this disease typically involves the use of short-acting corticosteroids to reduce uveitic flares (such as TRIESENCE), followed by additional treatments of sustained release and lower dose steroids to minimize the risk of further flares.

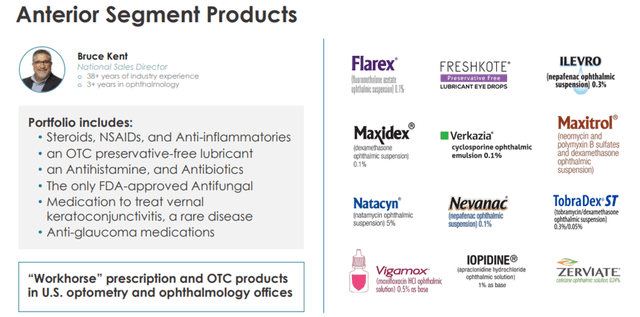

In addition to the medications discussed, Harrow provides a number of anterior segment products, each with unique uses and characteristics.

Image Source: Company

As can be seen from the above discussion, Harrow’s products can treat a wide variety of eye diseases and thus cater to a significant section of the eye patient population.

Image Source: Company

Moreover, as the eye patient population continues to grow, Harrow may significantly benefit from the upcoming expansion in the market.

- Financial Performance:

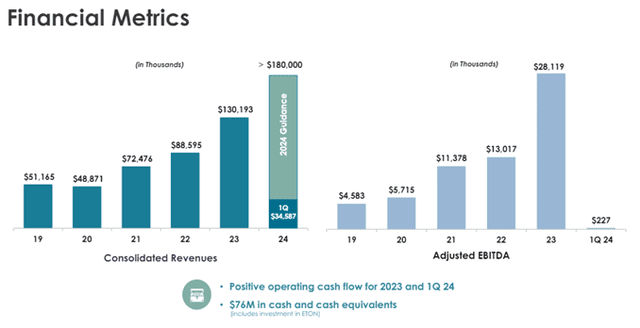

For Q1 FY24, Harrow announced revenues of $34.6 million, a 33% increase over the $26.1 million realized in the prior-year quarter. GAAP Gross margin stood at 69% compared to 68% in Q1 FY23.

Adjusted EBITDA stood at $.23 million compared to $5.34 million in Q1 FY23. The net loss for Q1 FY24 was $13.57 million compared to $6.64 million in the prior year’s quarter.

Image Source: Company

For FY23, the Company reported revenues of $130.2 million, an increase of 47% over 2022 revenues of $88.6 million. GAAP gross margin was 70% compared to 71% in the prior year.

Adjusted EBITDA was $28.1 million, an increase of 116% over 2022 Adjusted EBITDA of $13.0 million. GAAP net loss of $(24.4 million) compared with $(14.1 million) for the prior-year period.

For FY24, Harrow has provided revenue guidance of at least $180 million. The Company expects revenue growth throughout 2024, with the back half of the year being more substantial than the first.

Especially for ImprimisRx compounded products, Harrow expects topline growth of more than 10%.

Image Source: Company

Risks

Harrow has grown steadily over the last few years but is exposed to certain risks. Firstly, the Company depends on the market acceptance of compounding pharmacies and compounded formulations. Physicians may be unwilling to prescribe, and patients may be reluctant to use Harrow’s proprietary customizable compounded formulations.

Secondly, state and federal statutes and regulations significantly impact Harrow’s business. Any change in existing rules could limit the market for the Company’s products.

Finally, as of December 31, 2023, Harrow had an accumulated deficit of $(133,904,000). The Company’s current projections indicate that it will have operating income and net income during 2024; however, these projections may need to be corrected, and Harrow’s plans could change, impacting any investments in the Company.

Conclusion

Harrow seems to be on an upward growth trajectory—in FY23 alone, it achieved a 70% gross margin and a 47% increase in revenues YoY. For FY24, the Company has provided guidance of at least $180 million in revenues, which indicates a 38% increase over FY23 revenues.

Nevertheless, the Company has a history of operating losses, and its future success depends on state and federal regulations and market acceptance of its products. Hence, investors must proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://investors.harrow.com/static-files/88a3a755-177a-49c3-a61e-00ac06f80180

https://www.sec.gov/ix?doc=/Archives/edgar/data/1360214/000149315224010518/form10-k.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1360214/000149315224018902/form10-q.htm

Sorry, the comment form is closed at this time.