23 Jun Ideanomics is Big on Ideas, but what about the Execution?

Ideanomics, Inc. (NASDAQ: IDEX) is aiming to disrupt the E-mobility and Fintech industries by leveraging technology and leading-edge innovation. The Company operates two divisions namely Ideanomics Mobility and Ideanomics Capital. The aim is to provide improvements in sustainability to industries seeking transparency and offer choices that can help transform their scalability and efficiency.

Carving a Space in the booming EV market!

Ideanomics Mobility provides turnkey solutions for commercial fleet operators by helping them overcome barriers to electrification related to charging and energy efficiency. The Company provides a comprehensive portfolio of products and services for electrification of commercial fleets, minimization of costs of ownership and improved operational efficiency. In addition, the Company’s extensive global network enables easy access to EV technology across America, Asia and Europe.

From providing vehicle procurement services to charging infrastructure, the Company helps draw up a strategy and roadmap for electrification. Some of the services provided by the company include inventory management, inventory benchmarking, funding, grants and incentive assistance and finding the right charging infrastructure. Ideanomics also provides fleet monitoring, telematic solutions, energy and charger management services among others. The Company can provide a wide range of electric vehicles such as Scooters, Motorcycles, Trucks, Vans, Agricultural Tractors, Buses and Coaches to name a few.

WAVE, the Company’s high power-power charging solutions ranging from 125kW to 500kW and higher are ideal for mass transit, shuttle services, warehouse and distribution services and its inductive chargers power the largest battery-electric mass transit bus fleet in the U.S, namely the Antelope Valley Transit Authority in Los Angeles County. In addition, Ideanomics also offers less intensive wired solutions, besides providing on-site energy storage through development of solar photovoltaics. The Company also helps design and implement vehicle-as-a-service and charging-as-a-service solutions.

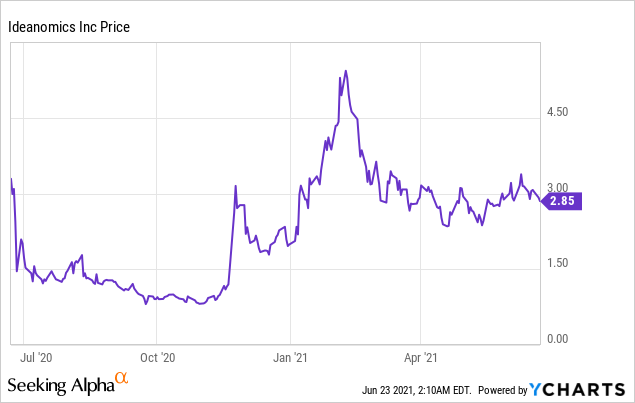

Ideanomics, Inc. (NASDAQ: IDEX)

Market Cap: $ 1.28B; Current Share Price: 2.85 USD

Data by YCharts

Aiming to Disrupt the Financial Technology Market

Ideanomics Capital, the Company’s Financial Technology division provides organizations the necessary tools and technology required for the New Economy. Timio is a Title and Escrow service that aims to provide a transparent and simplified real estate buying experience for both buyers and sellers. The platform has over 380,000 transactions to its credit with more than $62 billion in total closings.

The Company also offers a digital commodities issuance and trading platform named TM2 (Technology Metals Market) that facilitates the issuance and trade of technology metals such as metals used for EV battery production, solar cells and energy storage systems. The platform brings together institutional investors, hedgers and metal issuers and the traded metals are backed by 100 percent physical metal.

Ideanomics also operates the Delaware Board of Trade (DBOT), which is a fully automated electronic platform meant for the small cap marketplace.

Strategic Acquisitions and Investments to Strengthen its Position

In June, 2021, the Company announced the completion of acquisition of the privately held US Hybrid, which manufactures components for medium and heavy-duty commercial fleet applications. US Hybrid has received orders from Global Environment Products (GEP) for all-electric street sweepers that will be deployed in multiple cities in the US and globally. The order will deliver more than one million in revenue and is the extension of an existing partnership between GEP and US Hybrid, which has fulfilled similar orders for customers in the US as well as Japan.

Ideanomics has also acquired Solectrac Inc, a manufacturer of Zero emission electric tractors and will work closely with the Company to become a global leader in clean agricultural equipment. The deal will help Ideanomics expand its footprint into the growing market for EV adoption in the agricultural sector, while the proceeds from the acquisition will help Solectrac increase its inventory, strengthen its supply chain and increase production capacity and drive sales and marketing initiatives.

In April 2021, the Company’s Malaysian subsidiary Tree Technologies Sdn Bhd (Treeletrik), entered into a partnership to supply 200,000 units of electric motorbikes to Indonesia. The agreement with distributors, PT Pasifik Sakti Enjiniring and the Nahdatul Ulama Board (PBNU) is for a period of three years. The product will be added to PT Pasifik Sakti Enjiniring’s existing motorbike brand MOLINUS (Motor Listrik Nusantara). There is also a potential joint venture in the offing between the two companies to set up an assembly plant to meet the growing demand for electric motorcycles in Indonesia.

In January 2021, the Company signed a definitive agreement to acquire Wireless Advanced Vehicle Electrification, Inc (WAVE), a company providing wireless charging solutions for medium and heavy-duty electric vehicles (EVs). Wave’s customers include the Antelope Valley Transit Authority, with partnerships with Kenworth, Gillig, BYD, Complete Coach Works, among others.

Ideanomics will soon join the Russell 3000® Index which enables the Company to improve its access to institutional shareholders and provide greater exposure.

Industry

The International Energy Agency predicts that Electric Vehicles, which stand at 3 million today, will grow to 125 million by 2030. The Global Electric Vehicle market is all set to compete with the internal combustion engine (ICE) vehicles in the next five-year, accounting for one out of every five cars sold by 2030, according to Seth Goldstein, an analyst and chair of Morningstar’s electric vehicle committee. The growth of this industry is a result of the initiatives by governments around the world, in the form of tax rebates, grants, and subsidies for adoption of renewable and more environment friendly options for transportation. Unlike conventional vehicles which can only replenish their fuel at specific public locations, Electric vehicles can be charged at home or commercial charging stations.

However, the limitation of sufficient charging capacity to cover long distances discourages the use of these vehicles. There is an increased focus on research and development activities, especially in the passenger car sector, to improve infrastructure and supply equipment and establish EV chargers at easily accessible public places, to allow long distance travel as well. Range anxiety, which acts as the biggest impediment for the market at present, will soon be a thing of the past, with Companies racing to develop connectivity modules.

The demand for electric vehicles will also bolster the demand for ancillary industries such as engine components, electronics for propulsion systems, battery optimization and torque transfer devices. In fact, the demand for lithium, which is a crucial component of energy storage in transportation batteries, is likely to quadruple over the next decade according to Seth Goldstein.

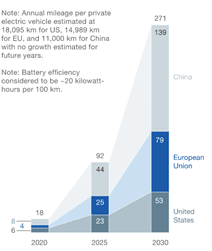

A report by McKinsey estimates that by 2025, there will be more than 350 EV models introduced into the market, with ranges of 200 miles. However, a lack of charging infrastructure could hamper the growth in the market. The report also highlights the fact that besides price and driving range, lack of access to charging stations is the third most serious barrier to EV. However there have been a gradual decline in prices and improvement in driving range and companies are making a concerted effort to provide the requisite charging infrastructure. Furthermore, the total energy demand for electric vehicles in China, the United States and European Union alone will reach 280 billion kilowatt-hours by 2030.

Image Source: Mckinsey

There has been an increasing interest in EV’s owing to environmental concerns, which has prompted leading automobile makers such as BMW, Daimler, Ford, and Volkswagen to announce an investment plan for deployment of 400 charging sites across Europe, in addition to investing approximately $90 billion in electric vehicles, according to a report by Reuters.

According to the U.S Energy Information Administration, In the year 2019, renewable energy provided 11.5 quadrillion British thermal units (Btu) or 11.4% of total U.S. energy consumption, out of which, 56% was contributed by electric power sector and 17 percent was from renewable energy sources.

The greatest advantage of renewable energy is their ability to reduce greenhouse gas emissions, by lowering fossil fuel consumption, the largest cause of carbon dioxide emissions. The renewable energy sector has now come under a sharp focus owing to Joe Biden’s administration’s plan to fight climate change with greater emphasis on clean energy and a mission to reach net-zero emissions by 2050.

The government’s position on clean energy was made clear by its recommitting to the Paris Climate accord and its call for moving to clean energy by 2035. The new administration will invest close to $1.7 trillion over the next 10 years in its bid for a “Clean Energy revolution” that aims to establish the US as the clean energy superpower and transform the energy sector by providing economic impetus.

Financial Position and Future Prospects

The stock of Ideanomics is deemed to be currently overvalued at its current price of 2.92 and market capitalization of 1.31 billion, which raised concerns that its long-term returns may not match up with its growth prospects. The Company has a cash-to-debt ratio of 4.09, which falls in the middle range for software related companies and overall financial strength of 5 out of 10, which indicates a fair strength. The Company has not been profitable for the past 10 years of operation.

However, In April 2021, Roth Capital Partners initiated coverage of the Company with a “Buy” rating and a price target of $7.00 price.

Craig Irwin, an analyst at Roth Capital believes that there is more upside to come, which offers nearly 150 + percent return at the time of publication. The analysts think that Ideanomics is a disruptive technology company and the multiple companies under one portfolio may give an attractive return in the future.

In the words of analyst Craig Irwin,

“Ideanomics’ portfolio approach unites entrepreneurs at solid but early-stage companies with a capable team to gain synergies by cross-company sharing of resources. We believe this approach allows more effective business development, procurement leverage, internal sourcing versus expensive outsourcing, and technology solutions supplemented by efforts at other sister businesses. Examples include the incorporation of WAVE inductive charging solutions in Medici commercial electric vehicles slated for launch this year as well as the cross-portfolio procurement of battery packs.”

During the past 3 years, the Company has made 11 acquisitions and 4 divestitures mostly in the eMobility space and has interests in the EV manufacturing companies like Medici, Tree Technologies, Solectrac and Energica. The revenue from WAVE, an inductive charging solutions provider, which the company has entered into an agreement to acquire, is likely to reach $5 million in 2021 and will touch $85 million by 2025, based on delivery of 250 of its charging units.

Ideanomics also holds a 22-per-cent equity stake in electric tractor company Solectrac, a 20 percent stake in Energica, an Italy-based electric motorcycle maker, in addition to investments in engineering and design services company Silk EV.

According to analyst estimates, the revenue for 2021 and 2022 is expected to be $105 million and $145 million respectively, which will grow to $500 million by 2025. Similarly, the EPS in 2021 and 2022, will go from a negative $0.11 per share and negative $0.05 per share to $0.25 per share in 2025.

The Company’s Q1,2021 financial results reported revenue of $32.7 million for the quarter and a gross profit of $10.8 million, representing a gross margin of 33.1 percent. Ideanomics had cash and cash equivalents of $356 million as of March 31, 2021. The revenue for 2020 was $26.8 as against $44.6 million in 2019, while the net loss was $106.0 million compared to a loss of $96.8 in the previous year.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://ideanomics.com/mobility/

https://www.timios.com/about-us/

https://ideanomics.com/capital/dbot/

https://finance.yahoo.com/news/ideanomics-completes-acquisition-us-hybrid-110000858.html

https://investors.ideanomics.com/2021-06-14-Ideanomics-Acquires-U-S-EV-Tractor-Maker-Solectrac

https://investors.ideanomics.com/2021-05-17-Ideanomics,-Inc-Reports-Q1-2021-Financial-Results

https://finance.yahoo.com/news/ideanomics-stock-gives-every-indication-020602566.html

https://www.cantechletter.com/2021/04/ideanomics-is-a-buy-says-roth-capital-partners/

https://www.cantechletter.com/2021/04/ideanomics-is-a-buy-says-roth-capital-partners/

No Comments