08 Dec Procept BioRobotics: Transforming the BPH Treatment Landscape

PROCEPT BioRobotics Corporation (NASDAQ: PRCT) is a surgical robotics company focused on advancing patient care by developing transformative solutions in urology. The Company develops, manufactures, and sells the AquaBeam Robotic System, an advanced, image-guided, surgical robotic system for use in minimally invasive urologic surgery, with an initial focus on treating benign prostatic hyperplasia, or BPH.

PROCEPT BioRobotics Corporation (NASDAQ: PRCT)

Market Cap: $2.02B; Current Share Price: 39.99 USD

Data by YCharts

The Company and its Products

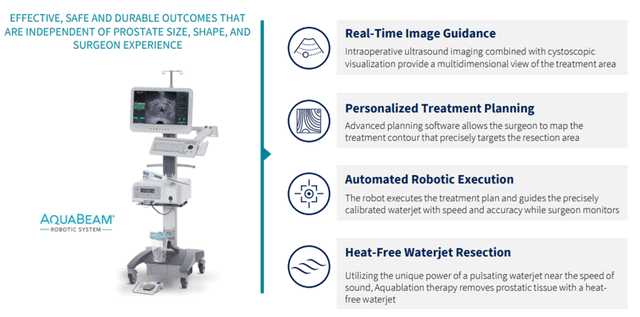

Procept’s AquaBeam Robotic System employs a single-use disposable handpiece to deliver the proprietary Aquablation therapy, which combines real-time, multi-dimensional imaging, personalized treatment planning, automated robotics, and heat-free waterjet ablation for targeted and rapid removal of prostate tissue.

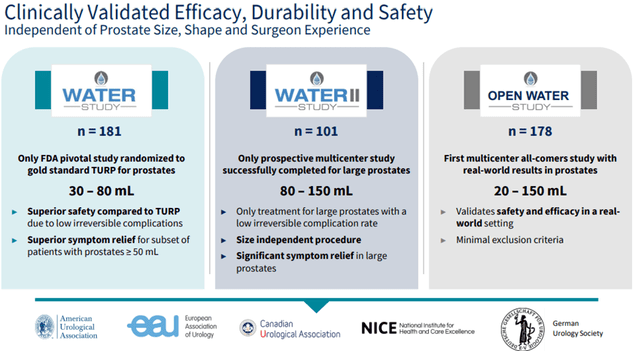

The Company designed the AquaBeam Robotic System to enable consistent and reproducible BPH surgery outcomes. Aquablation therapy represents a paradigm shift in the surgical treatment of BPH by addressing compromises associated with alternative surgical interventions. It delivers effective, safe, and durable outcomes for males suffering from lower urinary tract symptoms, or LUTS, due to BPH that is independent of prostate size and shape. It also delivers resection independent of surgeon experience. Thus, Aquablation therapy is uniquely positioned to become the BPH treatment of choice for all prostrate sizes and shapes.

Image Source: Company

Below, we will discuss the critical rationale for covering this Company.

- A large market with significant unmet needs:

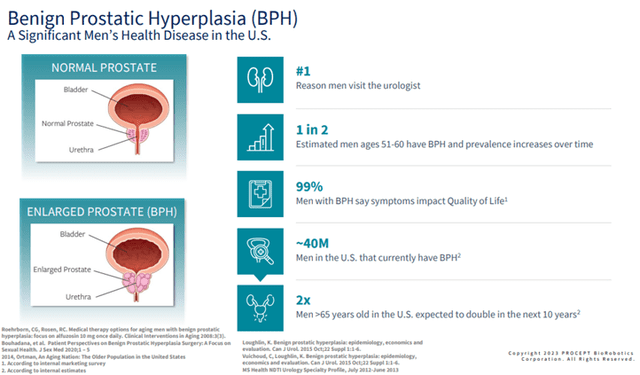

BPH is the number one reason men visit a urologist in the United States. BPH is estimated to occur in more than 50% of men in their 50s, growing to 70% of men in their 60s, and is the fourth most commonly diagnosed disease in men above 50 years old, ranking behind coronary artery disease, hypertension, and type 2 diabetes. BPH often results in uncomfortable LUTS, which can significantly impact quality of life. If left untreated, BPH may eventually lead to more severe complications.

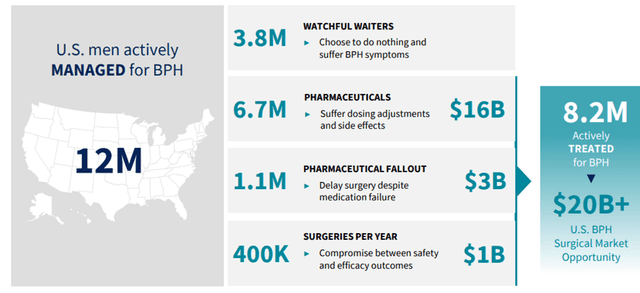

In the United States, it is estimated that approximately 40 million men are impacted by BPH, with aging demographics expected to drive future growth. Of these men, about 12 million are being managed by a physician for symptoms related to their disease. Procept’s total addressable patient population in the United States includes approximately 8.2 million patients, comprising 6.7 million receiving drug therapy, 1.1 million who have tried but failed drug therapy, and 400,000 undergoing surgical intervention each year.

Image Source: Company

Over the next ten years, it is expected that the number of men over 65 years old in the United States will double and include a corresponding increase in the number of men with enlarged prostates. Based on the average selling price of our single-use handpiece, Procept estimates that its total addressable market opportunity is more than $20 billion in the United States. The global incidence of BPH among men over 50 years old is similar to that of the United States, representing a significant incremental market opportunity outside the United States.

Image Source: Company

The main goal of BPH treatment is to alleviate the symptoms associated with the disease and improve the patient’s quality of life. While drug therapy is a first-line treatment option, limited efficacy and adverse side effects contribute to low compliance, high failure rates, and dropouts. On the other hand, surgical intervention is proven to provide effective and durable symptom relief compared to drug therapy. Still, the use of surgery is significantly underpenetrated, mainly due to the compromise patients must make between the incidence of irreversible side effects associated with alternative resective surgical interventions, where obstructive tissue is removed at the time of intervention, or the lower rates of efficacy and durability associated with non-resective surgical interventions, where obstructive tissue is not removed, but rather the prostatic urethra is re-shaped. In addition, most alternative surgical interventions are limited by prostate size and shape, with no single procedure capable of effectively addressing the full range of prostate anatomies regardless of surgeon experience level.

Image Source: Company

The Aquabeam Robotic System addresses many of the shortcomings of alternative surgical interventions by delivering the Aquablation therapy, the first and only image-guided robotic therapy for treating BPH. It offers several benefits, such as

- Significant and durable symptom relief

- Favorable safety profile

- Resection independent of prostate size and shape and surgeon experience

- Personalized treatment planning and improved decision-making

- Targeted and controlled resection with consistent resection times.

- Proven growth strategy

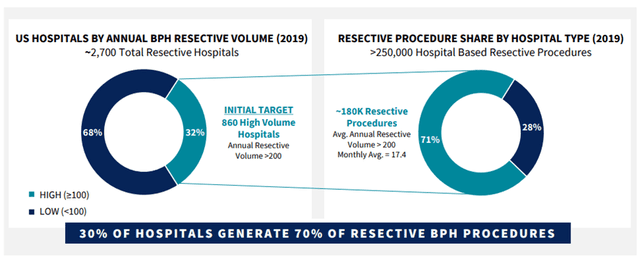

- Grow installed base of AquaBeam Robotic Systems by driving adoption of Aquablation therapy among urologists. Procept initially targets 860 high-volume hospitals that perform, on average, more than 200 resective procedures annually and account for approximately 70% of all hospital-based resective procedures. It also targets about 1,840 U.S. hospitals that perform the remaining 30% of resective BPH procedures.

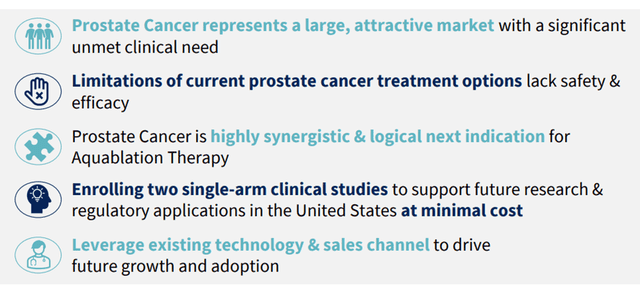

In this way, the Company’s proprietary technology allows it to meet the needs of a large, underserved market. As a result, Procept may be able to scale new heights.

Procept aims to establish Aquablation therapy as the surgical standard of care for BPH through the following growth strategy:

Image Source: Company

Image Source: Company

Image Source: Company

Image Source: Company

- Financial Performance:

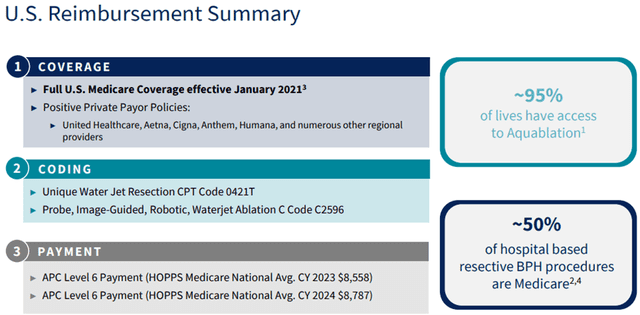

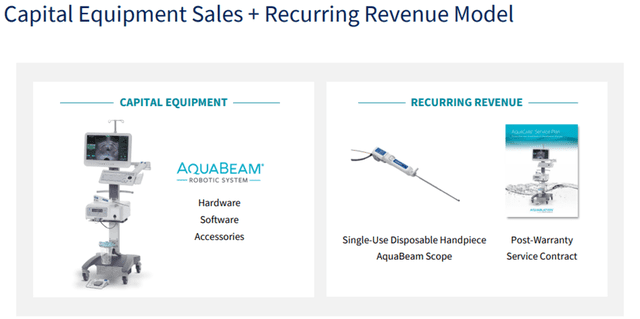

Procept generates revenue primarily from hospitals making capital purchases of AquaBeam Robotic System and purchasing single-use handpieces for individual patient use. The Company also generates revenue by providing post-warranty service for the AquaBeam Robotic System. The business model of selling capital equipment that generates corresponding disposables utilization and post-warranty service contracts provides a path to predictable, recurring revenue.

Image Source: Company

The recurring revenue model has enabled the Company to grow its sales figures by leaps and bounds.

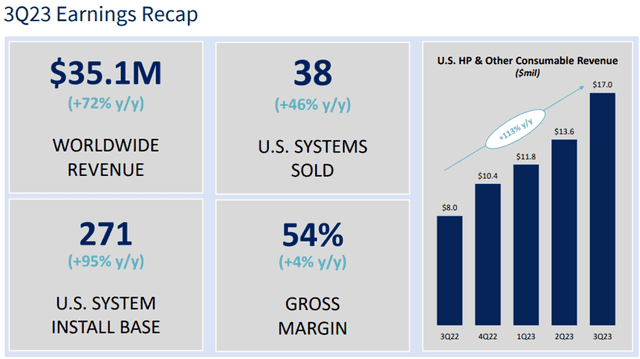

For Q3 FY23, Procept reported total revenue of $35.1 million, an increase of 72% compared to Q2 FY23. U.S. handpiece and consumables revenue of $17.0 million for Q3 FY23, an increase of 113% compared to Q2 FY23. U.S. robotic system and rental revenue was $13.5 million for Q3 FY23, an increase of 37% compared to Q2 FY22.

The gross margin for Q3 FY23 was 54% compared to 50% in the prior year period. Net loss was $24.6 million for Q3 FY23, compared to $22.6 million in the previous year.

Image Source: Company

As of September 30, 2023, cash and short-term investments totaled $287.1 million, while long-term borrowings totaled $52.0 million.

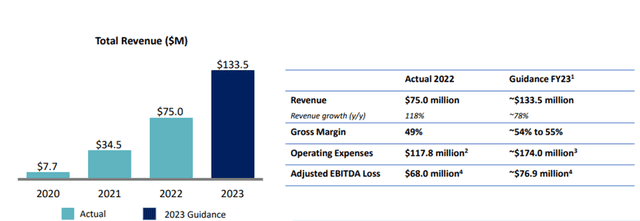

For FY22, total revenues were $75.0 million, an increase of 118% compared to 2021. The Gross margin for 2022 was 49%, compared to 46% for 2021. Net loss was $87.2 million for the full year 2022, compared to $59.9 million for the full year 2021.

The Company projects revenue for 2023 to be approximately $133.5 million, representing 78% growth over the prior year’s revenue. Full-year 2023 gross margin is expected to be in the range of 54% to 55%. Full-year 2023 Adjusted EBITDA loss is expected to be ($76.9) million.

Image Source: Company

Thus, Procept expects exponential revenue growth and consistent gross margins.

Risks

From the above discussion, Procept seems to have a promising future; however, the Company is subject to certain risks. The industry in which Procept operates is subject to rapid change, from introducing new products and technologies to other activities of industry participants. While Aquablation therapy and the AquaBeam Robotic System provide the Company a competitive advantage against competing BPH treatment modalities, its currently marketed products are subject to intense competition.

Moreover, the Company’s products and our operations are subject to extensive regulation by the FDA and other federal and state authorities in the United States and comparable authorities outside the United States. Any change in these regulations may hamper Procept’s prospects.

Finally, Procept is an early-stage company with a history of significant net losses. It expects to continue to incur operating losses for the foreseeable future and may not be able to achieve or sustain profitability.

Conclusion

Procept has a bright future because of its innovative proprietary technology that aims to fulfill the unmet needs of the large BPH market. The Company’s proven growth strategy has allowed it to grow revenues exponentially, and it seems that this trend is here to stay.

However, Procept is an early-stage business with a history of losses. It operates in an intensely competitive environment, so it may not be able to sustain its upward trajectory. Hence, investors must proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://ir.procept-biorobotics.com/static-files/c3e03aad-b7e1-48d4-bed9-7eb9ce66a06e

https://www.sec.gov/ix?doc=/Archives/edgar/data/1588978/000158897823000028/prct-20230930.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1588978/000158897823000009/prct-20221231.htm

Sorry, the comment form is closed at this time.