07 Nov Silvertip Acquisition Makes ProPetro an Attractive Buy

ProPetro Holding Corp. (NYSE: PUMP), an oilfield services company, has acquired Silvertip Completion Services Operating, LLC, a provider of wireline perforating and pump down services solely in the Permian Basin, creating a leading completions-focused oilfield services company headquartered in the Permian Basin.

According to Sam Sledge, Chief Executive Officer of ProPetro,

“This acquisition represents another important step for ProPetro, advancing our strategy of pursuing accretive growth opportunities that expand our margins and increase free cash flow generation to create a stronger, more resilient and more diversified company. With our highly complementary service offerings including Silvertip’s premier wireline franchise, strong cash flow metrics, and blue-chip customer relationships, ProPetro is now well-positioned to execute on cross-selling opportunities, while accelerating our ability to achieve our financial growth targets through a more integrated and diversified service offering.”

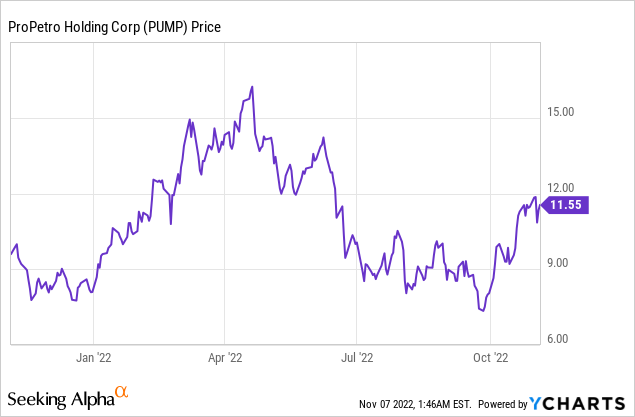

ProPetro Holding Corp. (NYSE: PUMP)

Market Cap: $1.23B; Current Share Price: $11.55

Data by YCharts

The Company

ProPetro is a Midland, Texas‑based oilfield services company providing hydraulic fracturing and other complementary services to leading upstream oil and gas companies engaged in the exploration and production of North American oil and natural gas resources. The company is one of the leading providers of hydraulic fracturing services in the region by hydraulic horsepower. Their operations are primarily focused in the Permian Basin, where they have cultivated long standing customer relationships with some of the region’s most active and well‑capitalized E&P companies.

Silvertip Acquisition

Silvertip Completion Services Operating, LLC is headquartered in Midland, Texas, and owns and operates 23 wireline units and a best-in-class pump down fleet. Silvertip provides operators with efficient wireline and pump down services including logging, perforating, and pressure control, while showcasing its culture of data-driven decision-making, and established track record of safety.

ProPetro acquired Silvertip for consideration of 10.1 million shares of ProPetro common stock, $30 million of cash, the payoff of $7 million of assumed debt, and certain other transaction costs, subject to customary post-closing adjustments, which implies a value of $150 million based upon a 15-day VWAP of ProPetro’s stock price as of October 27, 2022. On a fully-diluted basis, Silvertip’s former shareholders now own approximately 9% of ProPetro.

The acquisition of Silvertip pairs the best-in-class Permian hydraulic fracturing and cementing company with one of the largest Permian wireline companies. It is expected that Silvertip will significantly enhance the free cash flow generation of ProPetro providing additional cash flow for future value enhancing investments and accelerating value distribution. Moreover, the transaction will be immediately accretive across all financial metrics including those based on Adjusted EBITDA multiple, earnings per share, and free cash flow per share.

More immediately, ProPetro management expects the acquisition of Silvertip to increase 2023 Adjusted EBITDA expectations by approximately $65 million to $75 million, while converting approximately 80% of that Adjusted EBITDA into free cash flow. Given its Adjusted EBITDA-to-cash flow conversion rate, which is double ProPetro’s approximately 40% Adjusted EBITDA-to-cash flow conversion rate.

Silvertip’s pump down business has complementary next-generation Tier IV equipment, which is expected to reduce ProPetro’s capital spending requirements through asset allocations.

ProPetro and Silvertip will share best practices for customer service and operational processes, leveraging their combined resources to enhance already strong partnerships and organizational agility, as well as geographic focus in the Permian Basin. There is expected to be additional exposure to the completions site which creates opportunities to capture more completions spend and deliver greater value to customers.

Strong Revenue Growth

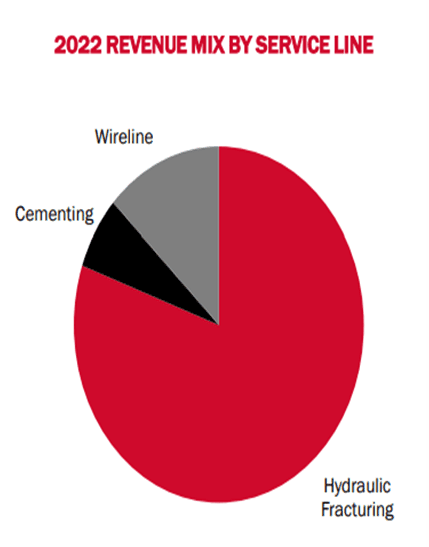

The Company generates revenue primarily through their pressure pumping segment and by providing hydraulic fracturing services and complementary services to customers, including cementing, coiled tubing and other related services.

For FY 2021, revenue increased $85.3 million, or 10.8%, to $874.5 million, as compared to $789.2 million for FY 2020, primarily a result of the increase in demand for pressure pumping services following the depressed oil prices and economic slowdown caused by the COVID-19 pandemic that negatively impacted E&P completions activity. The increase in demand for pressure pumping services resulted in an approximate 20% increase in the Company’s average effectively utilized fleet count to approximately 12 active fleets in 2021 from 10 active fleets in 2020.

For Q3 2022, total revenues increased 6% to $333 million compared to $315 million for Q2 2022. The 6% increase exceeded consensus estimates and is attributable to continued net pricing gains and fleet repositioning efforts. Adjusted EBITDA for Q3 2022 increased 18% to $90 million or 27% of revenues, compared to $76 million or 24% of revenues for the second quarter of 2022. The increase in Adjusted EBITDA was primarily attributable to net pricing improvements, additional material revenue, and a favorable job mix.

Based on projected activity levels, the Company’s outlook for full year 2022 cash capital expenditures is expected to be approximately $325 million, and incurred capital expenditures to be slightly above the top end of the prior range of $350 million. Looking to next year and beyond, the Company expects capital expenditures to decrease.

Based on current calendar outlook for the fourth quarter of 2022, the Company anticipates to be in line with prior second half of 2022 fleet guidance ranging between 14 and 15 fleets.

Image Source: Company

Positive Outlook for the Future

The Company’s revenue, profitability and cash flows are highly dependent upon prevailing crude oil prices and expectations about future prices.

Over the last few years, demand for oil and gas has been impacted by the COVID-19 pandemic. This was reflected in the highly volatile oil prices and markets where average WTI oil prices per barrel were approximately $68, $39 and $57 for the years ended December 31, 2021, 2020 and 2019, respectively.

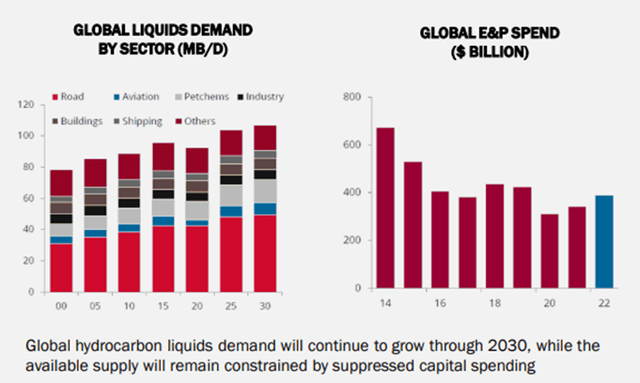

Of late, demand has rebounded but structural energy supply issues persist. In fact, supply is expected to be suppressed long-term due to the COVID-19 pandemic which further dampened the already insufficient capital spending in the oil and gas production space.

A bullish demand outlook coupled with constrained supply availability reinforces the belief of a long-term up-cycle that supports incremental margins and sustainable cash flow generation for completion services.

Image Source: Company

More specifically, in 2022, the price is expected to reach an average of 98.07 U.S. dollars per barrel in 2022 primarily due to severe implications of the Russia-Ukraine war. If the situation persists, demand for the Company’s services will be positively impacted, which could result in a significant increase in their future profitability and cash flows.

Forward looking Fleet Transition Strategy

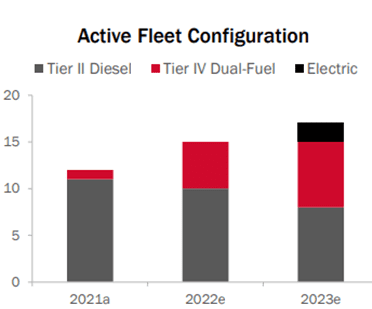

The Company’s total available hydraulic horsepower (HHP) at December 31, 2021 was 1,423,000 HHP, which was comprised of 90,000 HHP of our Tier IV Dynamic Gas Blending (DGB) equipment, 1,225,000 HHP of conventional Tier II equipment and 108,000 HHP of our DuraStim® electric hydraulic fracturing equipment.

Of late, the energy industry and its customers have been shifting to lower emissions equipment – this is expected to be an increasingly important factor in an E&P company’s selection of a service provider. Keeping this in mind, the Company has developed a number of lower emission solutions for pumping equipment, including Tier IV DGB, electric, direct drive gas turbine and other technologies, and they expect additional lower emission solutions will be developed in the future.

More precisely, in 2021, the Company transitioned 90,000 HHP of their equipment portfolio to lower emissions, Tier IV DGB equipment. By 2022, they plan to convert an additional 125,000 HHP to Tier IV DGB equipment, with total conversion costs expected to approximate $74 million.

In August 2022, ProPetro announced a long-term lease agreement for two electric hydraulic fracturing fleets with expected delivery in 3Q23.

The aim is to convert the fleet to Tier IV DGB dual-fuel and electric-powered fleets and displace diesel – up to ~70% – with cleaner-burning natural gas.

Image Source: Company

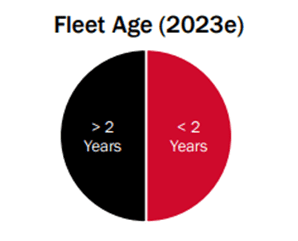

They also expect to bring youth to their fleet through the 2022 investment cycle with the fleet age reducing to less than 2 years in 2023.

Image Source: Company

Using natural gas to power frac fleets can result in annualized savings of $8 million to $15 million due to the diesel/natural gas spread. Additionally, customers are willing to pay a premium due to fuel savings and lower emissions.

Overall, investment in Tier IV DGB and electric fleets should reduce costs, while enhancing competitiveness and free cash flow profile.

Strategic Geographic Location

ProPetro is strategically located in and focused on the Permian Basin, one of the world’s most attractive regions for oilfield service operations as a result of its size, geology, and customer activity levels.

The Permian Basin consists of mature, legacy, onshore oil and liquids-rich natural gas reservoirs spanning ~86,000 square miles in West Texas and New Mexico, with multiple prospective geologic benches for horizontal development. The Permian Basin contains ~60 billion barrels of oil equivalent, the largest recoverable hydrocarbon resource base in the U.S. and the second largest in the world.

According to Baker Hughes, the Permian Basin rig count has increased significantly from approximately 179 at the beginning of 2021 to approximately 294 at the end of 2021, It is assumed that this area will be the most attractive basin to E&P companies (at least for the next few decades) and should command higher prices and associated profitability, if the overall demand for crude oil and services continues to increase.

The Company’s substantial market presence in the Permian Basin positions them to capitalize on drilling and completion activity in the region. In fact, for the years ended December 31, 2021, 2020 and 2019, approximately 98.7%, 99.5% and 99.4%, respectively, of ProPetro’s revenues were attributable to operations in the Permian Basin.

The Company’s hydraulic fracturing fleet has been designed to handle the operating conditions commonly utilized in the Permian Basin and the region’s increasingly high-intensity well completions. Therefore, many of the Company’s customers elect to work with them based on their operational efficiencies, productivity, equipment quality, reliability, ability to manage multifaceted logistics challenges, commitment to safety and their ability to handle the most complex Permian Basin well completions.

If the Permian Basin rig count and market conditions such as WTI crude oil prices continue to improve, along with improved customers’ pricing, and the Company is able to meet their customers’ lower emissions equipment demands, ProPetro’s operational and financial results will also continue to improve. This in turn would make the Company a lucrative investment in the near future.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1680247/000168024722000007/pump-20211231.htm

https://www.statista.com/statistics/206764/forecast-for-west-texas-intermediate-crude-oil-prices/

No Comments