06 Jun Turtle Beach: Making Waves in the Gaming Accessories Industry

Turtle Beach Corporation (NASDAQ: HEAR) is a leading gaming accessories brand. The Company’s namesake Turtle Beach brand is known for designing best-selling gaming headsets, top-rated game controllers, award-winning PC gaming peripherals, and groundbreaking gaming simulation accessories.

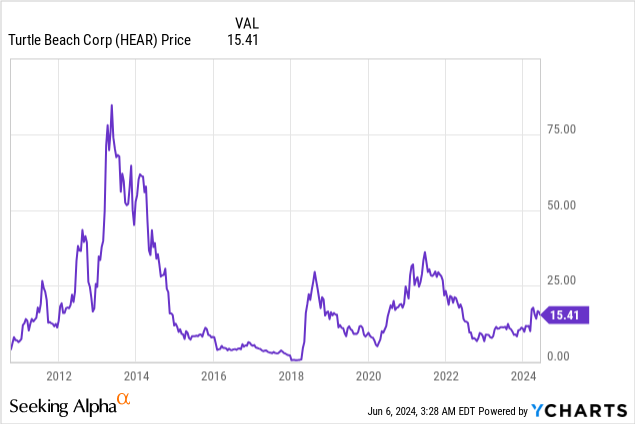

Turtle Beach Corporation (NASDAQ: HEAR)

Market Cap: $331.67M; Current Share Price: 15.41 USD

Data by YCharts

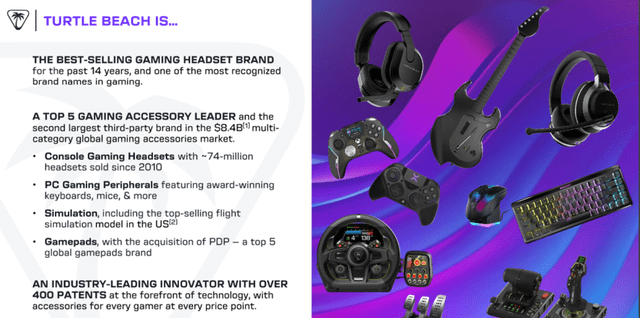

The Company and its Products

For nearly 50 years, Turtle Beach has been a pioneer and key innovator in audio technology, and today, it is one of the most recognized brand names in gaming. The Turtle Beach® brand has been the market share leader in console gaming headsets for 14 years running, with a vast portfolio of headsets designed to be compatible with the latest Xbox, PlayStation, and Nintendo consoles, as well as for personal computers (PCs) and mobile/tablet devices. Turtle Beach Corporation’s PC product portfolio includes headsets, gaming keyboards, mice, and other gaming accessories focused on the PC gaming platform.

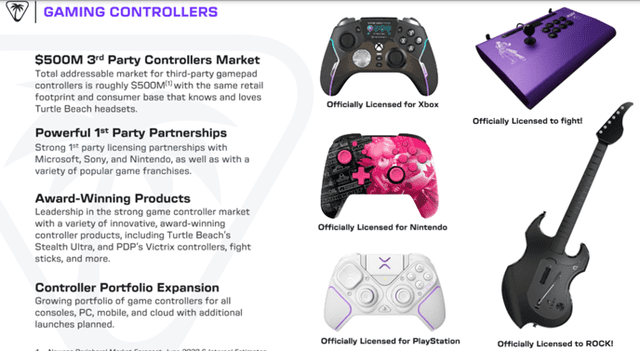

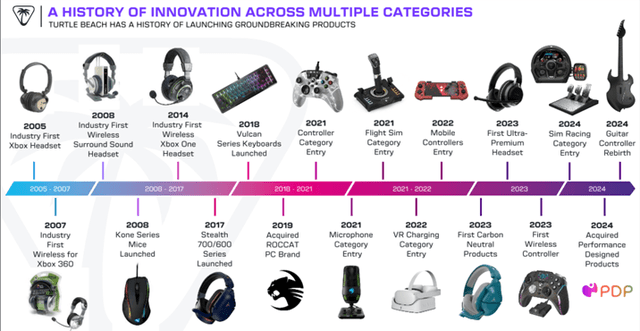

Recently, Turtle Beach expanded its brand beyond gaming headsets and began making game controllers, gaming flight simulation, and racing simulation accessories. Turtle Beach also creates high-quality USB and analog microphones for gamers, streamers, professionals, and students who embrace cutting-edge technology and design.

Image Source: Company

In 2024, Turtle Beach Corporation is moving all forward-looking accessories under its best-selling Turtle Beach brand. All forward-looking products for console, PC, and multiplatform gaming headsets, mice, keyboards, microphones, and other PC gaming peripherals, game controllers, and flight/racing simulation accessories will be unified under one of the industry’s most recognized brand names.

We will discuss the critical rationale for covering this Company.

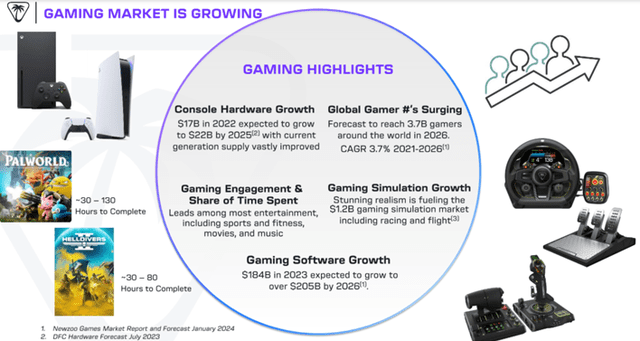

- Rapidly Growing Industry

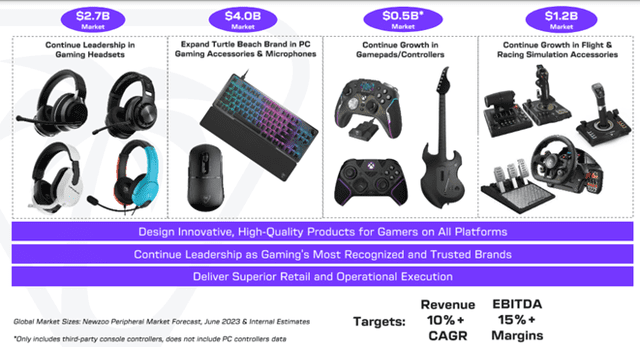

Turtle Beach operates in a $190 billion global games and accessories market. The global gaming audience now exceeds the international cinema and music markets, with over three billion active gamers worldwide. Gaming peripherals, such as headsets, keyboards, mice, microphones, controllers, and simulation controls, are estimated to be an $8.4 billion business globally.

The console and PC gaming accessory markets are also driven by significant game launches and long-running franchises encouraging players to buy equipment and accessories continually. On Xbox, PlayStation, Nintendo Switch, and PC, flagship games like Call of Duty, Destiny, Star Wars: Battlefront, Battlefield, Grand Theft Auto, and battle royale games like Fortnite, Call of Duty Warzone, Apex Legends, and PlayerUnknown’s Battlegrounds, are examples of significant franchises that prominently feature online multiplayer modes that encourage communication and drive increased demand for gaming headsets. Many established franchises launch new titles annually, leading into the holidays. As a result, it can cause an additional boost to the typically strong holiday sales for gaming accessories.

Image Source: Company

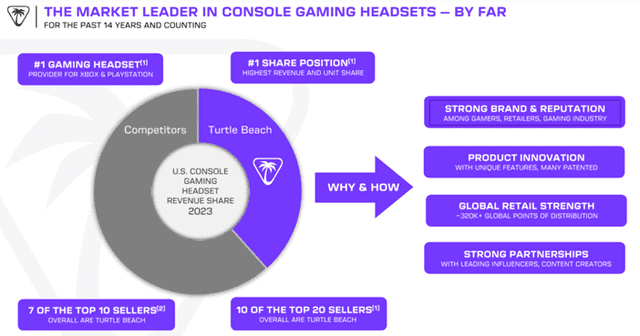

The global market for console gaming headsets, in which Turtle Beach has been the market leader for the past 14 years, is estimated to be approximately $1.4 billion.

Image Source: Company

On the other hand, the market for PC gaming headsets, mice, and keyboards is estimated to be approximately $3.2 billion.

Image Source: Company

The market for gamepad controllers is estimated to be approximately $0.5 billion, and Turtle Beach gaming headsets share the same retail footprint and consumer base in which they compete.

Image Source: Company

Finally, the market for gaming simulation accessories is estimated to be approximately $1.2 billion.

Image Source: Company

Overall, Turtle has a comprehensive growth strategy to fuel its position as the 2nd largest 3rd party gaming accessories maker.

Image Source: Company

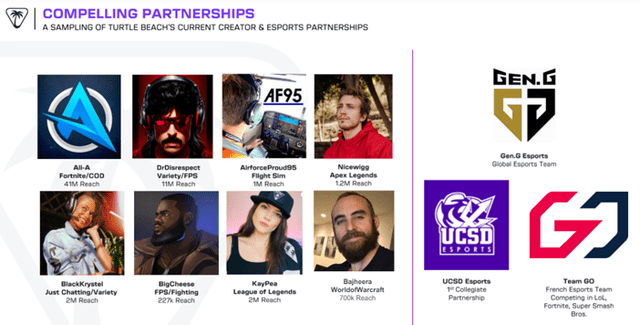

Specifically, the Company intends to further build upon Turtle Beach’s brand awareness, innovation, superior audio technology, and high-quality products, as well as further promote and expand the brand in certain geographic regions to increase sales and profitability. Under these circumstances, Turtle Beach seems likely to succeed in expanding its position in the gaming industry.

- Effective Business Strategy

The Company’s business strategy focuses on the following:

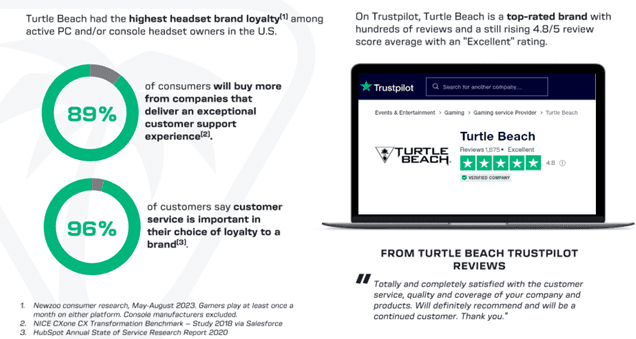

- Continue to advance the Turtle brand: Turtle Beach’s reputation among gamers is a competitive advantage. The Company is known for its top brand loyalty and customer service. Turtle’s success is attributable to its emphasis on creating the highest-quality, most innovative products and leveraging its extensive global distribution footprint to deliver these products to more gamers around the world.

Image Source: Company

- Continued Product Line Expansion and Revenue Growth in Controllers/Simulation Markets: The Company intends to increase available markets by continuing to develop products internally or through partnerships or acquisitions in new gaming accessory categories like game controllers and gaming simulation.

Image Source: Company

- Targeted Geographic Expansion: The Company will continue efforts for further growth, specifically in select markets, as it looks to deliver Turtle Beach products to an even wider audience of global gamers in 2024 and beyond.

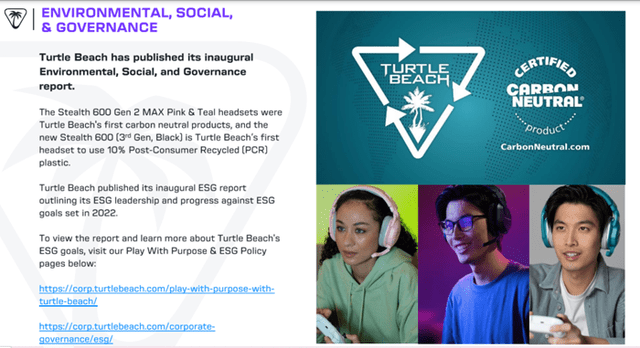

- Sustainable Products: Turtle’s investment in sustainable products is an ongoing and continued focus for Turtle Beach Corporation. In 2022, Turtle Beach transitioned to using sustainably sourced paper packaging materials for most gaming headsets and eliminated most plastics from packaging. In March 2023, the Company launched the Stealth 600 Gen 2 MAX Teal & Pink colorways as its first carbon-neutral products, as well as partnered with Climate Impact Partners’ Million Mangroves program, where it contributes to helping develop new mangrove forests, which allows combat carbon.

- deliver innovative, high-quality gaming headsets that provide superior game and chat audio, premium comfort, and advanced features designed to help gamers have a profoundly immersive experience;

- deliver innovations in speed, precision, RGB LED lighting, and form factor in PC gaming keyboards, mice, and other gaming categories that can leverage those capabilities;

- expand product lines in game controllers and gaming simulation accessories, reaching into additional categories, including mobile controllers and racing simulation products;

- Acquisition of PDP

- Financial Performance

Image Source: Company

In addition, to improve its competitive position, Turtle plans to

Image Source: Company

Given Turtle’s track record so far, the Company seems likely to successfully follow its growth strategy and achieve new heights.

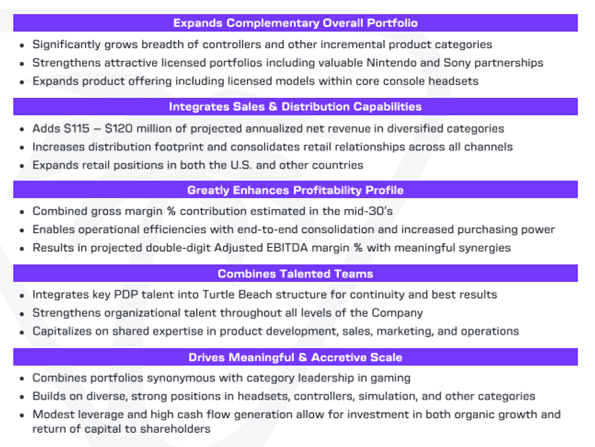

In 2024, the Company acquired Performance Design Products (PDP), a leading gaming accessories company with solid momentum.

Image Source: Company

The acquisition is expected to benefit Turtle, significantly strengthening its position in the gaming industry.

Image Source: Company

For Q1 FY24, net was $55.8 million, an increase of 8.6% compared to $51.4 million a year ago. Adjusted EBITDA improved to $1.4 million compared to an Adjusted EBITDA loss of $2.8 million a year ago. Net income was $0.2 million, or $0.01 per diluted share, compared to a net loss of $6.7 million, or $0.40 per diluted share, a year ago.

The YoY growth in revenue and adjusted EBITDA reflects increased demand for controller and simulation products, improvements in business mix, lower freight costs, and promotional credits. Moreover, proactive expense management resulted in a 6% decline in cash-based recurring expenses YoY.

For FY23, net revenue was $258.1 million, an increase of 7.5% compared to $240.2 million a year ago. Adjusted EBITDA improved to $6.5 million compared to an Adjusted EBITDA loss of $29.9 million a year ago. Net loss was $17.7 million, or $1.03 per diluted share, compared to $59.5 million or $3.62 a year ago.

Overall, the Company’s FY23 net revenue increased due to significant share gains across multiple categories and geographies, including the core business of console gaming headsets.

For FY24, the Company expects net revenues of $370 million to $380 million, with the growth driven primarily by the acquisition of PDP and the expected out-performance of the gaming markets in specific categories based on the Company’s product plans for 2024. The Company expects pro forma combined Adjusted EBITDA to be between $51 million and $54 million, incorporating approximately nine months of operations from PDP.

The Company further reiterates its long-term goals of a 10%+ revenue CAGR and a mid-30 gross margin percentage and is focused on driving a mid-teens percentage for Adjusted EBITDA margins.

Image Source: Company

Risks

Turtle Beach expects to see significant revenue growth over the long term; however, the Company is subject to certain risks. Turtle’s brands face significant competition from other consumer electronic companies, and this competition could have a material adverse effect on our financial condition and results of operations.

Secondly, product manufacture, supply, and shipment depend upon a limited number of third parties. Turtle’s success is dependent upon the ability of these parties to manufacture, supply, and ship sufficient quantities of our products in a timely fashion, as well as the continued viability and financial stability of these third parties. In addition, many products use components with long order lead times and constrained supply. Any disruption in the supply of these components could materially impact the ability of third-party manufacturing partners to produce Turtle’s products.

Finally, the industries in which Turtle operates are subject to rapid technological change, and if Turtle does not adapt to emerging technologies, its revenues could be negatively affected.

Conclusion

For FY24, Turtle expects 43% – 47% increases in revenues compared to FY23. The Company has long-term goals of a 10%+ revenue CAGR and a mid-30 gross margin percentage. It is focused on driving a mid-teens percentage for Adjusted EBITDA margins, indicating a promising future. However, Turtle operates in a highly competitive industry subject to frequent technological changes that may impact the outcome of its operations. Hence, investors must proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://corp.turtlebeach.com/events-presentations/

https://corp.turtlebeach.com/2024/05/07/turtle-beach-announces-first-quarter-2024-earnings-results/

https://www.sec.gov/ix?doc=/Archives/edgar/data/1493761/000095017024054767/hear-20240331.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1493761/000095017024030883/hear-20231231.htm

Sorry, the comment form is closed at this time.