29 Oct Zix Corporation : An Attractive Small Cap Growth Stock!

Zix Corporation, (NASDAQ: ZIXI), formerly known as ZixIt Corporation, is a premier cloud and email security company that offers a seamless experience to over 21,000 customers, over 1200 U.S hospitals and more than 30 percent of the U.S banks. The Company offers security solutions such as Email Encryption, Information Archiving, Email privacy and Backup and Recovery services, besides productivity and Compliance Solutions.

Zix offers its products and services to a wide range of industries such as financial services, Healthcare, Information Technology and Manufacturing sector among others. In September 2021, the Company launched a Secure Large File add-on as part of Zix Email Encryption, enabling customers to send large files securely up to 100 GB per message, without the need for additional storage quotas or credentials for recipients.

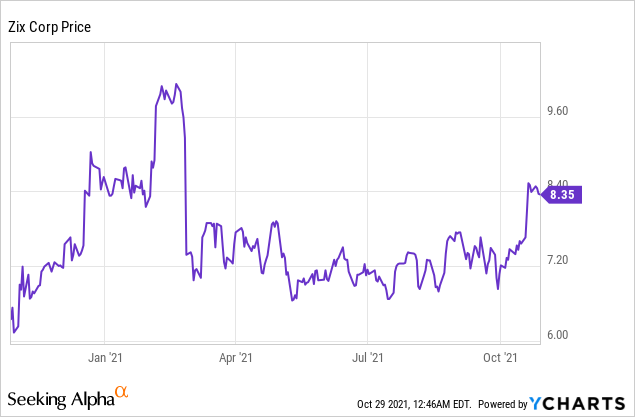

Zix Corporation, (NASDAQ: ZIXI)

Market Cap: $475.25M; Current Share Price: 8.35 USD

Data by YCharts

Strengths

The Company is a leading provider of email protection and productivity services targeting a diverse business communications market ranging from Enterprise to small and medium businesses. Zix has a world-class SaaS platform which is being used to deliver multi-layered security, resiliency, and compliance in the cloud. The Company is using platform intelligence to provide robust customer protection and gain a strong foothold in the international market.

As per its financial results ending June 30, 2021 the Company had

- Annual recurring revenue of $252.4 million

- An adjusted EBITDA margin of $53.5M (23%) for trailing twelve months

- A revenue growth of 18 % YOY.

Zix has more than 100,000 customers and a net dollar retention of 101%. The Company has been able to achieve an Annual recurring revenue of $252.4M in 2021, growing from $55M in 2016. The aim is now to achieve $500M by 2025.

The Company reported $62.83 million in revenue for the quarter ending June 30,2021, a 17.8% increase over the previous year.

Image Source: Company

As part of its Secure Cloud portfolio, the Company offers Secure platform, Cyber Intelligence and Secure Suite that encompass products and services such as native architecture, unified archiving, secure file sharing, email encryption and threat protection, collaboration tools and Microsoft 365 among others. The ARR from cloud represents 89 percent of the Company’s total ARR, which have received a boost by its recent acquisitions namely Greenview Data, erado, appriver and CloudAlly.

The COVID-19 Pandemic has brought a shift in the consumption habits of consumers around the globe. Owing to widespread lockdown and safety concerns, more customers are choosing digital and e-commerce routes to procure essential goods and carry out imperative services. Companies are now looking for digital solutions to transform the way their business is conducted. In addition, many companies are offering employees the option of work-from-home, which requires additional security measures to prevent data theft and misuse of data.

However, this transformation also puts businesses at risk of cyberattacks, especially since more offices are now offering remote work. Companies now realize the importance of having a back up and recovery plan in case of ransomware and malware attacks and are looking for solutions that strengthen their cloud, while helping meet increased compliance measures that require protection of customer data. These changes provide a great opportunity for growth and expansion to Zix.

The Company has over 20 years of experience as a Microsoft Cloud Solution Provider (CSP) and has handled more than 14000 successful M365 migrations, providing 97 percent first call resolution on support calls.

Zix is focused on three growth areas namely new customer acquisition, sales to existing customers and increasing retention. The Company has on-boarded 5,232 new customers to the secure cloud platform in Q2,2021 as compared to 4,503 in Q2,2020. They also on-boarded 5,644 new partners in 2021 so far as compared to 5,003 in 2020. The Company has a 100 percent subscription-based business model, which is predictable and has resulted in 8 consecutive years of profitability.

Weakness

As of June 30, 2021, the Company has a total debt of $211.3 million consisting of a 5-Year Term Loan of $201.5M (@ 4.00%) and a Delayed Draw Term Loan of $9.8M (@ 3.41%), which are due in February 20,2024. Zix had a debt of $185.8 million in 2020. However, the Company has cash of $33.9 million, thereby placing the net debt at about $ 177.4 million.

The Company’s balance sheet shows that Zix had liabilities of $85 million due within 12 months, another $217.4 million due beyond 12 months, while it had cash of $33.9 million plus receivable worth $18.2 million due within 12 months, which puts its total liabilities at $250.4 million, which is more than its cash and near-term receivables together.

Zix currently has a market capitalization of $480.938 million, which gives it a chance to raise cash to ameliorate its balance sheet, in case of a need. One more thing to note is that though the company’s EBITDA ratio is 4.5, it has high leverage, since its interest cover is weak at just 0.47. One concerning fact is that its EBITDA is down 63% over 2020, however it has also produced more free cash flow than EBIT over the last two years.

According to a report by Reuters, the Company is exploring multiple options, including sale of the company. Zix has reportedly hired Citigroup Inc to negotiate with interested parties and private equity firms.

Opportunity

The advent of smartphones, the impact of the pandemic and increasing adoption of cloud storage solutions are compelling organizations to digitize their services, to cater to new-age customers, who rely greatly on online platforms for their needs. According to a report by IDC, the worldwide spending on digital transformation products and services is likely to reach $2.3 trillion in 2023, growing at a CAGR of 17.1% from 2019 to 2023. This calls for a robust and reliable consumer identity and access management solution that can ensure that only those authorized to access and use specific services are authenticated diligently to prevent fraud. This is especially true for organizations that offer banking and financial services as they deal with financially critical and sensitive information that is vulnerable to cyber-attacks.

The COVID -19 pandemic has led to companies offering work-from-home options to employees and this poses a significant opportunity for cyber criminals seeking to misuse data. Cyberattacks can be carried out in the form of hacking, data breaches, malware attacks and DDoS that are more challenging to defend against.

The inherent vulnerability of remote working is proving advantageous for criminals who use default passwords to hack into accounts. The advent of machine learning and artificial intelligence to tackle data breaches and security lapses is revolutionizing the way data is stored and protected.

According to a report by Research and Markets, the global cloud security market is poised to reach $67.6 billion by 2026, growing at a CAGR of 14.2, from $34.8 billion in 2021. The growth in the market will be fueled by the growing demand for cloud services, increasing cyberattacks and data breaches, and trends such as Bring Your Own Device (BYOD) and Choose Your Own Device (CYOD). The services rendered encompass areas such as identity access management, security analytics, application and endpoint security and intrusion detection and prevention. The technology finds application in a wide variety of industries ranging from automotive, healthcare, banking and financial services and Insurance.

The global email encryption market size is estimated to reach $12.9 billion by 2027, growing at a CAGR of 20 percent as per a report by Research and Markets.

Further the industry is constantly evolving and adopting new technology to ensure that it offers the best security and networking facilities available. BlockChain, Artificial Intelligence and Machine Learning are the current buzzwords in the world of cloud security, with more and more companies realizing the need for an immutable decentralized record of transactions that can offer enhanced safety, performance, and efficiency.

Image Source: Company

Threats

There is a possibility of a new and better technology emerging in the market, which may render the Company’s technology obsolete. Customers may opt to go with its competitors for their business needs and the Company may fail to acquire new customers or not be able to achieve its targeted growth in ARR.

The Company also faces stiff competition from competitors such as Barracuda, Proofpoint, Sonic wall and FIREEYE among others. Zix may be acquired by a competitor or a private equity firm.

The Company may fail to repay its debt or issue additional shares, diluting shareholder value.

Key Takeaways

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

http://investor.zixcorp.com/static-files/0eca7e8e-2990-4564-b192-329af0a64040

https://www.helpnetsecurity.com/2021/09/22/zix-secure-large-file

No Comments