22 Oct 4 Small-Cap Stocks Insiders are Selling!

Insider selling cannot be the sole indicator for investing in a stock, but it would be wise to make a note of the buying and selling activities to gauge a company’s prospects or the lack thereof. While insiders buying or selling the Company’s stock could provide investors with a general idea about the direction it is headed, a thorough understanding of its fundamentals, recent news and analyst estimates should be taken into consideration while making an investment decision.

We take a look at four companies that have witnessed insider selling in the past year.

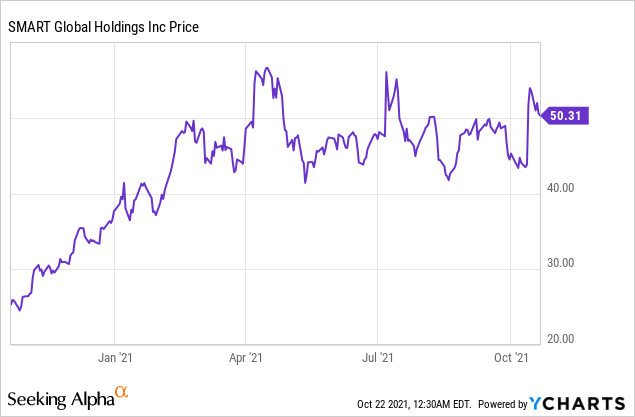

Smart Global Holdings, Inc. (NASDAQ: SGH)

Market Cap: $1.22B; Current Share Price: 50.31 USD

Data by YCharts

Insider Selling Information for Past 12 Months: Mukesh Patel, Director of the company sold 96959 shares at an average price of 52.16, for a total amount of $5,057,762.30.

Recent News: The Company reported better-than-expected Q4 revenue and sales and beat market estimates on earnings and revenues estimates. SGH’s net sales grew by 57% from the year ago quarter to reach $467.7 million, while the net sales for the fiscal year 2021 rose to $1.5 billion, up 34% versus fiscal 2020. Commenting on the results, the CEO Mark Adams, called it a “transformative year for SGH”.

Company Profile: SGH provides leading-edge, high-performance computing, wireless and embedded technologies to customers across the globe. The Company has manufacturing facilities in the United States, Brazil, Malaysia and China, with sales and design offices around the world. The Company owns and operates various brands such as Penguin Computing (Linux-based solutions for enterprise data centers, HPC and Cloud); SMART embedded computing for use in weapons control, retail video analytics and SIGINT surveillance among others as part of its Intelligent Platform Solutions. CreeLED is SGH’s brand that offers LED solutions, while its Memory Solutions encompass SMART Modular Technologies and SMART Supply Chain Services.

The Company offers its products and services directly to original equipment manufacturers, enterprise and government organizations.

Funko, Inc. (NASDAQ: FNKO)

Market Cap: $684.58M; Current Share Price: 17.38 USD

Data by YCharts

Insider Selling Information for Past 12 Months: Brian Richard Mariotti, CEO of Funko Inc, sold 118278 shares at an average price of $19.38, for a total amount of $1,146,067.53. In May 2021, the Company’s President Andrew Perlmutter sold $ 367 thousand worth of shares at an average price of $ 24.48 per share, which reduced their holding by 11 percent.

Recent News: Funko Inc recently signed a lease for an 863,000-square-foot industrial facility, which is likely to be completed by early 2022. The facility may be used as a distribution or manufacturing center; however, the Company hasn’t yet disclosed what the facility will be used for as yet.

The Company also reported a 141% year-on-year growth in net sales, which stood at $236.1 million, while the U.S. net sales increased 110% to $163.2 million, Europe net sales increased 393% to $52.0 million, and Other International net sales rose 117% to $20.9 million over Q2 2020 results, as per the Company’s Q2,2021 financial results.

Brian Mariotti, Chief Executive Officer called it the “largest top line quarter in Company history”.

Company Profile: Funko offers a range lifestyle product in the pop culture consumer landscape. The Company’s products consist of vinyl figures, action toys, plush, apparel, board games, housewares and accessories. Funko owns and operates brands such as Loungefly, Funko Games and Funko Animation Studio and has presence in more than 25000 retail stores such as Walmart, Carrefour, Gamestop, PRIMARK, Target among others in Everett, Washington and Hollywood, California.

As of December 31, 2020, the Company had over 1000 active licensed properties with more than 200 content providers and has brought to the market more than 600 million pop culture products. Some of Funko’s licensing partnerships include WB, Marvel, Disney, LucasFilms ltd to name a few.

The Company has joined the NFT bandwagon in 2021, with the launch of POP! Digital featuring Teenage Mutant Ninja Turtles.

Hub Group, Inc. (NASDAQ: HUBG)

Market Cap: $2.59B; Current Share Price: 75.45 USD

Data by YCharts

Insider Selling Information for Past 12 Months: There were multiple insiders selling transactions during the course of the past year. The biggest single sale was by Vava Dimond, the Executive VP & Chief Information Officer, who sold $843 thousand worth of shares at $60.35 per share, which constituted 17 percent of their total holdings. Insiders own 5.3 percent of the shares, which translates to about $134 million.

Recent News: The Company acquired Choptank Transport, which provides non-asset refrigerated transportation services, a move that will help increase its presence in the refrigerated transportation market. Choptank was acquired for $130 million, funded by cash on hand and is expected to generate over $450 million in revenue.

Company Profile: HUB provides end-to-end supply chain solutions by leveraging its private intermodal fleet (second-largest in the industry), cutting-edge technology and robust third-party relationships. The Company’s transportation solutions encompass intermodal, truck brokerage, asset tracking and dedicated trucking.

HUB also offers Logistics Management Solutions including consolidation and warehousing, international freight and last mile delivery. The industries it serves range from retail logistics, e-commerce, automotive, healthcare logistics, asset solutions for 3PLs and the Food and Beverage industry among others.

Transcat, Inc. (NASDAQ: TRNS)

Market Cap: $542.86M; Current Share Price: 72.20 USD

Data by YCharts

Insider Selling Information for Past 12 Months: Independent Director Charles Hadeed sold shares worth $680 thousand at a price of $68.00 per share, which constituted 24 percent of their total holdings. Over the past year, insiders sold 40.58k shares worth $1.8 million. Insiders own 6.6 percent of the company, translating to approximately $35 million.

Recent News: The Company will be releasing its second quarter fiscal year 2022 results after the close of financial markets on Tuesday, November 2, 2021. In August 2021, Transcat acquired an asset of NEXA Enterprise, marking its foray into Ireland. Transcat paid $20.25 million in cash and $2.25 million in Transcat common stock, in addition to the potential earn-out payments of up to $7.5 million over the next four years that will be paid out in the form of common stock, when NEXA achieves annual revenue and EBITDA goals.

Company Profile: A leader in the test and measurement industry for over 40 years, Transcat offers high quality calibration and repair services and laboratory instrument services in the United States and internationally. The Company’s range of products include data loggers, dimensional measuring tools, electrical test instruments, environmental testing and process instruments among others. The service segment of the Company also offers a proprietary document and asset management software, namely CalTrak, that integrates calibration service centers and customers’ assets and Compliance, Control and Cost, an online customer portal with web-based asset management capability.

The distribution segment sells and rents instruments to various industries such as pharmaceutical, biotechnology, medical device, aerospace, defense, oil and alternative energy to name a few.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://www.logisticsmgmt.com/article/hub_group_announces_acquisition_of_choptank_transport

No Comments