28 Jan 5 Reasons to Add Sierra Oncology to Your Portfolio

Sierra Oncology, Inc. (NASDAQ: SRRA) is focussed on creating novel targeted therapies that address large unmet needs in rare forms of cancer. The Company’s lead product candidate is momelotinib, a selective and orally bioavailable JAK1, JAK2 and ACVR1/ALK2 inhibitor being developed for the treatment of myelofibrosis.

Positive Results from a Critical Phase 3 Trial

Sierra Oncology, a late-stage biopharmaceutical company, announced positive topline results from a pivotal Phase 3 MOMENTUM study, which was evaluating momelotinib (MMB), an orally bioavailable JAK1, JAK2 and ACVR1 / ALK2 inhibitor, intended for the treatment of myelofibrosis in patients who are symptomatic and anemic and previously treated with an approved JAK inhibitor.

The candidate has been evaluated in over 1200 patients since clinical trials were initiated in 2009, including 1000 patients treated for myelofibrosis who have been taking Momelotinib, the first and only JAK inhibitor that has demonstrated significant effect on disease symptoms, splenic response and anemia.

The results based on 195 patients (MMB n = 130; DAN n = 65) show that momelotinib met the primary endpoint of Total Symptom Score (TSS) of >50% and secondary endpoints of Transfusion Independence (TI) and Splenic Response Rate (SRR). Serious adverse events were 35% in the MMB arm and 40% in the control arm.

Barbara Klencke, MD, Chief Medical Officer of Sierra Oncology, commented

“We are committed to working tirelessly to bring momelotinib to patients as quickly as possible. We would like to thank the patients and investigators who participated in this study and look forward to presenting the full data set at an upcoming medical meeting.”

The Company intends to file a New Drug Application (NDA) for momelotinib for treatment of myelofibrosis, who are symptomatic and anemic in Q2,2022.

Sierra Oncology, Inc. (NASDAQ: SRRA)

Market Cap: $376.22M; Current Share Price: 24.99 USD

Data by YCharts

A Billion Dollar Market Opportunity

Myelofibrosis a form of myeloproliferative disorder that is caused by mutations in the DNA. Some of the genetic mutations causing this are Janus kinase 2 (JAK2) gene mutation, CALR and MPL mutation. Myelofibrosis can progress to chronic leukemia or bone marrow cancer in which production of blood cells is disrupted by scarring in the bone marrow, which in turn leads to anemia. The scarring can also lead to a lower number of platelets that increase the risk of bleeding.

The disease can be characterized into primary myelofibrosis or secondary myelofibrosis and often causes an enlarged spleen. The disease develops gradually over a period of time and is asymptomatic in the early stages. As the disease progresses, the symptoms manifest in the form of tiredness, enlarged spleen, bruising and bleeding, night sweats and bone pain.

Risk factors include age, pre-existing blood cell disorders such as thrombocythemia or polycythemia vera, exposure to chemicals such as toluene and benzene and radiation exposure. The treatment of myelofibrosis is currently limited to alleviating symptoms and includes chemotherapy, drug therapy, surgery, radiation and stem cell transplant among others.

According to a report by Future Wise Research, the global myelofibrosis market is expected to reach over USD 1 billion by 2027, growing at a CAGR of 7% from 2020. The growth in the market will be driven by increased research and development, technological advancements, improved diagnostics and an increasing geriatric population.

A Differentiated Approach

Momelotinib was acquired by the Company from Gilead (NASDAQ: GILD) in 2018, in exchange of a $3 million upfront payment, after the candidate faced setbacks in clinical trials at Gilead. The candidate was originally acquired by Gilead from YM BioSciences and was intended to rival Incyte’s Jakafi. However, disappointing results and questions about safety led to the candidate being dropped from Gilead’s pipeline back then.

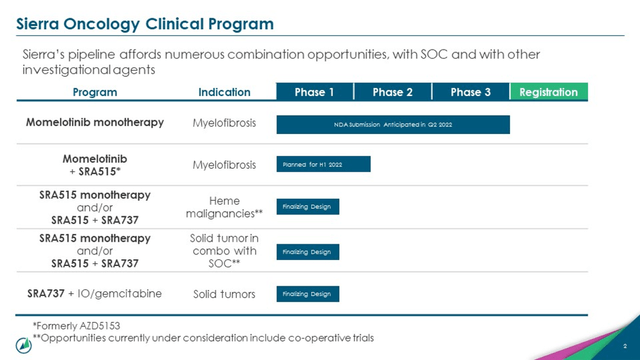

In August 2021, the Company acquired a BRD4 BET inhibitor named AZD5153 from AstraZeneca (NASDAQ: AZN) with plans to test it in a phase 2 trial with momelotinib. The candidate has been evaluated in a Phase 1 trial in solid tumor and lymphoma and demonstrated safety and tolerability, however it is yet to show evidence that it can improve anti-tumor activity in humans. The drug was dropped from Astrazeneca’s pipeline in 2019 and has now been picked up by Sierra. The Company has paid $8 million in upfront payment, with a potential $208 million in milestones for exclusive global rights. Sierra intends to initiate a Phase 2 clinical trial evaluating the combination of momelotinib and SRA515 in the first of 2022.

The current treatment approach in Myelofibrosis involves use of JAK inhibitors. This often leads to myelosuppression, causing reduction in platelet production and hemoglobin and resulting in severe anemia and/or thrombocytopenia. These conditions can inhibit the efficiency of therapies and cause toxicity or increased cytopenia as well.

Image Source: Company

Sierra is finalizing trial design for evaluating SRA515 as a monotherapy or in combination with SRA737 for treatment of Heme Malignancies. Furthermore, the Company intends to evaluate the candidate as a monotherapy or a standalone treatment in solid tumors and solid tumors in combination with SOC.

Analyst Rating

On January 26,2022 Oppenheimer analyst Jay Olson raised the price target of Sierra Oncology to $38.00 from $32.00. In December 2021, Cantor Fitzgerald increased their price target to $39 from $33 with a rating of “overweight”. In November 2021, HC Wainwright restated a price target of $35.00 per share with a “buy” rating.

Key Takeaways

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://www.sierraoncology.com/science/

https://s28.q4cdn.com/726829854/files/doc_presentation/2022/2022.pdf

No Comments