12 Nov 5 Stocks for Your Investment Watchlist!

Technology Industry has been focused on minimizing the impact of COVID-19 and marching ahead with its innovations and breakthroughs, be it critical security systems, innovative marketing solutions or cutting-edge data analytics and search technology.

We take a look at some tech companies that are impervious to the scare and offer a very attractive upside in the long run. These companies not only have an excellent potential for growth and returns but have major upcoming catalysts such as contract awards, new products and services, growing client base or even global expansion plans lined up for 2021.

Our biotech picks this week are making strides in fields such as immune-oncology, genetic medicine and home-monitoring equipment. Some of these companies upcoming catalysts in the form of data readouts, initiation of clinical trials and IND submission to look forward to.

Cyclerion Therapeutics, Inc. (NASDAQ: CYCN)

Market Cap: $114.68M; Current Share Price: 2.65 USD

Data by YCharts

Cyclerion Therapeutics is exploring the potential of the NO-cGMP pathway, by developing next-generation soluble guanylate cyclase (sGC) stimulators to address debilitating orphan diseases. Cyclerion’s pipeline includes five sGC stimulator programs indicated for the treatment of Sickle cell disease, DN, HFpEF, CNS, Liver and Lung orphan disease conditions.

The Company is targeting nitric-oxide signaling, a crucial component of real-time regulation of various biological systems. Soluble guanylate cyclase (sGC) plays an important role in regulating Nitric oxide signaling, and is present in tissues throughout the body, including in the vasculature, kidney, brain, lung, heart, liver, adipose and skeletal muscle. Nitric Oxide produced locally percolates into target cells and binds to sG, which in turn catalyzes the conversion of guanosine – 5’ – triphosphate (GTP) to cyclic guanosine monophosphate (cGMP), effecting a marked improvement in the secondary signaling molecule.

Cyclerion’s strategy is to design novel small molecule sGC stimulators, which are capable of increasing nitric oxide signalling in disease-relevant tissues, thereby resulting in improved production of cGMP. The Company has sights on extending the application of this technology in developing therapeutics for diseases associated with inflammation, fibrosis or metabolic dysregulation.

Image Source: Company

The Company’s pipeline consists of CY6463, a first-in-class, CNS penetrant sGC stimulator and other candidates targeting improvement in cognitive function. In clinical studies, CY6463 has demonstrated rapid improvements in biomarkers associated with cognitive impairment such as improved alpha and gamma power, better N200 latency and reduced inflammatory biomarkers among others. The candidate is being evaluated in multiple CNS areas such as Alzheimer’s Disease with vascular pathology (ADv), Cognitive Impairment Associated with Schizophrenia (CIAS) and Mitochondrial Encephalomyopathy, Lactic Acidosis, and Stroke-like episodes (MELAS).

In November 2019, Cyclerion had reported failures of its drug candidate praliciguat in meeting the primary endpoints in two separate clinical studies, in diabetic nephropathy (DN) and heart failure with preserved ejection fraction (HFpEF). Praliciguat is a soluble guanylate cyclase (sGC) stimulator indicated for the treatment of cardiometabolic diseases, which was granted a Fast-Track Designation by the U.S FDA for the treatment of HFpEF. In preclinical studies, the drug demonstrated extensive distribution to adipose tissue, kidney, heart and liver.

The Company has entered into a global licensing agreement with Akebia Therapeutics, Inc., for development and commercialization of praliciguat, in exchange for $225M in pre-commercial milestones, with $15M due in the first 18 months and total potential development, regulatory, and commercialization amounting to $585M, besides sales-based royalties.

The Company was spun out of Ironwood Pharmaceuticals in April 2019.

Cogent Biosciences, Inc. (NASDAQ: COGT)

Market Cap: $417.22M; Current Share Price: 10.47 USD

Data by YCharts

Cogent Biosciences is a clinical-stage biotechnology company targeting underlying causes of genetic dysfunction that cause diseases such as cancers, autoimmune disorders and rare diseases. The Company’s lead candidate bezuclastinib (CGT9486), is a precision kinase inhibitor that inhibits the KIT D816V mutation, which is responsible for a rare condition, namely, Systemic Mastocytosis. In addition, the candidate is being evaluated for the treatment of advanced gastrointestinal stromal tumors (GIST).

Bezuclastinib is intended to target the exon 17 mutation including KIT D816V, which causes mast cells to accumulate in the bone marrow as well as various organs by being in a perpetual “on” state. The Company has initiated a Phase 2 clinical trial of bezuclastinib for Nonadvanced Systemic Mastocytosis (NonAdvSM) patients and intends to initiate a Phase 3 clinical trial namely PEAK evaluating bezuclastinib and sunitinib for Gastrointestinal Stromal Tumor (GIST) patients, in 2021. The Company has had positive interactions with the FDA and is on track to initiating a Phase 3 trial. The candidate has demonstrated encouraging clinical activity in combination of bezuclastinib + sunitinib in heavily pre-treated GIST patients.

The Company is currently enrolling patients in a Phase 2 APEX trial of bezuclastinib in patients with Advanced Systemic Mastocytosis (AdvSM) and is planning to announce preliminary clinical data at a scientific conference in H1, 2022.

Cogent has partnered with Serán Biosciences to create an updated formulation of bezuclastinib, which will be used in the PEAK trial and has the potential to reduce the daily pill burden.

In October 2021, H.C Wainwright initiated coverage for the stock with a “Buy” rating and a price target of $25, which shows a massive upside potential.

Quipt Home Medical Corp (NASDAQ: QIPT)

Market Cap: $196.18M; Current Share Price: 5.89 USD

Data by YCharts

Quipt provides in-home disease management and monitoring services such as ambulatory aides, end-to-end respiratory solutions, power mobility equipment, ventilators and oxygen concentrators, sleep apnea and PAP treatment equipment among others, to customers in the U.S.

The Company leverages its expertise in telehealth systems and automated distribution to improve the home management of chronic health. Quipt has built a robust network of over 18,500 referring physicians, operating a largely subscription-based revenue model, with nearly 250,000 pieces of equipment delivered every year.

Quipt’s ordering platform uses a fully integrated system that begins with the field sales team obtaining orders from Physicians, hospitals, long term care centers, which are then processed by a verification team. The distribution team ensures delivery of the equipment as well as patient training by certified respiratory therapists and technicians, while the revenue team takes care of the documentation for billing and collection. The Company has a growing and strong recurring revenue model, with 75% of its revenues being recurring in nature. Oxygen therapy (22.9%), PAP Therapy (21.2%) and Sleep Therapy Supplies (19.1%) constitute the three major components of the product mix. Furthermore, Medicare (39.7%) and private insurance (37.7%) contribute to 75% of the Company’s revenue.

Quipt has been making significant investment in developing its technology platform, which not only helps deliver exceptional customer service but also acts as a differentiating factor from other competitors. The Company has set its sight on capturing a major share of a potential $84 billion market by 2028, through consolidation in a highly fragmented market. The Company has a network of more than 6,000 medical equipment providers in the U.S.

Image Source: Company

The Company’s growth strategy is based on targeting a rising geriatric population and a growing number of Americans suffering from conditions such as Sleep Apnea, COPD and other chronic conditions. In addition, the Company has been investing in technology that helps understand various workflow processes and results in operational efficiency. Quipt is gearing up for the launch of the Sleepwell re-supply program to reduce fulfillment errors and drive growth to over $30 million from the current $25 million.

Quipt has been on an acquisition spree with focus on companies that fit its strategic growth model such as Coastal Medtech, Riverside Medical, Colley Medical, Acadia Medical Supply and Sleepwell among others. These acquisitions bring in new customers, orders as well as referring physicians.

Chico’s FAS, Inc. (NYSE: CHS)

Market Cap: $770.31M; Current Share Price: 6.29 USD

Data by YCharts

Chico’s FAS is a fashion retailer that has a portfolio consisting of three brands Chico’s (Women’s apparel), WHBM (Upscale clothing) and Soma (intimate clothing) that are sold through 1,286 boutiques and outlets throughout the U.S. (including Puerto Rico and U.S. Virgin Islands (as of July 1,2021). The Company also retails through online channels.

SOMA, the Company’s intimate apparel brand is on track to achieve $100M in sales in the fiscal year 2021. The brand has achieved a 53% sales growth over Q2,2020, exceeding sales growth of that of the U.S Market in certain categories. Chico’s FAS and WHBM also achieved sales growth of 59% and 48% over Q2,2020 on the back of new fabrics, styling and quality enhancements.

Image Source: Company

The Company has also reported an EPS of $0.21 per diluted share, its best second quarter performance since 2013. Gross margin also improved to 38.4%, its best performance over the past 13 consecutive quarters CHS has also clocked a growth in digital sales, which grew by 23% in Q2,2021 over 2019 levels. The growth is driven by the adoption of enhanced marketing efforts such as more focus and investment on digital storytelling and social influencer marketing among others.

CHS is also pruning its real estate portfolio with a view to enhance productivity, the Company has closed 9 stores during Q2,2021 and intends to close about 13% to 16% of the remaining store fleet by the end of 2023. The Company has obtained $ 15M in incremental savings for a total of $80M in rent reductions and abatements. On the other hand, CHS has opened 47 SOMA shop-in-shops in Chico’s stores.

The Company is targeting a YoY net year sales improvement between 18% to 22% in Q3,2021 and a YoY net sales improvement between 32% to 35% for the fiscal year 2021.

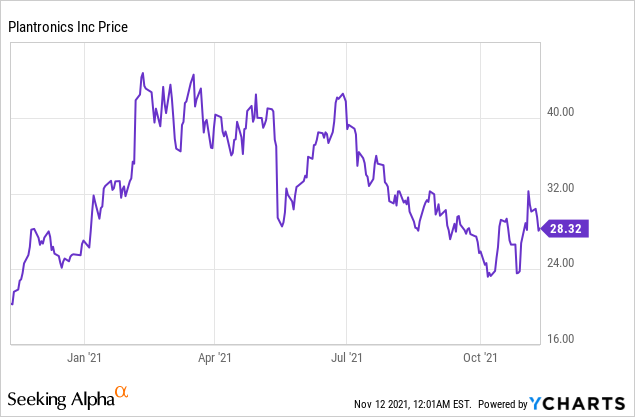

Plantronics, Inc. (NYSE: POLY)

Market Cap: $1.21B; Current Share Price: 28.32 USD

Data by YCharts

POLY creates integrated communication tools for corporate clients, individuals and small businesses in the United States, Europe, the Middle East, Africa, the Asia Pacific. The Company’s product offerings consist of wired and wireless communication headsets including Bluetooth, DECT, USB and Call Center Headsets, Desktop phones, Wireless Phones and conference room phones and video conferencing solutions such as cameras, speakers, and microphones.

The Company caters to diverse industries ranging from government to healthcare, education, call centers and financial services. POLY has created award-winning products such as the Voyager Headsets, which witnessed the recent addition of Voyager 4300 UC, an affordable solution for the hybrid worker. The Company has also integrated with AppSpace, a leading cloud- based digital signage software to deliver workspace communication and digital signage pop-ups during downtime.

Image Source: Company

Most recently, the Company introduced an updated Poly Room solutions for Microsoft team rooms, which include studio kits that offer cutting-edge audio and video for focus, small, medium, and large rooms.

During Q2,2022, the Company’s voice revenue was up 36%, while Video revenue was up 15%, despite facing supply challenges. In fact, POLY continues to garner market share in video almost doubling its share Y-o-Y, the growth driven primarily by shifting focus to higher-margin headsets and video products. POLY also gained significant market share in two primary video conferencing markets, with double-digit percentage point gains in each market on a year-over-year basis, as per the Company.

The Company also launched Poly Studio X70 and E70 to cater to the needs of broadcast-quality video to large conference rooms. Microsoft and POLY have partnered to deliver Meeting Room AI with the Poly Studio E70, a Pro -Grade Video Conferencing Solution. On the other hand, e X70 and E70 devices support Zoom Rooms Smart Gallery and are Zoom certified.

The Company is poised to capitalize on the shift to remote work and hybrid working environments and has extended its portfolio to include new tools for remote management, backing it up with quality support and services. The COVID -19 pandemic has led to companies offering work-from-home options to employees and this poses a significant opportunity for companies like Poly to cater to the needs of the changing workspace environments. The Company has built a robust partner network consisting of industry leaders such as Microsoft, Zoom, Ring Central, AWS, Google, Comcast, Verizon among others.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://cyclerion.gcs-web.com/static-files/5d4e0343-0d3e-4774-bf23-aa0964be2e51

https://investors.cogentbio.com/static-files/0ab4e5d3-7fa0-4e73-a7ba-d497c7bf2923

https://quipthomemedical.com/investor-presentation/

https://chicosfas.com/our-brands/chicos/default.aspx

https://s25.q4cdn.com/748803619/files/doc_financials/2022/q2/Q2’22-Earnings-Presentation.pdf

https://s25.q4cdn.com/748803619/files/doc_presentations/2021/Poly_Inv_Day-5.19-FINAL.pdf

No Comments