29 Jun 5 Stocks to Consider Adding to your Investment Portfolio!

While Industries across the globe are grappling with the pandemic and its impact on their Operations, Technology Industry has been focused on minimizing the impact and marching ahead with its innovations and breakthroughs, be it critical communication systems, innovative marketing solutions or cutting-edge electric transportation technology.

We take a look at some tech companies that are impervious to the scare and offer a very attractive upside in the long run. These companies not only have an excellent potential for growth and returns but have major upcoming catalysts such as contract awards, new products and services, growing client base or even global expansion plans lined up for 2021.

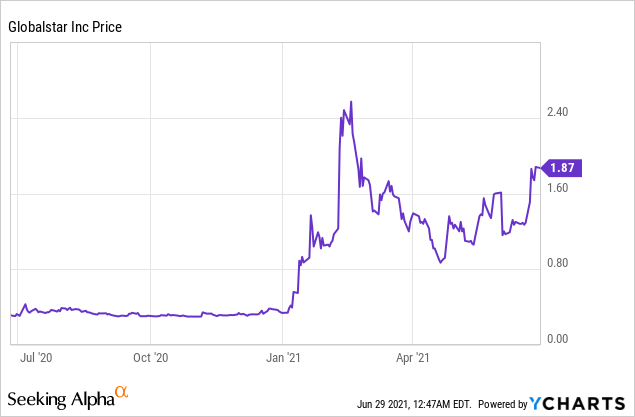

Globalstar, Inc (NYSEAMERICAN: GSAT)

Market Cap: $3.35B; Current Share Price: 1.87 USD

Data by YCharts

Globalstar is in the spotlight after analyst Mike Crawford from B. Riley Financial initiated a coverage for the stock with a “buy” rating and a price target of $3.25 per share, which offers a massive upside from its current levels.

Globalstar provides customizable Commercial IoT Solutions such as fleet asset tracking, connectivity and equipment monitoring to diverse industries including government and public safety, transportation, energy, construction and commercial maritime among others. The Company is aiming to redefine communication beyond cellular connectivity through its proprietary network of satellites that provide round-the-clock connectivity. The solutions offered by the Company include Asset Management, Personnel safety and management, emergency and remote communication and data management and mapping services to name a few.

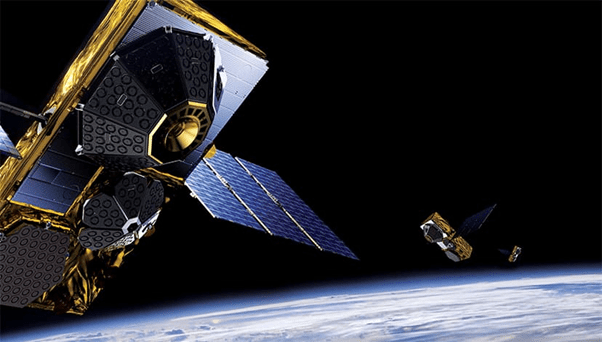

Image Source: Company

The Company is leveraging its state-of-the art technology to offer unparalleled and reliable connectivity to users across the globe. The product portfolio of the company offers voice, data, commercial IoT and SPOT business tracking and messaging, to provide operability in areas which lack connectivity or are extremely remote. According to the Company, its two-way duplex, one-way Commercial IoT and SPOT products transmit more than 1.8 billion messages a year to carry out essential functions such as asset monitoring and IoT connectivity in over 100 countries across six continents. Globalstar has contributed to over 7,500 rescues, initiated through the help of its SPOT tracking technology.

According to a report by Riot Research, the global IoT-focused satellite services market is projected to reach $5.9 billion in 2025. The growth will primarily be driven by reduced barriers to entry, technological advancements and lower power consumption. Furthermore, the report estimates that by 2025, there will be 30.3 million Satellite IoT devices.

The growth in the market will be fueled by the growing demand for internet of things devices that are interconnected such as connected cars, smart cities, wearable devices, smart homes to name a few. The services rendered encompass areas such as identity access management, security analytics, application and endpoint security and intrusion detection and prevention. The technology finds application in a wide variety of industries ranging from automotive, healthcare, banking and financial services and Insurance.

The technology of the company enables the transmission of customer signals through use of CDMA technology, to antennas located at a suitable terrestrial gateway, and are in turn routed through the local networks, creating the shortest possible connectivity latency. The Company’s Low Earth Orbit (LEO) satellites and cutting-edge ground infrastructure deliver quality and reliability. Furthermore, it enables customers to connect to a different satellite or gateway in case of signal interruption even in difficult terrains.

Image Source: Company

The Company has 24 ground stations that act as links between the LEO Satellites ground infrastructure across the 6 continents and offer connectivity to over 120 and countries throughout the world. The ground infrastructure of the company uses Internet protocol multimedia subsystem (IMS) configuration allowing for continuous updating and adaptation.

The biggest advantage for customers is that unlike other LEO systems, they do not require international numbering plans. The Company’s system offers local dialing and pricing plans that makes the services affordable.

In April 2021, the company’s subsidiary partnered with Cisa Trading, a company offering various commercial services such as logistics, shipment tracking and financing for the oil and gas sector, enabling it to bring asset management solutions to Brazil, which has already been successful in improving operations in one of the largest oils and gas companies in the world. As part of the contract, Cisa’s containers need to be outfitted with tracking and monitoring devices that can work through satellite technology, as their work takes them to remote areas that do not always have cellular coverage.

Cisa chose SmartOne Solar devices from Globalstar, which can operate for over 10 years without maintenance, are powered by solar energy and come equipped with ATEX, IECEx, IP68/69K and HERO certifications.

In February 2021, the Company entered into a global strategic alliance with XCOM Labs, a wireless technology company, to jointly commercialize XCOM’s capacity-multiplying technology, with Globalstar’s Band n53 for dense 5G deployments in the United states as well as other territories where Global star has terrestrial rights.

Furthermore, Qualcomm has included Globalstar’s Band n53 in its 5G X65 modem, which is Qualcomm’s flagship 5G modem, expanding the company’s device ecosystem to include smartphones, laptops, tablets and IoT modules to name a few.

Ayro, Inc. (NASDAQ: AYRO)

Market Cap: $175.79M; Current Share Price: 4.99USD

Data by YCharts

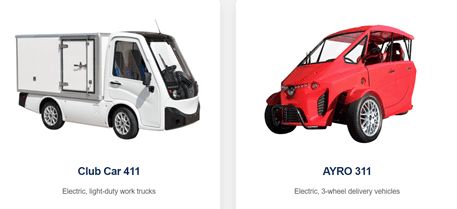

Ayro recently announced the receipt of an initial purchase order for 2022 Club Car Current, the next-generation club car 411 that aims to fill the gap between full-sized trucks and small utility carts. The Company had launched the new Club Car Current in June, 2021, in partnership with Club Car, a premier golf, consumer and utility vehicles company.

AYRO forte is purpose-built electric vehicles (EVs) that cater to the micro distribution and last mile delivery market. The Company’s offerings are customized to suit specific user requirements and enable a smooth transitioning to Electric Vehicles for the clients. AYRO’s EV’s not only reduce CO2 emissions and noise pollution by nearly 75 percent, but also cost almost 50 percent less to maintain, as compared to an internal combustion engine vehicle. The Vehicles are a perfect fit to the needs of educational campuses, hotels and resorts, government and corporate entities who are looking for vehicles that offer easy mobility, efficiency and reduced carbon footprint.

Image Source: Company

The Company’s Club Car- 411 is a compact all-electric vehicle suited for low-speed logistics and cargo services, and is targeted at campuses or urban environments that need agility and efficiency. The vehicle can be customized as there are multiple bed configurations to choose from such as truck, pickup bed, and flatbed. The vehicle comes with features such as Power-assist steering and 4-wheel hydraulic disc brakes, backup camera, cabin heat and ventilation, and an LCM display. In addition, the vehicle can also be turned into a part of a smart fleet through use of a GPS locator, alerts and geofencing.

AYRO-311 was first launched in 2018 as an all-electric 3-wheeled vehicle meant to serve the delivery and micro distribution market consisting of Restaurants, pharmacies, retailers, and other businesses. The Company is now working on the next generation of the vehicle by incorporating inputs from leading brands and its own research and experience. The vehicle named 311X is a customizable purpose-built, all-electric vehicle that has a longer driving range and improved features to serve the needs of commercial fleets. The vehicle is especially suited for the delivery requirements of packages, pharmaceuticals, groceries and restaurants.

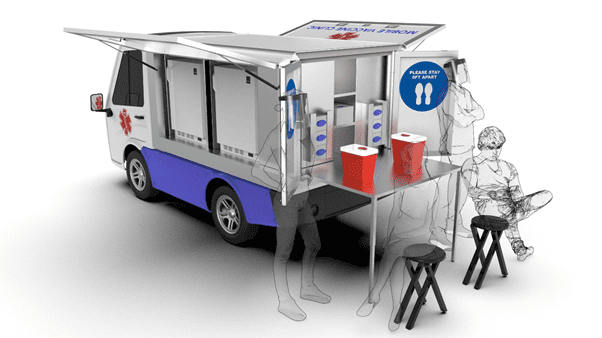

Image Source: Company

The Company has developed an Electric Vaccine Vehicle (EVV) to meet the specific requirements of on-demand and mobile clinics engaged in COVID-19 virus testing and vaccine administration. The vehicle has features such as power to support medical-grade freezers and refrigerators, lighting systems and drop-down treatment tables that confirm to CDC Vaccine Storage Requirements and are equipped with medical-grade equipment. The Vehicle can be used as a transportable vaccination center that can travel to different neighborhoods for easy administration.

In March, 2021, the Company entered into an agreement with one of the world’s largest pure-play automotive fleet managers namely Element Fleet Management. The partnership will leverage AYRO’s marketing, engineering, and production expertise with Element’s global footprint and consulting experience to enable the deployment of AYRO electric delivery vehicles over the next four years in the U.S and the Canadian Market. The deal encompasses access to Element’s suite of services spanning the entire vehicle lifecycle such as consulting, commercial sales team and service infrastructure.

AYRO’s agility to adapt to changing times is its biggest strength as evidenced by the Electric Vaccine Vehicle, that fills the gap for a transportable vaccine vehicle adeptly. The Company is now focused on designing AYRO 511 4×4 Concept, an all-season, all -electric truck designed to drive any terrain or season. In addition, the Company is also working on the next-generation AYRO-311X, an upgrade to its first legacy model that serves the delivery and micro distribution market.

The global last mile delivery market in the U.S was valued at over US$9.5 Billion in the year 2020, according to a report by Reportlinker. Furthermore the new U.S administration will invest close to $1.7 trillion over the next 10 years in its bid for a “Clean Energy revolution” that aims to establish the US as the clean energy superpower and transform the energy sector by providing economic impetus. The Company is well-poised to capitalize on the opportunities that arise from an increasing number of people looking forward to sustainable and environment friendly transportation options.

The Company has signed a deal with Club Car, a division of Ingersoll Rand that develops golf cars and utility task vehicles, which provides AYRO access to its dealer network. AYRO has managed to leverage the partnership to gain entry into Princeton University and Penn State University as part of a test run. In August 2020, the Company also placed its vehicles in a military medical campus in the Northeast United States, and saw potential opportunity for follow-on orders.

Marin Software Inc. (NASDAQ: MRIN)

Market Cap: $82.26M; Current Share Price: 7.50 USD

Data by YCharts

Marin Software is a premier enterprise SaaS and software solutions company offering advertisement management and digital marketing solutions for advertisers in the U.S.A, U.K and worldwide. MarineOne search, the Company’s online ecommerce platform offers advertisers the opportunity to zero in on growth opportunities and optimize their revenue across various search platforms such as Google, Bing, Apple Search Ads among others.

In June,2021, the Company announced that its flagship platform MarineOne will now be able to manage ads on Instacart, a leading online grocery platform in North America. Instacart delivers to more than 55,000 stores in more than 5,500 cities in the U.S and Canada and offers ad management services for over 2,500 consumer packaged goods (CPG) brands including the top 25 CPG companies.

The Company’s solutions help in campaign optimization with use of advanced analytical tools that enable budget planning and predictive intelligence. In addition, Marin helps utilize first and third-party data to create highly effective bidding rules that can help achieve better visibility when compared to competitors through intraday, position-based bidding.

Furthermore, Marin’s advertising insights deliver cross-channel dashboards that can evaluate paid search performance, while its advanced filters can identify ineffective keywords and creatives. The platform also enables advertisers to fully comprehend the conversion rates and revenue from search ads.

The Company’s portfolio of advertising and digital marketing solutions includes search, social, eCommerce, Amazon attribution, full-funnel bidding, BI Connect and Marine Go. Marine serves companies in various industries including agencies, B2B, Education, Financial services, retail and travel. Marin is partnering with industry leading companies to offer seamless integration with improved visibility and better revenue outcomes. The Company’s technology partners include Adclear, adjust, adobe analytics, facebook, IBM, Google analytics 360, salesforce to name a few.

Marin is also the largest 3rd party platform for biddable media and works closely with the world’s foremost social, search and mobile networks such as Adlux, Amazon, AOL, Baidu, bing, Instagram, twitter and Yahoo! among others.

The advent of the smartphone, growing internet penetration, digitalization of the economy and more importantly the COVID-19 pandemic, have resulted in an increase in the time spent online by individuals. Mobile phones are now omnipresent, and many people are increasingly using them not only for entertainment but also for work and essential services. This has led to the creation of a humongous marketing opportunity for advertisers. Facebook and other social media platforms have demonstrated the potential of targeted digital advertising, and the trend is here to stay as the world moves towards rapid digitalization. According to Statisca, the Global programmatic advertising market was valued at USD 106 Billion in 2019, and will reach nearly USD 147 Billion by the end of 2021.

Programmatic advertising helps advertisers maximize their spend by targeting a specific set of audience who are more likely to engage with a brand. They facilitate the creation of effective campaigns that convey relevant messages to their targeted subset of audiences. In addition, companies can buy and bid for advertising in real time and create customized advertising to appeal to their audience, based on the insights obtained from understanding customer preferences.

A report by ResearchandMarkets estimates that Real Time Bidding will reach US$33.7 Billion by 2027, growing at a CAGR of 30.7% from US$5.2 Billion in the year 2020, while the Private Marketplace segment is likely to grow at 28.6% CAGR for the next 7-year period. In the U.S alone the market for programmatic advertising is projected to be worth US$1.6 Billion in the year 2020.

Drive Shack Inc (NYSE: DS)

Market Cap: $297.39M; Current Share Price: 3.23 USD

Data by YCharts

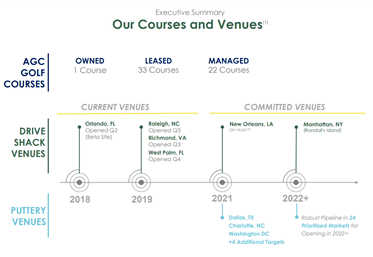

Drive Shack, formerly known as Newcastle Investment Corp, is a golf-related leisure and entertainment company, which owns, leases and manages 60 venues over 9 states as of December 31, 2020. The Company is reinterpreting conventional driveways by combining three experiences namely Entertainment, Sports and Food and Beverage. The Company calls this “Competitive Socializing” where customers can interact, play and eat at the same place.

The Company has sold a major portion of its owned courses and is now focused on leasing and managing courses. The first Drive Shack was opened in Orlando in April,2018, which served as the testing site, which led to the launch of three new sites in the second half of 2019 at Raleigh, Richmond and West Palm Beach, which exceeded performance expectations and beat revenue plans by 14 percent.

Image Source: Company

Drive Shack is currently working on delivering a differentiated experience through “Puttery”, a venture that aims to provide technology assisted putting and is likely to open 7 venues by the end of 2021. The Company has chosen Dallas, Tx, Charlotte, NC, Washington DC and four additional places for a potential launch in 2021 and has a strong pipeline of new venues targeting 22 priority markets for launch in 2022. The Company has announced a strategic partnership with PGA player, Rory McIlroy, a two-time FedEx Cup winner and PGA 2019 Player of the Year.

The Company owns and operates American Golf Corp, one of the largest golf operators in the U.S, which has 56 traditional courses and serves 3 million people per annum. 85 percent of these properties are leased from municipalities and the Company is leveraging these strong partnerships to build further venues.

DriveShack continues to enjoy high demand for its traditional golf services as evidenced by a 46 percent increase in its revenue from the green and cart fees in Q1,2021 as compared to Q1,2020 in its public courses. The Company also reported a 33 percent increase in Daily fee rounds for the same period. The private courses registered a 30 percent increase in member sales in Q1,2021, while total rounds grew by 29 percent.

Extreme Networks (NASDAQ: EXTR)

Market Cap: $1.40B; Current Share Price: 11.07 USD

Data by YCharts

Extreme Networks is a leading provider of software-driven networking solutions and is one of the fastest growing cloud managed network providers. The company aids clients with their digital transformation journey and was founded by three industry veterans namely Gordon Stitt, Herb Schneider, and Stephen Haddock in June 1996. The Company managed to achieve a record-breaking millionth port milestone in switch port shipments in April 1999, just within two and a half years of its inception. Extreme introduced the first all-in-one wired and wireless switches for Unified Access Architecture in April 2003 and soon reached its 10 million 3 Ethernet ports shipped worldwide by January 2004.

The Company has more than 1000 patents granted to its credit and became the only 4th generation cloud platform on the market with its ExtremeCloud IQ. Extreme Networks serves a wide variety of customers from industry leading enterprises, world-famous sports leagues to college campuses and even small towns. Some of its customers include Novant Health Imaging, NFL, Baylor Bears and Lowe’s among others.

In June 2021, the Company added a new regional data center (RDC) in London, which will help customers run the ExtremeCloud IQ on Microsoft Azure. This will also lead to faster data transmission for the customers while extending the company’s cloud footprint to 17 data centers across the world.

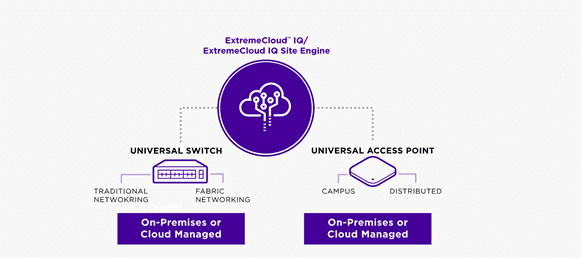

Extreme Networks product offerings include ExtremeSwitching, which delivers automated networks that are secure, cloud-driven and reliable. In addition, the solutions can be customized to provide flexibility to meet the requirements of organizations of any scale, be it a data center, campus or even metro. ExtremeRouting provides high-performance connectivity and ExtremeWireless, a combination of Cloud, ML and AI for effortless networking, are the other constituents of its product portfolio.

Image Source: Company

The Company’s universal platforms offer flexibility and investment protection as they can change any deployment model with the help of software and offer simplified licensing, warranty and a truly differentiated deployment experience. The ExtremeSwitching 5520 Series offer a choice of ExtremeXOS or VOSS operating systems and can be managed through ExtremeCloud IQ.

Extreme’s Enterprise cloud management solution namely ExtremeCloud™ IQ provides comprehensive networking solutions through value-based licensing services such as IQ Connect, IQ Navigator, IQ pilot and IQ Co-Pilot. In addition, the engine provides site management solutions and a dashboard that can be managed in the cloud or on premise, along with features like task automation, access control, granular visibility with real-time analytics and multi-vendor device management.

The advent of smartphones, the impact of the pandemic and increasing adoption of cloud storage solutions are compelling organizations to digitize their services to cater to new-age customers who rely greatly on online platforms for their needs. According to a report by IDC, the worldwide spending on digital transformation products and services is likely to reach $2.3 trillion in 2023, growing at a CAGR of 17.1% from 2019 to 2023.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://finance.yahoo.com/news/globalstar-announces-strategic-alliance-xcom-140000860.html’

https://finance.yahoo.com/news/globalstar-band-n53-qualcomm-x65-164700490.html

https://www.globalstar.com/en-us/corporate/initiatives/spectrum

https://www.clubcar.com/en-us/our-company/news/club-car-launches-all-new-electric-truck

https://www.prnewswire.com/news-releases/marinone-integrates-with-instacart-ads-301318727.html

https://www.marinsoftware.com/resources/news/press-releases

https://ir.driveshack.com/company-information/presentations

No Comments