06 Jul DermTech Inc: Disrupting Skin Cancer Detection

DermTech Inc (NASDAQ: DMTK) is pioneering a new way for detecting skin cancer through a smart sticker, which eliminates the need for a biopsy and the use of a scalpel to collect skin samples for detection of melanoma. The technology promises to revolutionize the melanoma diagnostics space through the use of precision genomics.

The sticker can detect changes in the skin at the RNA and DNA level and thus expedites the process of detection, as conventional technology still relies on results from a biopsy which need to be analyzed by a pathologist to notice cellular changes. There is a chance that around 17 percent of the early melanoma cases are missed through the conventional diagnosis method, while the DermTech Melanoma Test misses less than 1 percent, thereby enabling early diagnosis and timely treatment.

DermTech Inc (NASDAQ: DMTK)

Market Cap: $1.12B; Current Share Price: 37.92 USD

Data by YCharts

Strength

DermTech aims to redefine the way skin cancer is detected, by leveraging its non-invasive skin genomics platform. The Company’s Pigmented Lesion Assay / PLA can lift the skin’s RNA material, eliminating the need of a scalpel. The test provides utmost accuracy with almost 99% negative predictive value and has the ability to see 10,000x further into a cell compared to a conventional biopsy. The samples are analysed in a state-of-the-art custom built lab Gene Lab, where they undergo an automated amplification process called RT-PCR, to study the presence of RNA molecules, specifically genes that are predictive of melanoma, namely PRAME and LINC00518.

The test has made it to the National Comprehensive Cancer Network (NCCN) guidelines, an alliance of 30 cancer centres across the U.S, that suggests that non-invasive PLA test can help Doctors decide if a biopsy is required. In addition, the PLA is now being covered by Medicare, Blue Cross and Blue Shield (in the States of Texas, Illinois and California) and Geisinger Health Plans in Pennsylvania boosting its reimbursements rates. The Company is trying to forge partnerships with telemedicine health providers and other entities, to offer its products as part of a PLA collection kit, to enhance its customer base.

Image Source: Company

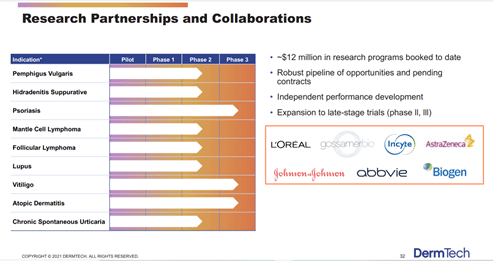

DermTech’s technology is being evaluated in Phase 1 – 3 trials to support the discovery and development of programs in cancers and inflammatory diseases that involve skin as a target organ. Some of these indications include GVHD, Alopecia Areata, Psoriasis, Vitiligo to name a few. DermTech’s Pharma and Lab partners are industry leading organizations such as AstraZeneca, Biogen, Covance, abbvie and Johnson & Johnson.

Image Source: Company

Furthermore, the Company’s pipeline consists of development of a Carcinoma test for the early detection of non-melanoma skin cancers at the genomic level and LuminateSM, a test to identify UV damage at the genomic level. LuminateSM is looking at a potential approval in the first half of 2022 and will be marketed directly to customers in the form of an at-home test.

Weakness

The Company’s product aims to eliminate the conventional scalpel-based diagnosis of melanoma, which relies on collecting skin samples through a biopsy that is analyzed by a pathologist in a lab. Any new product, especially when it is the first-of-its-kind, would need to assess the market for physician adoption. The valuation of the company is currently based on expectations of future growth, which would need doctors on the same page as the company that their method of diagnosis is far more efficient, pain-free and cost effective than a biopsy.

DermTech is working on establishing this by demonstrating the efficacy of its product to the doctors, who are the key decision makers, when referring patients for a biopsy.

The lack of precedence in this case may work either-ways for the Company. It can be a potential gamechanger for the company and the industry if physicians are able to rely on this test instead of biopsies. However, there is also a chance that the product may fail to capture the interest of the doctors and may not be able to realize its true potential.

Opportunity

Melanoma, a form of skin cancer, accounts for about 1% of skin cancers but is responsible for over 7,230 deaths every year as per an estimate by the American Cancer Society, these numbers are steadily rising over the years with approximately 96,480 new melanomas diagnosis being made each year. WHO places the global incidences of melanoma at 132,000 new diagnoses each year.

The 5-year survival rate for this illness has shown a significant improvement with faster and timely diagnosis, aggressive skin cancer screening programs for populations at greater risk of contracting the disease and rapid advancements in surgical and therapeutic options.

Global data predicts the global treatment market for melanoma to reach $5.64 billion by 2023 from $1.34 billion in 2013 with a CAGR of 15.5%. The major drivers for growth in the market would be the expanding treatment options to include targeted combination therapies, deteriorating environmental condition leading to higher exposure to UV rays, favorable government and regulatory environment, patent expiration of certain biosimilars and launch of generics that are expected to pave the way for new players to enter the market.

However, the prohibitive cost of treatment may prove challenging and affect the growth prospects to an extent.

Threat

The Company may face competition from competitors such as Mindera, a company developing a dermal biomarker patch for extraction of RNA from the skin. The company is also building a database of information pertaining to its dermal biomarker patch, imaging data and patient metadata. Mindera was recently awarded the “Best New Technology Solution for Dermatology” in the fifth annual MedTech Breakthrough Awards program held by MedTech Breakthrough.

Mindera is currently using this technology, in combination with machine learning algorithms to predict the right psoriasis drug after understanding patient response to it. Though not direct competitors at present, expansion of the pipeline in areas of mutual interest by either company is a possibility in the future.

Conclusion

The Company is continuing to build valuable payor relationships, with recent addition of payor contracts with the Blue Cross Blue Shield of IL, Blue Shield of CA and Blue Cross of Tx. DermTech is targeting a potential $10 billion market opportunity, with more than 1 billion in sales expected from the Medicare market alone.

DermTech currently has a sales force of 40 sales representatives, which it intends to increase to 75-80 for coverage of over 13,000 dermatology clinical professionals with an aim to achieve at least 10 percent market penetration, which translates to nearly 446,000 tests per year, with a $312 MM/year revenue potential as per company estimates.

The Company is using social and visual media channels to drive patient action and intends to explore emerging options such as telemedicine, home collection kits and partnerships with employee service providers, integrated networks and other telemedicine channels to drive future growth.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://dermtech.com/wp-content/uploads/MelRes2018RealWorldFe

No Comments