25 Oct 4 Growth Stocks to Consider for Your Investment Portfolio!

Technology Industry has been focused on leaving the COVID-19 pandemic behind, and marching ahead with its innovations and breakthroughs, be it critical security systems, innovative marketing solutions or cutting-edge data analytics and search technology.

We look at some technology companies that are impervious to the scare and offer a very attractive upside in the long run. These companies not only have an excellent potential for growth and returns but have major upcoming catalysts such as contract awards, new products, and services, growing client base or even global expansion plans lined up for 2021.

Information Services Group, Inc. (NASDAQ: III)

Market Cap: $368.32M; Current Share Price: 7.60 USD

Data by YCharts

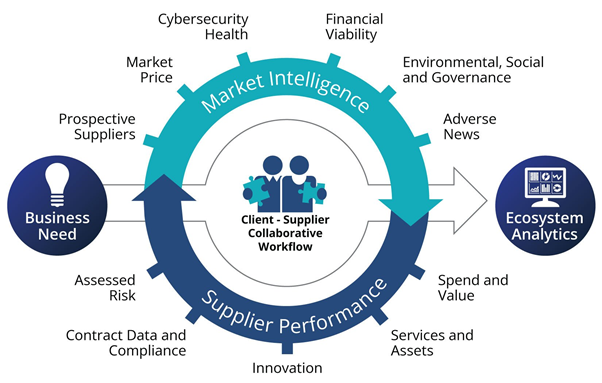

Information Services Group (ISG) is a premier technology research and advisory firm that provides digital transformation services to more than 700 blue chip clients including, including some of the topmost organizations in the world. The Company’s services include cloud and data analytics, automation, risk management, strategy and operations design and market intelligence among others. ISG offers these services to various entities across the globe such as public sector organizations and private corporations in the aerospace and defense, automotive, banking, and financial services, healthcare, retail, and telecommunication sectors to name a few.

Image Source: Company

The Company owns and operates multiple brands such as ISG INDEX, ISG Momentum, ISG ProBenchmark, ISG Relationship 360 (Research); ISG GovernX, ISG GovernX Contract Lifecycle, ISG GovernX – Spend Management (Third Party Management). ISG offers products such as ISG Inform (IT benchmarking solution), ISG Momentum Contract KnowledgeBase (a database of outsourcing contracts) and ISG GovernX – Risk Monitor (real-time supplier alerts) and ISG ProBenchmark (IT price benchmarking).

The advent of smartphones, the impact of the pandemic and increasing adoption of cloud storage solutions are compelling organizations to digitize their services, to cater to new-age customers, who rely greatly on online platforms for their needs. According to a report by IDC, the worldwide spending on digital transformation products and services is likely to reach $2.3 trillion in 2023, growing at a CAGR of 17.1% from 2019 to 2023.

An increasing number of organizations are now focusing on their digital customer experience, and are using big data analytics, to generate actionable insights that will lead to better customer understanding, improved engagement and loyalty. However, increasing concerns about data security and privacy, network vulnerability and challenges with integrating legacy systems with new age systems may hamper the growth and adoption of digital platforms. The evolution of technology is also contributing to the rising popularity of digitization, with Artificial Intelligence, Machine learning, IoT and blockchain simplifying the complexities of Digital Transformation.

To meet the growing demand for digitalization, the Company has created two solution areas namely, ISG Digital and ISG Enterprise that help companies in areas such as XaaS, cyber security, enterprise agility and transformation, global business operations, technology adoption and cost optimization.

VirTra, Inc. (NASDAQ: VTSI)

Market Cap: $93.46M; Current Share Price: 8.65 USD

Data by YCharts

VirTra, one of the first companies to foray into virtual reality, is a leader in simulation training. The Company delivers best-in-class firearms and use of force training for military and law-enforcement, educational and aerospace industries. The Company is leveraging its patented Threat-Fire® return fire device and the world’s first 300-degree small-arms simulator, to become the organization of choice for training needs across the globe.

The Company has an impressive 95 percent customer retention rate and has presence in over 40 counties across the world. The Company’s services include force training simulators, firearms training simulators, and driving simulators, with product offerings like the V-300 simulator, V-180 simulator, V-100, V-100 MIL and V-ST PRO. VirTra also provides a vehicle-based simulator namely VirTra Driving Sim and runs a Virtual Interactive Coursework Training Academy that addresses the requirements of departmental training for law enforcement agencies. The services can also be availed through a subscription program and can be customized through the V-Author software to suit the specific objectives of various organizations. In addition, the Company also offers Threat-Fire a return fire device and TASER, OC spray and low-light training devices.

Image Source: Company

VirTra can replicate real-life confrontations in a safe and cost-effective manner to train law-enforcement officers to de-escalate a situation effectively. The Company’s products offer an improvement over existing training methods that are either expensive, time-consuming, or ineffective in replicating real-life situations. At VirTra the training is done using realistic firearms parts, with weapons used every day by the trainee. The Company’s patented technology can generate adjustable electric impulse and provide skin-in-the game to test stress and physiological responses.

The Company is targeting a potential $650 million total addressable market, consisting of over 6500 U.S agencies. The current customer base of the Company includes AZ Dept. of Public Safety, Denver Police Dept, New Jersey Transit Police L.A. County Sheriff’s Dept. San Francisco Police Dept among others. VirTra has multiple competitive advantages over competitors such as far more realistic stimulators, superior training content library, patented products and consistent quality and customer service.

VirTra has built strategic partnerships with organizations such as Force Science Institute, Haley Strategic Partners and the National Sheriff’s Association. The Company’s strategy involves market expansion to newer territories, introducing new products and improving recurring revenue streams. STEP – Subscription Training Equipment and Partnership Program is the industry’s only subscription-based stimulator training program, which helps lower the barrier to entry for agencies.

Furthermore, the Company is targeting additional growth opportunities in Military and has engaged JL O’Connell & Associates to redouble its sales and marketing efforts. John Givens, a military simulation training expert, has been added to the board of directors in November 2020.

Funko, Inc. (NASDAQ: FNKO)

Market Cap: $688.12M; Current Share Price: 17.47 USD

Data by YCharts

Funko offers a range of lifestyle products in the pop culture consumer landscape. The Company’s products consist of vinyl figures, action toys, plush, apparel, board games, housewares and accessories. Funko owns and operates brands such as Loungefly, Funko Games and Funko Animation Studio and has presence in more than 25000 retail stores such as Walmart, Carrefour, Gamestop, PRIMARK, Target among others in Everett, Washington and Hollywood, California.

As of December 31,2020, the Company had over 1000 active licensed properties with more than 200 content providers and has brought to the market more than 600 million pop culture products. Some of Funko’s licensing partnerships include WB, Marvel, Disney, LucasFilms ltd to name a few.

The Company offers pop culture paraphernalia from Movies, TV, Music, Sports, Anime and Games. Funko has built a robust distribution network with diversification into Mass retailers like TARGET, Walmart, and Primark; Specialty stores like BOXLUNCH, GameStop and Hot Topic and Digital platforms like Amazon, Walmart.com and Funko.com. The Company has been able to achieve a 10 percent penetration in direct to customer sales in 2020 and is working on further enhancing its digital opportunities.

Funko’s target customers include all age groups across demographics, be it children, young adults, adults or senior citizens and its products appeal to all forms of buyers, from occasional enthusiasts to serious collectors. The Company connects with its customers through digital platforms (Funko.com), pop culture events (FUNKON Summer), social media (Facebook, Instagram, Twitter) and pop culture events (Comic Con). The Company aims to diversify its revenue streams, extend its footprint in the international markets and focus on speeding up its direct to customer initiatives through creating customer connect and driving traffic and conversion to its ecommerce websites.

The Company has joined the NFT bandwagon in 2021, with the launch of POP! Digital featuring Teenage Mutant Ninja Turtles.

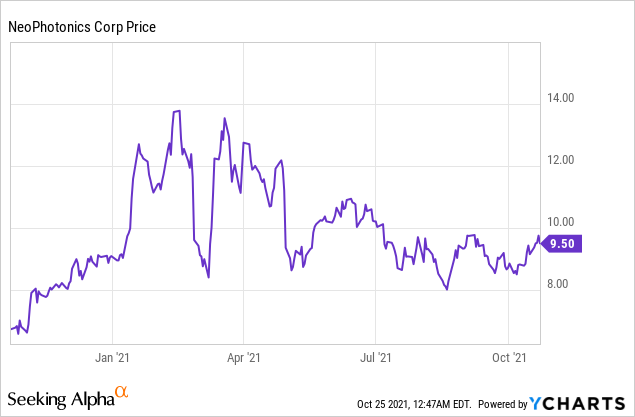

NeoPhotonics Corp (NYSE: NPTN)

Market Cap: $495.76M; Current Share Price: 9.50 USD

Data by YCharts

NeoPhotonics, formerly known as NanoGram, designs and manufactures hybrid photonic integrated optoelectronic modules and subsystems for high-speed communication networks. The Company’s products deliver reliable, high performance and highly efficient modules for bandwidth intensive, highest speed over distance applications, which require data rates of 200G, 400G, 600G and 800G (Upcoming) per second on a single wavelength. The Company addresses the needs of companies engaged in cloud computing, storage, data centers and telecommunication networks.

Products offered by the Company include lasers, coherent transceivers, wavelength management products and high-speed drivers integrated circuits, in addition to a plethora of services for various industries namely communications, data center, silicon photonics and 5G wireless solutions among others.

Image Source: Company

The Company reported revenues of $371M in 2020, with over 97 percent growth in 400G, while its YTD 2021 revenues grew by over 100 y-o-y for 400G. NPTN has built a strong intellectual property rights portfolio with over 500 issued patents, which it intends to leverage to create a stronghold in the emerging market for high-speed networks.

The Company is focused on three main verticals namely cloud, content providers and edge-cloud catering to the demand for 400ZR and 400ZR+ Based Networks by entities like Google, Amazon, Microsoft, Netflix, Autonomous vehicle manufacturers. NPTN is the only supplier with vertically integrated InP, SiP and RF-ICs, which can act as a one-stop shop for all 400G+ coherent pluggable module applications.

NTPN is gearing up for the introduction of Coherent pluggable in 800G router ports, which are expected to be introduced in 2024/2025. The Company’s silicon photonics technology can easily be adopted from 400ZR to 800ZR pluggable module, through extension of its mature 400ZR COSA. The Company is upbeat about multiple growth drivers such as increased bandwidth deployment, the growing adoption by LiDAR players and most importantly a potential $3 billion market growth opportunity in the Cloud data center and other cloud services.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://investor.funko.com/news-and-events/presentations/default.aspx

https://ir.neophotonics.com/static-files/2ba1e6af-afe8-4530-9a6d-d6cb9bf9c0be

No Comments