07 Dec Richardson Electronics: Poised to Engineer the Future?

Richardson Electronics, Ltd. (NASDAQ: RELL), a leading global manufacturer of engineered solutions such as the power grid and microwave tubes, power conversion, RF, and microwave components, announced a global distribution agreement with Gallium Semiconductor.

Headquartered in Singapore, Gallium Semiconductor is an innovative supplier of RF Gallium Nitride (GaN) semiconductor solutions for 5G communication networks as well as aerospace, defense, industrial, scientific, and medical applications. The agreement aligns with both companies’ commitment to providing high performing, high efficiency RF GaN products.

Greg Peloquin, Executive Vice President of Richardson Electronics, commented,

“Gallium Semi’s portfolio of GaN products offer exceptional performance for RF power applications. We are excited to work with Gallium Semi to bring these products to our customers worldwide.”

Richardson Electronics serves customers in the alternative energy, healthcare, aviation, broadcast, communications, industrial, marine, medical, military, scientific, and semiconductor markets. The Company provides solutions and adds value through design-in support, systems integration, prototype design and manufacturing, testing, logistics, and aftermarket technical service and repair through its global infrastructure.

Richardson Electronics, Ltd. (NASDAQ: RELL)

Market Cap: $355.17M; Current Share Price: $25.55

Data by YCharts

We take a comprehensive look at the Company through SWOT analysis.

Strength

The Company has demonstrated robust growth supported by strong core business, 75 years of engineering capabilities, and global platform.

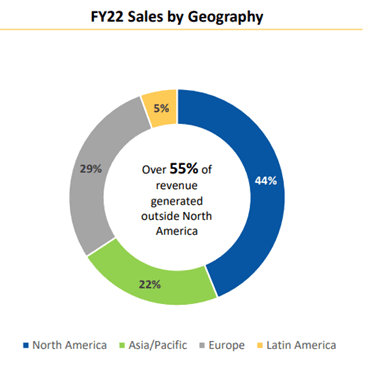

Location wise, the Company’s operations are well diversified in the major geographic regions of North America, Asia/Pacific, Europe and Latin America. The organization benefits from a sophisticated global infrastructure, with more than 60 sales offices & stocking locations, global field engineering support including 75 RF and Microwave and CT engineers for leading technology suppliers, as well as service and repair supported by local presence.

Image Source: Company

Additionally, the Company offers global logistics and supply chain facilities. It is an importer of record in 24 countries with international distribution hubs in North America, Asia, and Europe, and can conduct transactions in local language and currency.

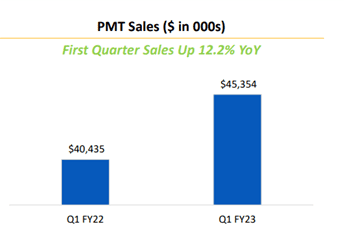

Operation wise, the Company has four segments – their Power and Microwave Technologies (PMT) segment combines their core engineered solutions capabilities, power grid and microwave tube business with new disruptive RF, Wireless and Power technologies. In Q1 FY23, the Company saw 12.2% YoY increase in net sales in this segment due to robust growth in the semi-wafer fabrication industry. The semiconductor capex cycle is expected to remain strong over the near-term, and Richardson Electronics seems prepared to profit from the opportunity. Moreover, this segment is also poised to benefit from high growth in demand for Electron Device Group, and growth related to the 5G industry.

Image Source: Company

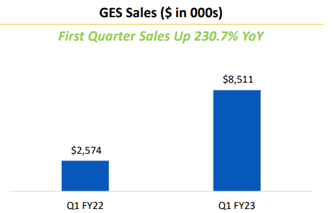

Green Energy Solutions (GES) combines their key technology partners and engineered solutions capabilities to design and manufacture key products for the fast-growing energy storage market and power management applications. In Q1 FY23, the Company saw an increase of 230.7% in net sales compared to Q1 FY22 due to growth in ULTRA3000 and other related product sales into the wind turbine industry and from customers manufacturing synthetic diamonds. The company benefitted in this segment due to increase in sales into the Electric Vehicle market – this is slated to continue in the near future.

Image Source: Company

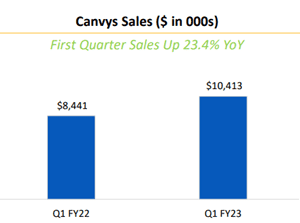

Canvys provides customized display solutions serving the corporate enterprise, financial, healthcare, industrial and medical original equipment manufacturers markets. 2,000+ global blue-chip customers rely on Canvys to supply leading display solutions for their unique needs. In Q1 FY23, the Company saw an increase of 23.4% in net sales compared to Q1 FY22 due to strong global customer demand. Going forward, increasing demand for blue-chip medical and industrial (OEM Original Equipment Manufacturers) systems is expected to continue to drive growth in this segment.

Image Source: Company

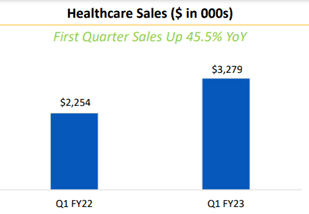

Healthcare manufactures, repairs, refurbishes and distributes high value replacement parts and equipment for the healthcare market including hospitals, medical centers, asset management companies, independent service organizations and multi-vendor service providers. The Company has invested over $35 million in its Healthcare SBU, creating a best-in-class, value-added CT Tube and CT refurbishment platform. Richardson Healthcare Q1 sales were up 45.5% YoY due to higher demand in all product lines. It is expected that additional tubes will drive revenue growth and margin improvement as factory utilization rate improves, more so since the Company has received certification and license to sell ALTA750® CT Tube in Canada. There is a $10 billion estimated global opportunity for aftermarket diagnostic imaging parts and service and Richardson Electronics seems well poised to take advantage of the same.

Image Source: Company

Weakness

The Company maintains significant inventories in an effort to ensure that customers have a reliable source of supply. The market for many products changes rapidly resulting from the development of new technologies, evolving industry standards, frequent new product introductions by some suppliers and changing end-user demand, which can contribute to the decline in value or obsolescence of inventory.

The Company does not have many long-term supply contracts with their customers. If they fail to anticipate the changing needs of customers or do not accurately forecast customer demand, customers may not place orders, and the Company may accumulate significant inventories of products which may result in a decline in the value of the inventory.

Moreover, products are currently produced by a relatively small number of manufacturers. One of the suppliers represented 11% of the total cost of sales. Hence, the Company’s success depends, in large part, on maintaining current vendor relationships and developing new relationships.

The Company sources and sells products worldwide, hence the business is subject to risks associated with doing business internationally. These risks include the costs and difficulties of managing foreign entities, limitations on the repatriation and investment of funds, cultural differences that affect customer preferences and business practices, unstable political or economic conditions, geopolitical risks and demand or supply reactions from events that could include political crises and conflict, trade protection measures and import or export licensing requirements, monetary policy, inflation, economic growth, recession, commodity prices, currency volatility, currency controls, and changes in tax laws.

Opportunity

Richardson Electronics rapid expansion in new markets and introduction of new applications seem to support significant expansion to the Company’s growth opportunities.

The Company believes that green solutions are key to their long-term growth strategy. They have an expanding line of energy storage products for various green energy applications, and plan to announce several new products in the second half of FY23.

Few new product launches deserve special mention, such as the Company’s lithium iron phosphate battery modules for EV-electric locomotives. This product not only replaces diesel electric engines, but it also saves fuel and reduces emissions, and at the same time requires less maintenance. The design wins with Progress Rail/Caterpillar and a multi-million dollar order has already been booked in February 2022.

There is also the BSE Gen-Start Growth Opportunity which leverages ultracapacitor expertise to create replacement modules for lead acid batteries in generators. This product launch is expected in CY22, with the initial application focused on wireless base stations.

In 2019, there were 395,562 cell sites, and approximately 59,000 or 15% had existing generators. Major wireless carriers expect to add 25,000-30,000 base stations in North America between 2021-2025. Hence, in entirety, for the Company, wireless base stations represent a Serviceable Available Market of $42 million with target customers such as AT&T, T-Mobile, Verizon.

Critical facilities support additional applications of the BSE Gen-start product. In the U.S., hospitals total 6,090 while fire Stations/municipalities total 58,150 – many of these facilities may use more than one application per site. Hence, the Serviceable Available Market with respect to critical facilities stands at about $23 million.

In effect, the long-term Total Addressable Market for the BSE Gen-Start product alone is estimated to be around $250 million, and the Company seems prepared to benefit from the same.

Threat

The Company’s overall competitive position depends on a number of factors including price, engineering capability, vendor representation, product diversity, lead times and the level of customer service. More specifically, the Company faces competition from a limited number of Chinese manufacturers whose ability to produce vacuum tubes has progressed over the past several years.

Canvys faces many competitors in the markets that the Company serves. Increased competition may result in price reductions, reduced margins or a loss of market share, any of which could materially and adversely affect the business, operating results and financial condition.

Key Takeaways:

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://www.sec.gov/ix?doc=/Archives/edgar/data/355948/000156459022027238/rell-10k_20220528.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/355948/000156459022033665/rell-10q_20220827.htm

https://www.rell.com/webfoo/wp-content/uploads/2022/10/RELL-Q1FY23-Investor-Presentation-Final.pdf

No Comments