09 Oct NuScale Power: A “Powerful” Reservoir of Carbon-Free Energy

NuScale Power Corporation (NYSE: SMR) provides proprietary and innovative advanced small modular reactor (SMR) nuclear technology to help power the global energy transition by delivering safe, scalable, and reliable carbon-free energy.

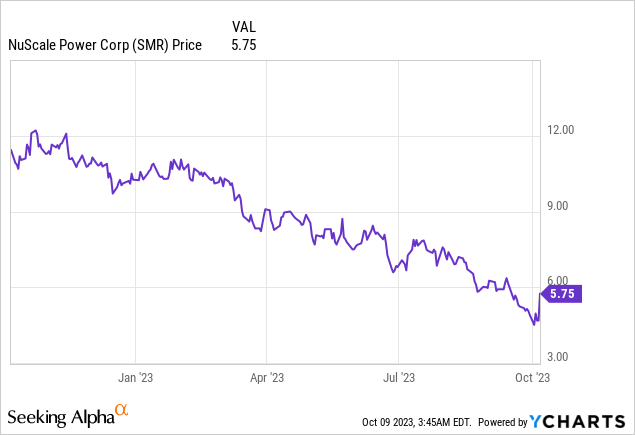

NuScale Power Corporation (NYSE: SMR)

Market Cap: $428.28M; Current Share Price: 5.75 USD

Data by YCharts

The Company and its Products

NuScale’s core technology, the NuScale Power Module (NPM), is a small, safe, pressurized water reactor that can generate 77 megawatts of electricity (MWe) or 250 megawatts thermal (gross). It is premised on well-established nuclear technology principles, focusing on integrating components, simplifying or eliminating systems, and using passive safety features.

Image Source: Company

The Company’s technology creates a safe and highly reliable power plant suitable to be sited near where electricity or process heat is needed. NuScale’s flagship VOYGR power plant is a scalable design that can accommodate up to 12 NPMs, resulting in a total gross output of 924 MWe. NuScale expects the first VOYGR power plant to be operational in 2029.

Since 2007, NuScale and the Department Of Energy (DOE) have invested over $1.4 billion to develop NPM and VOYGR power plant technology. The Company has been issued 469 patents globally, with 186 pending applications.

In September 2020, NuScale’s 12-module VOYGR-12TM design (currently approved for 160 million watts of thermal power (MWt) or 50 MWe per NPM) became the first and only SMR to receive a U.S. Nuclear Regulatory Commission (NRC) Standard Design Approval (SDA) from the NRC. The NRC’s final rulemaking approving NuScale’s design certification was effective in February 2023. The approval was a critical milestone that allowed customers to move forward with plans to develop VOYGR power plants, knowing that safety aspects of the NuScale design are NRC-approved.

In December 2022, NuScale applied for an SDA to increase NPM power from 50 MWe to 77 MWe (160 MWt to 250 MWt) per module, which it expects to receive in 2024. The Company expects to be ready to deliver modules to customers by 2028.

In addition to the sale of NPMs and VOYGR power plant designs, NuScale will offer a diversified suite of services throughout the development and operating life of the power plant. Its services include licensing support, testing, training, fuel supply services, and program management. The Company anticipates that its service offering will have high penetration rates across its customer base and will provide consistent, recurring revenues throughout the life of the VOYGR power plant. NuScale expects service revenue to begin approximately eight years before a power plant’s commercial operation date and to extend throughout the life of the power plant.

Below, we will discuss the critical rationale for covering this Company.

- Increasing Global Demand for Carbon-Free Energy

According to BloombergNEF’s New Energy Outlook 2021 “Red Scenario” (NEO 2021), which includes SMR capacity as part of the pathway to global net-zero carbon emissions, global power consumption is expected to increase 191% between 2020 and 2040, requiring approximately 22,000 gigawatts (GW) of additional generating capacity.

Today, the energy and power markets are changing as they shift from fossil fuels to carbon-free sources. Technological, economic, regulatory, social, and investor pressures lead the drive to decarbonize electricity and other sectors, such as transportation (electric vehicles) and buildings (electric heating). As such, most required global capacity additions, including replacing existing carbon-intensive power generation, are expected to come from carbon-free sources.

Image Source: Company

In fact, according to the NEO 2021, approximately 16,000 GW of carbon-free generation capacity additions are required globally through 2040 to meet domestic and international climate goals.

Although critical in helping meet climate goals, renewables, such as solar, wind, and hydroelectric, are constrained due to intermittency, seasonality, and issues associated with land use and grid interconnections. According to the U.S. Energy Information Administration, the average 2020 capacity factor (the ratio of actual power output over generation capacity) for solar, wind, and hydro was 24.2%, 35.3%, and 40.7%, respectively, compared to 92.4% for nuclear. In most regions globally, flexible and dispatchable sources, such as long-duration storage, geothermal, gas, coal with carbon capture, and nuclear, will be essential. Among these sources, SMRs represent an attractive option based on their near-term viability, competitive costs, carbon-free emissions, and reliability.

Moreover, SMRs have several inherent advantages over traditional large-scale nuclear and other carbon-free power generation, including simplicity of design and enhanced safety features. They are more economical than conventional large-scale nuclear facilities with high upfront capital costs and are more modular and scalable. Finally, SMRs have a comparatively smaller footprint – NuScale’s SMR uses up to 99% less land per MWh than wind and solar projects.

Image Source: Company

It is interesting to note that on December 8, 2021, President Biden signed an executive order mandating all electricity procured by the government be 100% carbon pollution-free by 2030, including at least 50% from around-the-clock dispatchable generation sources. The order also requires that federally-owned buildings produce no net emissions by 2045 and that each federal agency achieve 100% zero-emission vehicle acquisitions by 2035. Additionally, on November 15, 2021, the U.S. Infrastructure Investment and Jobs Act was signed into law, which includes $65 billion in funding for power and grid investments – this includes investments in grid reliability and resiliency as well as clean energy technologies such as carbon capture, hydrogen and advanced nuclear, including SMRs.

Internationally, more than 190 countries and the European Union have signed the Paris Agreement, which seeks to keep the rise in mean global temperature below 2°C above pre-industrial levels. More than 130 countries, including China and the United States – the countries with the first and second largest CO2 emissions globally – have now set, or are considering setting, a target of reducing net emissions to zero by mid-century.

In other words, there is an excellent upcoming opportunity for carbon-free power providers. As an SMR nuclear technology provider, NuScale is poised to seize the forthcoming global opportunity.

- Robust and Diversified Global Customer Pipeline

NuScale’s potential customers are a mix of domestic and international governments, political subdivisions, public and investor-owned utilities, state-owned enterprises, coal plant refurbishment, process heat applications, private sector and commercial nuclear power producers, generation and transmission cooperatives and industrial companies in need of carbon-free, reliable energy.

Image Source: Company

Carbon-Free Power Project: The Company’s first contract to deploy a VOYGR power plant is with UAMPS. UAMPS is expected to deploy a six-module (462 MWe) VOYGR-6 power plant as part of its CFPP located at the Idaho National Laboratory near Idaho Falls, Idaho. Construction at the CFPP is expected to begin in 2025, and the plant will be operational in 2029.

RoPower Project: In November 2021, NuScale signed a teaming agreement with S.N. Nuclearelectrica to advance the delivery of its technology in Romania as early as 2029.

Image Source: Company

The Company’s sales pipeline currently includes over 120 active customer opportunities and 17 signed Memoranda of Understanding (MOUs) globally.

To date, the DOE has granted NuScale four separate cost-share awards totaling more than $656 million, most recently, $350 million as part of a 5-year, $700 million 50/50 cost-share award granted in 2020. The Company also benefits from a global network of strategic investors and supply chain partners that should be integral in bringing NuScale’s technology to market worldwide. Fluor, a leading global engineering, procurement, and construction (EPC) firm, is the majority stockholder in NuScale and collaborates with NuScale on plant standard design and providing EPC services to NuScale’s customers. Other strategic investors and supply chain partners include Doosan, Sargent & Lundy, LLC; Sarens; JGC; IHI; GS Energy Corporation; and Samsung C&T.

Thus, NuScale has a robust and diversified global customer pipeline demonstrating the demand for its offerings and can help it create and grow a solid revenue base. In addition, the Company’s prestigious clientele and partnerships also foster faith and trust in the Company to create the opportunity for more future alliances.

- Financial Performance

It is important to note that the Company has yet to generate any material revenue. All revenue generated to date came from engineering and licensing services provided to potential customers. However, due to those Front-End Engineering and Design (FEED) services, NuScale expects to generate significant revenue from selling NPMs. The Company also expects to generate revenue by providing critical services, such as start-up and testing and nuclear fuel and refueling services, over the life cycle of each power plant.

For Q2 FY23, the Company reported revenue of $5.8 million and a net loss of $29.7 million compared to revenue of $2.7 million and a net loss of $21.4 million for Q2 FY23, representing a 114.8% increase in revenue.

For FY22, the Company had reported revenue of $11.8 million and a net loss of $141.6 million, compared to revenue of $2.9 million and a net loss of $102.5 million for FY21, representing about a 4x increase in revenues YoY.

At the end of Q2 FY23, NuScale had cash and cash equivalents of $214.6 million ($60.2 million of which is restricted) and no debt, reflecting a solid balance sheet.

The key takeaways regarding NuScale’s future performance are given below

- New revenue contracts are expected to be accretive and lead to incremental customer growth

- NuScale’s strong cash profile – with no debt – provides financial flexibility.

Recent Developments

Important updates regarding progress on committed customers’ projects –

Carbon Free Power Project

House and Senate appropriations bills fully fund FY24 CFPP needs. The Company has submitted Limited Work Authorization to perform early construction activities to the U.S. Nuclear Regulatory Commission – an SMR industry first. Currently, NuScale is developing a Class 2 cost estimate and making efforts to increase subscriber commitments.

RoPower Project

NuScale is in the late stages of Phase 1 Front-End Engineering and Design (FEED) work. Public-private commitments have been made by the U.S., Japan, South Korea, and the U.A.E. of up to $275m to support Phase 2 work, and the first international Energy Exploration Center opened in Bucharest to further develop Romania’s nuclear workforce.

Additionally, NuScale is teaming up with Nucor Corporation to explore deploying NuScale’s VOYGR™ SMR power plants to provide baseload electricity to Nucor’s electric arc furnace steel mills. Nucor is North America’s largest and most diversified steel and clean steel products company. NuScale is exploring the possibility of an expanded partnership where Nucor would supply NuScale with its net-zero steel products for NuScale projects.

Risks

NuScale is subject to several risks – for example, the Company has not yet commercialized or sold NPMs, and several factors could prevent, delay, or hinder commercialization. Moreover, competitors in China and Russia currently operate commercial SMRs and may have advantages in marketing their SMRs to potential customers.

It is important to note that the market for SMRs has yet to be established and may not achieve the growth potential expected or may grow more slowly than expected. Finally, the cost of electricity generated from nuclear sources or NuScale’s NPMs may be low-competitive with other electricity generation sources in some markets, which could materially and adversely affect its business.

Conclusion

As discussed, NuScale is the only Company to receive a U.S. Nuclear Regulatory Commission (NRC) Standard Design Approval (SDA) from the NRC for its SMR. The Company has been issued 469 patents globally for its innovative technology, with an additional 186 patent applications currently pending. The Company already has two commercial commitments – a Carbon Free Power Project in Idaho and RoPower in Romania, and more than 120 potential customers in the pipeline.

Thus, NuScale seems poised to benefit from the expansion of the global carbon-free energy industry. However, the Company has not commercialized or sold a single NPM, and the market for SMRs generating nuclear power has yet to be established. Hence, investors must move ahead cautiously.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://www.nuscalepower.com/-/media/nuscale/pdf/investors/2023/smr-2q23-press- release.pdf

https://www.nuscalepower.com/-/media/nuscale/pdf/investors/2023/smr-2q23-press-release.pdf

https://www.nuscalepower.com/-/media/nuscale/pdf/investors/2022/smr-4q22-press-release.pdf

https://www.nuscalepower.com/-/media/nuscale/pdf/investors/2022/smr-4q22-presentation.pdf

https://www.sec.gov/ix?doc=/Archives/edgar/data/1822966/000182296623000200/smr-20230630.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1822966/000182296623000059/smr-20221231.htm

No Comments