29 Jan Veeco: Charging Ahead in the Semiconductor Industry

Veeco Instruments Inc. (NASDAQ: VECO) is an innovative manufacturer of semiconductor process equipment. The Company’s laser annealing, ion beam, chemical vapor deposition (CVD), metal-organic chemical vapor deposition (MOCVD), single wafer etch & clean, and lithography technologies are integral in fabricating and packaging advanced semiconductor devices.

Veeco Instruments Inc. (NASDAQ: VECO)

Market Cap: $1.89B; Current Share Price: 32.45 USD

Data by YCharts

The Company and its Products

Veeco is a manufacturer of advanced semiconductor process equipment that solves an array of challenging materials engineering problems for its customers. The Company’s comprehensive collection of ion beam, laser annealing, metal-organic chemical vapor deposition (MOCVD), advanced packaging lithography, single wafer wet processing, molecular beam epitaxy (MBE), and atomic layer deposition (ALD) technologies play an integral role in the fabrication of critical devices that are enabling the 4th industrial revolution of all things connected.

Such devices include leading advanced node application processors for mobile devices, thin film magnetic heads for hard disk drives in data storage, photonics devices for 3D sensing, advanced displays, and high-speed data communications, and radio frequency (RF) filters and power amplifiers for fifth generation (5G) networks and mobile electronics.

Image Source: Company

In close partnership with customers, Veeco combines decades of applications and materials know-how with leading-edge systems engineering to deliver high-volume manufacturing solutions with competitive ownership costs. Serving a global and highly interconnected customer base, the Company has comprehensive sales and service operations across the Asia-Pacific, Europe, and North America regions to ensure real-time close collaboration and responsiveness.

We will discuss the critical rationale for covering this Company.

- Vast Market Opportunity

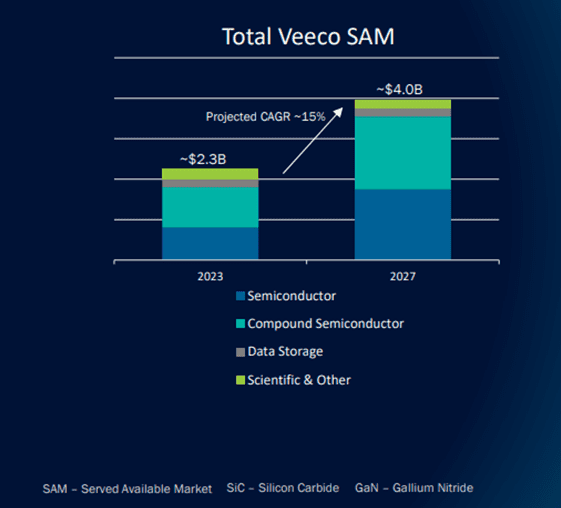

Customers purchase Veecos’ products in the following four end markets: 1) Semiconductor, 2) Compound Semiconductor, 3) Data Storage, and 4) Scientific & Other.

By 2027, Veeco’s Served Available Market may grow to about $4.0 billion from about $2.3 billion in 2023 – this represents a CAGR of about 15%.

Image Source: Company

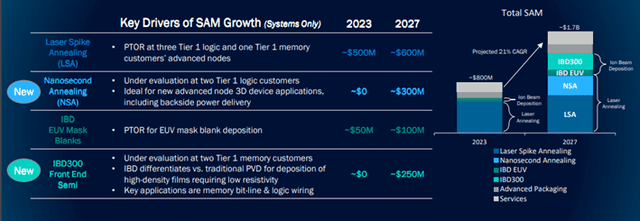

The Company’s semiconductor opportunity is expected to grow to about $1.7 billion, driven by Laser Annealing.

Image Source: Company

At the same time, Compound Semiconductor’s opportunity is expected to grow to about $1.8 billion, driven by Epitaxy equipment for Power Electronics (SiC & GaN) and MicroLEDs.

Image Source: Company

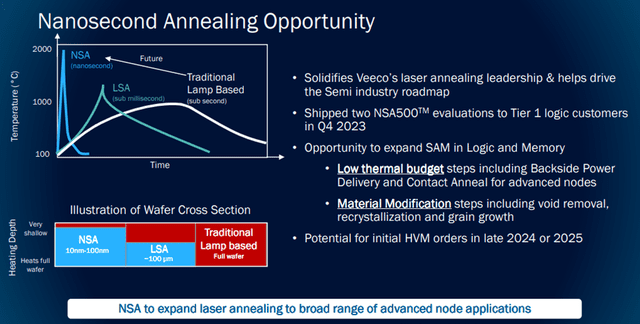

Overall, Veeco seems well-positioned for immediate and long-term growth. Over the short term, the semiconductor business may increase by about 10% in 2023 despite declining Wafer Fab Equipment (WFE) spending. Semiconductor growth is well positioned to outperform WFE growth, driven by new and existing products (LSA, NSA, IBD300)

At the same time, Laser Annealing is expanding to new markets and applications in logic and memory.

Image Source: Company

In other words, there is a significant market opportunity, and Veeco is well prepared to capitalize on it.

- Solid Business Foundation

The Company’s business foundation rests on the following five pillars:

Image Source: Company

The pillars above provide a solid foundation for the Company, based on which Veeco can scale new heights.

- Financial Performance

For Q3 FY23, Veeco reported revenue of $177.4 million, compared with $171.9 million in the same period last year. GAAP net income was $24.6 million, or $0.42 per diluted share, compared with $15.0 million, or $0.27 per diluted share in the same period last year.

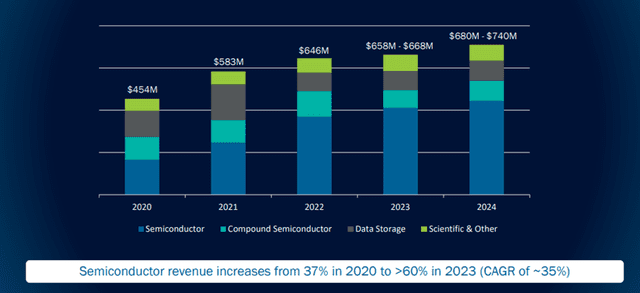

For FY22, Veeco reported revenues of $646.1 million, compared with $583.3 million in the same period last year. GAAP net income was $166.9 million, or $2.71 per diluted share, compared with $26.0 million, or $0.49 per diluted share in the same period last year. During FY22, the Company achieved record revenue with semiconductor products led by increased traction in laser annealing for advanced and trailing nodes.

Image Source: Company

The Company expects revenue for Q4 FY23 to be between $165 million and $175 million, compared to prior guidance of $155 million to $175 million. FY23 revenue is now expected to be in the range of $658 to $668 million.

GAAP earnings per diluted share for Q4 FY23 are expected to be between $0.27 and $0.32, while non-GAAP diluted EPS is expected to be between $0.40 and $0.45, compared to prior guidance of $0.35 to $0.45. FY23 GAAP diluted loss per share is expected in the range of $(0.70) to $(0.59), while non-GAAP diluted earnings per share are expected in the range of $1.58 to $1.65.

Veeco’s initial 2024 outlook for revenue is between $680 to $740 million, and Non-GAAP earnings per diluted share between $1.60 to $1.90

As is evident from the above graph, Veeco’s revenues have grown significantly since FY20, and the trend is expected to continue in FY2024.

Risks

The Company’s revenues are expected to grow in FY24 and beyond due to substantial market opportunity. Nevertheless, Veeco is exposed to certain risks. Firstly, the Company faces significant global competition, which may increase as specific markets evolve. Some of Veeco’s competitors have greater financial, engineering, manufacturing, and marketing resources than Veeco. Other competitors are located in regions with lower labor costs and other reduced operation costs.

Secondly, each of the industries in which Veeco operates is subject to rapid technological change. The Company’s ability to remain competitive depends on its ability to enhance existing products, develop and manufacture new products in a timely and cost-effective manner, and accurately predict technology transitions. Veeco’s performance may be adversely affected if it cannot accurately predict evolving market trends and related customer needs and effectively allocate resources among new and existing products and technologies.

Conclusion

Veeco’s market opportunity is expected to grow from $2.3 billion in FY23 to about $4 billion in FY27. Since FY20, the Company has steadily increased revenues. Its semiconductor revenue has grown at a CAGR of about 35% from FY20 to FY23. In 2023 and beyond, the semiconductor business and Laser Annealing are expected to expand further, making the Company an exciting watch.

Nevertheless, the Company faces tough competition and operates in an industry affected by rapid technological change, which may affect its future performance. Hence, potential investors must proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://www.sec.gov/ix?doc=/Archives/edgar/data/103145/000155837023017774/veco-20230930x10q.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/103145/000155837023001744/veco-20221231x10k.htm

Sorry, the comment form is closed at this time.