26 Feb Shockwave: Transforming Cardiovascular Disease Treatment

Shockwave Medical, Inc. (NASDAQ: SWAV) is a medical device company focused on developing products to transform how calcified cardiovascular disease is treated.

Shockwave Medical, Inc. (NASDAQ: SWAV)

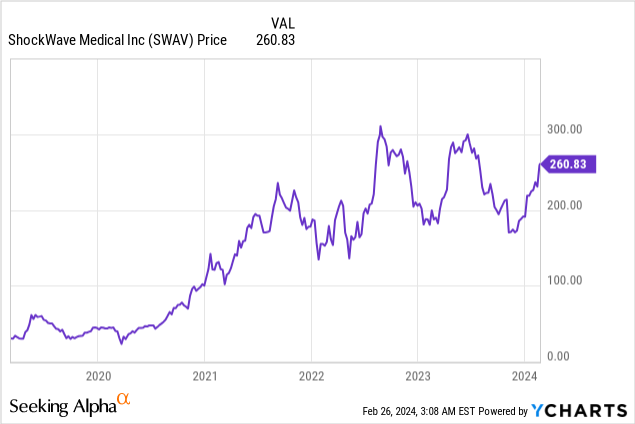

Market Cap: $9.62B; Current Share Price: 260.83 USD

Data by YCharts

The Company and its Products

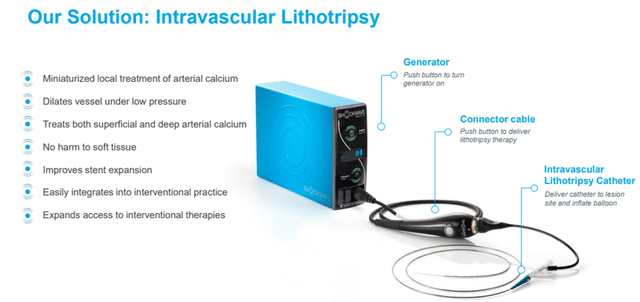

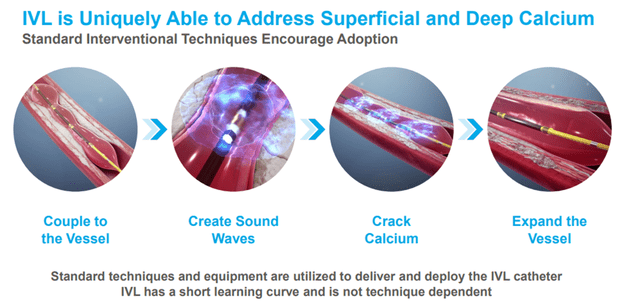

Shockwave aims to establish a new standard of care for treating calcified cardiovascular disease (atherosclerosis) through its differentiated and proprietary local delivery of sonic pressure waves, called intravascular lithotripsy (IVL).

Image Source: Company

The IVL system is a minimally invasive, easy-to-use, and safe way to improve outcomes for patients with calcified cardiovascular disease.

Image Source: Company

Shockwave’s IVL catheters are cleared or approved for use in several countries, and development programs are underway to expand indications and geographies.

The Company is currently selling the following products in countries where it has applicable regulatory approvals:

Products for Treatment of Peripheral Artery Disease (PAD)

Product for the Treatment of Coronary Artery Disease (CAD)

The Company’s differentiated range of IVL catheters enables the delivery of IVL therapy to diseased vasculature throughout the body for calcium modification. Shockwave’s IVL catheters resemble a standard balloon angioplasty catheter, the device most commonly used by interventionalists, and this familiarity makes the IVL System easy to learn, adapt, and use daily.

We will discuss the rationale for covering this Company.

- Large Market Opportunity

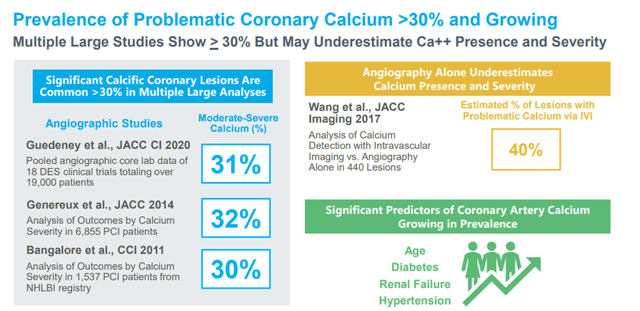

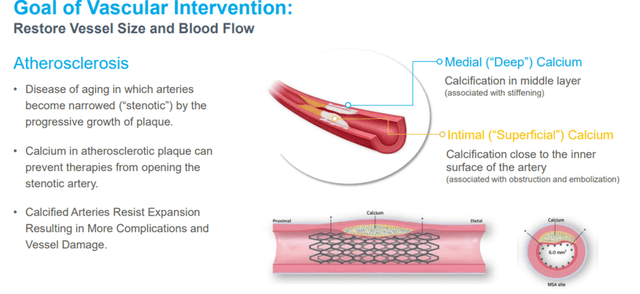

Atherosclerosis is a common disease of aging in which arteries become narrowed (stenotic), and the progressive growth of plaque reduces the supply of oxygenated blood to the affected organ. Atherosclerotic plaque comprises fibrous tissue, lipids (fat), and, when it progresses, calcium. This calcium is present both deep within the artery’s walls (deep or medial calcium) and close to the inner surface of the artery (superficial or intimal calcium).

Image Source: Company

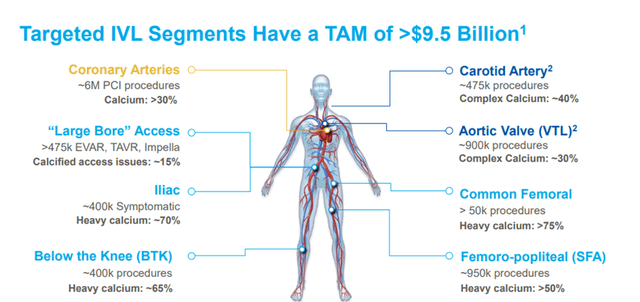

The first two indications that the IVL System addresses are PAD, the narrowing or blockage of vessels that carry blood from the heart to the extremities, and CAD, the narrowing or blockage of the arteries that supply blood to the heart. In the future, there is the potential treatment of Aortic Stenosis (AS), a condition in which the heart’s aortic valve becomes increasingly calcified with age, causing it to narrow and obstruct blood flow from the heart.

The market opportunity for IVL in treating PAD and CAD can generally be defined as interventional procedures performed to treat those diseases where severe or moderate arterial calcium is present.

Image Source: Company

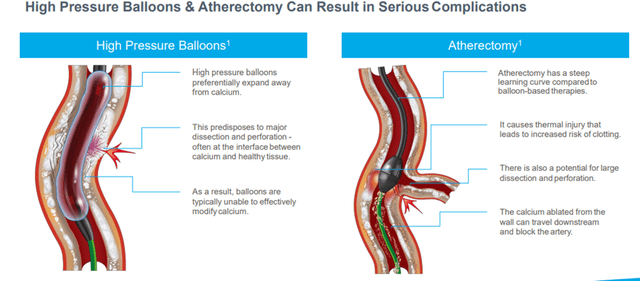

IVL is preferable to current treatment options such as high-pressure balloons and atherectomy due to the risks posed by these technologies.

Image Source: Company

In addition, IVL is utilized in so-called “large bore” endovascular procedures such as transcatheter aortic valve replacements (TAVR) and endovascular aortic aneurysm repair (EVAR) to treat calcified arteries along the access route, typically the common femoral or iliac arteries, where calcification can hinder the advancement of large-sized sheaths required to deliver these large-sized heart valves or endovascular grafts.

The number of interventional procedures and prevalence of severe or moderate calcium varies by arterial segment, but the aggregate addressable market for IVL is estimated to be over $9.5 billion.

Image Source: Company

The Company is currently working to develop an IVL catheter that can safely and effectively treat patients with AS. If successful, this represents a potential total addressable market of over $3 billion for the IVL System to treat AS.

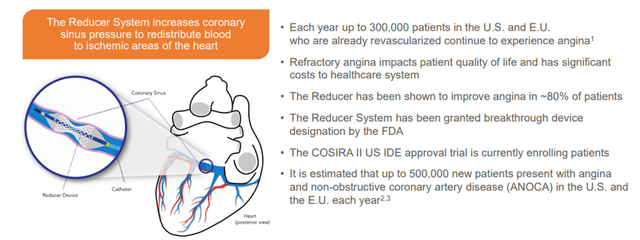

Shockwave is also developing the Reducer System to address another significant unmet need for Refractory Angina treatment, representing a multi-billion dollar TAM.

Image Source: Company

Overall, Shockwave’s TAM has expanded from $6 billion at its 2019 IPO to about $14.5 billion – this provides the Company with significant opportunity for long-term growth.

- Effective Growth Strategy

The Company has based its growth strategy on the following four pillars:

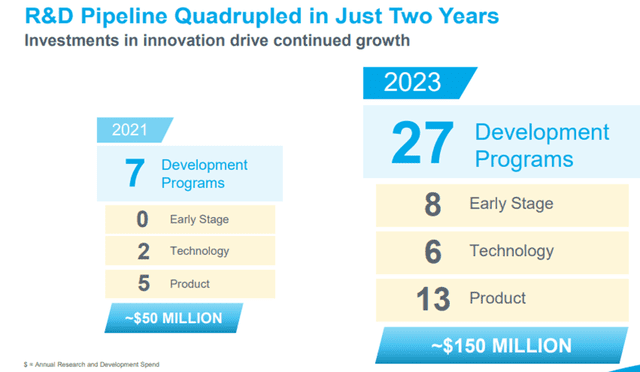

- Research and Development

Shockwave has invested in research and development that advances its IVL Technology and related technologies to expand and improve upon existing product offerings.

Image Source: Company

- Manufacturing and Operational Excellence

The manufacturing of IVL catheters is principally done at Shockwave’s facilities in Santa Clara, California, except that a portion of the demand for certain catheters is manufactured by a third-party contract manufacturer in Costa Rica.

The Company has approximately 1,500 employees, and its lean manufacturing process is expected to drive margin expansion. Shockwave uses contract manufacturing to enhance capacity and efficiency. It has about 370 operations employees, a robust IP portfolio of 176 issued, and 80 pending patents.

Shockwave’s rigorous quality control management programs have earned it several quality-related manufacturing designations. The Company’s manufacturing facilities comply with the International Organization for Standardization (ISO) 13485:2016. In 2014, Shockwave achieved compliance with the European Union’s Medical Device Directive (93/42/EEC) (the MDD). In January 2021, its quality system was successfully audited and deemed compliant with the EU’s new Medical Devices Regulation (Regulation 2017/745) (the MDR), and the Company received its first device approval under the MDR for our C2+ catheter in August 2022. Shockwave is working to achieve compliance for other IVL catheters under the MDR, which supersedes the MDD, subject to specific transition provisions contained in the MDR.

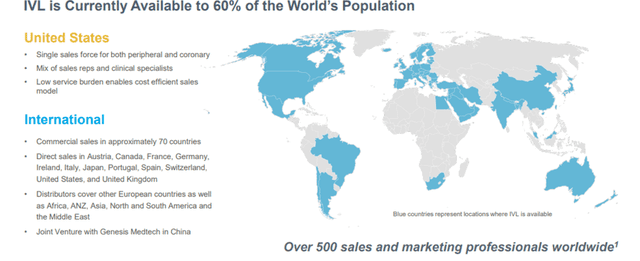

- Sales and Marketing

The Company markets its IVL System to hospitals whose interventional cardiologists, vascular surgeons, and interventional radiologists treat patients with PAD and CAD. Shockwave has dedicated meaningful resources to establish direct sales capability in the United States, Germany, Austria, Switzerland, France, Ireland, Japan, and the UK, which it has complemented with distributors actively selling in over 55 countries in North and South America, Europe, the Middle East, Asia, Africa, and Australia/New Zealand. The Company continues to add new US sales territories. It is expanding its international field presence through new distributors, additional sales and clinical personnel, and expanded direct sales territories.

Image Source: Company

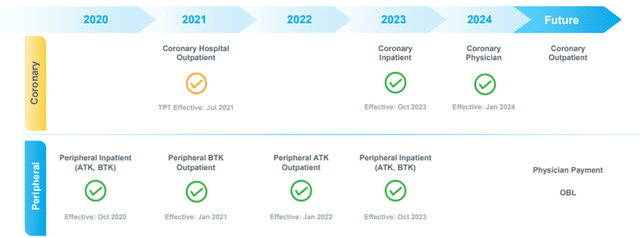

- Reimbursement

In the United States, Shockwave’s products are generally purchased by hospitals, which typically bill various third-party payors, including government programs, such as Medicare and Medicaid, and private health insurance plans, for the healthcare services required to treat each patient. The applicable third-party payors determine whether to provide coverage for a particular procedure or product and, if so, how much the provider will be reimbursed for treatment. Nevertheless, the Company has made significant progress on Medicare Reimbursement.

Medicare has established dedicated coding and payment for peripheral IVL procedures in hospitals’ inpatient, outpatient, and ambulatory surgical care settings. Coronary IVL is an FDA-designated Breakthrough Device with coding and payment established under the New Technology Add-On Payment (NTAP) and Transitional Pass-Through Payment (TPT) programs for procedures performed in inpatient and outpatient settings, respectively.

Image Source: Company

- Financial Performance

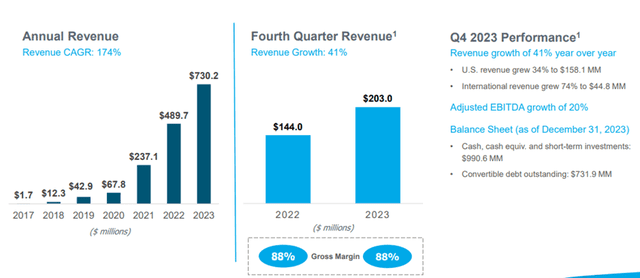

For FY23, revenue was $730.2 million, an increase of $240.5 million, or 49%, compared to FY22. Gross profit was $634.8 million compared to $424.7 million for FY22. The gross margin for FY23 was 87%, consistent with 87% for FY22. Adjusted EBITDA was $242.7 million for FY23, a 40% increase compared to adjusted EBITDA of $173.9 million for FY22.

Image Source: Company

As can be seen from the above chart, the Company has consistently grown revenues from $1.7 million in FY17 to $730.2 million in FY23, representing a CAGR of 174%.

Shockwave Medical expects revenue for 2024 to range from $910 million to $930 million, representing 25% to 27% growth over the full year 2023 revenue.

Risks

Though the Company has a history of growing revenues, which indicates a promising future, it is subject to certain risks.

Firstly, Shockwave currently manufactures and sells products used in a limited number of procedures and for only specific specified indications, which could negatively affect its operations and financial condition. The Company is, therefore, dependent on widespread market adoption of these products and will continue to be dependent on the success of these products for the foreseeable future. There can be no assurance that Shockwave’s products will gain substantial market acceptance among specialty physicians, patients, or healthcare providers.

Moreover, the Company’s products are subject to FDA regulations, and product clearances and approvals can often be denied or significantly delayed, and material modifications to its products may require new clearances or pre-market approvals or may require the Company to recall or cease marketing products until clearances or approvals are obtained – this may affect the future performance of the Company.

Conclusion

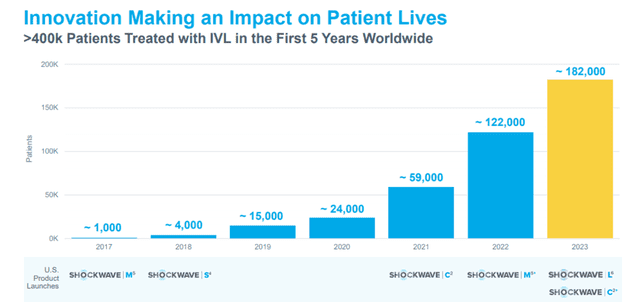

Shockwave’s products have achieved quick market acceptance over a short period, indicating a promising future for the Company.

Image Source: Company

Nevertheless, Shockwave is exposed to risks – for example, its products are currently used in a limited number of procedures and affected by FDA rules and regulations, as well as any change that could impact its future performance. Hence, investors must proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://ir.shockwavemedical.com/static-files/84cb0382-3ad6-435e-a6de-1a132160ff68

Sorry, the comment form is closed at this time.