19 Dec Arlo Technologies: Leading the Smart Home Security Segment

Arlo Technologies, Inc. (NYSE: ARLO) is an award-winning, leading smart home security brand that focuses on delivering a seamless, smart home experience.

Arlo Technologies, Inc. (NYSE: ARLO)

Market Cap: $944.39M; Current Share Price: 9.98 USD

Data by YCharts

The Company and its Products

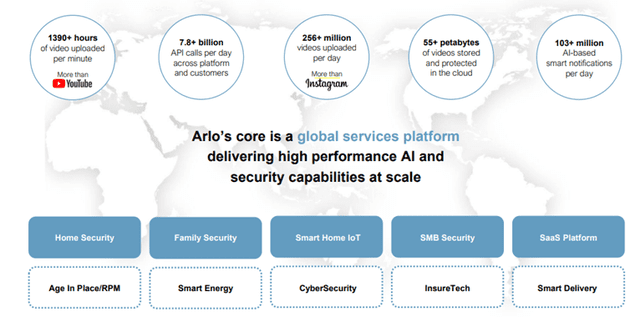

Arlo has deep expertise in product design, wireless connectivity, cloud infrastructure, and cutting-edge AI capabilities. The Company’s cloud-based platform provides users with visibility, insight, and a powerful means to help protect and connect in real-time with the people and things that matter most from any location with a Wi-Fi or a cellular connection.

Image Source: Company

To date, Arlo has launched several categories of award-winning smart connected devices, software, and services, including wire-free smart Wi-Fi and LTE-enabled security cameras, audio and video doorbells, a floodlight, home security systems, and the Arlo Apps: Arlo Secure, and Arlo Safe, AI-based subscription services designed to maximize security through personalized notifications and emergency services for quicker help during a crisis. It is a service business with recurring customer relationships driving significant value at scale.

Image Source: Company

Since the launch of Arlo’s first product in December 2014, it has shipped over 27.5 million smart connected devices. As of December 31, 2022, the Arlo platform had approximately 7.2 million cumulative registered accounts across more than 100 countries worldwide, 1.9 million of which were paid service subscribers. Moreover, Arlo’s broad compatibility allows the platform to seamlessly integrate with third-party internet-of-things (IoT) products and protocols, such as Amazon Alexa, Apple HomeKit, Apple TV, Google Assistant, IFTTT, Stringify, and Samsung SmartThings.

The Company plans to continue introducing new smart connected devices to the Arlo platform in cameras and other categories, increase the number of registered accounts on its platform, keep them highly engaged through its mobile app, and generate incremental recurring revenue by offering them paid subscription services.

Below, we’ll discuss the critical rationale for covering the Company.

- Rapidly Expanding Market

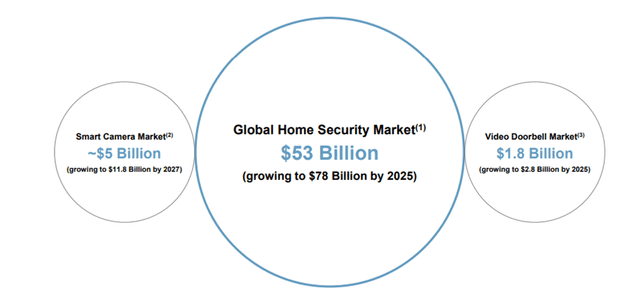

Arlo’s total addressable market consists of individuals and business owners who use connected devices to enhance their lives and businesses. Outside the home, the Company’s cellular-enabled products are used in various cases, such as neighborhood watch, construction site monitoring, wildlife and outdoor trail surveillance, and event monitoring.

Image Source: Company

The small business, government, and direct home monitoring channels provide growth areas for the Company along with its retail and e-commerce presence. Arlo is poised to benefit from these prospects – its Software as a Service (SaaS) solution includes Arlo Secure, a service plan with coverage for unlimited cameras and an enhanced Emergency Response solution, Arlo Safe, a personal safety app with panic button accessory, and Arlo SmartCloud, a solution that delivers highly efficient and secure cloud services at scale.

Image Source: Company

As discussed above, there is immense opportunity for the Company. Arlo seems well-positioned to extend its current reach to the broader connected lifestyle market within and beyond the home as it continues to launch new products and services within its connected lifestyle platform.

- Well-rounded Business Strategy

Arlo is known for its best-in-class technology, direct relationship with users and user engagement, trusted Arlo platform, strong Arlo brand and channel partners, and deep strategic partnerships with key suppliers, such as Infineon Technologies AG, OmniVision Technologies Inc., and Qualcomm Incorporated. Moreover, its focus on building a connected lifestyle platform, combined with innovation in the consumer network connected camera systems market, has led to the strength of the Arlo brand worldwide.

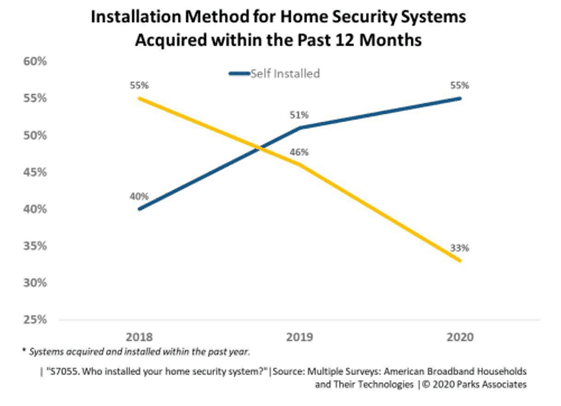

The Company continues developing innovative products and services that enable a connected lifestyle. For example, Arlo pioneered DIY Smart Security, which consumers now prefer over professionally installed solutions.

Image Source: Company

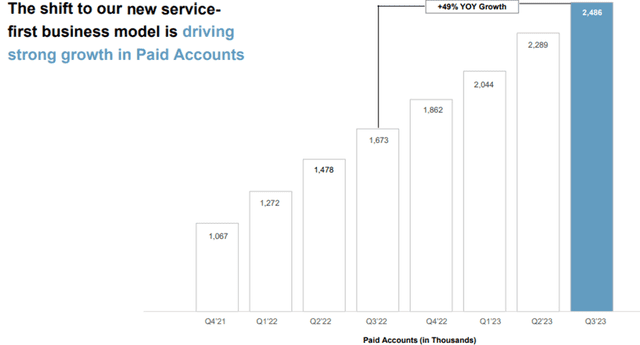

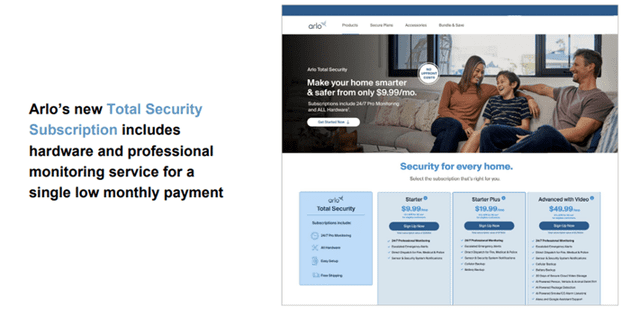

The Company can switch to and seamlessly adopt new business models if they prove lucrative. Specifically, Arlo recently shifted to a new service-first business model, driving strong growth in Paid Accounts.

Image Source: Company

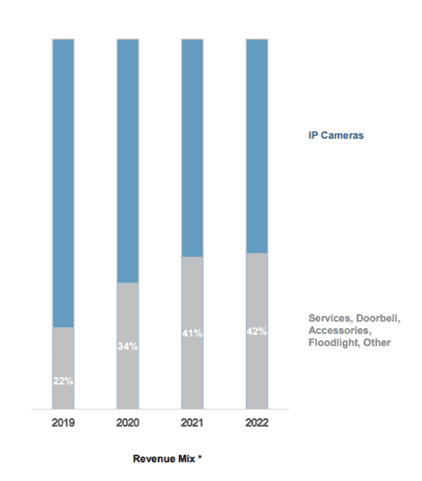

Arlo’s research and development team collaborates with the product team to design and build differentiated new products and improve upon existing products and services. Arlo’s goal is to create unique user experiences within the connected lifestyle. As a result of these efforts, Arlo has expanded into new categories, which has driven product diversification and growth.

Image Source: Company

Lately, the Company has achieved rapid growth in strategic accounts, driving meaningful revenue diversification and predictability.

Image Source: Company

The Company has a robust marketing system in place and reaches customers through the most prominent consumer channels in the world.

Image Source: Company

Finally, the Company continues to focus on enhancing direct user engagement via measures such as investment in Arlo.com – this approach has also led to highly profitable transactions for the Company.

In other words, Arlo’s comprehensive business strategy is adequate to help it grow and expand in every possible manner and direction and thus take the Company to new heights.

- Financial Performance

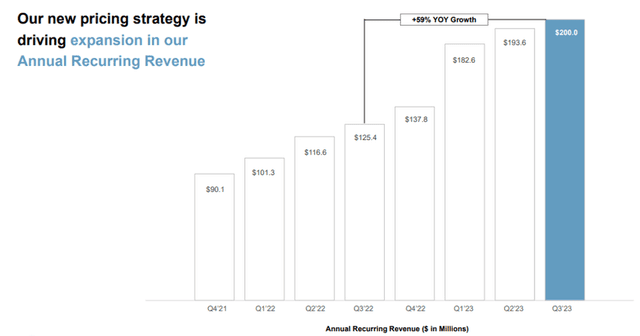

Arlo has delivered consistent financial performance primarily because of 2 reasons – its highly predictable services subscription model drives consistent revenue growth, and its services business model unit economics creates long-term profitability.

Image Source: Company

For Q3 FY23, Arlo reported

- Total revenue of $130.0 million, an increase of 1.4% yearly.

- Record service revenue of $51.0 million, growing 44.0% year over year.

- GAAP services gross margin of 73.5% and non-GAAP services gross margin of 74.1%.

- GAAP net loss per share of $(0.01); record non-GAAP earnings per diluted share of $0.09.

Image Source: Company

During this period, Arlo added 197,000 paid accounts in Q3, ending cumulative paid accounts around 2.5 million, growing 48.6% year over year.

For FY22, Arlo had reported-

- Total revenue of $490.4 million, an increase of 12.7% yearly.

- Service revenue of $136 million, growing 32% year over year.

- GAAP gross profit of $136.0 million, an increase of 25.9% year over year; non-GAAP gross profit of $140.9 million, an increase of 25.8% year over year.

- GAAP gross margin of 27.7%; non-GAAP gross margin of 28.7%.

Overall, the Company has grown strongly over the last few quarters on the back of its service business, reaching $200 million in annual recurring revenue in Q3 FY23. This significant milestone grew nearly 60% year over year.

Image Source: Company

To summarize, Arlo’s revenues continue to grow on the back of its service business performance, thus indicating a bright future for the Company.

Risks

Arlo has a promising outlook but is exposed to certain risks. Firstly, some of Arlo’s competitors have substantially greater resources, and to be competitive, Arlo may be required to lower prices or increase sales and marketing expenses, which could result in reduced margins and loss of market share.

Secondly, the Company relies on a limited number of traditional and online retailers and wholesale distributors for a substantial portion of sales, and its revenue could decline if they refuse to pay requested prices or reduce their level of purchases or if there is significant consolidation in sales channels, which results in fewer sales channels for products.

Finally, if Arlo fails to continue to introduce or acquire new products or services that achieve broad market acceptance on a timely basis, or if its products or services are not adopted as expected, it will not be able to compete effectively and will be unable to increase or maintain revenue and gross margin.

Conclusion

Arlo seems poised to exploit the rapidly expanding smart home security market due to its expertise in product design, wireless connectivity, cloud infrastructure, and cutting-edge AI capabilities. The Company has recently proved its mettle through its service business, which grew 44% year over year in Q3 FY23 and 32% for FY22.

However, the Company operates in a highly competitive environment, and it may not be able to continue to introduce or acquire new products and services successfully. As a result, it may not be able to achieve the expected results, which is why investors must proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://s22.q4cdn.com/363130056/files/doc_financials/2023/q3/Arlo-Investor-Deck-Q3-2023-Final.pdf

https://www.sec.gov/ix?doc=/Archives/edgar/data/1736946/000173694623000012/arlo-20221231.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1736946/000173694623000042/arlo-20231001.htm

Sorry, the comment form is closed at this time.