03 Oct Aspen Aerogels: Gaining from Energy Industrial & EV markets

Aspen Aerogels, Inc. (NYSE: ASPN) is an aerogel technology company that designs, develops, and manufactures innovative, high-performance materials used primarily in the energy industrial, sustainable insulation materials, and electric vehicle markets.

Aspen Aerogels, Inc. (NYSE: ASPN)

Market Cap: $557.45M; Current Share Price: 7.94 USD

Data by YCharts

The Company and its Products

Aspen Aerogels, Inc. has provided high-performance aerogel insulation to the energy industrial and sustainable insulation markets for over a decade. The Company has developed and commercialized its proprietary line of PyroThin® aerogel thermal barriers for battery packs in electric vehicles. In addition, Aspen is developing applications for its aerogel technology in the battery materials market and several other high-potential markets.

The Company’s products replace traditional insulation in existing facilities during regular maintenance, upgrades, and capacity expansions. In addition, its aerogel products are increasingly being specified for use in new-build energy industrial facilities.

Overall, Aspen’s aerogel products promote the adoption of electric vehicles, enhance energy efficiency and asset resiliency, improve safety in green buildings, and support the availability of cleaner fuels in traditional energy markets.

Aspen’s technology is proven and protected with an installed base of over $1 billion of aerogel materials and a comprehensive global IP portfolio. Built on two decades of R&D investment, its Aerogel Technology Platform™ holds the potential to solve emerging global challenges and contribute to a more sustainable future.

Image Source: Company

Below, we will discuss the critical rationale for covering this Company.

- Upcoming Opportunities Due to Increasing Energy Industrial Demand

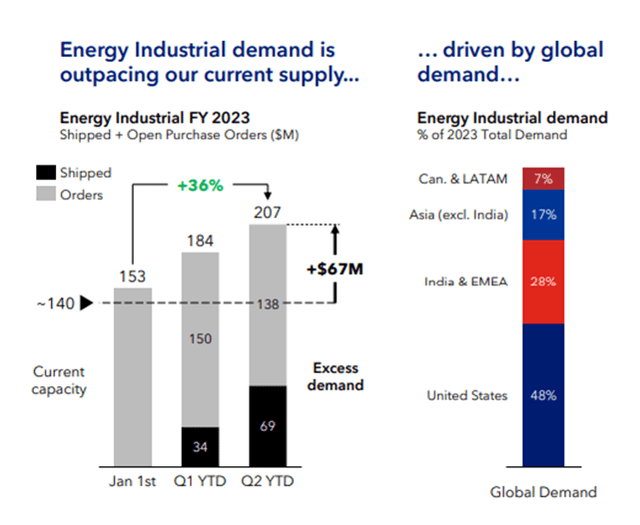

As per Aspen’s FY23 annual report, the Company’s technologically advanced insulation products are targeted at the estimated $3.9 billion annual global market for energy industrial insulation materials. During 2022, Aspen’s market share was approximately 3% of the estimated yearly global market – which means that the Company has significantly more room to grow.

Also, according to the Company’s Q2 FY24 presentation, strong demand for Energy Industrial products across all regions and applications is currently supply-constrained.

Image Source: Company

The Company’s aerogel insulation has undergone rigorous technical validation. It is used by many of the world’s largest oil producers and the owners and operators of refineries, petrochemical plants, liquefied natural gas facilities, and power generating and distribution assets, such as ExxonMobil, Reliance Industries, PTT LNG, and Royal Dutch Shell.

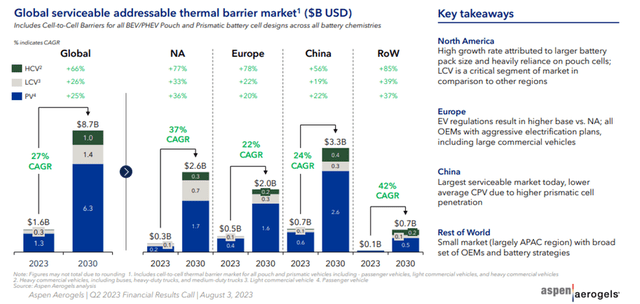

Aspen is also developing several promising aerogel products and technologies for the electric vehicle market. As per Aspen Aerogels analysis, the serviceable addressable market of pouch and prismatic cell packs of $1.6B is growing at 27% CAGR to $8.7B by 2030.

Image Source: Company

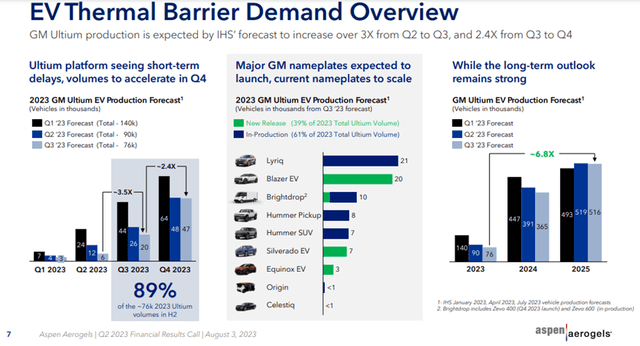

The Company is fully prepared to benefit from the upcoming opportunity – it has already entered into multi-year production contracts with General Motors to supply fabricated, multi-part thermal barriers for use in the battery system of its next-generation electric vehicles. Aspen provides thermal barrier production parts to both General Motors and Toyota.

Image Source: Company

Aspen also supplies thermal barrier prototype parts to several other U.S., European, and Asian manufacturers of electric vehicles, grid storage, and home battery systems. The Company recently received a letter of intent from the luxury brand of a German original equipment manufacturer, or OEM, group where the thermal barrier parts are targeted for a battery platform intended for use across several of their models. Aspen also received an order for approximately 1.5 million prototype parts for a commercial vehicle brand within the same German OEM group.

Historically, Aspen’s insulation product revenue grew from $17.2 million in 2008 to $124.8 million in 2022, representing a compound annual growth rate of 15%. During this period, the Company sold nearly $1.3 billion of its insulation products globally, representing an installed base of more than 400 million square feet of insulation.

The above track record of growth indicates the increasing popularity of Aspen’s products in its target market. Moreover, the long-term record of success positions the Company for future growth and continued gain in market share in the energy industrial and sustainable insulation markets.

- Comprehensive Growth Strategy

The Company follows an impactful growth strategy. Among other things, it aims to –

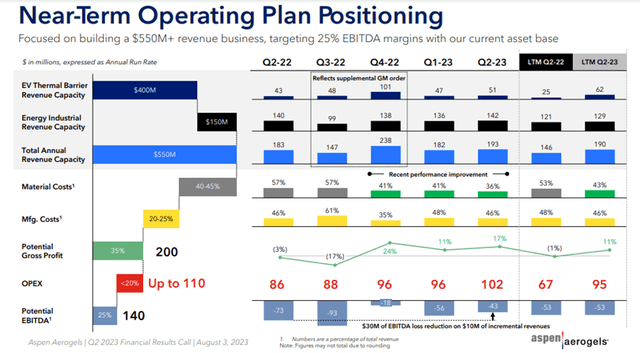

In fact, through the above measures, in the near term, Aspen aims to build more than $550 million annual revenue capacity and deliver $200 million annual gross profit and $140 million Adjusted EBITDA.

Image Source: Company

- Financial Performance

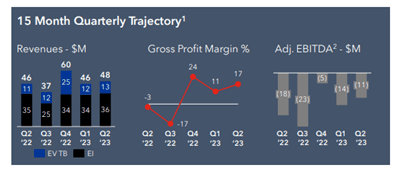

For Q2 FY23, total revenue was $48.2 million, compared to $45.6 million in Q2 FY22. During this time, the Company delivered gross margins of 17%, a 20-percentage point improvement over the same period last year.

Image Source: Company

Further, for Q2 FY23, Aspen achieved a record quarterly Energy Industrial gross profit margin of 27% and decreased YoY quarterly net loss by $8.6 million – a 36% reduction on 6% higher revenues. The Company ended the quarter with cash and equivalents of $134.3 million.

Image Source: Company

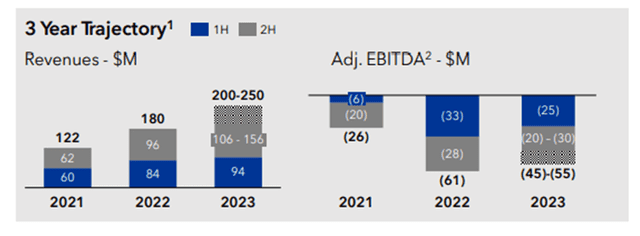

For FY22, Aspen reported total revenue of $180.4 million, compared to $121.6 million in FY21, an increase of 48% YoY. During this time, Aspen generated $55.6 million of PyroThin® thermal barrier revenue (an increase of nearly nine times FY21 revenues) and $124.8 million of Energy Industrial revenues.

For FY23, Aspen has provided guidance of total revenue between $200 million and $250 million (an increase of between 11% to 39%, YoY), Adjusted EBITDA between $(55) million and $(45) million, and net loss between $85.0 million and $75.0 million.

Moreover, the Company expects CAPEX of up to $150 million – this, along with expanded opportunities, should enable continued growth for the Company in 2024.

Risks

Nevertheless, Aspen is subject to several risks. Firstly, the Company has incurred annual net losses since inception and may never reach profitability due to expenses related to the expansion of its business, such as research and development, sales and marketing, and general and administrative costs.

Secondly, the growth of the Company depends on substantial amounts of additional capital for the expansion of existing production lines or construction of new production lines or facilities, for ongoing operating expenses, for continued development of Aerogel Technology Platform, or the introduction of new product lines. However, there is no guarantee that Aspen will be able to obtain the following on favorable terms or on time.

Finally, the estimates regarding the market opportunity for Aspen’s products in the electric vehicle market and the assumptions on which financial targets and planned production capacity increases are based may prove to be inaccurate, which may cause the Company’s actual results to materially differ from such targets, which may adversely affect Aspen’s future profitability, cash flows, and stock price.

Conclusion

Aspen has a promising future, primarily due to increased demand for aerogel products and technologies in the expanding EV market. Over the last few years, the Company has demonstrated steady growth in revenues, which indicates the popularity of its products among consumers and is increasing capacity to cater to expected future demand. Also, the Company has a prestigious customer list that includes organizations such as ExxonMobil, Reliance Industries, PTT LNG, GM, and Toyota, which it can leverage to expand the market share of existing products and encourage the production of new products.

However, the Company is exposed to several risks – for example, it may not get adequate or timely access to funds to implement expansion plans – moreover, its estimates regarding market opportunity for products and financial targets may be inaccurate. Hence, it is essential to move ahead cautiously.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://ir.aerogel.com/why-invest/default.aspx

https://s28.q4cdn.com/942626632/files/doc_financials/2023/q2/aspn_q2-fy-2023-earnings-final.pdf

https://s28.q4cdn.com/942626632/files/doc_financials/2022/q4/ASPN_Q4-FY-2022-Earnings-Deck-Final.pdf

https://www.sec.gov/ix?doc=/Archives/edgar/data/1145986/000095017023038088/aspn-20230630.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1145986/000095017023008476/aspn-20221231.htm

No Comments