15 Mar Axcelis Technologies: A Must Watch Semiconductor Stock!

Axcelis Technologies, Inc. (NASDAQ: ACLS) is leveraging its leading-edge Purion Platform to create a comprehensive suite of ion implanters that combine precision, quality, purity and low cost of ownership. Axcelis’ source technology uses H2 as a co-gas with fluorine-based dopants leading to minimal glitches, optimizing implanter performance, preventing tungsten metal contamination, besides improving source lifetimes.

Axcelis Technologies, Inc. (NASDAQ: ACLS)

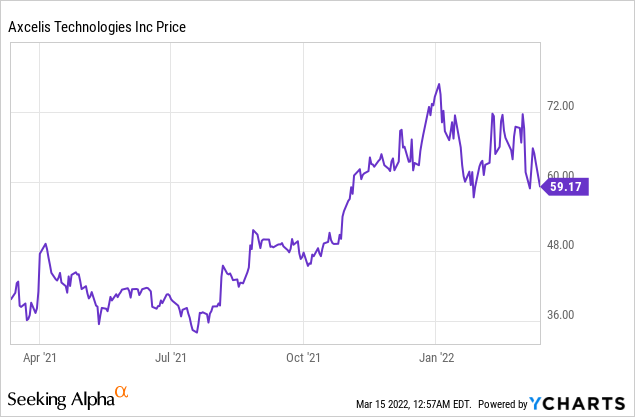

Market Cap: $1.97B; Current Share Price: 59.17 USD

Data by YCharts

We take a holistic look at the Company through a SWOT analysis below:

Strength

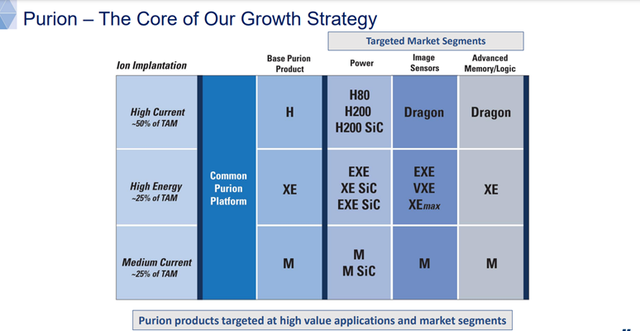

In February 2022, the Company announced that it has sent multiple shipments of Purion H200™ high current, Purion EXE™ high energy and the Purion M™ medium current Power Series™ implanters to leading power device chipmakers located in Europe and Asia. The implants address the need for implant intensive device fabrication in the market and the need for a reliable and scalable product.

The Company is a leader in ion implant systems with a growing installed base of over 3200 tools. Axcelis has been serving customers in more than 32 countries around the globe for over 40 years. Clients of the Company include leading semiconductor makers in the multiple market segments such as DRAM, NAND, Foundry, Logic, Power and Image Sensor.

Axcelis’ revenue for Q4,2021 was $205.7M and EPS of $1.05, with gross margins of 43.5% and systems revenue of $147.3M. Revenues for FY2021 stood at /$662.4M, with an EPS of $2.88, while gross margins were 43.2% and Systems revenue were $454.6M and CS&I revenue was $207.8M. The Company has managed to achieve the $650M revenue model two-years ahead of plan and intends to achieve a quarterly revenue run rate of $850M in 2022. The Company had total cash of $295.7M at the end of Q4,2021.

Furthermore, Purion product family accounted for 29% of systems revenue and the company had systems backlog of $460.6M at the end of FY2021 as compared to $116.2M in FY2020. The Company earned $75M in stock buybacks in FY2021, and is expected to receive another $100 million in buybacks in 2022 as well.

Revenue guidance for Q1 2022 pegs the revenue at ~$193M, gross margins at ~43%, operating profit at ~$41M and an EPS of ~$0.92.

The Company expects its mature process technology to constitute 70% and 80% of 2022 systems revenue, while the power device segment is expected to bring in 25% to 30% of systems revenue, with the Purion Power Series making inroads into the SiC market. The mature process technology segment saw considerable growth in 2021 and constituted 82% of Axcelis systems revenues.

In November, 2021, Axcelis had opened an Asia Operations Center in South Korea, which was followed by the first shipment of Purion XE in January 2022. The Company also focused on expanding its footprint in China to cater to mature process technology and memory applications for both domestic and international customers. Axcelis is also taking initiative in Japan to focus on power devices, image sensors and NAND. In addition, the Company intends to expand the relationship with existing customers by introducing new Purion product types and develop new uses for ion implants.

Axcelis is gearing up to capitalize on the tailwinds in the semiconductor industry that include strong demand across multiple industries, which will necessitate capacity expansion and robust service. The growth in the industry will be driven by the rise of 5G, smart phones, Metaverse, IOT and Data analytics among others. The global device shortage will result in additional investments in the industry, leading to capacity and geographical expansion, owing to government incentives and calls for indigenous manufacturing.

Image Source: Company

The Company’s growth strategy revolves around the Purion family of ion implanters designed to address the needs of fab processes at 10nm or less and are based on a high-performance platform with 3 novel beamline technologies to meet the demands of High current, Medium Current and High Energy applications. The platform can deliver throughput of up to 500 WPH and ensures consistency and repeatability as it is a single-wafer platform.

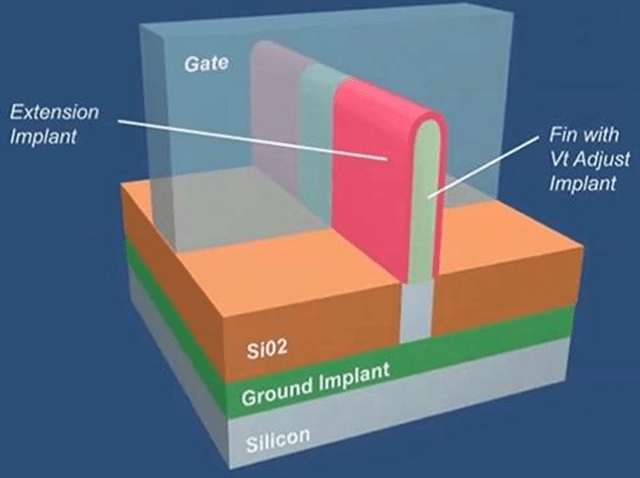

Image Source: Company

Axcelis has a team of engineers who work with clients to develop and customize technology extensions to optimize performance of the implanters. The Company currently has three Purion evaluation systems in the field and expects to ship additional systems in 2022.

The Company is focussing on achieving “On time material availability” by working closely with supply chain partners to remove bottlenecks, add extra shipping lanes, focus on logistics and reduce shipping costs. To address the issues of supply chain disruptions, the Company is working on carrying higher than required inventory and review of MRP lead times.

Weakness

The year 2022 has been challenging for tech stocks, including semiconductor companies, even those that are performing well. The stocks of these companies are falling, in spite of record revenues, growth figures and strong outlook. Factors such as inflation, the Ukraine situation, tightening of stimulus by Fed are some of the reasons why stocks like Axcelis continue to lose ground.

The market is now looking for opportunities in stocks that are likely to benefit from Fed shift in policy and this has had an impact on tech stocks. The situation in Ukraine has added a lot of political uncertainty to the equation and coupled with rising inflation, the market is extremely volatile at present.

The Ukraine – Russia situation is also likely to cause supply chain disruptions leading to shortage of critical manufacturing components, which may weigh on the Company’s prospects.

Opportunity

Ion Implantation is a key process used in semiconductor device fabrication and involves the acceleration of ions onto a solid target resulting in the transformation in the properties of the target. The changes could be physical, chemical or electrical in nature as the force of acceleration can alter, destroy or even cause nuclear transmutation. Semiconductor doping finds application in the semiconductor industry, wherein the implants in a semiconductor lead to creation of dopant atoms which can be classified into p-type or n-type.

The process plays a crucial role in development of components utilised to enhance the performance of power transistors used in storage batteries, improving efficiency of photovoltaic cells and adoption of cutting-edge technologies like silicon carbide, helping it keep abreast of advancements in nanoelectronics. Ion Implanters can be categorised into high-energy, medium-current and high-current implanters.

According to a report by Transparency Market Research, the global market for ion implanters is projected to be worth US$ 2.9 Bn by 2031. The growth will be driven by the demand for targeted doping, which is emerging as a well-sought technique for semiconductor production. The need for improving the emission characteristics of laser diodes and refining switching behavior in devices such as MOFSET’s and thyristors, is helping companies expand their business. Increased investments in research and development and breakthroughs in technology will fuel the growth in the market.

The Consumer electronics market was estimated to be worth over 1 trillion in 2020 and is likely to grow at a CAGR of 8% from 2021 to 2027 according to a report by Gm Insights. The rapid technological advancements, growing demand for leading-edge systems for use in advanced driver-assistance systems (ADAS), increasing demand for solutions for electric and hybrid vehicles and demand for semiconductors in high-end display systems for use in smartphones, wearables and projectors and other consumer electronics is driving the growth in the market.

Threats

Technology is a constantly evolving field. A breakthrough innovation of today can easily become outdated in a matter of years. To sustain in such a highly competitive environment, companies need to constantly be one step ahead of the competitors in research and development and delivering highly differentiated experiences for their customers.

The Company faces stiff competition from the likes of Applied materials, but the chip shortage and the consequent demand for equipment to increase capacity by fabricators is likely to create enough demand for the players in the semiconductor industry.

Market volatility caused by rising inflation, Fed policy changes pertaining to pandemic related stimulus and the Russia-Ukraine conflict may weigh on the Company’s performance.

Key Takeaways

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://www.transparencymarketresearch.com/ion-implanter-market.html

https://investor.axcelis.com/static-files/a140fbec-a336-46ec-b07e-f3b4af72d298

No Comments