11 Feb Can Intercept Make it to the Finishing Line in NASH?

Intercept Pharmaceuticals, Inc. (NASDAQ: ICPT) is a biopharmaceutical Company aiming to create novel therapeutics for the treatment of progressive non-viral liver diseases. The Company’s lead compound Ocalive or obeticholic acid (OCA), is an analog of the bile acid chenodeoxycholic acid (CDCA), which is being evaluated for treatment of multiple indications such as Fibrosis due to NASH and compensated cirrhosis due to NASH. Ocaliva, received an FDA approval for the treatment of patients with Primary biliary cholangitis in 2016, making it the first therapy to receive approval from the FDA in nearly 20 years.

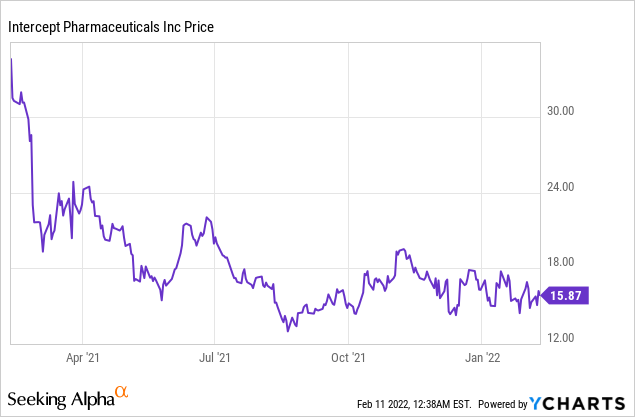

Intercept Pharmaceuticals, Inc. (NASDAQ: ICPT)

Market Cap: $468.91M; Current Share Price: 15.87 USD

Data by YCharts

We take a holistic look at the Company through a SWOT analysis below:

SWOT Analysis

Strength

In December 2021, the Company announced that the topline data from a crucial Phase 3 REVERSE trial will be released in the first half of 2022 as against the previous guidance of the end of 2021. The study is the only active late-stage Phase 3 study that is evaluating compensated cirrhosis due to NASH. Intercept is also using a new methodology to compile data from the Phase 3 REGENERATE study that is studying liver fibrosis due to NASH, which will enable a potential resubmission meeting with the FDA in the first half of 2022.

The new consensus methodology will be used to read the month 18 biopsies from REGENERATE and REVERSE biopsies. In addition, the safety database being compiled by the Company will include double the exposure of patient data from interim analysis to median of 30 months, with a view to making it the e largest data set in the NASH field.

The Company is working on bringing novel therapeutics for progressive non-viral liver diseases. Intercept’s approach is based on unravelling the complex connection between bile acid and the Farnesoid X receptor (FXR), which plays a crucial role in regulation of bile acid, inflammatory, fibrotic and metabolic pathways.

Image Source: Company

Ocaliva has witnessed a strong revenue growth of over 25% for financial year 2020 in PBC, where it was approved by the FDA in 2016. The drug is used in combination with ursodeoxycholic acid (UDCA) in adults with an inadequate response to UDCA, or as monotherapy in adults unable to tolerate UDCA. Ocaliva is the first FXR agonist to be approved for liver disease. The Company is currently enrolling patients in a Phase 2 trial evaluating the combination of OCA-bezafibrate.

Image Source: Company

Sales of Ocaliva were $92.8 Million for the third quarter 2021, with the U.S clocking $66.6M, while EU sales stood at $26.2M. Nearly 25% of Ocaliva’s sales come from the international market (FY2020) and is approved in over 40 countries across the world, with the Company using full-service distributor partners in the Middle East, Israel, CEE markets, Australia and New Zealand. As per the Company’s Q3,2021 financial results, Ocaliva net sales worldwide grew by 17% over the prior year quarter. Intercept also increased the net sales guidance for Ocaliva to $370 million from $355 million for the year 2021 and adjusted the non-GAAP adjusted operating expense guidance to $380 million from $395 million.

The Company has in place a specialty sales force consisting of 55 representatives. The organization enjoys broad payer coverage with access to over 95% of covered lives and an extended HCP coverage of 7500 hepatologists through digital channels.

Intercept is also focused on advancing its pipeline, with first-in-human studies underway for INT-787 and intends to select a target indication in early 2022. The Company is also engaged in a Phase 2 trial evaluating OCA+ Bezafibrate Combination and is enrolling patients outside the U.S, while planning to study a broader range of doses in additional Phase 2 trials in the U.S.

Weakness

The Company faced a setback in June 2020, when Ocaliva (obeticholic acid), an Farnesoid X receptor (FXR) agonist, being developed by Intercept that showed at least a one-stage improvement in fibrosis but failed to prevent the worsening of fibrosis, failed to win an FDA approval. The FDA had issued a CRL to the Company amidst concerns that the surrogate endpoint from their Phase III trial of reduction in liver fibrosis may not actually translate into benefit for patients. While the study achieved statistically significant reduction in liver fibrosis without a worsening in NASH, the patients receiving the highest-dosage, also the most effective group, reported severe pruritus and experienced trial discontinuations when compared to those receiving a placebo.

The FDA issues a CRL to the Company asking for additional trial and safety data, which the Company is looking forward to furnishing in 2022.

Ocaliva was approved by the FDA in 2016 as a treatment for primary biliary cholangitis (PBC), but was given a black box warning for being incorrectly dosed daily instead of weekly, this was followed by news that the FDA was evaluating the drug for potential risk of liver disorder in PBC patients. In May 2021, the FDA restricted the use of Ocaliva (obeticholic acid) in patients having PBC with advanced cirrhosis of the liver over concerns that it can cause serious harm.

Intercept recently withdrew its application for Ocaliva’s reimbursement for PBC in France as it was not able to reach mutually acceptable pricing terms with the Economic Committee for Health Products (CEPS), the French regulatory agency which is tasked with setting the prices of pharmaceutical products and medical devices and also handles reimbursement by health insurance providers. The sales in France, currently undertaken by the Company’s subsidiary ICPT France are being conducted under a temporary use authorization (ATU).

However, the withdrawal will not have a significant impact on the sales of Ocaliva, as they constitute only 1% of the global sales currently.

Opportunity

Nonalcoholic Steatohepatitis (NASH) is a form of Non-Alcoholic Fatty Liver Disease (NAFLD) and is characterized by the buildup of FAT in the liver. This condition is marked by hepatitis, inflammation, cell damage and fat deposits in the liver. These fat deposits can cause fibrosis of the liver, in turn leading to liver cancer or cirrhosis.

According to an estimate only 20 percent of the people suffering from NAFLD have NASH, while the rest only have a simple fatty liver. While nearly 40 percent in the U.S are afflicted with NAFLD, around 3 to 4 percent have NASH. The American Liver foundation estimates that over 100 million people suffer from NAFLD in the U.S alone.

Though the exact cause of the disease is still unknown, NASH often develops from underlying conditions such as obesity and type 2 diabetes, and can affect people of any age. Individuals who have insulin resistance, high triglyceride levels or abnormal cholesterol levels, hypertension and uncontrolled blood glucose are at an increased risk of developing this condition. NASH also increases the chances of developing cardiovascular anomalies and can lead to death from liver-related causes.

The diagnosis usually involves blood tests, use of imaging techniques such as ultrasound, CT scans and MRI, and a liver biopsy. Losing weight through a healthy diet and exercise can help reduce the fat in the liver and is usually the recommended course of action. Currently there are no approved therapies for this condition, with treatment limited to alleviating the symptoms of the condition.

According to a report by Reports and Data, the Global NASH market will be worth over USD 13.38 Billion by 2026. The healthcare costs associated with this disease are likely to reach USD 18 billion by 2030 from USD 5 billion now, if the disease is left untreated.

Threat

The Company’s pipeline is currently centered around one candidate – Ocaliva. Clinical Trials are fraught with risk and uncertainty. However, a diverse pipeline will help mitigate the risk in case of adverse results or the failure to muster a regulatory approval. The success of its clinical trials will help the Company advance its pipeline but it should also be prepared to face any setbacks, in case its ongoing trials fail to meet their endpoints.

The clinical development of potential drug candidates in NASH has been extremely challenging, with many of them failing to show any significant improvement or benefit in larger clinical trials, in spite of demonstrating promising results in pre-clinical or early-clinical development. In July 2020, Genfit’s elafibranor was unable to achieve the primary endpoint of resolving NASH without worsening fibrosis scarring compared to placebo as well as its secondary endpoint in the Phase 3 RESOLVE-IT trial. The candidate joins a long list of similar failures in the NASH landscape which have failed to demonstrate significant impact in pivotal trials, tumbling at the last hurdle.

Ocaliva (obeticholic acid), an Farnesoid X receptor (FXR) agonist, being developed by Intercept that showed at least a one-stage improvement in fibrosis but failed to prevent the worsening of fibrosis, failed to win an FDA approval in June 2020.

Key Takeaways

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://ir.interceptpharma.com/static-files/6d4e44bd-385e-4d53-be30-98e9a398d4ba

No Comments