24 Jul Ekso Bionics: Advancing Rapidly in the Exoskeleton Industry

Ekso Bionics Holdings, Inc. (NASDAQ: EKSO) designs, develops, and markets exoskeleton products that augment human strength, endurance, and mobility. Its exoskeleton technology serves multiple markets and can be utilized by able-bodied persons and persons with physical disabilities or impairments.

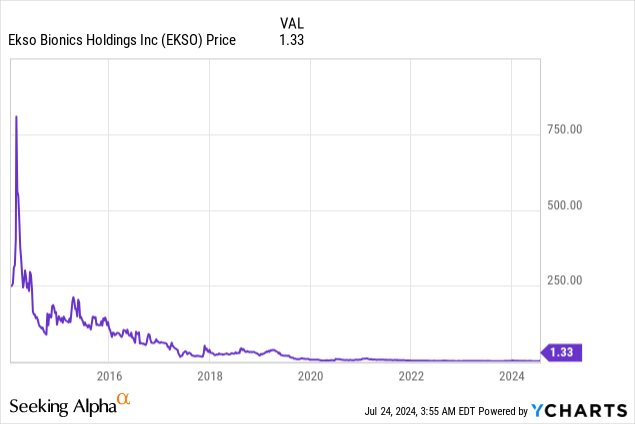

Ekso Bionics Holdings, Inc. (NASDAQ: EKSO)

Market Cap: $24.17M; Current Share Price: 1.33 USD

Data by YCharts

The Company and its Products

Ekso offers multiple products and services to customers from its diverse portfolio.

Products

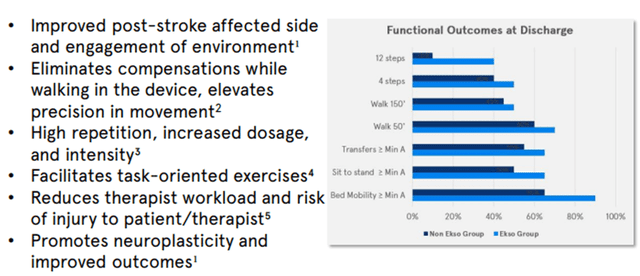

- EksoNR is a wearable robotic exoskeleton specifically designed to be used in a rehabilitation setting to assist individuals recovering from both acute and chronic conditions.

Image Source: Company

Services

Image Source: Company

The Company has two business segments:

Image Source: Company

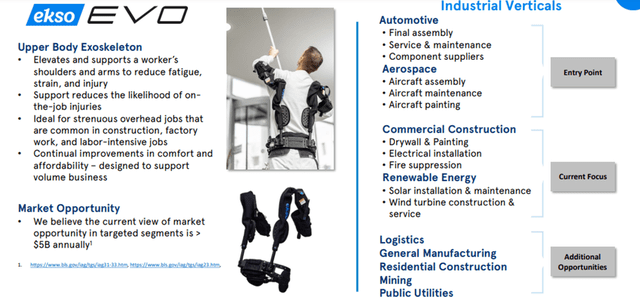

- The EksoWorks segment represents sales of products to able-bodied individuals for industrial or work-related use. The only active product within This segment is EVO.

On December 5, 2022, Ekso acquired the Human Motion and Control Business Unit from Parker Hannifin Corporation, an Ohio corporation. The assets acquired from the business unit included intellectual property rights for devices. These include the U.S. Food and Drug Administration (FDA) cleared lower-limb powered exoskeletons that enable task-specific overground gait training to patients with weakness or paralysis in their lower extremities.

We will discuss the critical rationale for covering this Company.

- Significant Market Opportunity

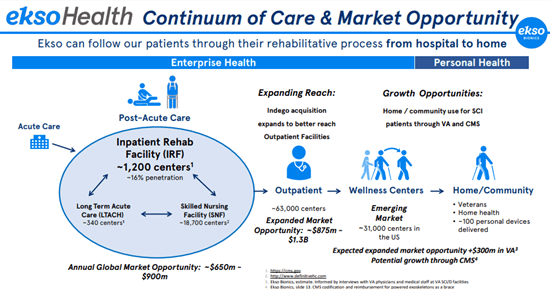

In the Enterprise Health Market segment, the Company focuses on rehabilitation treatments that can benefit from EksoNR and Ekso Indego Therapy products. These treatments take place in inpatient rehabilitation facilities (IRF), long-term acute care hospitals (LTACH), skilled nursing facilities (SNF), and outpatient rehabilitation clinics, among others. Ekso can follow patients through their rehabilitative process from hospital to home. Overall, in the Health Market segment, Ekso expects an annual global market opportunity of $650m – $900m, an expanded market opportunity of about $875m – $1.3B through outpatient centers, and more than $300m through VA and CMS.

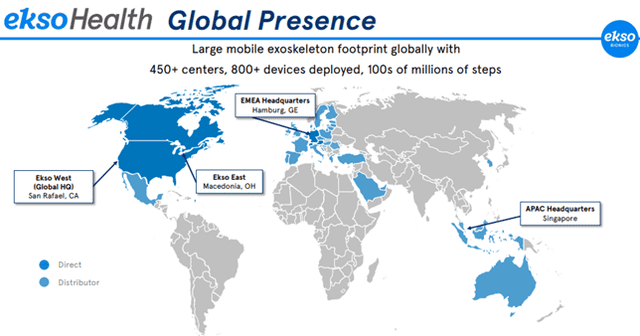

Image Source: Company

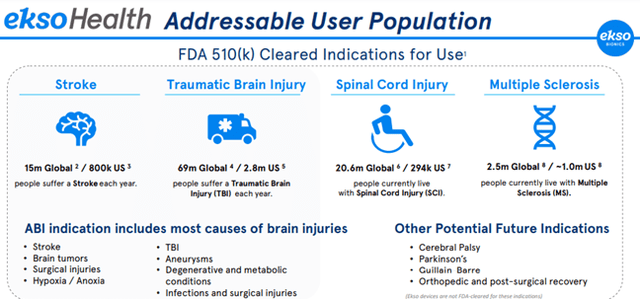

For Ekso Health, the addressable user population includes those with Stroke, Traumatic Brain Injury, Spinal Cord Injury, and Multiple Sclerosis.

Image Source: Company

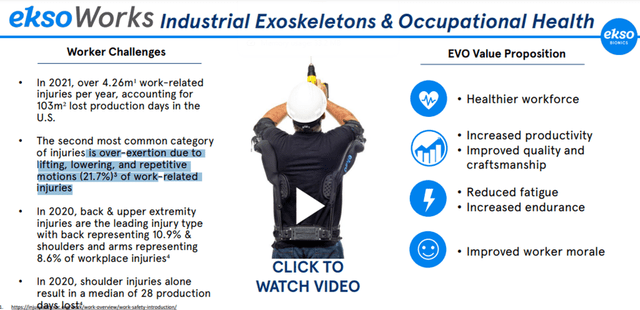

The Ekso Works segment also has a promising future. The second most common category of injuries is over-exertion due to lifting, lowering, and repetitive motions (21.7%)³ of work-related injuries. The Company’s EVO product can help able-bodied workers reduce fatigue and increase endurance, leading to a healthier workforce.

Image Source: Company

The current market opportunity in the Works segment is more than $5 billion annually.

Image Source: Company

Thus, through its varied portfolio, Ekso is poised to capture a significant share in multiple markets by providing exoskeleton products to both able-bodied individuals and those with impairments.

- Sound business strategy

Ekso constantly explores business development initiatives to fuel growth and long-term value. The Company has implemented the following strategies to build shareholder value.

If successfully implemented, the above strategies can help Ekso achieve its aim of improving people’s lives with advanced robotics through a continuum of care from hospital to home.

- Financial Performance

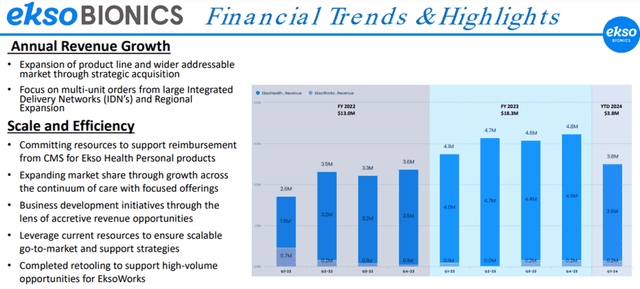

For Q1 FY24, revenue was $3.8 million compared to $4.1 million for Q1 FY23. Gross profit for Q1 FY24 and Q1 FY23 were $2.0 million, representing a gross margin of approximately 52% in the first quarter of 2024, compared to a gross margin of 49% for the same period in 2023.

Net loss applicable to common stockholders for Q1 FY24 was $3.4 million, or $0.20 per basic and diluted share, compared to a net loss of $4.4 million, or $0.33 per basic and diluted share, for the same period in 2023.

Image Source: Company

For FY23, the Company achieved record revenue of $18.3 million, compared to $12.9 million for FY22, an increase of 42% YoY.

Gross profit for FY23 was $9.1 million, representing a gross margin of approximately 50%, compared to gross profit of $6.2 million for FY22, representing a gross margin of 48%. Net loss applicable to common shareholders for FY23 was $15.2 million, or $1.10 per basic and diluted share, compared to $15.1 million, or $1.16 per basic and diluted share, for FY22.

Thus, the Company achieved exceptional YoY growth for FY23, and this trend may continue given the abundant market opportunity, subject to widespread adoption of the Company’s products.

Risks

Ekso has a promising future. However, the Company is subject to certain risks.

Firstly, the markets in which Ekso’s products are sold are highly competitive and continue to develop, making future performance uncertain. Moreover, coverage policies and reimbursement levels of third-party payers, including Medicare or Medicaid, may impact the sales of the Company’s products. Finally, Ekso has incurred significant losses to date and anticipates continuing to incur losses in the future, and it may not achieve or maintain profitability.

Conclusion

For FY23, Ekso achieved record revenue of $18.3 million, compared to $12.9 million for FY22, an increase of 42% YoY. The Company has significant opportunities in the markets it serves. Specifically, the Health segment has an annual global market opportunity of at least $650m—$900 m. On the other hand, the Works segment presents an annual opportunity of more than $5 billion, indicating a bright future for the Company.

However, Ekso operates in a highly competitive environment, and coverage policies and reimbursement levels of third-party payers may impact the sales of the Company’s products. This makes the Company’s future performance uncertain. Hence potential investors must proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1549084/000143774924013696/ekso20240331_10q.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1549084/000143774924006423/ekso20230626_10k.htm

Sorry, the comment form is closed at this time.