15 Jul Esperion: Revolutionizing the Pharma Industry

Esperion Therapeutics Inc. (NASDAQ: ESPR) is a pharmaceutical company currently focused on developing and commercializing accessible, oral, once-daily, non-statin medicines for patients struggling with elevated low-density lipoprotein cholesterol, or LDL-C. Through the commercial execution and completion of its CLEAR Outcomes trial and the advancement of its pre-clinical pipeline, the Company continues to evolve into a differentiated, global biotech.

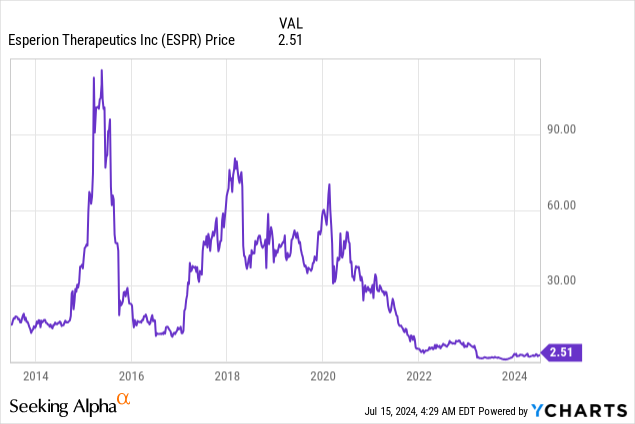

Esperion Therapeutics Inc. (NASDAQ: ESPR)

Market Cap: $474.6M; Current Share Price: 2.51 USD

Data by YCharts

The Company and its Products

Esperion’s team of experts is dedicated to lowering LDL cholesterol through the discovery, development, and commercialization of innovative medicines and their combinations with established medicines.

The Company’s first two products were approved by the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and Swiss Agency for Therapeutic Products (Swissmedic) in 2020. NEXLETOL® (bempedoic acid) and NEXLIZET® (bempedoic acid and ezetimibe) tablets are oral, once-daily, non-statin medicines for the treatment of primary hyperlipidemia in adults with heterozygous familial hypercholesterolemia (HeFH) or atherosclerotic cardiovascular disease (ASCVD) who require additional LDL-C lowering.

Image Source: Company

The Company completed a global cardiovascular outcomes trial, or CVOT, called Cholesterol Lowering via BEmpedoic Acid, an ACL-inhibiting Regimen (CLEAR) Outcomes. The study showed that bempedoic acid demonstrated significant cardiovascular risk reductions and significantly reduced the risk of heart attack and coronary revascularization compared to placebo. These results were seen in a broad population of primary and secondary prevention patients who cannot maximize or tolerate a statin. The proportions of patients experiencing adverse events and serious adverse events were similar between the active and placebo treatment groups.

Image Source: Company

Bempedoic acid, contained in NEXLETOL and NEXLIZET (bempedoic acid and ezetimibe) tablets, became the first LDL-C lowering therapy since statins to demonstrate the ability to lower challenging ischemic events, not only in those with ASCVD but also in the large number of primary prevention patients for whom limited therapies exist.

We will discuss the critical rationale for covering the Company.

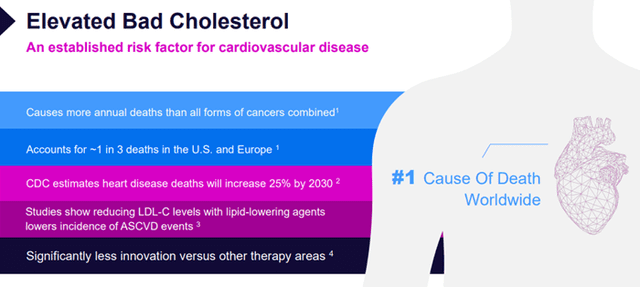

- Large Attractive Market with High Unmet Need

Atherosclerotic cardiovascular disease, or ASCVD, is a chronic, progressive disease; the presence of increasing low-density lipoprotein cholesterol, or LDL-C, is causal in the development of ASCVD and plays a central role in the multifactorial disease process of lipid accumulation and systemic inflammation. ASCVD is the underlying cause of many significant cardiovascular, or CV, events, including myocardial infarction, or MI, and ischemic stroke, or IS. In practice, ASCVD can include a spectrum of diagnoses, including acute events such as MI or stroke, coronary revascularization procedures, as well as conditions such as peripheral artery disease or PAD, coronary artery disease or CAD, or angina. Extensive evidence has shown that LDL-C is a significant risk factor for ASCVD.

Image Source: Company

Overall, 71 million adults in the U.S. are at high risk of ASCVD and eligible for statin therapy, according to the AHA/ACC guidelines.

Image Source: Company

The estimated U.S. prevalence of risk groups is as follows:

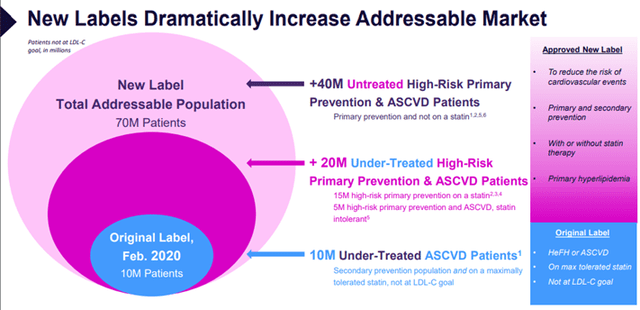

- Patients with HeFH or established ASCVD who require additional lowering of LDL-C

Despite the prevalence of statins, many patients with ASCVD are still not achieving their LDL-C goals and need additional LDL-C lowering beyond that achieved with statin monotherapy. It is estimated that approximately 10 million patients with ASCVD in the United States currently taking statins require additional LDL-C lowering. Approximately 60% to 70% of patients receiving statins do not meet their LDL-C goals, and estimates are worse among high CV risk groups, such as adults with severe hypercholesterolemia (98%) or ASCVD (80%). There are also potentially 2 million additional patients with ASCVD not being treated per current guidelines because they cannot or will not take a high enough dose of a statin.

- Patients at High Risk of Developing ASCVD (Primary Prevention)

Difficulty achieving guideline-recommended LDL-C goals is wider than that of the established ASCVD population. Several recent estimates indicate that up to 15 million U.S. adults currently on statin medications for primary prevention may not be at goal and need treatment optimization, either via statin intensification or additional therapies. A further 3 million adults who are eligible for statins for primary prevention may be statin intolerant and unwilling or unable to initiate, continue, or maximize statin medications.

- Untreated Patients

Due to a myriad of reasons, up to an additional 40 million adults in the U.S. with ASCVD or at high risk for ASCVD remain untreated with statins. This gap in care represents a significant public health opportunity.

- Unable or Unwilling to Take Guideline Recommended Doses of Statins

Muscle pain and weakness are the most common side effects experienced by statin users and the most common causes for discontinuing therapy. Moreover, a significant proportion of patients remain on statin therapy despite experiencing muscle-related side effects and require additional LDL-C lowering therapies to help them achieve their LDL-C treatment goals. Accordingly, the statin-intolerant market could grow substantially in the presence of an oral, once-daily, non-statin LDL-C and cardiovascular risk-lowering therapy. According to research, approximately 9.6 million patients in the United States are not on statins and need additional LDL-C lowering, and it is estimated that many are only able to tolerate less than the lowest approved daily starting dose of their statin and are therefore considered to be statin intolerant.

Esperion’s products address a gap in existing therapy by providing patients with an option next after statins.

Image Source: Company

Thus, the Company has the potential to grow significantly, given the widespread acceptance of its products.

- Compelling Business Strategy

The Company focuses on discovering, developing, and commercializing innovative medicines to help improve patient outcomes. Its strategy for accomplishing this includes the following:

- The completion of the global, landmark CLEAR Outcomes trial involving nearly 14,000 patients in 32 countries generated robust data, driving global awareness of the significant cardiovascular risk reduction benefits of bempedoic acid. Dissemination of additional, powerful sub-group analyses at medical conferences and in top-tier journals further educates the market and supports commercialization efforts.

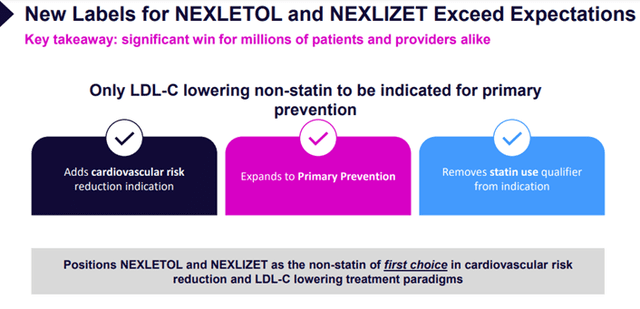

Image Source: Company

- Obtain significant label expansions for existing products in the United States and Europe, which will remove existing limitations and enable millions more patients around the globe to access life-saving therapies. The Company filed broad cardiovascular risk reduction labels in both jurisdictions and anticipates approvals in the first half of 2024.

Image Source: Company

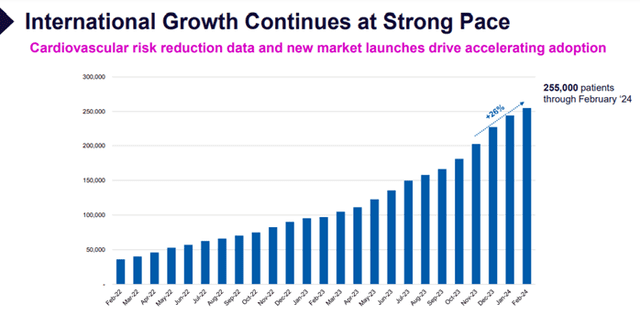

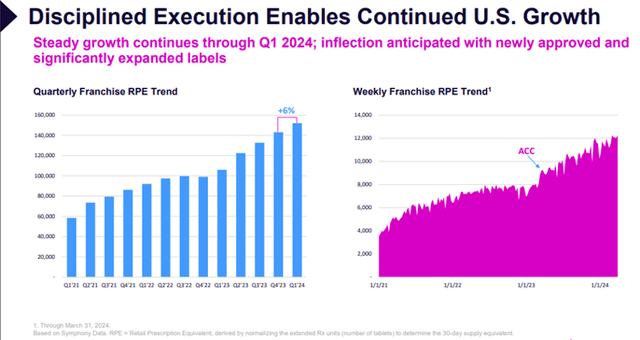

- Execution of strategic commercialization plan to generate significant growth for currently approved products. The Company expects anticipated label expansions and promotional efforts to unlock significant growth potential for NEXLETOL and NEXLIZET in the United States, with additional, commensurate growth potential in Europe driven by its partner’s efforts in that territory.

Image Source: Company

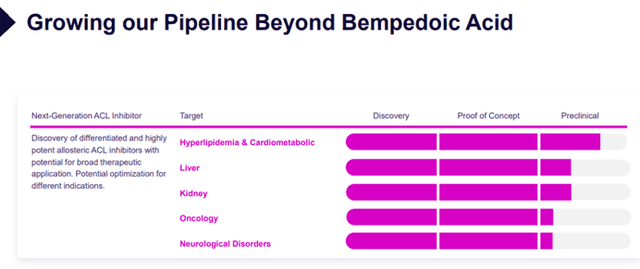

- Continue to advance its pre-clinical pipeline. The Company is leveraging its existing research and development capabilities to advance and grow its internal pre-clinical pipeline candidates, including next-generation ACLY inhibitors, which have potential for broad therapeutic application.

Image Source: Company

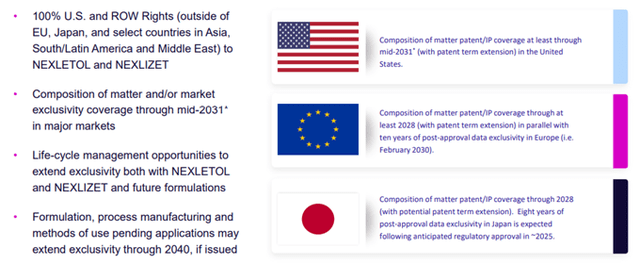

Additionally, the Company has a well-established Intellectual Property base that provides security for ample growth and value creation.

Image Source: Company

In other words, the Company has a well-defined business strategy supported by strong intellectual property that can help it achieve its growth objectives steadily.

- Financial Performance

For Q1 FY24, total revenue was $137.7 million, compared to $24.3 million for Q1 FY23, an increase of approximately 467%. U.S. net product revenue was $24.8 million, compared to $17.0 million for Q1 FY23, an increase of roughly 46%, driven by retail prescription growth of 43%.

Image Source: Company

Collaboration revenue was $113.0 million, compared to $7.3 million for Q1 FY23, an increase of 1,448%. Increased tablet sales drove this to international partners, sales growth within partner territories, and settlement-related milestone payments.

Total net income for the quarter was $61.0 million, compared to a net loss of $61.7 million for Q1 FY23.

For FY23, Esperion reported a total revenue of $116.3 million compared to $75.5 million for FY22, an increase of approximately 54%.

U.S. net product revenue was $78.3 million for FY23, compared to $55.9 million for FY22, an increase of 40%, driven by 30% retail prescription growth.

Collaboration revenue was $38.0 million for FY23, compared to $19.6 million for FY22, an increase of approximately 94%, driven by increased royalty revenue and tablet shipments to international partners.

The Company had net losses of $209.2 million for FY23, compared to $233.7 million for FY22.

Recent Developments

On March 22, 2024, Esperion was granted an expanded label from the FDA for NEXLETOL and NEXLIZET. The label expansion added the prevention of heart attacks and reduction of cardiovascular risk as indications and expanded the LDL-C-lowering indication to include use with or without a statin. The updates to the label expand accessibility by approximately 70 million patients in the U.S.

The Company has initiated the technology transfer process for NILEMDO and NUSTENDI tablet manufacturing to DSE for its territories, which is expected to be completed in the second half of 2025. Additionally, as part of its amended partnership, Esperion authorized DSE to proceed with commercialization of a triple formulation product comprising bempedoic acid, ezetimibe, and a statin, which, if approved, has the potential to extend the product’s lifecycle in Europe meaningfully.

The Company’s collaboration with Otsuka in Japan remains on track. Otsuka’s phase III study is expected to close out in Q2 2024, a Japan New Drug Application (JNDA) filing is anticipated in late 2024, and approval and National Health Insurance (NHI) pricing are expected in 2025.

Overall, the Company reported an increase in total revenues of 467% and 54% for Q1 FY24 and FY23, respectively. Additionally, the FDA has granted Esperion an expanded label for its products. It has also initiated a technology transfer process for its tablet manufacturing to DSE for its territories. All these instances indicate that the Company may rise to greater heights.

Risks

Esperion has embarked on an upward trajectory. However, the Company is subject to certain risks. Firstly, manufacturing pharmaceutical products is complex and subject to product loss for various reasons. The Company contracts with third parties to manufacture the bempedoic acid tablet and the bempedoic acid/ezetimibe combination tablet for commercialization and clinical trials. This reliance on third parties increases the risk that it will not have sufficient quantities of drugs, drug candidates, or such quantities at an acceptable cost or quality, which could delay, prevent, or impair development or commercialization efforts.

Secondly, if the Company is unable to adequately protect proprietary technology or maintain issued patents sufficient to protect bempedoic acid and the bempedoic acid/ezetimibe combination tablet, others could compete more directly, which would have a material adverse impact on the business, results of operations, financial condition, and prospects.

If Esperion cannot adequately prevent disclosure of trade secrets and other proprietary information, the value of its technology and products could be significantly diminished.

Conclusion

Esperion has introduced the first oral non-statin LDL-C lowering therapy in 20 years, thus catering to a large, attractive market with high unmet needs. The Company has received approval and an expanded label from the FDA for its two drugs. Moreover, it reported increases in total revenues of 467% and 54% for Q1 FY24 and FY23, respectively, indicating the potential for exponential growth.

However, pharmaceutical manufacturing is complex and subject to product loss for various reasons. Additionally, if a company is unable to adequately protect proprietary technology or maintain issued patents, there may be a material impact on its revenues and future prospects; hence, investors must proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://www.esperion.com/static-files/f5cbbe1e-287b-4398-acef-d48d2b6433b8

https://www.sec.gov/ix?doc=/Archives/edgar/data/1434868/000162828024007066/espr-20231231.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1434868/000162828024020862/espr-20240331.htm

Sorry, the comment form is closed at this time.