21 Aug Pennant Group: Track Record of “Healthy” Growth

Pennant Group, Inc. (NASDAQ: PNTG), is a leading provider of high-quality healthcare services to patients or residents of all ages, including the growing senior population, in the United States. The Company operates multiple lines of business, including home health, hospice, and senior living.

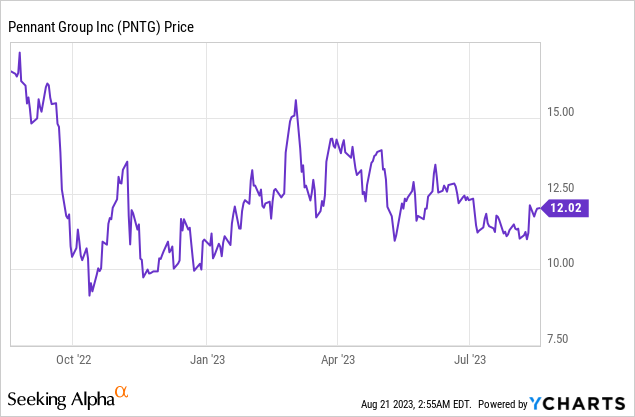

Pennant Group, Inc. (NASDAQ: PNTG)

Market Cap: $357.48M; Current Share Price: $12.02

Data by YCharts

The Company

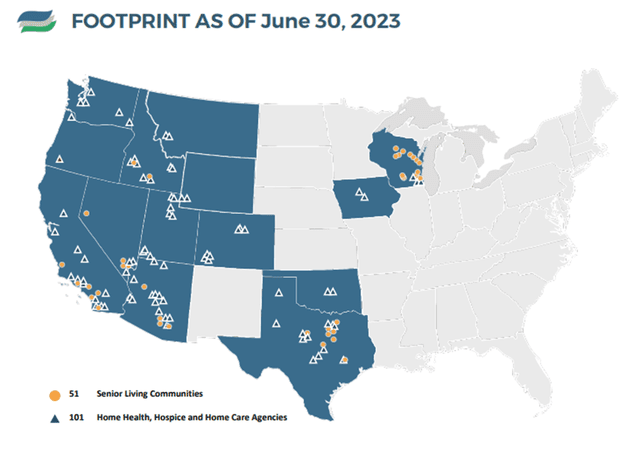

Pennant provides home health and hospice services throughout Arizona, California, Colorado, Idaho, Iowa, Montana, Nevada, Oklahoma, Oregon, Texas, Utah, Washington, Wisconsin, and Wyoming.

The Company operates through 95 agencies and senior living services at 49 communities with 3,500 total units in its assisted living, independent living, and memory care business, and derives revenue from a diversified blend of payors, including Medicare and Medicaid programs, private pay patients and residents, and managed care payors.

Image Source: Company

Pennant’s independent operating subsidiaries are organized into industry-specific portfolios, which enables it to maintain a local, field-driven organizational structure, attract qualified leaders and expert resources, and effectively identify, acquire, and improve operations.

There are two reportable segments (1) home health and hospice services, which includes home health, hospice, and home care businesses; and (2) senior living services, which includes assisted living, independent living, and memory care communities.

We will discuss key elements that make the Company worth watching out for.

- Favorable market drivers

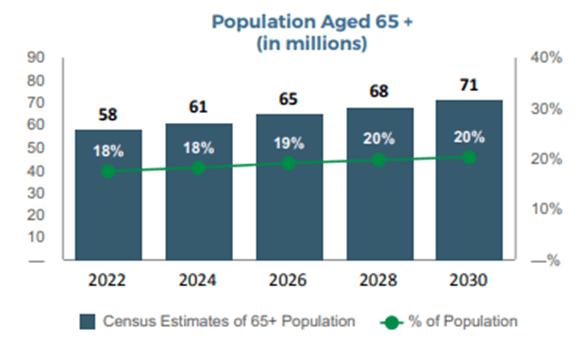

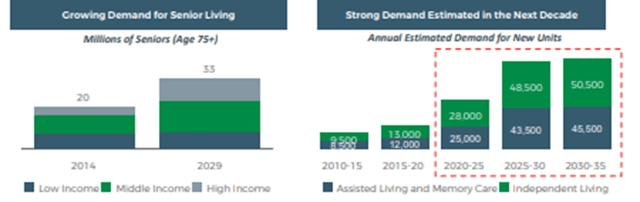

The healthcare sector is one of the largest and fastest-growing sectors of the U.S. economy, with a key driver being the aging population. The population above 65 is projected to nearly double by 2050.

Image Source: Company

As per studies, about 70% of Americans who reach age 65 require long-term care for an average of 3 years. Today, more than 70% of home health patients are seniors, and 83% of hospice patients are over 65. There is also an anticipated need for 2 million additional senior housing units by 2040.

Due to these market drivers, the healthcare industry has sustainable growth potential.

According to the Centers for Medicare and Medicaid Services (CMS), national healthcare spending increased from 8.9% of U.S. GDP, or $253 billion, in 1980 to an estimated 18.3% of GDP, or $4.3 trillion, in 2021. CMS projects national healthcare spending will grow by an average of 5.1% annually from 2021 through 2030, accounting for approximately 19.6% of U.S. GDP, or roughly $6.8 trillion, in 2030.

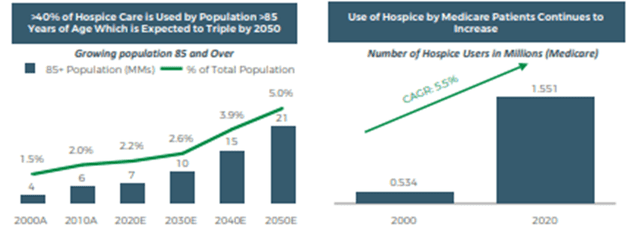

Image Source: Company

The home health and hospice segment is growing within the healthcare landscape in the United States. According to Grandview Research, Inc., the home health market is estimated at approximately $142.9 billion and is expected to grow at a compounded annual growth rate (CAGR) of 7.5% from 2022 to 2030. The hospice industry is estimated at approximately $34.5 billion and is projected to grow at an estimated CAGR of 8.2% from 2022 to 2030. The senior living market is estimated at roughly $91.8 billion and is expected to expand at an estimated CAGR of 5.5% between 2022 to 2030.

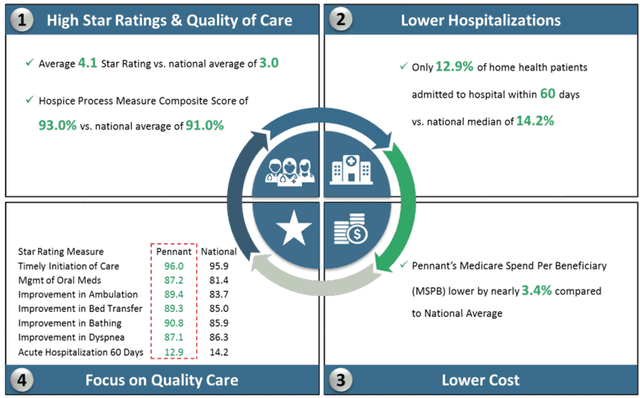

Thus, Pennant is operating in growing industries with attractive fundamentals. With its focus on clinical outcomes, Pennant is well-positioned to benefit from value-based reimbursement trends in the home health sector, such as PDGM.

Image Source: Company

Additionally, Pennant has a high-touch and community-oriented approach to hospice care, positioning it as the provider of choice in a fast-growing hospice market.

Image Source: Company

Moreover, Pennant’s opportunistic acquisition approach and disciplined operating strategy positions it well to take advantage of the evolving demand and supply imbalance in the senior living markets in which it operates.

Image Source: Company

Finally, Pennant is also likely to benefit from operating in a highly fragmented market with significant consolidation opportunities.

Image Source: Company

Pennant has formulated highly effective strategies to derive maximum benefit from the opportunities provided by the growing industry.

- Efficient operating model

The Company delivers superior client care due to its highly effective operating model.

Pennant’s business model allows it to

The effectiveness of Pennants’ operating model is evident through its clinical outperformance

Image Source: Company

The Company also follows a disciplined acquisitions strategy focusing on selectively acquiring strategic and underperforming operations within target markets. Pennant has proved its expertise in transitioning newly-acquired operations to its innovative operating model and culture. In fact, from 2011 to 2018, Pennant increased its number of home health/hospice and senior living operations by >300%

Image Source: Company

Additionally, Pennant focuses on organic growth by growing talent, developing leaders, adding new operations, and leveraging operational capabilities to expand partnerships.

In other words, Pennant’s comprehensive business model allows it to deliver exceptional services to retain existing clients and grow its customer base, and at the same time, grow through organic and inorganic opportunities.

- Financial performance

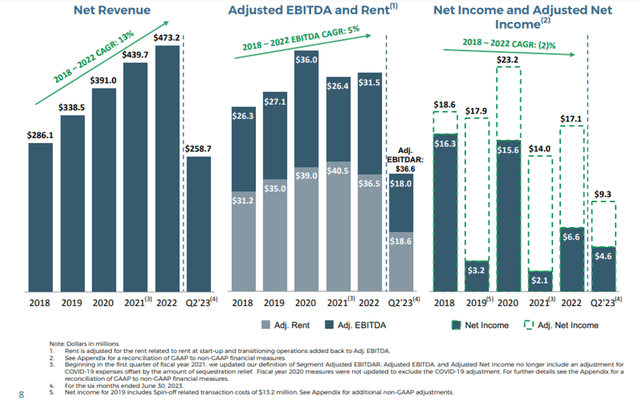

From 2013 – 2022, Pennant demonstrated a revenue CAGR of about 24%, driven by solid organic growth and a sound acquisition strategy.

Most recently, for Q2 FY23, Pennant reported total revenue of $132.3 million, an increase of $16.0 million or 13.7% over Q2 FY22. Net income for Q2 FY23 was $2.8 million, an increase of $5.5 million or 204.5% over Q2 FY22, and adjusted net income for Q2 FY23 was $5.4 million, an increase of $1.3 million or 30.4% over the prior-year quarter.

For FY22, total revenue was $473.2 million, an increase of $33.5 million or 7.6% over FY21. Net income for FY22 was $6.6 million, an increase of $3.9 million over the prior year, and adjusted net income for FY22 was $17.1 million, an increase of $3.1 million or 21.8% over FY21.

Image Source: Company

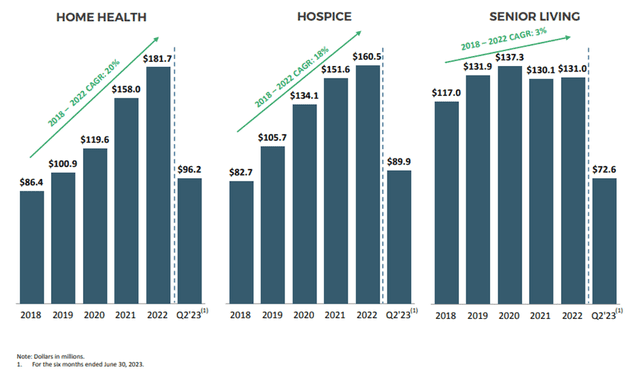

Home Health and Hospice Services segment revenue for Q2 FY23 was $95.0 million, an increase of $9.7 million or 11.3% over the prior-year quarter. Senior Living Services segment revenue for the Q2 FY23 was $37.3 million, an increase of $6.3 million or 20.3% over the prior year’s quarter.

On the other hand, Home Health and Hospice Services segment revenue for FY22 was $342.2 million, an increase of $32.7 million or 10.6% over the prior year. Senior Living Services segment revenue for FY22 was $131.0 million, an increase of $0.9 million or 0.7% over the preceding year.

Image Source: Company

The Company’s operations produced $15.5 million in cash in the first half of FY23. With this cash and its positive impact on its leverage ratios, Pennant plans to take advantage of an increasing number of attractive acquisition opportunities.

The Company has shown consistent growth over the past several years and seems prepared to benefit from upcoming market opportunities, making it a compelling watch.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://www.sec.gov/ix?doc=/Archives/edgar/data/1766400/000176640023000026/pntg-20221231.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1766400/000176640023000061/pntg-20230331.htm

https://www.sec.gov/ix?doc=/Archives/edgar/data/1766400/000176640023000095/pntg-20230630.htm

https://investor.pennantgroup.com/static-files/15ec2bb8-4275-4c21-8d4c-af6c551cf164

No Comments