12 Mar SkyWater: Facilitating Semiconductor Industry Growth

SkyWater Technology, Inc. (NASDAQ: SKYT) is an independent, pure-play technology foundry that offers advanced semiconductor development and manufacturing services from its fabrication facilities, or fabs, in Bloomington, Minnesota, and Kissimmee, Florida.

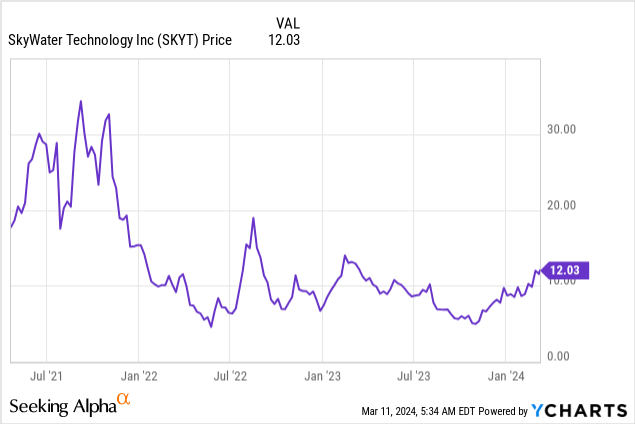

SkyWater Technology, Inc. (NASDAQ: SKYT)

Market Cap: $565.75M; Current Share Price: 12.03 USD

Data by YCharts

The Company and its Products

SkyWater operates a technology-as-a-service model.

Image Source: Company

The Company leverages a strong foundation of proprietary technology to co-develop process technology intellectual property (IP) with its customers that enable disruptive concepts through its Advanced Technology Services for diverse microelectronics (integrated circuits, or ICs) and related micro- and nanotechnology applications. In addition to differentiated technology development services, SkyWater supports customers with volume production of ICs for high-growth markets through Wafer Services.

Image source: Company

The combination of semiconductor development and manufacturing services that SkyWater provides its customers is unavailable from a conventional fab. In addition, the Company’s status as a publicly-traded, U.S.-based, pure-play technology foundry with Defense Microelectronics Activity, or DMEA, Category 1A accreditation from the DoD positions it well to provide distinct, competitive advantages to customers. These advantages include enhanced IP security and easy US domestic supply chain access.

Image Source: Company

The Company primarily focuses on serving diversified, high-growth end users in numerous vertical markets, including (1) advanced computation, (2) aerospace, and defense, or A&D, (3) automotive and transportation, (4) bio-health, (5) consumer and (6) industrial/internet of things, or IoT. By housing development and manufacturing in a single operation, SkyWater rapidly and efficiently transitions newly-developed processes to high-yielding volume production, eliminating the time it would otherwise take to transfer production to a third-party fab.

Through its Advanced Technology Services, SkyWater specializes in co-creating with customers advanced solutions that directly serve end markets, such as superconducting ICs for quantum computing and sensing, integrated photonics, carbon nanotube technologies, or CNTs, microelectromechanical systems, or MEMS, technologies for biomedical and imaging applications, and advanced packaging. SkyWater’s Wafer Services include the manufacture of silicon-based analog and mixed-signal ICs for end markets. The Company’s Advanced Technology Services and Wafer Services customers include Infineon, D-Wave, L3Harris, and Leonardo DRS.

We will discuss the rationale for covering the Company.

- Large, High-Growth Target Markets with Expected Long-Term Secular Tailwinds

Microelectronics are the enabling technology of the information age and have served as a conduit for the growth of the electronics industry over the past sixty years. Semiconductors make solid-state electronics possible and are vital inputs for products such as computers, communications equipment, consumer products, industrial automation and control systems, military equipment, automobiles, medical equipment, and, increasingly, a broad array of internet-enabled products and devices. As electronics have become more sophisticated and integrated, meeting the demand for semiconductors used in these products has required advances in semiconductor design and manufacturing.

Image Source: Company

As discussed, SkyWater offers a unique, pure-play technology foundry model through Technology-as-a-Service, or TaaS, providing innovation to customers through Advanced Technology Services and 200 mm volume wafer manufacturing capabilities through Wafer Services. By having both services in one operation, the Company is well-positioned to take advantage of the market opportunity in end-market industries, build key market relationships as technology develops, and produce those technologies at scale as adoption expands.

Image Source: Company

Thus, SkyWater is uniquely positioned to serve megatrends like artificial intelligence, electricity, medical implants, rapid disease screening, 5G/6G communications, and the commercialization of space. The Company has multiple levers to drive continued growth, including Disruptive Technologies, Customer-driven Technology Development, Sticky Technology Partnerships, and Differentiated High Margin Volume Manufacturing.

To achieve growth, SkyWater has been actively engaged for more than two years in its target states and with relevant partners and government entities. Recently released DoD/DoC guidelines (ME Commons/CHIPS) drive the next execution stage.

Image Source: Company

SkyWater is expected to be the first US provider of Deca M-SeriesTM Adaptive Patterning Technology.

Image Source: Company

Overall, SkyWater expects to achieve continued growth because –

Finally, the Company serves reputed partners and customers, who may help SkyWater grow even further.

Image Source: Company

Hence, SkyWater has significant growth opportunities and is positioned to use them fully, indicating a bright future for the Company.

- Financial Performance

For FY23, revenue increased 35% YoY to a record $286.7 million. Gross margin increased to 20.7% on a GAAP basis, compared to 12.2% in FY22, and increased to 22.0% on a non-GAAP basis, compared to 13.7% in FY22.

Adjusted EBITDA was $37.2 million, or 13.0% of revenue, compared to $7.7 million, or 3.6% of revenue in FY22.

Total ATS revenue totaled a record $67.1M in Q4 FY23 and $225.6M in FY23. There was 40% growth from Q4 FY22 to Q4 FY23 and 62% growth from FY22 to FY23

Total ATS revenue included tool revenue of $9.9M in Q4 FY23 and $14.7M in FY23.

For Q3 FY23, revenue increased 22% YoY to a record $79.2 million.

The Company has recently demonstrated six quarters of consecutive revenue growth.

Image Source: Company

For FY24, SkyWater expects solid year-over-year growth in ATS development revenue. The strong demand for the Company’s ATS development business demonstrates that its customers’ innovation investments remain strong and that its unique business model offers a compelling value proposition for the accelerated development of new technology platforms and products.

SkyWater’s strategic DoD and US Government programs have expanded in scope and scale over the past year and continue to drive most of its ATS growth.

The Company’s next two fastest-growing end markets are advanced computing and medical diagnostics. SkyWater expects ATS development revenue to grow from 10% to 20% in 2024.

Risks

Skywater seems to have a promising future but is exposed to certain risks. Firstly, a material decrease in demand for products that contain semiconductors may decrease the market for the Company’s services and products, and a reduction in the selling prices of customers’ products may significantly affect SkyWater’s business, financial results, and financial position.

Secondly, a significant portion of SkyWater’s sales comes from three customers, the loss of which would adversely affect the Company’s financial results.

Conclusion

SkyWater serves high-growth target markets with long-term tailwinds and boasts multiple levers to drive continued growth, such as disruptive technologies, customer-driven technology development, sticky technology partnerships, and differentiated high-margin volume manufacturing.

Nevertheless, the Company is exposed to certain risks; for example, SkyWater’s financial results may be negatively impacted if there is a decrease in demand for semiconductors or if the Company cannot diversify its customer base.

Hence, potential investors must proceed with caution.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

Reference:

https://s27.q4cdn.com/656702482/files/doc_presentations/2024/Jan/SKYT-IR-deck-for-NGC-Jan-2024.pdf

Sorry, the comment form is closed at this time.