03 Aug The Curious Case of Clovis Oncology

Clovis Oncology Inc (NASDAQ: CLVS) is a commercial stage biotechnology company engaged in developing and commercializing oncology treatments worldwide. The Company develops diagnostic tools through its partners, which can identify patients who will benefit the most from its developmental programs, focused on targeting specific subsets of cancer. The Company’s strategic collaborations allow it to choose the most appropriate technology for each indication, while providing access to expertise in gaining regulatory approvals for its global commercialization paths.

Clovis Oncology Inc (NASDAQ: CLVS)

Market Cap: $514.46M; Current Share Price: 4.92 USD

Data by YCharts

Strength

The Company’s lead product is Rubraca (rucaparib), an oral, small molecule inhibitor of poly (ADP-ribose) polymerase (PARP)1, 2 and 3, intended for the treatment of adults with ovarian cancer, fallopian tube cancer, or primary peritoneal cancers, whose cancer has come back and who are in response (complete or partial response) to a platinum-based chemotherapy. The company is conducting multiple clinical trials to study the efficacy of Rucaparib in the treatment of BRCA wild-type/LOH high Ovarian Cancer, Prostate Cancer and Bladder Cancer.

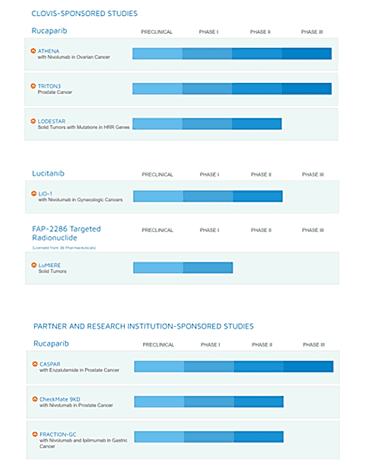

Rucaparib is currently undergoing three pivotal clinical trials such as Athena (In combination with Nivolumab), a Phase 3 clinical trial in advanced ovarian cancer in collaboration with Bristol Myers Squibb (NYSE: BMY). The candidate is also being evaluated in a phase 3 trial, TRITON 3, in patients with Metastatic Castration Resistant Prostate Cancer Associated with Homologous Recombination Deficiency and a Phase 2 trial named LODESTAR in patients with Solid Tumors and with Deleterious Mutations in Homologous Recombination Repair (HRR) Genes.

Clovis is also engaged in research institution sponsored studies such as CASPER a phase 3 study of Rucaparib in combination with Enzalutamide in men with Metastatic Prostate Cancer That Has Become Resistant to Testosterone-Deprivation Therapy, which is being sponsored by the Alliance for Clinical Trials in Oncology, a part of the National Cancer Institute. Furthermore, additional trials include a Phase 2 trial, CheckMate 9KD, studying Nivolumab in Combination With Either Rucaparib, Docetaxel, or Enzalutamide in Men With Castration-resistant Metastatic Prostate Cancer and Fraction-GC (Nivolumab and Ipilimumab in Gastric Cancer), both of which are being sponsored by Bristol Myers Squibb.

Image Source: Company

The Company’s pipeline consists of Lucitanib, an investigational, oral, potent inhibitor of the tyrosine kinase activity of vascular endothelial growth factor receptors 1 through 3 (VEGFR1-3), platelet-derived growth factor receptors alpha and beta (PDFGRα/β) and fibroblast growth factor receptors 1 through 3 (FGFR1-3) indicated for treatment of ovarian cancer. The candidate has the potential to reverse immunosuppression and improve response to immunotherapy and the Company is exploring various combinations with checkpoint inhibitors in gynecologic cancers. Lucitanib is currently being evaluated in combination with Nivolumab in a phase 1b / 2 clinical trial namely LIO-1, in patients with advanced solid tumor and patients with an advanced gynecological solid tumor, as part of a clinical collaboration with Bristol Myers Squibb.

In addition, the Company’s pipeline has FAP-2286, a peptide-targeted radionuclide therapy (PTRT) and imaging agent targeting fibroblast activation protein (FAP), which is being developed under a global licensing and collaboration agreement with 3B Pharmaceuticals GmbH. It is a PTRT and imaging agent and is the lead candidate of the company’s targeted radionuclide therapy development program. The Company is currently enrolling patients in a Phase 1/ 2 clinical study namely LuMIERE to test the efficacy of FAP-2286 in patients with advanced solid tumors.

Weakness

The Company’s cash burn in Q1, 2021 stood at $48.1 million, which was down 28% from $66.9 million in Q1 2020. However, the company’s cash burn has been a cause for concern, especially when coupled with its dilution. In May 2021, the Company announced a $75 million stock offering, with an aim to raise $69.9 million to finance its development programs and for working capital and general corporate purposes. This news was contrary to the statements during the Q1 earning call which stated that it had sufficient cash to fund its operations until early 2023. The Company hasn’t committed any date to the sale of the shares as yet. The shares outstanding have increased from 104.2M from 71.6M, which does not augur well for the shareholders as well as investors.

Clovis does not have access to the same marketing opportunities as players such as AstraZeneca, Merck or GlaxoSmithKline, which will impact the marketing of Rucaparib. In addition, the company also lacks the financial wherewithal to engage in multiple clinical trials and churn out supporting data, which may differentiate its candidate from the competition.

Opportunity

The American Cancer society estimates that in 2021, there will be around 21,410 new diagnoses of Ovarian Cancer and 13,770 women will succumb to the disease. It is the fifth largest cause for death in women, with over 1 in 78 chances of acquiring this disease during one’s lifetime.

The risk factors include menopause-related hormone therapy, obesity, delayed pregnancy, fertility treatments, and a family history; lynch syndrome, inherited BRAC genetic mutations to name a few. Currently there are no definitive screening tests available for ovarian cancer, which acts as an impediment for early detection and treatment. TVUS (transvaginal ultrasound) and CA-125 blood test are used to detect ovarian cancer, but are unreliable and ineffective.

Surgery is the recommended treatment option, as it helps in staging and debulking. Other treatment plans include chemotherapy with a combination of drugs, targeted therapy, and hormone or radiation therapy. However, these come with a plethora of side effects such as toxicity, hypersensitivity, hemorrhagic cystitis, neuropathy, alopecia and ototoxicity, peripheral organ damage, infertility and in some cases can even lead to second cancers.

According to a report by Grand View Research, the global ovarian cancer drugs market is expected to reach USD 4.5 billion by 2022, growing at a CAGR of 23.7%. A rising geriatric population coupled with improper lifestyle habits is fuelling the growth in the market. Scientific advancements such as non-platinum based PARP inhibitors, VEGF inhibitors, and development of biologic or small molecule therapies are changing the treatment landscape.

Prostate Cancer is the second leading cause of death in men in the U.S, with over 1 in 41 men likely to succumb to the disease. According to an estimate by the American Cancer Society there would be 248,530 new cases of prostate cancer and 34,130 deaths from prostate cancer in 2021.

The current treatment options for the disease, which primarily affects the prostate gland, is removal of the gland surgically (Radical prostatectomy), BrachyTherapy (Implanting Radioactive Seeds into the prostate) and Conformal Radiation therapy in combination with hormonal therapy. In addition, Chemotherapy and Androgen Suppression Therapy are used in advanced cases of prostate cancer. The stage and grade of the disease along with the state of the patient with respect to age, existing illnesses and certain genetic factors determine the course of treatment.

A report by Datamonitor Healthcare estimates that the Total prostate cancer drug market will reach $13.5bn in 2024, growing at a CAGR of 8.6% from $6.4bn in 2015. The introduction of novel therapeutics and treatment methodologies, a rise in geriatric population and increased awareness will drive the growth in the market. However prohibitive treatment costs, adverse side-effects that include infertility may act as a deterrent for growth.

Threats

The Company faces stiff competition from AstraZeneca and Merck’s Lynparza, which has demonstrated that it can reduce disease progression and lower risk of death by an impressive 66 percent, which offers it a competitive advantage. The drug was approved by the US Food and Drug Administration (FDA) in May 2020.

Rubraca was approved by the FDA in May 2020, in patients with BRCA mutation-associated metastatic castration-resistant prostate cancer (mCRPC), who had previously received androgen receptor-directed therapy as well as chemotherapy, making it the first PARP-inhibitor in the prostate cancer setting.

Clovis is engaged in a late-stage study of the Overall survival in prostate cancer, namely TRITON3, while Lynparza has already demonstrated impressive OS rates in the Phase 3 PROpel trial and will announce further data in 2021. The drug has already shown improvement over anti-androgen therapies from Pfizer and Astellas’ Xtandi and Johnson & Johnson’s Zytiga by improving overall survival rates and lowering disease progression rates.

Another advantage that Lynparza enjoys is that while Rubraca is a third-line of treatment after androgen-receptor and taxane therapy, Lynpraza is a first-line maintenance treatment. So, in addition to being allowed to treat the same category of patients as Rubraca, Lynparza is also allowed for the treatment of newly diagnosed patients and less-heavily treated patients.

In addition, the Company also has to contend with other PARP-inhibitors from Pfizer and GlaxoSmithKline.

While the first quarter sales from Lynparza stood at $543 million, an increase of over 37 percent year-over-year, the sales from Rubraca were down by 11% year-over-year and stood at $38.1 million, owing to a lower number of new patients starting treatment due to the COVID-19 pandemic. The Company is hopeful that the sales will improve further by the second half of 2021.

Conclusion

There is a lot riding on the success of the Athena trial, which will position Rubraca as the first- line maintenance treatment of choice for ovarian cancer. The data which is expected to be made available in September 2021, could provide the boost the Company requires and turn out to be a potential blockbuster.

The Company is also focused on targeted radiotherapy and developing a line of radiopharmaceutical compounds for treatment of various oncology conditions, which is deemed to be the future of cancer treatment. If Clovis is able to make some meaningful advances in this field, then it can position itself quite well in the emerging oncology treatment landscape.

The cash burn rate and its dilution are a cause for concern and the management would do well to provide further clarity in its impending Q2 earnings call, scheduled for the 4th of August 2021.

Most importantly, Clinical Trials are fraught with risk and uncertainty. However, a diverse pipeline will help mitigate the risk in case of adverse results or the failure to meet endpoints in any of its ongoing trials. The success of its clinical trials will help the Company advance its pipeline but it should also be prepared to face any setbacks, in case its ongoing trials fail to meet their endpoints.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://www.cancer.org/cancer/ovarian-cancer/about/key-statistics.html

https://www.cancer.org/cancer/prostate-cancer/about/key-statistics.html

https://www.ncbi.nlm.nih.gov/pubmed/26759527

https://www.grandviewresearch.com/press-release/global-ovarian-cancer-drugs-market

https://www.medicalnewstoday.com/articles/150086.php

https://www.nasdaq.com/articles/clovis-clvs-q1-earnings-beat-covid-19-hurts-rubraca-sales-2021-05-06

No Comments