13 Sep XORTX Therapeutics: Why This Company is Worth Investing In

XORTX Therapeutics Inc. (NASDAQ: XRTX), a late-stage clinical pharmaceutical company focused on developing innovative therapies to treat progressive kidney disease, announced that its Pharmacokinetics Bridging Study – XRX-OXY-101 – Part 2 showed a significant increase in oral bioavailability of XORTX’s proprietary oxypurinol formulation provided with food compared to the fasted state.

The study also indicated a clean safety and pharmacologic profile with no drug related adverse or serious adverse events related to oral administration of oxypurinol.

Dr. Allen Davidoff, CEO of XORTX, stated, “Successful completion of Part 1 and now part 2 of the XRX-OXY-101 study provides key data and knowledge for selecting the clinical dose and formulation for future oral dosing for our planned phase 3 registration trial in ADPKD. Results arising from this study support the XRx-008 program, understanding of absorption, distribution, metabolism and excretion (ADME) of oxypurinol in our formulation.”

XORTX currently has two clinically advanced products in development: 1) a lead, XRx-008 program for ADPKD; and 2) a secondary program in XRx-101 for acute kidney and other acute organ injury associated with Coronavirus / COVID-19 infection. In addition, XRx-225 is a pre-clinical stage program for Type 2 Diabetic Nephropathy.

XORTX is also working to advance its clinical development stage products that target aberrant purine metabolism and xanthine oxidase to decrease or inhibit production of uric acid.

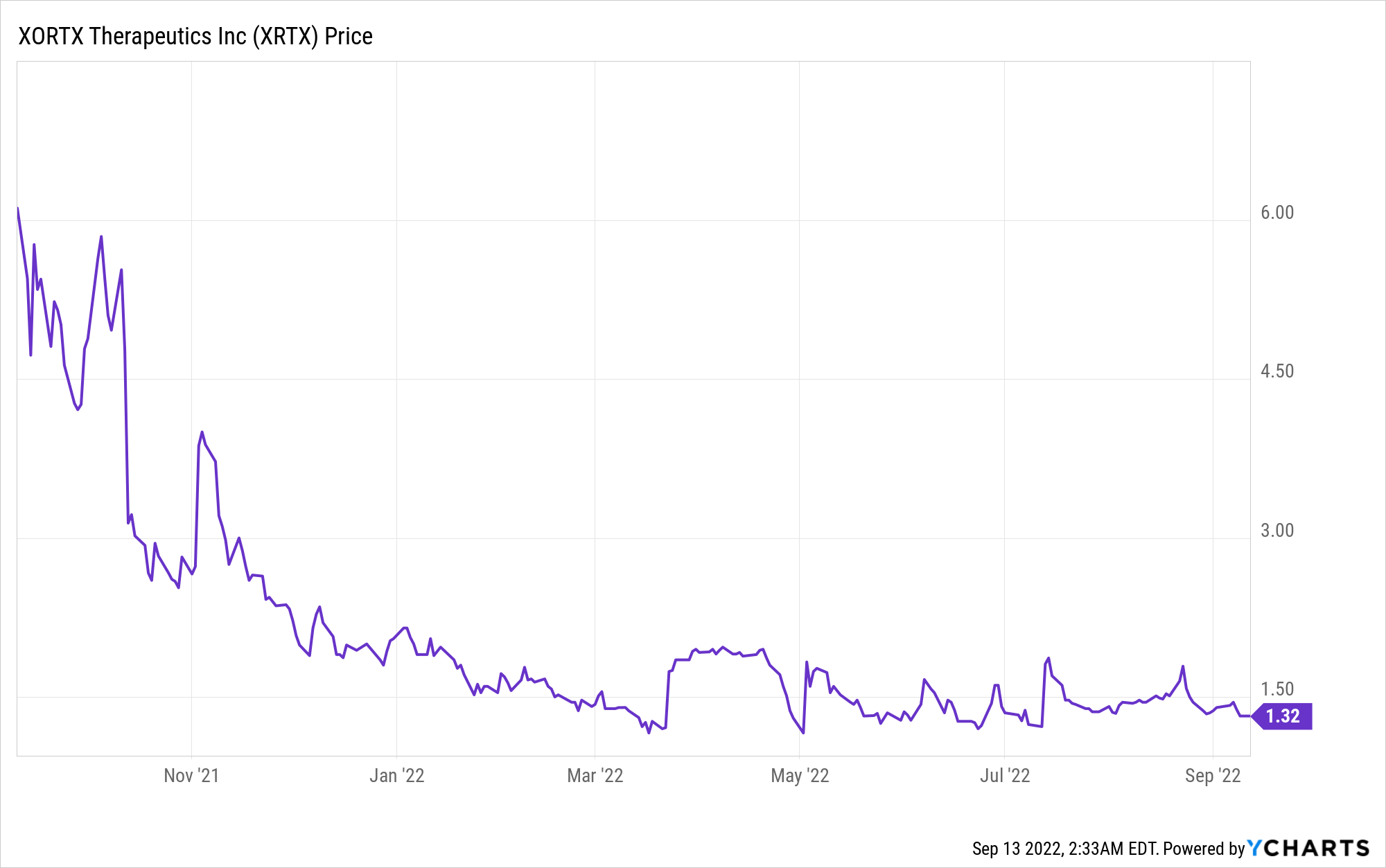

XORTX Therapeutics Inc. (NASDAQ: XRTX)

Market Cap: $17.15M; Current Share Price: $1.32

Strength

The company is led by an experienced and dedicated management team whose average experience exceeds 15 years in the pharmaceutical industry. Their Board of Directors constitutes highly qualified researchers, pharmaceutical senior executives and experts in the fields of drug development, corporate development and pharmaceutical commercialization. The company is supported by a highly regarded network of leading experts within the field of ADPKD, including prominent ADPKD specialists throughout the world, that serve as external advisors and investigators on clinical trials in ADPKD, chronic and acute kidney disease.

The company is collaborating with the Polycystic Kidney Disease Foundation to evaluate the potential beneficial effects of our therapies in ADPKD patients and potentially in other forms of polycystic kidney disease as well.

On March 11, 2019, the Company signed a non-binding letter of intent with Teijin Pharma Limited from Japan for the exclusive global rights (excluding Japan) to develop TMX-049, a new generation of xanthine oxidoreductase inhibitor, for the treatment of progressive kidney disease.

On April 30, 2020, XORTX announced the appointment of LONZA Group as manufacturer of GMP oxypurinol for the XRx-008 and XRx-101 programs. The company also has a partnership with the Icahn School of Medicine at Mount Sinai, New York to study the incidence of AKI and hyperuricemia in patients hospitalized with COVID-19.

Further, on December 8, 2020, the Company received notification that the patent “Formulations of Xanthine Oxidase Inhibitors” will be granted by the European Patent Office. The patent covers compositions and methods of using XORTX’s proprietary formulations of xanthine oxidase inhibitors for renal and other diseases where aberrant purine metabolism has been implicated in disease progression.

Image Source: Company

Weakness

XORTX is a clinical stage biotechnology company – currently, it has no products approved for commercial sale, and to date they have not generated any revenue or profit from product sales. There have been significant losses since inception and they are expected to incur losses in the near future as well. As of December 21, 2021, there was an accumulated deficit of approximately $9.69 million.

The company does not have any capability for sales, marketing or distribution. However, they have entered into strategic partnerships with other companies that can provide such capabilities, including collaboration and license agreements with the Icahn School of Medicine at Mt. Sinai in New York, University of Florida, Dr. Richard Johnson, and Dr. Takahiko Nakagawa.

As far as securities are concerned, XORTX is a “foreign private issuer” and has disclosure obligations that are different from those of U.S. domestic reporting companies. Also, the company is governed by the corporate laws of Canada which in some cases have a different effect on shareholders than the corporate laws of the United States.

The company’s operations and expenditures are to some extent paid in foreign currencies, so they are exposed to market risks resulting from fluctuations in foreign currency exchange rates.

Opportunity

The overall estimated healthcare costs to treat ADPKD patients ranges from US$7.3 billion to US$9.6 billion per year (or US$52,000 to US$68,000 per patient annually). Also, kidney disease may advance to a stage where it requires dialysis as a treatment, which is estimated to cost patients an average of approximately US$100,000 per year.

The company’s product candidates are expected to be significantly more cost-effective for patients being treated for kidney disease, which could give it a substantial competitive advantage over existing treatments.

Threat

XORTX has competitors both in the United States and internationally, including major multinational pharmaceutical companies, established biotechnology companies, specialty pharmaceutical companies, universities and other research institutions. Many of these have significantly greater financial, manufacturing, marketing, drug development, technical and human resources. More specifically, companies like Pfizer, Teijin, Takeda, Merck, are developing new treatments for cardiovascular, kidney disease or diabetes that may affect the progression of acute, intermittent or chronic kidney disease.

Moreover, the Affordable Care Act, affects the way healthcare is financed by both governmental and private insurers, and significantly impacts the pharmaceutical and biologics industries. Any reduction in reimbursement from Medicare, Medicaid, or other government programs may prevent the company from being able to generate revenue, attain and maintain profitability of their products.

Key Takeaways:

XORTX is poised to advance therapies into the global markets at a time when the global end stage renal disease market is expanding rapidly and few therapeutic options exist. It is developing a potential first-in-class therapeutic solution for ADPKD, with a unique mechanism of action, focused on slowing the progression of kidney disease.

We believe that the current medical scenario and clinical milestones will help XORTX evoluve into a high growth company.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://www.sec.gov/ixdoc=/Archives/edgar/data/0001729214/000175392622000646/g082980_20f.htm

No Comments