17 Nov 4 Risky Stocks to Avoid!

This week we bring to you four companies, namely Digital World Acquisition Corp (NASDAQ: DWAC), SmileDirectClub (NASDAQ: SDC), Remark Holdings Inc (NASDAQ: MARK) and PetMed Express (NASDAQ: PETS) that could turn out be to vulnerable investments, in view of the challenges being faced by these companies, such as loss of market share, dwindling revenues, tough competition or short seller interest.

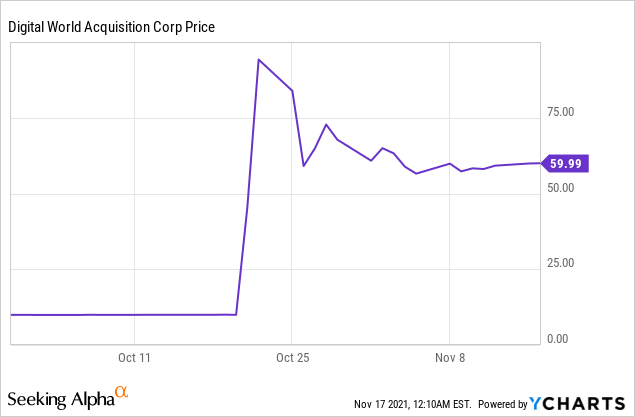

Digital World Acquisition Corp (NASDAQ: DWAC)

Market Cap: $2.156B; Current Share Price: 59.99 USD

Data by YCharts

On October 20,2021, Trump Media & Technology Group announced that it has entered into a definitive merger agreement with Digital World Acquisition Corp that will result in Trump Media & Technology Group becoming a publicly listed company. The new entity is aimed to

“create a rival to the liberal media consortium and fight back against the “Big Tech” companies of Silicon Valley, which have used their unilateral power to silence opposing voices in America.”

as per a statement.

The social network platform is named “TRUTH Social” and will begin a Beta Launch for select guests in November 2021, with a nationwide rollout planned in Q1, 2022.

The growth plans of the new entity, which was valued at an initial enterprise value of $875 Million, with an additional earnout of $825 Million in additional shares, will be initially funded by DWAC’s $293 Million in trust, assuming minimal redemptions. The companies believe that it could achieve a cumulative valuation of up to $1.7 Billion post-business combination, subject to the performance of the stock.

DWAC is a black check company that seeks to forge business combinations with companies in the FinTech, Tech or Media space. The Company had made an initial public offer of 25,000,000 units at $10.00 per unit and made its debut on the Nasdaq Global Market in September 2021.

The stock had an epic run, before catching the attention of short sellers such as Iceberg Research that publicly disclosed that it was betting against DWAC as it only sees risk for investors as it is concerned that investors do not own any part of the project yet, with renegotiation likely to favour Trump Media & Technology Group. The concerns stem from reports from Bloomberg, which states that the agreement will be renegotiated as the market cap has exceeded the $875 million, which was a part of the agreement originally agreed to.

The stock has been touted as the culmination of all meme-stock, joining the ranks of AMC and GameStop as the new entity does not have any clear growth plans, revenues or any cash flows or profit till date. The platform aims to compete against social media giants such as Facebook and Twitter, which spend billions of dollars every year on network expansion, while “TRUTH Social” intends to use $293 million in cash for establishing and growing its network. There is a chance that the loyal supporter base of Mr. Trump will quickly adapt to the new platform, however it will still need considerable investment and time to match the scale of existing social media platforms.

SmileDirectClub (NASDAQ: SDC)

Market Cap: $480.11M; Current Share Price: 4.03 USD

Data by YCharts

SmileDirectClub is a teledentistry company and pioneer of the direct-to-consumer medtech platform. The Company is leveraging its cutting-edge clear aligner treatment and a vertically integrated model to address the large and underserved malocclusion market worldwide.

However, the Company is facing many hurdles in the form of tough competition, depleting market share and lack of profitability. Most recently, the SDC reported wider quarterly losses and missed sales targets, owing to macroeconomic headwinds. As per its Q3,2021 financial results, the Company reported a loss of $89 million, or 23 cents a share, as compared to $13 million, or 11 cents a share for the same period in 2020. Furthermore, the Company’s revenues were$137.68 million for the quarter as against $156.46 million for the same period last year. David Katzman, Chief Executive Officer and Chairman stated during the earnings call that the headwinds faced by the company’s core demographic of customers such as inflation, changing preferences, underemployment, were the primary reason for the lacklustre figures, however, they believe that this macro impact is transitory. The Company was also impacted by Apple’s iOS 14 and privacy changes.

Image Source: Company

SDC had also commissioned a study from a third-party market research firm that surveyed 1200 respondents, which showed that SDC and Invisalign are frequently tied statistically in many important categories including claiming an identical experience between SDC and Invisalign. This despite SDC charging 60% less in price.

Analyst Jonathan Block from Stifel pointed out that not only SDC was losing market share to its rival Align Technology, but another rival Dentsply Sirona witnessed an increase in case volume in the second quarter, while SDC reported a sequential decline. The analyst also raised concerns about increasing competition overseas from the likes of Switzerland-based Straumann and its expectations from the teen market.

In June 2020, the Company filed a lawsuit against NBC Universal Media, seeking $2.8 billion for intentionally making false and inaccurate claims about the company. The Nightly News item caused a massive plunge and cost it $950 million in market valuation.

Remark Holdings Inc (NASDAQ: MARK)

Market Cap: $170.356M; Current Share Price: 1.48 USD

Data by YCharts

Remark Holdings has a diverse portfolio of artificial intelligence solutions and digital media properties. KANKAN AI, its artificial intelligence arm delivers tailor made applications for the retail, food and workplace safety industry, agriculture and traffic management and public safety spheres. The Company’s digital media portfolio consists of Sharecare Inc, a digital health and wellness platform. Remark’s Thermal and Biosafety platform that was launched in view of the pandemic offers intelligent solutions such as contactless attendance and mask detection.

Retail solutions include in depth real-time customer analytics that offer insights on consumer behavior, shopping habits, frequency of visits and their transaction history, helping retailers make intelligent and targeted decisions pertaining to store layouts and promotions. The Company has released two new computing systems namely S and T Series Smart Boxes that use an NVIDIA module that offer support to its AI inference cores and facilitate actions such as facial recognition, vehicle recognition, license plate detection, PPE enforcement, social distancing enforcement, and contact tracing.

The stock was in news recently as there were tweets from Trump Hotels announcing that 7 of its destinations were the first in the world to become Sharecare Health Security Verified, which garnered attention for the Company. However, MARK is only a partial owner of Sharecare and has gained $78.9 Million against an investment of $1.0 million investment in Sharecare, as per its Q3,2021 financial reports. The stock has witnessed multiple rallies in the past as well and is considered a meme stock.

The Company’s revenues from China fell by $1.2 million to $0.8 million due to stringent COVID-19 lockdown norms in China. This put a spoke in the wheel of the Company’s plan to roll out its DMP platform for banks, schools and its China mobile project. MARK also faced setbacks in the U.S Market as a newer client that was using the Company’s AI-driven data intelligence offering for marketing activities, temporarily ceased marketing activity in Q3, 2021. The Company is now working on onboarding larger entities for using its data intelligence software.

PetMed Express (NASDAQ: PETS)

Market Cap: $636.87M; Current Share Price: 30.41 USD

Data by YCharts

The COVID-19 pandemic may have caused mayhem in a lot of areas but one good thing to come out of the ordeal was the growing adoption of cats and dogs. According to the ASPCA (The American Society for the Prevention of Cruelty to Animals), one in five households adopted a cat or since the beginning of the pandemic, which makes it nearly 23 million American households based on the 2019 U.S. Census. A majority of these households still have the pets at home and are not planning to rehome them in the near future.

The COVID-19 pandemic has put many of the PET industry participants in a very advantageous position. The growing rates of pet adoption, change in consumption habits from brick and mortar to online shopping and the humanization of pets, with increased spending on their care and well-being, are driving growth in the Pet care industry.

Image Source: Company

Unfortunately, PetMed Express has not been able to translate this opportunity into growth and revenue. The Company’s net sales for the quarter ended September 30, 2021 stood at $67.4 million, compared to $75.4 million for the same period a year ago, a decrease of 10.7%. The net sales for six months ended September 30, 2021 were $146.7 million, compared to $171.6 million for the six months ended September 30, 2020, a decrease of 14.5%. The Net income also reduced by 24.5% from $8.4 million, or $0.42 diluted per share, for the quarter ended September 30, 2020, to $6.3 million, or $0.31 diluted per share, for the quarter ended September 30, 2021.

PetMed Express is a pet pharmacy that delivers prescription and non-prescription pet medications and other health products for pets like dogs, cats and horses through its 1-800-PetMeds toll free number and on the Internet. The Company is a widely known and trusted brand with over two decades of operations that has built a loyal customer base in 50 licensed states.

The Company is now foraying into the much larger $107 billion total pet care market; however, the move will put pressure on the bottom line in the near term. PETS has been facing stiff competition from other online pet medicine competitors such as Amazon and Chewy and even brick and mortar retailers like Walmart that provide home delivery.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://tmtgcorp.com/press-releases/announcement-10-20-2021/

https://seekingalpha.com/news/3741777-smiledirectclub-cut-to-hold-at-stifel-on-competitive-concerns

No Comments