07 Feb 5 Biotech Stocks with Major Upcoming Catalysts

Clinical-Stage companies offer an exciting investment opportunity with massive upside potential. Most of these companies bring new and highly differentiated approaches, advanced scientific knowledge and a zeal for innovation to the table.

These Companies have major upcoming catalysts such as an impending FDA approval, drug launch,data readouts, initiation of clinical trials and IND submission to look forward to

However, a word of caution is in order as clinical trials are fraught with risk and uncertainty. Even the slightest setback can prove detrimental to the existence of these companies. Failure to meet clinical endpoints, lack of funding or rejection from regulatory authorities are risks that these companies have to bear in pursuit of excellence.

Cytokinetics, Inc (NASDAQ: CYTK)

Market Cap: $2.84B; Current Share Price: 33.70 USD

Data by YCharts

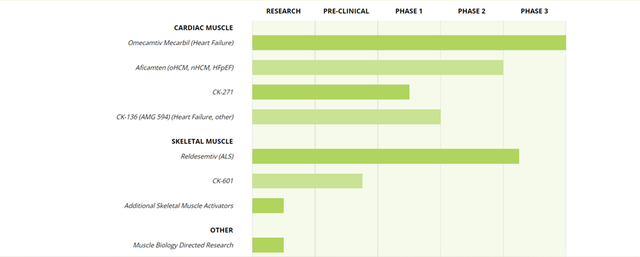

CytoKinetics, a late-stage biopharmaceutical company, is developing therapeutics for the treatment of cardiovascular and neuromuscular diseases that are characterized by impaired muscle function such as amyotrophic lateral sclerosis (ALS), spinal muscular atrophy (SMA) heart failure and hypertrophic cardiomyopathies (HCM).

In February 2022, the FDA accepted the Company’s New Drug Application (NDA) for omecamtiv mecarbil, a selective cardiac myosin activator, intended for the treatment of heart failure with reduced ejection fraction (HFrEF). The candidate has undergone seven phase 2 clinical trials, which evaluated its safety, efficacy and tolerability in patients with chronic heart failure and left ventricular systolic dysfunction. The candidate has been assigned a standard review with a Prescription Drug User Fee Act (PDUFA) target action date of November 30, 2022. There are no plans for an advisory committee meeting to discuss the application at present.

The filing is supported by data from a phase 3 clinical trial namely, GALACTIC-HF (Global Approach to Lowering Adverse Cardiac Outcomes Through Improving Contractility in Heart Failure), which had enrolled 8000 patients across 945 sites in 35 countries. The results show that omecamtiv mecarbil demonstrated reduced risk of the primary composite endpoint of cardiovascular (CV) death or heart failure events (heart failure hospitalization and other urgent treatment for heart failure). In addition, there was a greater treatment effect in patients with lower left ventricular ejection fraction (LVEF). The candidate is also being evaluated in another Phase 3 clinical trial namely METEORIC-HF, to study the treatment effect of omecamtiv mecarbil on exercise capacity, results from which are expected in early 2022.

In April 2021, the Company announced preclinical data for CK-3773274 (CK-274), a potential Next-In-Class Cardiac Myosin Inhibitor, intended for the treatment of hyper, trophic cardiomyopathy (HCM). CK-274, is a small molecule cardiac myosin inhibitor that has the potential to reduce hypercontractility in hypertrophic cardiomyopathy (HCM). The candidate has demonstrated the ability to reduce myocardial contractility, along with compensatory cardiac hypertrophy and cardiac fibrosis in preclinical studies.

Image Source: Company

The Company is also developing aficamten (CK-274), which was evaluated in a phase 2 clinical trial namely, REDWOOD-HCM (Randomized Evaluation of Dosing With CK-274 in Obstructive Outflow Disease in HCM), in patients with symptomatic, obstructive HCM and is gearing up for SEQUOIA-HCM, the Phase 3 clinical trial of aficamten in patients with obstructive HCM.

CytoKinetics is developing RELDEMESTIV in collaboration with Astellas. The investigational drug candidate is a fast skeletal muscle troponin activator (FSTA), which can regulate the rate of calcium release from the regulatory troponin complex of fast skeletal muscle fibres. The Company is also collaborating with Astellas for the development of an Additional Skeletal Muscle Activator. The Company is evaluating Reldesemtiv in a phase 3 trial named COURAGE-ALS, in patients with amyotrophic lateral sclerosis (ALS).

CytoKinetics received an approval for its IND application in China for conducting a phase 1 study of CK-274, which is being developed through a licensing and collaboration agreement with Ji Xing Pharmaceuticals Limited. CytoKinetics has entered into strategic collaboration with Companies such RTW/XI JING and Royalty Pharma.

Adagio Therapeutics Inc (NASDAQ: ADGI)

Market Cap: $915.60M; Current Share Price: 8.23 USD

Data by YCharts

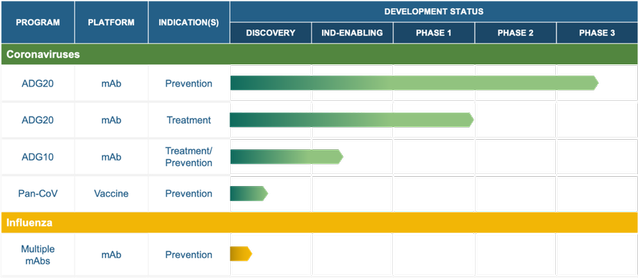

In January 2022, the Company reported findings that show ADG20, the Company’s lead monoclonal antibody (mAb), has neutralization activity against the Omicron (B.1.1.529) variant of SARS-CoV-2. The candidate is being evaluated in a Phase 2/3 clinical trial for prevention and treatment of COVID-19. The Company is reportedly co-ordinating with the FDA for potential protocol updates and dosing strategy and had previously reported that the candidate retains multiple variants including Alpha, Beta, Delta and Gamma as well as variants such as Lambda, Mu and Delta plus variants.

Adagio is a clinical-stage biopharmaceutical Company that is focused on developing antibody-based solutions for viral diseases with pandemic potential. The Company’s lead candidate ADG20 is a potent, long-acting antibody, intended to be used as a single or combination agent, for the prevention and treatment of COVID-19.

The candidate is currently being evaluated in two phase 2/3 trials namely STAMP and EVADE.

Image Source: Company

Adagio is also developing ADG-10 for use in combination with ADG20 for COVID-19, besides initiating discovery programs for other preventative agents.

The Company is a spin-off of Adimab, LLC and was formed in July 2020. Adagio has an exclusive agreement with Adimab for access to a proprietary library of 100’s of mAbs that have the potential to address current and future SARS-CoV-2 variants.

Adagio had cash and cash equivalents of $660 million as of 30 September 2021, which it believes will be sufficient to fund its operations into 2023.

The Company intends to file for an EUA in the third quarter of 2022 and initiate a study evaluating ADG20 as a preventative option in the pediatric population aged between two and 11 years of age by mid-year 2022.

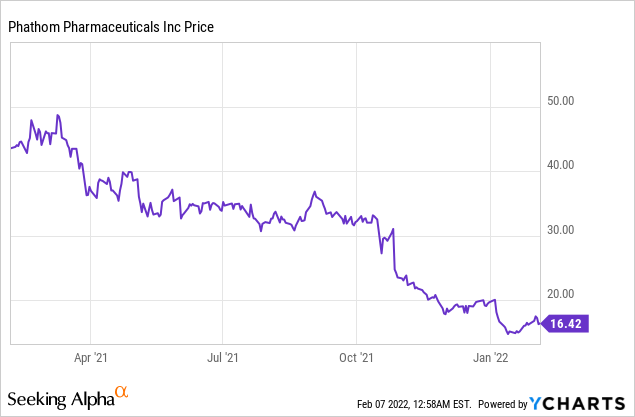

Phathom Pharmaceuticals Inc (NASDAQ: PHAT)

Market Cap: $519.59M; Current Share Price: 16.42 USD

Data by YCharts

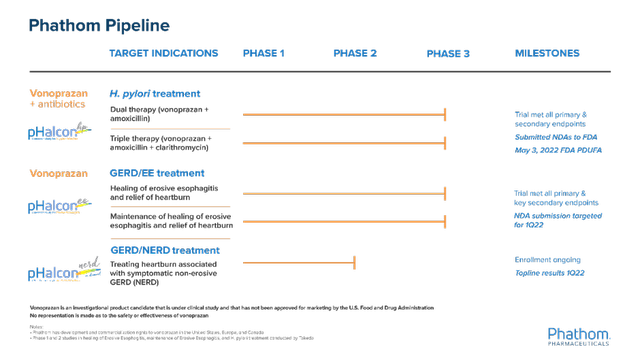

This late-stage biopharmaceutical company is aiming to change the treatment landscape for acid-related gastrointestinal disorders. The Company’s lead product candidate vonoprazan, is a potassium competitive acid blocker (P-CAB) that is intended for the treatment of nonerosive reflux disease (NERD) and other acid-related disorders. The candidate has the potential to become the first gastric, anti-secretory agent, part of a new class of drugs approved in the United States, Europe, or Canada in over 30 years.

The Company is currently engaged in a Phase 2 trial in nonerosive reflux disease (NERD). In April 2021, the Company had reported topline results from a Phase 3 trial in H. pylori infection, followed by the submission of a New Drug Application (NDA) to the FDA. The FDA has granted a PDUFA date of May 3, 2022. The candidate was previously designated as a qualified infectious disease product (QIDPs), which upon approval, provides an additional five years of regulatory exclusivity.

Furthermore, the Company also announced topline results from a Phase 3 clinical trial in erosive gastroesophageal disease in October 2021. The trial has met both the primary and secondary endpoints and intends to submit an NDA in the first quarter of 2022.

Image Source: Company

Phathom is also developing a treatment for heartburn associated with symptomatic non-erosive GERD (NERD) and is looking to announce the topline results in the first quarter of 2022.

Phathom believes that its treatment approach addresses the limitations of conventional treatment approaches such as proton pump inhibitors (PPIs). Slow onset, insufficient duration of acid control and increasing antibiotic resistance severely limits the efficacy of PPI-based therapy.

In September 2021, the Company secured an up to $200 million term loan facility from Hercules Capital (Loan Agreement), of which, $100 million were drawn at closing, while another $50 million were made available upon the receipt of positive topline results in PHALCON-EE. The final tranche of $50 million will be made available upon the FDA approval of a vonoprazan-based regimen for the treatment of H. pylori, and FDA acceptance of filing of an NDA for vonoprazan for the treatment of erosive esophagitis.

The Company had $224.6 million in cash and cash equivalents at the end of September 2021, which along with future drawdown of the remaining $100 million under the Loan Agreement are sufficient to fund its operating plans until mid-2023.

Agios Pharmaceuticals Inc (NASDAQ: AGIO)

Market Cap: $1.56B; Current Share Price: 28.74 USD

Data by YCharts

Agios Pharmaceuticals therapeutic focus is on genetically defined diseases by leveraging its expertise in the field of cellular metabolism. The Company’s pipeline has three late-stage clinical candidates for treatment of hemolytic anemias namely Pyruvate Kinase (PK) Deficiency, Thalassemia and Sickle Cell Disease.

The Company is anticipating FDA’s regulatory decision for Mitapivat, intended as a treatment of Adults with PK Deficiency. In addition, the Company is also engaged in two crucial Phase 3 trials namely ENERGIZE and ENERGIZE-T in thalassemia and a Phase 2/3 RISE UP study in sickle cell disease.

Agios is gearing up for initiating clinical trials in pediatric PK deficiency, advancing AG-946, amPK activator in sickle cell disease and low to intermediate risk myelodysplastic syndrome and complete enrollment in the Phase 2 RISE UP study.

Image Source: Company

The Company is also awaiting a decision from the European Medicines Agency (EMA) for mitapivat in adults with PK deficiency, which is expected to be announced by the end of 2022. Agios aims to score three FDA approvals in indications of adult PK deficiency, thalassemia and sickle cell disease and expand its pipeline to include at least 5 molecules exploring at least 10 indications. In addition, it is focused on creating a strong research pipeline that can deliver an IND every 12-24 months and achieve cash-flow positivity as part of its five-year strategic vision.

Intercept Pharmaceuticals Inc (NASDAQ: ICPT)

Market Cap: $452.37M; Current Share Price: 15.31 USD

Data by YCharts

In December 2021, the Company announced that the topline data from a crucial Phase 3 REVERSE trial will be released in the first half of 2022 as against the previous guidance of the end of 2021. The study is the only active late-stage Phase 3 study that is evaluating compensated cirrhosis due to NASH. Intercept is also using a new methodology to compile data from the Phase 3 REGENERATE study that is studying liver fibrosis due to NASH, which will enable a potential resubmission meeting with the FDA in the first half of 2022.

The Company is working on bringing novel therapeutics for progressive non-viral liver diseases. Intercept’s approach is based on unravelling the complex connection between bile acid and the Farnesoid X receptor (FXR), which plays a crucial role in regulation of bile acid, inflammatory, fibrotic and metabolic pathways.

Image Source: Company

The Company’s lead compound obeticholic acid (OCA), is an analog of the bile acid chenodeoxycholic acid (CDCA), which is being evaluated for treatment of multiple indications such as primary biliary cholangitis (PBC), Fibrosis due to NASH and compensated cirrhosis due to NASH.

Image Source: Company

The Company faced a setback in June 2020, when Ocaliva (obeticholic acid), an Farnesoid X receptor (FXR) agonist, being developed by Intercept that showed at least a one-stage improvement in fibrosis but failed to prevent the worsening of fibrosis, failed to win an FDA approval. The FDA had issued a CRL to the Company amidst concerns that the surrogate endpoint from their Phase III trial of reduction in liver fibrosis may not actually translate into benefit for patients.

Ocaliva was approved by the FDA in 2016 as a treatment for PBC, but was given a black box warning for being incorrectly dosed daily instead of weekly, this was followed by news that the FDA was evaluating the drug for potential risk of liver disorder in PBC patients. In May 2021, the FDA restricted the use of Ocaliva (obeticholic acid) in patients having primary biliary cholangitis (PBC) with advanced cirrhosis of the liver over concerns that it can cause serious harm.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://ir.cytokinetics.com/static-files/064f9a43-4e59-467d-a81c-51795f0cdf44

https://adagiotx.com/our-approach/#pipeline

https://www.adimab.com/news/2020-07-16-adagio

https://investors.adagiotx.com/static-files/d88f7cc3-ab96-4eab-959b-ab92eebe1090

https://www.phathompharma.com/our-science/

https://www.phathompharma.com/our-science/clinical-trial-and-pipeline/

https://investor.agios.com/static-files/a4273fb9-793b-47ce-83b2-d3edcadd29f2

https://www.interceptpharma.com/our-research/fxr/

https://www.thepharmaletter.com/article/fda-curbs-use-of-liver-drug-ocaliva-on-safety-concerns

No Comments