25 Feb The Unravelling of Kodiak Sciences

Kodiak Sciences, Inc. (NASDAQ: KOD), a clinical-stage biotechnology Company focused on creating novel therapeutics for the treatment of retinal diseases, announced top-line results from a Phase 2b/3 clinical trial evaluating KSI-301, a novel antibody biopolymer conjugate, intended for the treatment of neovascular (wet) age-related macular degeneration.

The candidate failed to meet the primary endpoint of showing non-inferior visual acuity gains compared to aflibercept given every eight weeks. The drug was aiming to improve Regeneron’s Eylea and was seeking to prolong the length of time between doses, however, patients who received KSI-301 every 12-weeks failed to show the same level of improvements as Eylea’s eight-week dosage regimen.

Kodiak Sciences, Inc. (NASDAQ: KOD)

Market Cap: $474.25M; Current Share Price: 9.17 USD

Data by YCharts

Victor Perlroth, MD, Kodiak’s Chief Executive Officer, commented,

“Allowing treatment with KSI-301 no more often than every 12 weeks after the loading phase for every patient turned out to be insufficient. Nonetheless, we believe the results demonstrate a clear anti-VEGF effect, strong durability and a reassuring safety profile. We think that these data continue to support the potential of our ABC Platform to significantly extend treatment intervals in retinal disorders in a safe and convenient manner.”

The candidate demonstrated strong durability, and was deemed safe and well-tolerated. An at 1 year assessment showed that nearly 59% of patients in the KSI-301 arm had achieved improvements in vision and eye anatomy when compared to the overall aflibercept group. In addition, patients treated with KSI-301 on an every five-month regiment achieved 20/40 vision required to drive a motor vehicle.

The Company is anticipating top-line data from BEACON study in retinal vein occlusion shortly after June, when it completes the primary endpoint visit for all patients. Furthermore, Kodiak is likely to have the results from the GLEAM and GLIMMER long-interval studies in diabetic macular edema and DAYLIGHT short-interval study in wet AMD by early 2023.

Strength

The Company’s aim is to build a leading “high-science retina pipeline” by leveraging its novel antibody biopolymer conjugate platform namely ABC platform. The platform that has been developed over a span of 10 years, has been instrumental in the creation of next-generation retinal medicines, which deliver clinically proven targets, antibody based biologic and fast and potent clinical responses. The candidates designed also offer ocular durability, rapid systemic clearance along with improved bioavailability, biocompatibility and stability.

Image Source: Company

Kodiak’s lead product candidate KSI-301 is an anti-VEGF biologic that is administered as an intravitreal injection and provides sustained inhibition of VEGF for up to 6 months. The candidate is being evaluated for the treatment of multiple ophthalmic indications including diabetic macular edema, retinal vein occlusion and diabetic retinopathy. The Company’s pipeline also consists of KSI-501, an anti-IL6 and anti-VEGF bispecific biopolymer conjugate that is currently undergoing pre-IND development in retinal vascular diseases with an inflammatory component. KSI-601, a triplet biopolymer conjugate, is also under pre-clinical development for treatment of dry age-related macular degeneration.

Image Source: Company

The Company’s candidates such as KSI-301, built by using the ABC platform, are designed to last longer in the eye and improve their therapeutic benefit. The candidates also exhibit deeper inhibitory potency and fast systemic clearance.

Kodiak’s triplet medicines use an amalgamation of the ABC platform and small molecules with potential to target three mechanisms of action that can tackle complex diseases like dry AMD.

Weakness

The candidate was the Company’s most advanced pipeline candidate and was targeting a potential market worth $1.2 billion in peak annual sales. Along with a missed opportunity, the Company has had over $2 billion in market capitalization wiped out overnight. The other candidates in the Company’s pipeline are still in early developmental stages and will take time to even reach clinical trials.

The failure of the trial has resulted in multiple downgrades for the Company’s stock. For instance, JP Morgan downgraded the stock from Overweight to Neutral and revised their price target from $90 to $21. Similarly, Citigroup revised their price target for the stock from $70 to $12 and reiterated to Neutral rating.

Opportunity

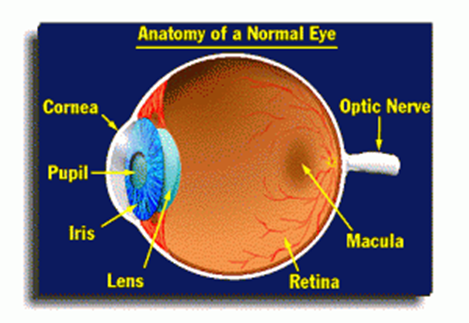

Macular Degeneration is caused by the age-related deterioration of the central portion of the retina named Macula. Macula is responsible for focusing the central vision in the eye and regulates reading, driving, facial and color recognition abilities. It collates the images from the center of the field of vision, and sends it to the optic nerves, so that it can be relayed to the brain. Macular degeneration is characterized by wavy or blurred vision and loss of central vision eventually, though peripheral vision may still be working fine.

Image Source: Macular.Org

The disease is categorised into “Dry” or “Wet” with an estimated 85% of the cases being “Dry” or atrophic and over 15% of the cases being “WET”. It progresses in three stages namely early-AMD which is characterised by yellow deposits named Drusen being accumulated underneath the retina. The Intermediate stage sees some changes in vision and pigment in the retina followed by the final Late AMD stage, where vision loss is noticeable.

Though the exact cause of this illness is still unknown, certain hereditary and environmental factors have been found to play a crucial role. Age is one of the most important factors with people over 55 years at a greater risk of contracting the disease. In addition, genetics, a family history of AMD and smoking are some of the other factors that can cause this disease.

The disease is the leading cause of vision loss for people over 60 years in the U.S, affecting an estimated 11 million people in the United States, and is likely to reach epidemic proportions by 2050, affecting over 22 million Americans, in the absence of research and treatment breakthroughs. According to an estimate, the direct cost of vision loss in North America is over $512.8 billion, and the indirect costs were $179 billion.

According to a report by Transparency Market Research, the global macular degeneration treatment market that was worth over US$ 6.1 billion in 2017 is likely to grow at a CAGR of 6.4% to reach US$ 11.1 billion by 2026. The increase in ageing population and rise in awareness levels will propel the growth in the market.

There is no cure for this illness as yet; however, some research breakthroughs are providing, hope for the patients. Current treatment options start with nutritional therapy, especially focused on an antioxidant rich diet. Laser photocoagulation was the earliest treatment for leaking blood vessels in wet AMD; this was followed by Photodynamic Therapy (PDT) with Visudyne™, wherein a Visudyne™ is injected intravenously in the patient’s’ arm, which is then activated through shining non-thermal laser light into the eyes. This treatment was a considerable improvement over conventional therapeutic options as it used low-level, non-thermal lasers to seal off leaking blood vessels, while leaving the healthy ones intact.

However, these cannot prevent reoccurrence of the illness leading to multiple treatment sessions. Most importantly they can only halt the degeneration or rate of progression of the disease and cannot restore lost vision. Additionally, only 10-15% of CNV lesions are eligible for laser treatment. They also have side-effects such as scarring or additional vision loss on account of the use of lasers.

Hence there is a need for a major breakthrough that can prevent repeated reoccurrence of the condition after treatment and offer relief from all forms of wet AMD.

Threats

The Company’s pipeline primarily consists of only one candidate being evaluated in multiple indications. The other candidates in the pipeline are either in pre-IND or pre-clinical testing stages. Clinical Trials are fraught with risk and uncertainty. There is a possibility that the candidates in the Company’s developmental pipeline may not be able to meet their clinical endpoints in trials.

However, a diverse pipeline will help mitigate the risk in case of adverse results or the failure to meet endpoints in any of its ongoing trials. The success of its clinical trials will help the Company advance its pipeline but it should also be prepared to face any setbacks, in case its ongoing trials fail to meet their endpoints.

Key Takeaways

- Upcoming catalysts for the Company include top-line data from BEACON RVO, which is expected to be announced in the third quarter of 2022.A proposed IND filing for KSI-501, a VEGF and IL-6 inhibitor, intended for the treatment of retinal diseases with inflammatory component in on the cards in 2023. Furthermore, Kodiak is also planning to file an IND for KSI-601for high-prevalence multifactorial diseases like dry AMD in 2023.

- Data readouts are expected from ongoing trials of KSI-301 from the DAYLIGHT wAMD Phase 3, GLEAM DME Phase 3, GLIMMER DME Phase 3 likely to be announced in the first quarter of 2021.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://finance.yahoo.com/news/kodiak-sciences-announces-top-line-110000492.html

https://kodiak.com/our-pipeline/

https://ir.kodiak.com/static-files/4c03da0e-2b0f-41d0-8782-084f1ec94649

No Comments