14 Sep CATALYST PHARMACEUTICALS: Next Big Thing on S&P SmallCap 600

Catalyst Pharmaceuticals Inc. (NASDAQ: CPRX), a commercial-stage biopharmaceutical company, is slated to replace ManTech International Corp. (NASDAQ: MANT) in the S&P SmallCap 600 before the opening of trading on Thursday, September 15.

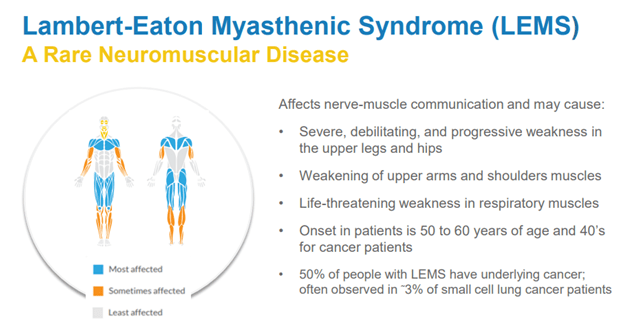

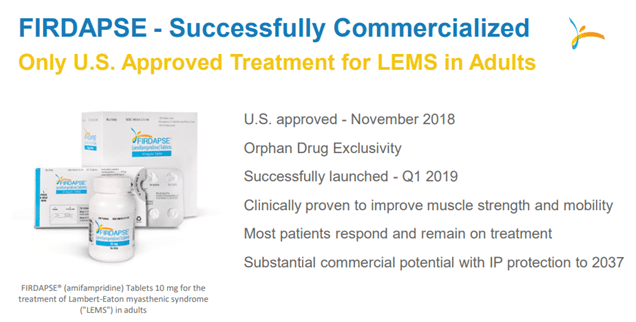

The company develops novel medicines for rare chronic neuromuscular and neurological diseases. Its main product is FIRDAPSE – amifampridine phosphate tablets for the treatment of Lambert-Eaton myasthenic syndrome or LEMS. At present, this is the only approved treatment for adults with LEMS in the U.S. The disorder currently affects about 3,000 people in the country.

Image Source: Company

In March 2022, CPRX was featured on Forbes 2022 “America’s Best Small Companies” list. It was ranked 65th among more than 1,000 companies evaluated.

Catalyst Pharmaceuticals Inc. (NASDAQ: CPRX)

Market Cap: $1.57B; Current Share Price: $15.30

Strength

The company sells FIRDAPSE through a field force experienced in neurologic, central nervous system or rare disease products consisting of approximately 30 field personnel. There are five medical science liaisons who help educate the medical communities and patients about LEMS and programs supporting patients and access to FIRDAPSE.

Image Source: Company

An experienced inside sales agency works to generate leads through telemarketing to targeted physicians, which include roughly 9,000 neurology and neuromuscular healthcare providers that may be treating an adult LEMS patient who can benefit from FIRDAPSE.

The company works with several rare disease advocacy organizations (including Global Genes, the National Organization for Rare Disorders (NORD), and the Myasthenia Gravis Foundation of America) to help increase awareness and level of support for patients living with LEMS.

CPRX supports the distribution of FIRDAPSE through Catalyst Pathways, their personalized treatment support program for patients who enroll in it. They’ve also developed an array of financial assistance programs to reduce patient co-pays and deductibles to a nominal affordable amount.

In March 2022, the company received three new patents covering additional patient amifampridine metabolizer types. According to Patrick J. McEnany, Chairman and Chief Executive Officer of Catalyst, the new patents will “…further fortify our intellectual property estate to provide lasting durability for our flagship product. As part of our portfolio strategy, we will continue to execute on our key initiatives to strengthen and protect the long-term commercial potential of FIRDAPSE, which currently has patent exclusivity protection in the U.S. until 2034.”

In July 2022, CPRX settled its ongoing patent infringement litigation with Jacobus Pharmaceutical Company, Inc. and PANTHERx Rare LLC. Catalyst had asserted in its patent litigation that Jacobus and PANTHERx induced infringement by third parties of FIRDAPSE-related patent rights in their marketing and distribution of Ruzurgi. As part of the settlement, Catalyst will dismiss all claims related to the patent litigation between the companies and has acquired certain of Jacobus’ intellectual property rights, including the rights to develop and commercialize Ruzurgi in the U.S. and Mexico.

Opportunity

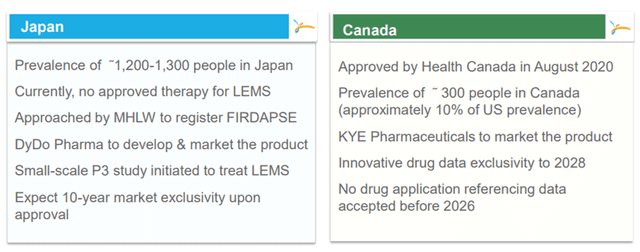

In May 2019, CPRX entered into an amendment to their license agreement for FIRDAPSE. Under the amendment, they expanded the commercial territory for FIRDAPSE, which initially comprised of North America, to include Japan. There is an option to further expand the territory under the license agreement to include most of Asia, as well as Central and South America, upon achieving certain milestones in Japan.

The company has been granted orphan drug designation in Japan for FIRDAPSE for the symptomatic treatment of LEMS. On June 28, 2021, they entered into a sub-license agreement with DyDo Pharma, Inc. (DyDo), according to which they sub-licensed to DyDo the Japanese rights for FIRDAPSE for the treatment of LEMS. Under the terms of the Agreement, DyDo will have joint rights to develop FIRDAPSE, and exclusive rights to commercialize the product in Japan. For the fiscal year ending December 31, 2021, CPRX generated revenues of approximately $2.9 million from their collaborative agreement with DyDo Pharma.

On August 6, 2020, the company announced that Canada’s national healthcare regulatory agency, Health Canada, had approved FIRDAPSE for treating patients in Canada with LEMS. On October 28, 2020, the company launched FIRDAPSE in Canada to treat patients with LEMS through a license and supply agreement with KYE Pharmaceuticals.

Image Source: Company

In December 2018, CPRX entered into a definitive agreement with Endo International plc’s subsidiary, Endo Ventures Limited (Endo), for the further development and commercialization of generic Sabril® tablets through Endo’s United States Generic Pharmaceuticals segment, Par Pharmaceutical. If and when the product is launched, the company will receive a milestone payment of $2.0 million on the commercial launch of the product. Further, they will receive a sharing of defined net profits upon commercialization, and they are obligated to share the costs of certain development expenses.

Also. in 2021, the company decided to broaden and diversify its product portfolio through acquisitions of early and late-stage products or companies or technology platforms in rare disease therapeutic categories outside of neuromuscular diseases. Though no agreements have been entered into till date, we expect that this vision will add more value to the company in the near and long term.

Weakness

CPRX is a single product company with limited commercial experience. Their success depends on their ability to continue to commercialize FIRDAPSE successfully. Since the target patient population for FIRDAPSE® is small, they must achieve significant market share and obtain relatively high per-patient prices for their products to achieve meaningful gross margins.

The company is licensed in Florida as a virtual drug manufacturer, which means that they have no in-house manufacturing capacity and must rely on contract manufacturers and packagers. They have no plans to build or acquire the manufacturing capability needed to manufacture any of their research materials or commercial products. They expect that their drug products and drug substances will be prepared by contractors with suitable capabilities for these tasks and that they will enter into appropriate supply agreements with these contractors at appropriate times in the development and commercialization of their products.

Moreover, the company has never declared or paid any cash dividends on their common stock or other securities, and they currently do not anticipate paying any cash dividends in the foreseeable future. Investors can realize a return on their investment only when the trading price of the common stock appreciates, which is uncertain and unpredictable.

Threat

For some years, Ruzurgi, for the treatment of pediatric patients with LEMS, was often prescribed to adult LEMS patients and at a lower price than FIRDAPSE. Now that Ruzurgi is no longer on the market, it is no longer competitive with FIRDAPSE. However, if Ruzurgi were to become available in the future, it would likely be competitive with FIRDAPSE.

Also, amifampridine has been available from compounding pharmacies for many years and may remain available, even though CPRX obtained FDA approval for FIRDAPSE. Compounded amifampridine is likely to be substantially less expensive than FIRDAPSE.

When FIRDAPSE was approved for the treatment of LEMS patients, the company received seven-year orphan drug exclusivity for the product. In recent times, the pricing of orphan drugs has received scrutiny from the press and from members of Congress of both parties. In the future, this may have an impact on the pricing of drugs in general and FIRDAPSE in particular.

Key Takeaways

By looking at the above statistics, we can see that the company is doing extremely well so far as revenue and earnings growth is concerned.

Before year-end, the company is expected to receive FDA approval for FIRDAPSE to treat pediatric LEMS patients. There is also an expectation that FIRDAPSE will receive an NDA in Japan by late 2023 or 2024. In the meantime, there are ongoing efforts to continue to identify undiagnosed LEMS patients.

All these factors are expected to contribute to Catalyst’s continued development, which in turn makes the company a lucrative investment for the foreseeable future.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Click here to please visit our detailed disclosure

References

https://www.sec.gov/ix?doc=/Archives/edgar/data/1369568/000119312522077228/d159262d10k.htm

https://ir.catalystpharma.com/static-files/14d365ed-c4d2-4556-ba05-ae76a3afaccc

No Comments